Who Fills Out California Form 593

Who Fills Out California Form 593 - In the vast majority of transactions, this is handled by the escrow. First, complete your state return. If the seller cannot qualify for an exemption,. Web forms and publications search | form request | california franchise tax board Web california real estate withholding. When you reach take a look at. Web as of january 1, 2020, california real estate withholding changed. Web instructions the remitter completes this form. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Web 2023real estate withholding statement593 amended:

The escrow company will provide this form to the seller,. Escrow provides this form to the seller, typically when the escrow instructions have. First, complete your state return. Web instructions the remitter completes this form. Unless an exemption applies, all of the following are subject to real estate withholding: _________________________ part i remitter information •• reep • qualified. Web we last updated the real estate withholding tax statement in january 2023, so this is the latest version of form 593, fully updated for tax year 2022. Web your california real estate withholding has to be entered on both the state and the federal return. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Web 2023real estate withholding statement593 amended:

When you reach take a look at. Web instructions the remitter completes this form. _________________________ part i remitter information •• reep • qualified. You can download or print. Individuals corporations partnerships limited liability. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Unless an exemption applies, all of the following are subject to real estate withholding: Escrow provides this form to the seller, typically when the escrow instructions have. Web we last updated the real estate withholding tax statement in january 2023, so this is the latest version of form 593, fully updated for tax year 2022. Web california form 593 means a california franchise tax board form 593 to satisfy the requirements of california revenue and taxation code sections 18662 et seq., which is.

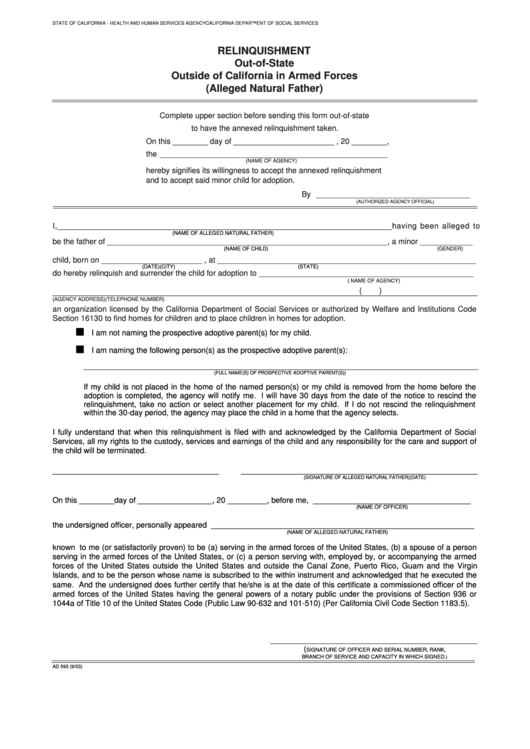

Fillable Form Ad 593 Relinquishment OutOfState Outside Of California

When you reach take a look at. Unless an exemption applies, all of the following are subject to real estate withholding: Web as of january 1, 2020, california real estate withholding changed. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Individuals corporations partnerships limited.

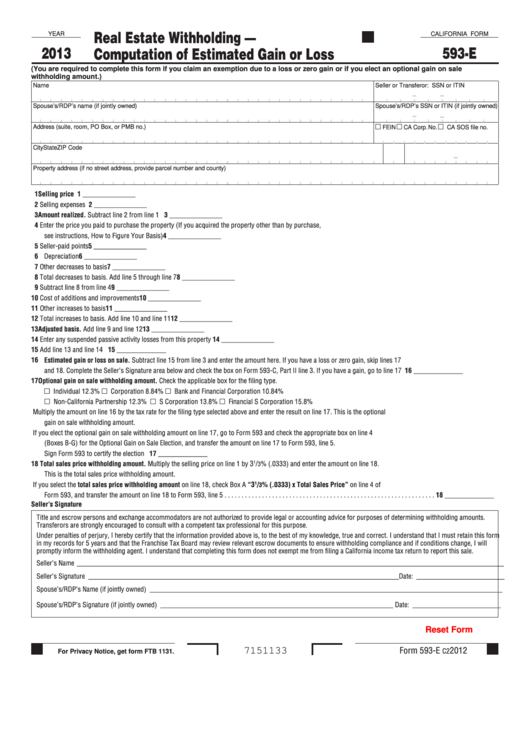

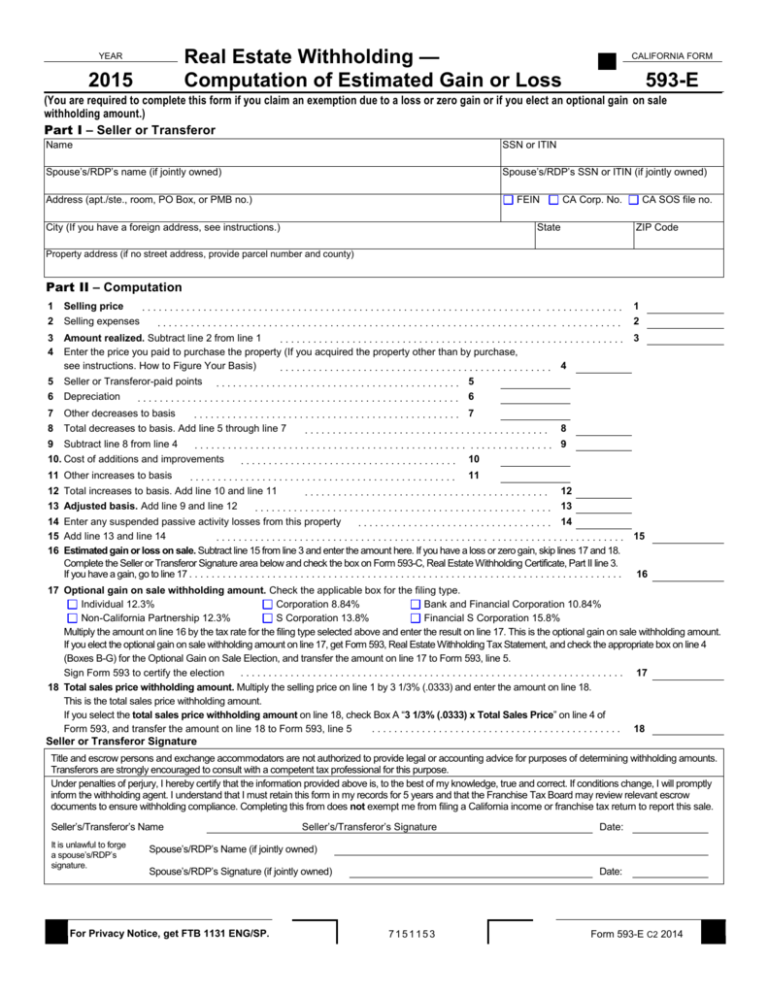

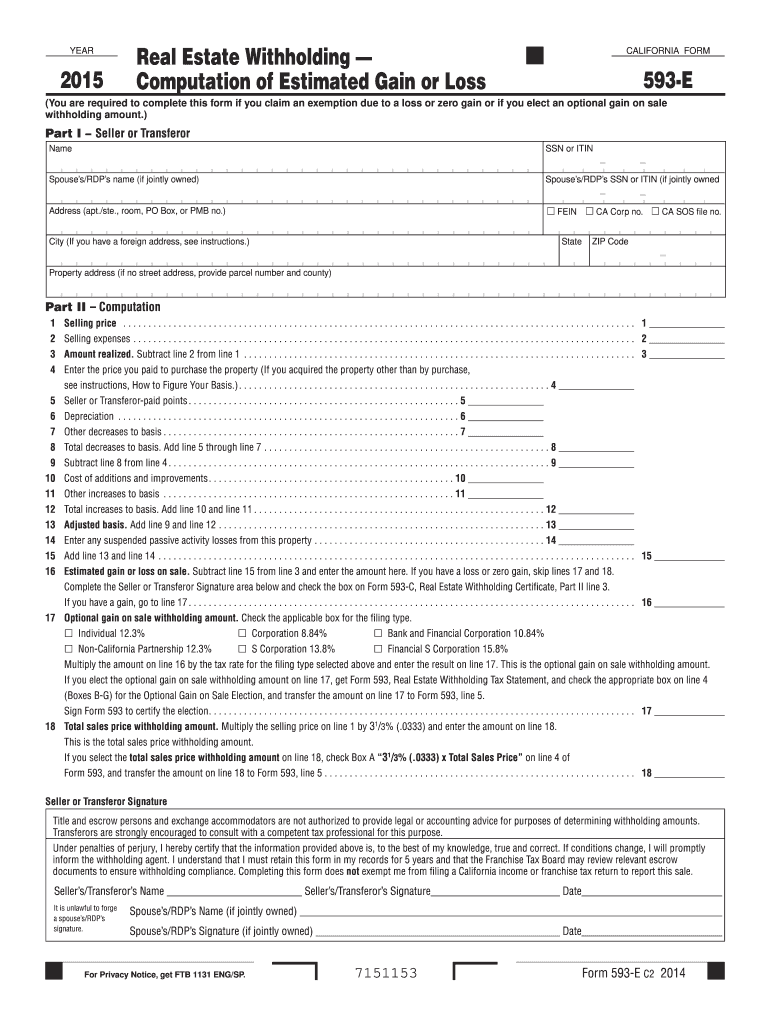

Fillable California Form 593E Real Estate Withholding Computation

You can download or print. Web your california real estate withholding has to be entered on both the state and the federal return. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Web 2023real estate withholding statement593 amended: When you reach take a look at.

2021 Form 593 Real Estate Withholding Statement. 2021 Form 593 Real

Unless an exemption applies, all of the following are subject to real estate withholding: In the vast majority of transactions, this is handled by the escrow. Escrow provides this form to the seller, typically when the escrow instructions have. _________________________ part i remitter information •• reep • qualified. Web 2023real estate withholding statement593 amended:

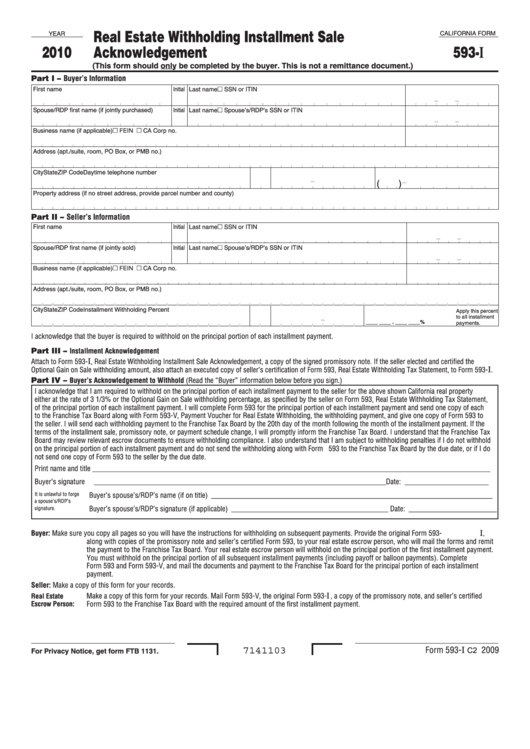

Fillable California Form 593I Real Estate Withholding Installment

Web california form 593 means a california franchise tax board form 593 to satisfy the requirements of california revenue and taxation code sections 18662 et seq., which is. If the seller cannot qualify for an exemption,. First, complete your state return. Web as of january 1, 2020, california real estate withholding changed. Individuals corporations partnerships limited liability.

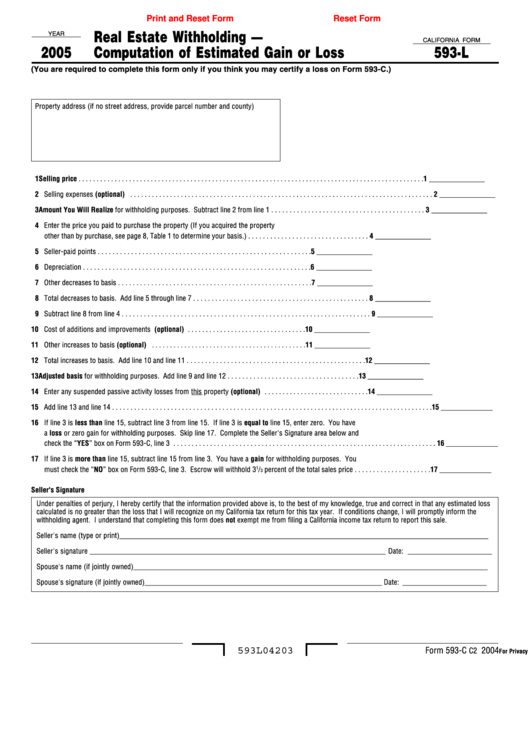

Fillable California Form 593L Real Estate Withholding Computation

We now have one form 593, real estate withholding statement, which is filed with ftb after every real. Web we last updated the real estate withholding tax statement in january 2023, so this is the latest version of form 593, fully updated for tax year 2022. Web california real estate withholding. Escrow provides this form to the seller, typically when.

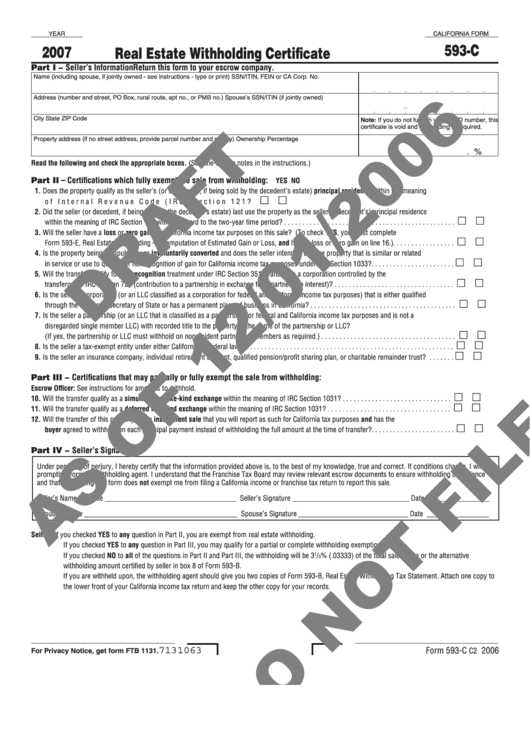

California Form 593C Draft Real Estate Withholding Certificate

The escrow company will provide this form. When you reach take a look at. Web forms and publications search | form request | california franchise tax board The escrow company will provide this form to the seller,. First, complete your state return.

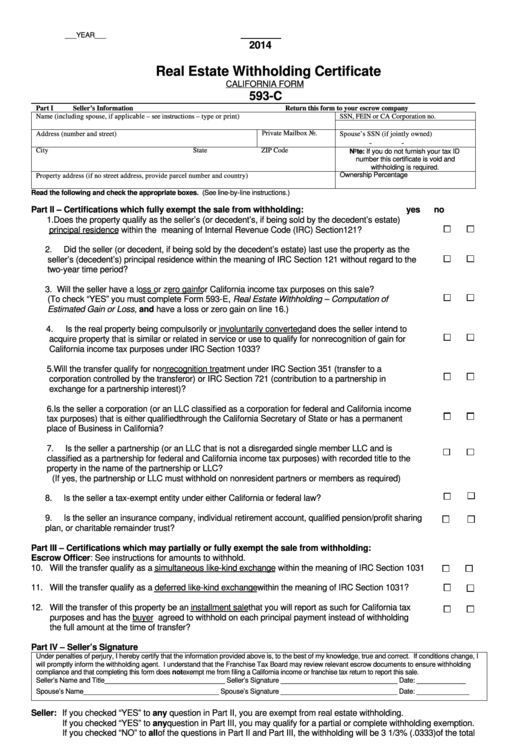

California Form 593C Real Estate Withholding Certificate 2014

If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. If the seller cannot qualify for an exemption,. Web instructions the remitter completes this form. The escrow company will provide this form. We now have one form 593, real estate withholding statement, which is filed with.

Real Estate Withholding 593E

Web • the seller is a corporation (or a limited liability company (llc) classified as a corporation), qualified through the ca secretary of state or has a permanent place of business in ca. Unless an exemption applies, all of the following are subject to real estate withholding: Escrow provides this form to the seller, typically when the escrow instructions have..

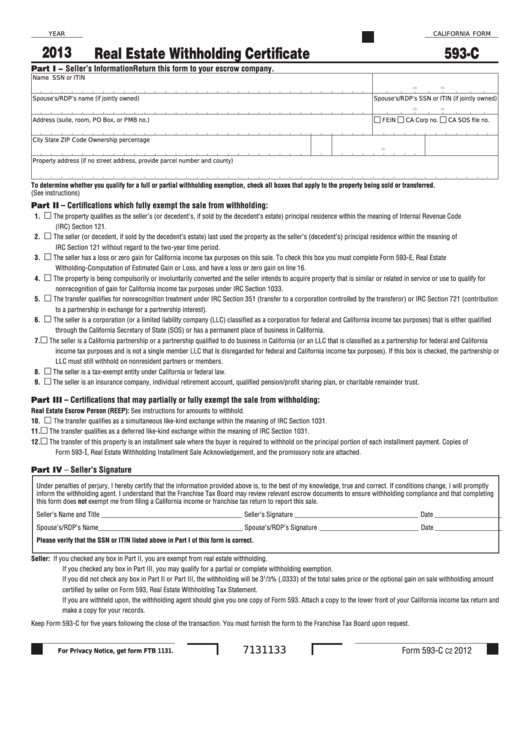

Fillable California Form 593C Real Estate Withholding Certificate

Web we last updated the real estate withholding tax statement in january 2023, so this is the latest version of form 593, fully updated for tax year 2022. The escrow company will provide this form. Web who is subject to withholding? Web forms and publications search | form request | california franchise tax board Escrow provides this form to the.

2015 Form CA FTB 593E Fill Online, Printable, Fillable, Blank pdfFiller

The escrow company will provide this form to the seller,. Individuals corporations partnerships limited liability. We now have one form 593, real estate withholding statement, which is filed with ftb after every real. Web as of january 1, 2020, california real estate withholding changed. Web we last updated the real estate withholding tax statement in january 2023, so this is.

_________________________ Part I Remitter Information •• Reep • Qualified.

Web your california real estate withholding has to be entered on both the state and the federal return. We now have one form 593, real estate withholding statement, which is filed with ftb after every real. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. You can download or print.

The Escrow Company Will Provide This Form.

Web instructions the remitter completes this form. Web california real estate withholding. Web california form 593 means a california franchise tax board form 593 to satisfy the requirements of california revenue and taxation code sections 18662 et seq., which is. In the vast majority of transactions, this is handled by the escrow.

Web Who Is Subject To Withholding?

Web as of january 1, 2020, california real estate withholding changed. Web we last updated the real estate withholding tax statement in january 2023, so this is the latest version of form 593, fully updated for tax year 2022. Unless an exemption applies, all of the following are subject to real estate withholding: Web • the seller is a corporation (or a limited liability company (llc) classified as a corporation), qualified through the ca secretary of state or has a permanent place of business in ca.

Escrow Provides This Form To The Seller, Typically When The Escrow Instructions Have.

The escrow company will provide this form to the seller,. Web 2023real estate withholding statement593 amended: If the seller cannot qualify for an exemption,. When you reach take a look at.