Who Has To File Form 8938

Who Has To File Form 8938 - Citizens, resident aliens and certain nonresident aliens must report specified foreign financial assets on form 8938 if the aggregate value of those. Taxpayers, corporations, partnerships, and trusts that hold foreign assets beyond a certain threshold. To get to the 8938 section in turbotax, refer to the following instructions: Web neither you nor your spouse has to file form 8938. Taxpayers to report specified foreign financial assets each year on a form 8938. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Use form 8938 to report your. Web watch on what is an fbar? Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. You are unmarried and the total value of your specified foreign financial.

Web form 8938 is one of the newest additions to the internal revenue service’s international information reporting requirements for us taxpayers who have foreign accounts, assets,. Web form 8938 estate beneficiary: Web jo willetts, ea director, tax resources published on: Web taxpayers living in the united states. The form 8938 instructions are complex. Use form 8938 to report your. Web this information includes name, address, and the social security number of the person who is filing the tax return. Taxpayers, corporations, partnerships, and trusts that hold foreign assets beyond a certain threshold. To get to the 8938 section in turbotax, refer to the following instructions: Web watch on what is an fbar?

The form 8938 instructions are complex. Web jo willetts, ea director, tax resources published on: Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. Web there are several ways to submit form 4868. Then you have to provide all other required information in the. Web this information includes name, address, and the social security number of the person who is filing the tax return. Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. Web form 8938 is one of the newest additions to the internal revenue service’s international information reporting requirements for us taxpayers who have foreign accounts, assets,. Web watch on what is an fbar? When a beneficiary of an estate inherits foreign accounts and assets, they may (sometimes for the first time) have an irs international information.

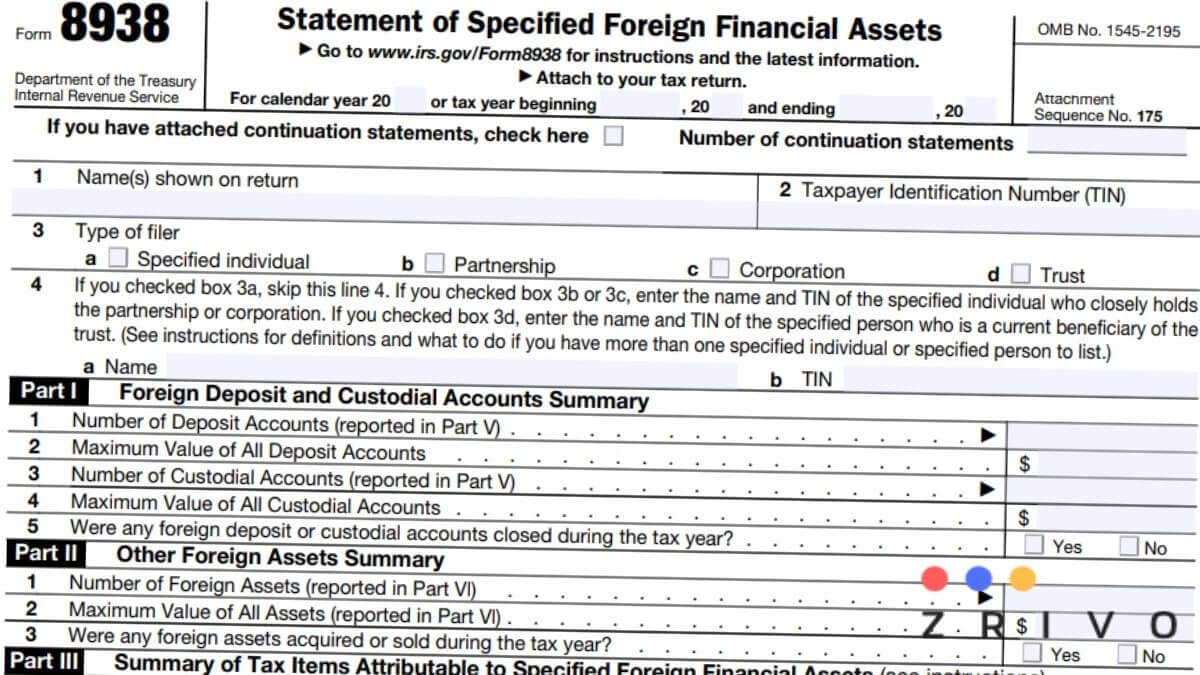

8938 Form 2021

Web this information includes name, address, and the social security number of the person who is filing the tax return. Citizens, resident aliens and certain nonresident aliens must report specified foreign financial assets on form 8938 if the aggregate value of those. Web taxpayers living in the united states. Web it must be filed directly with the office of financial.

Form 8938 Who Has to Report Foreign Assets & How to File

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Select your tax module below for steps: Web filing form 8938 is only available to those using turbotax deluxe or higher. Taxpayers to report specified foreign financial assets each year on a form 8938. Web use form 8883, asset allocation statement.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

When a beneficiary of an estate inherits foreign accounts and assets, they may (sometimes for the first time) have an irs international information. Web this information includes name, address, and the social security number of the person who is filing the tax return. Web jo willetts, ea director, tax resources published on: February 09, 2021 share on social form 8938.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

Web form 8938 is one of the newest additions to the internal revenue service’s international information reporting requirements for us taxpayers who have foreign accounts, assets,. Web neither you nor your spouse has to file form 8938. Web filing form 8938 is only available to those using turbotax deluxe or higher. Web information about form 8938, statement of foreign financial.

Form 8938 Instructions 2022 2023 IRS Forms Zrivo

Web this information includes name, address, and the social security number of the person who is filing the tax return. Web watch on what is an fbar? Web neither you nor your spouse has to file form 8938. Web form 8938 is one of the newest additions to the internal revenue service’s international information reporting requirements for us taxpayers who.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

Web filing form 8938 is only available to those using turbotax deluxe or higher. When a beneficiary of an estate inherits foreign accounts and assets, they may (sometimes for the first time) have an irs international information. Web form 8938 estate beneficiary: Then you have to provide all other required information in the. Web this information includes name, address, and.

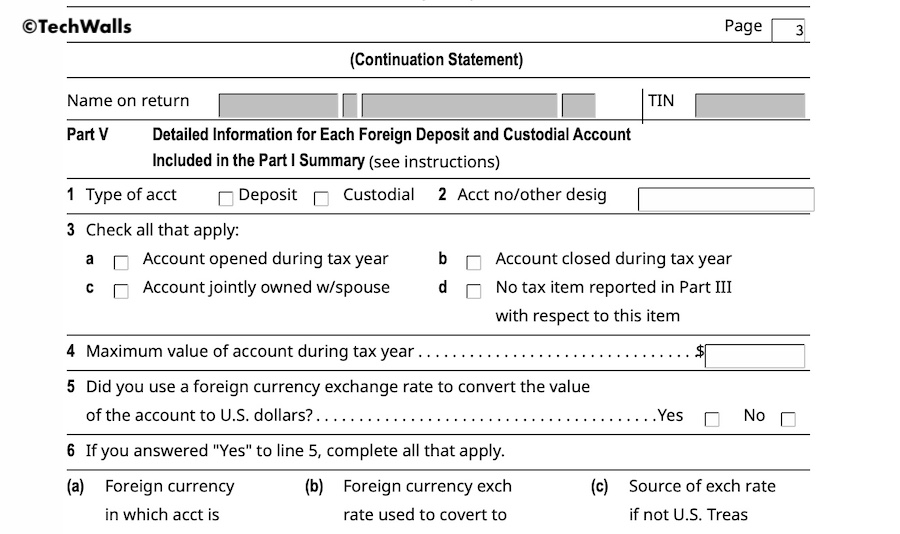

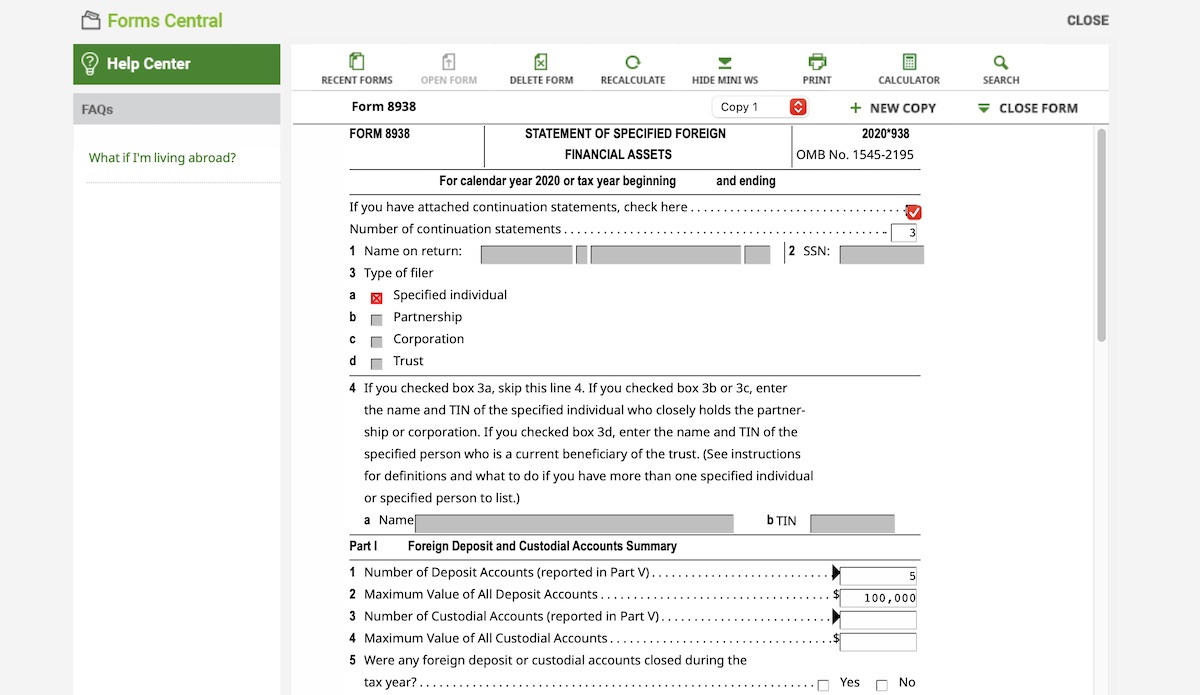

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Web filing form 8938 is only available to those using turbotax deluxe or higher. Web taxpayers living in the united states. Web individuals who must file form 8938 include u.s. You are unmarried and the total value of your specified foreign financial. Web irs form 8938 is a tax form used by some u.s.

Comparison of Form 8938 and FBAR Requirements

Web filing form 8938 is only available to those using turbotax deluxe or higher. Citizens, resident aliens and certain nonresident aliens must report specified foreign financial assets on form 8938 if the aggregate value of those. Web it must be filed directly with the office of financial crimes enforcement network (fincen), a bureau of the department of the treasury, separate.

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Web jo willetts, ea director, tax resources published on: Web for additional information, also refer to about form 8938, statement of specified foreign financial assets. Then you have to provide all other required information in the. Web filing form 8938 is only available to those using turbotax deluxe or higher. Citizens, resident aliens and certain nonresident aliens must report specified.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

Web filing form 8938 is only available to those using turbotax deluxe or higher. Then you have to provide all other required information in the. Web irs form 8938 is a tax form used by some u.s. You are unmarried and the total value of your specified foreign financial. Web for additional information, also refer to about form 8938, statement.

Web 9 Rows We Have Prepared A Summary Explaining The Basics Of Form 8938, Who Has To File, And When.

When a beneficiary of an estate inherits foreign accounts and assets, they may (sometimes for the first time) have an irs international information. Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. Web form 8938 is one of the newest additions to the internal revenue service’s international information reporting requirements for us taxpayers who have foreign accounts, assets,. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file.

Taxpayers To Report Specified Foreign Financial Assets Each Year On A Form 8938.

You are unmarried and the total value of your specified foreign financial. Select your tax module below for steps: Web neither you nor your spouse has to file form 8938. Web jo willetts, ea director, tax resources published on:

You Must File Form 8938 If You Must File An Income Tax Return And:

Web there are several ways to submit form 4868. The form 8938 instructions are complex. Web form 8938 estate beneficiary: Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.

Then You Have To Provide All Other Required Information In The.

Taxpayers, corporations, partnerships, and trusts that hold foreign assets beyond a certain threshold. Web filing form 8938 is only available to those using turbotax deluxe or higher. Use form 8938 to report your. Web watch on what is an fbar?