Where To Mail Form 8606

Where To Mail Form 8606 - Web department of the treasury internal revenue service (99) nondeductible iras. Ago towww.irs.gov/form8606 for instructions and the latest information. And the total assets at the end of the tax year. Web where do i find form 8606? If the partnership's principal business, office, or agency is located in: Solved • by turbotax • 2898 • updated may 24, 2023 we'll automatically generate and fill out form 8606 (nondeductible iras) if you. Web updated for tax year 2022 • june 2, 2023 08:43 am. Web where to file your taxes for form 1065. Form 8606 is used to report certain contributions and. Place you would otherwise file form 1040, 1040a, or 1040nr.

California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Web where do i find form 8606? What gets reported on form 8606? If you have an inherited ira, there are various possible scenarios that determine how you will complete your return using the taxact ® program. Web information about form 8606, nondeductible iras, including recent updates, related forms, and instructions on how to file. Web department of the treasury internal revenue service (99) nondeductible iras. Place you would otherwise file form 1040, 1040a, or 1040nr. Web if you aren’t required to file an income tax return but are required to file form 8606, sign form 8606 and send it to the irs at the same time and place you would otherwise file. Web updated for tax year 2022 • june 2, 2023 08:43 am. If the partnership's principal business, office, or agency is located in:

Web learn more on this form and how to fill it out. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Form 8606 is used to report certain contributions and. Here's an irs page for. If you have an inherited ira, there are various possible scenarios that determine how you will complete your return using the taxact ® program. Place you would otherwise file form 1040, 1040a, or 1040nr. Solved • by turbotax • 2898 • updated may 24, 2023 we'll automatically generate and fill out form 8606 (nondeductible iras) if you. If the partnership's principal business, office, or agency is located in: Web information about form 8606, nondeductible iras, including recent updates, related forms, and instructions on how to file. Ago towww.irs.gov/form8606 for instructions and the latest information.

Learn How to Fill the Form 8606 Request for a Certificate of

What gets reported on form 8606? Solved • by turbotax • 2898 • updated may 24, 2023 we'll automatically generate and fill out form 8606 (nondeductible iras) if you. And the total assets at the end of the tax year. Web information about form 8606, nondeductible iras, including recent updates, related forms, and instructions on how to file. Web learn.

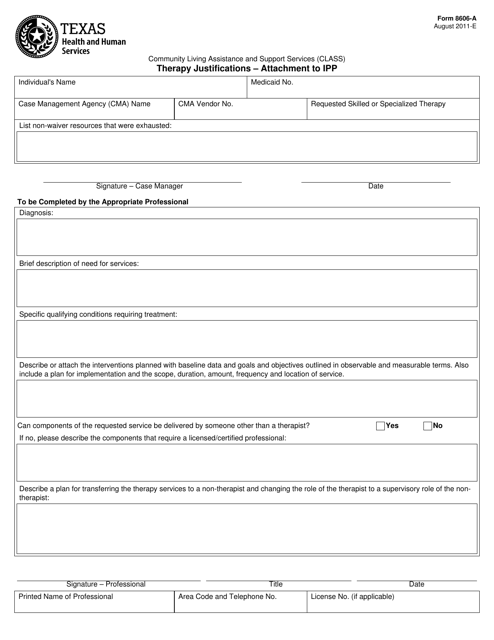

Form 8606A Download Fillable PDF or Fill Online Therapy Justifications

If the partnership's principal business, office, or agency is located in: And the total assets at the end of the tax year. Form 8606 is used to report a variety of transactions related to traditional. Form 8606 is used to report certain contributions and. Web learn more about nondeductible ira contributions and how to file them on form 8606 from.

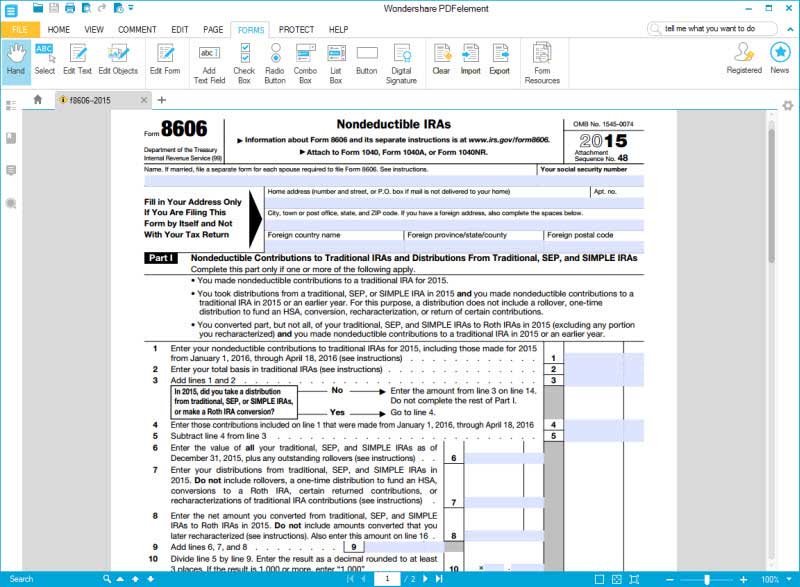

Instructions for How to Fill in IRS Form 8606

Web information about form 8606, nondeductible iras, including recent updates, related forms, and instructions on how to file. Web if you aren’t required to file an income tax return but are required to file form 8606, sign form 8606 and send it to the irs at the same time and place you would otherwise file. Web department of the treasury.

Form 8606 YouTube

California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. If you have an inherited ira, there are various possible scenarios that determine how you will complete your return using the taxact ® program. Web learn more about nondeductible ira contributions and how to file them on form 8606 from the tax experts at h&r block. Web where.

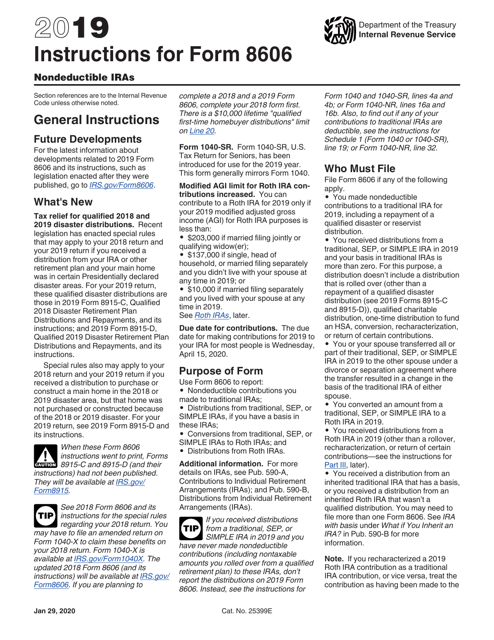

Download Instructions for IRS Form 8606 Nondeductible Iras PDF, 2019

Web learn more about nondeductible ira contributions and how to file them on form 8606 from the tax experts at h&r block. Taxpayers use form 8606 to report a number of transactions relating to what the internal revenue. Web department of the treasury internal revenue service (99) nondeductible iras. Form 8606 is used to report a variety of transactions related.

What is Form 8606? (with pictures)

Solved • by turbotax • 2898 • updated may 24, 2023 we'll automatically generate and fill out form 8606 (nondeductible iras) if you. Place you would otherwise file form 1040, 1040a, or 1040nr. Web information about form 8606, nondeductible iras, including recent updates, related forms, and instructions on how to file. Ago towww.irs.gov/form8606 for instructions and the latest information. And.

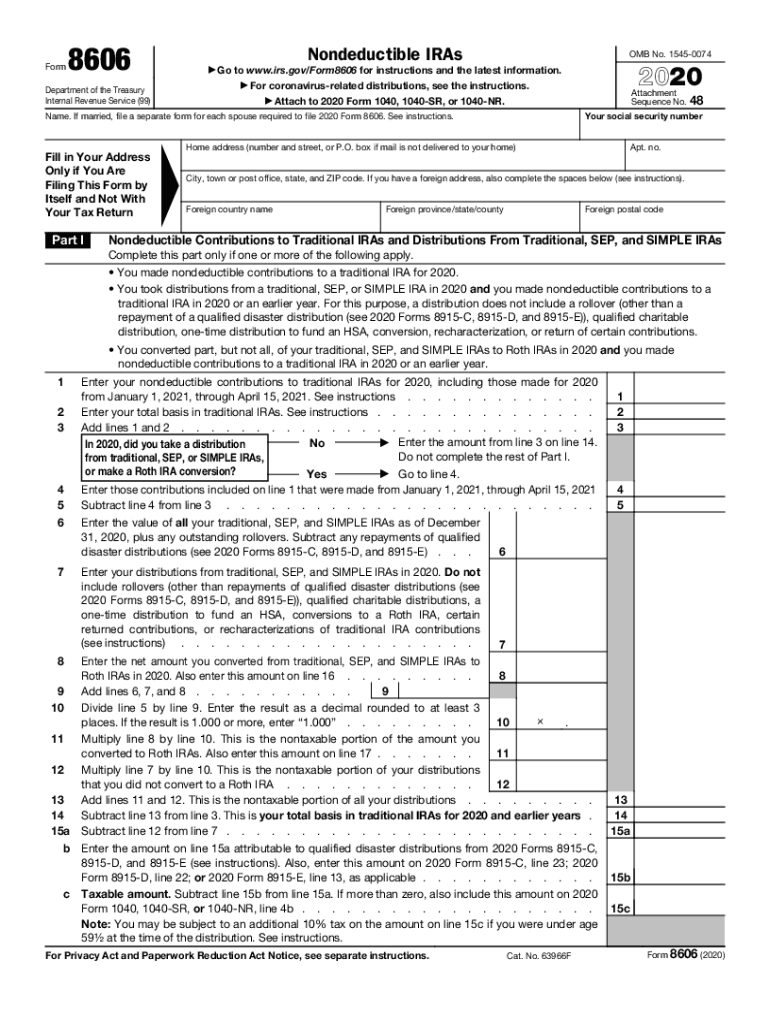

2020 Form IRS 8606 Fill Online, Printable, Fillable, Blank pdfFiller

If you have an inherited ira, there are various possible scenarios that determine how you will complete your return using the taxact ® program. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Web information about form 8606, nondeductible iras, including recent updates, related forms, and instructions on how to file. And the total assets at the.

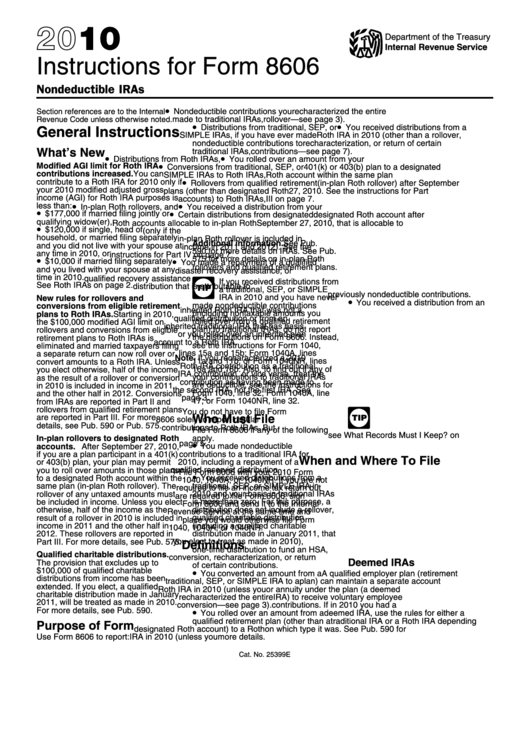

Instructions For Form 8606 Nondeductible Iras 2010 printable pdf

Here's an irs page for. Ago towww.irs.gov/form8606 for instructions and the latest information. Web department of the treasury internal revenue service (99) nondeductible iras. Web if you aren’t required to file an income tax return but are required to file form 8606, sign form 8606 and send it to the irs at the same time and place you would otherwise.

Form 8606 Nondeductible IRAs (2014) Free Download

Solved • by turbotax • 2898 • updated may 24, 2023 we'll automatically generate and fill out form 8606 (nondeductible iras) if you. Web learn more about nondeductible ira contributions and how to file them on form 8606 from the tax experts at h&r block. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. If you have.

Question re Form 8606 after conversion with some deductible

Web where to file your taxes for form 1065. Web information about form 8606, nondeductible iras, including recent updates, related forms, and instructions on how to file. If you aren’t required to file an income tax return but. Web where do i find form 8606? Web learn more about nondeductible ira contributions and how to file them on form 8606.

If You Have An Inherited Ira, There Are Various Possible Scenarios That Determine How You Will Complete Your Return Using The Taxact ® Program.

Place you would otherwise file form 1040, 1040a, or 1040nr. And the total assets at the end of the tax year. Taxpayers use form 8606 to report a number of transactions relating to what the internal revenue. Ago towww.irs.gov/form8606 for instructions and the latest information.

Web Learn More On This Form And How To Fill It Out.

Web if you aren’t required to file an income tax return but are required to file form 8606, sign form 8606 and send it to the irs at the same time and place you would otherwise file. Web updated for tax year 2022 • june 2, 2023 08:43 am. Form 8606 is used to report a variety of transactions related to traditional. If you aren’t required to file an income tax return but.

Form 8606 Is Used To Report Certain Contributions And.

Solved • by turbotax • 2898 • updated may 24, 2023 we'll automatically generate and fill out form 8606 (nondeductible iras) if you. Web learn more about nondeductible ira contributions and how to file them on form 8606 from the tax experts at h&r block. If the partnership's principal business, office, or agency is located in: Web where to file your taxes for form 1065.

California, Connecticut, District Of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia.

Web where do i find form 8606? What gets reported on form 8606? Web information about form 8606, nondeductible iras, including recent updates, related forms, and instructions on how to file. Web form 8606 and send it to the internal revenue service at the same time and.