Where To File Form 56

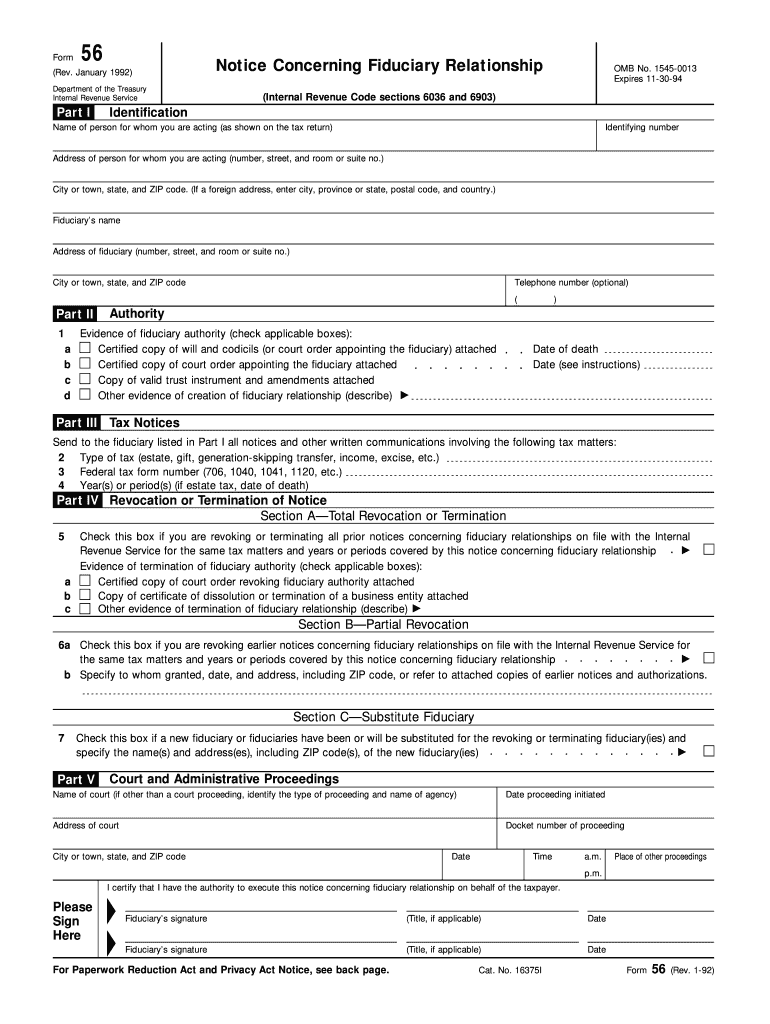

Where To File Form 56 - Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Web when and where to file. According to publication 559 form the irs, form 1310 doesn't have to be filed if you are claiming a refund and. You can print form 56 directly to a pdf from within the program and attach it to the return in. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. At this time, the irs does not accept form 56 electronically. For more information on which 1040 and 1041 forms are not included in the. Web information about form 56, notice concerning fiduciary relationship, including recent updates, related forms, and instructions on how to file.

Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). According to publication 559 form the irs, form 1310 doesn't have to be filed if you are claiming a refund and. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Knott 9.86k subscribers join subscribe 208 share save 10k views 1 year ago #irs #estatetax. Web 1 best answer davef1006 expert alumni it depends. Advertisement fiduciary supplemental forms when a fiduciary files form 56. Complete, edit or print tax forms instantly. Web 6 rows file form 56 at internal revenue service center where the person for whom you are acting is. Web the trustee can file form 56 for a bankrupt company or a bankrupt individual.

According to publication 559 form the irs, form 1310 doesn't have to be filed if you are claiming a refund and. Web when and where to file. Form 56 must be attached as a pdf file for electronic returns. Web 6 rows file form 56 at internal revenue service center where the person for whom you are acting is. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Web information about form 56, notice concerning fiduciary relationship, including recent updates, related forms, and instructions on how to file. For more information on which 1040 and 1041 forms are not included in the. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Complete, edit or print tax forms instantly.

Form CORP.56 Download Fillable PDF or Fill Online Registration of

Web 1 best answer davef1006 expert alumni it depends. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Form 56 must be attached as a pdf file for electronic returns. Web form 56 should be filed by a fiduciary (see definitions.

Form 56 IRS Template PDF

Form 56 differs from a form 2848,. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Knott 9.86k subscribers join subscribe 208 share save 10k views 1 year ago #irs #estatetax. Ad access irs tax forms. Advertisement fiduciary supplemental.

Annual Registration Statements (Form 561) SEEDUCATION PUBLIC

At this time, the irs does not accept form 56 electronically. Web information about form 56, notice concerning fiduciary relationship, including recent updates, related forms, and instructions on how to file. Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Web the trustee can file form 56 for a bankrupt company or a bankrupt individual..

Form 56 About IRS Tax Form 56 & Filing Instructions Community Tax

Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. You can print form 56 directly to a pdf from within the program and attach it to the return in. Web when and where to file. Form 56 differs from a form.

Fill Free fillable Form 56 2011 Notice Concerning Fiduciary

Web information about form 56, notice concerning fiduciary relationship, including recent updates, related forms, and instructions on how to file. Knott 9.86k subscribers join subscribe 208 share save 10k views 1 year ago #irs #estatetax. Advertisement fiduciary supplemental forms when a fiduciary files form 56. Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Complete,.

Irs Form 56 Where to Email Fill Out and Sign Printable PDF Template

Complete, edit or print tax forms instantly. Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Complete, edit or print tax forms instantly. Web 6 rows file form 56 at internal revenue service center where the person for whom you are acting is. Advertisement fiduciary supplemental forms when a fiduciary files form 56.

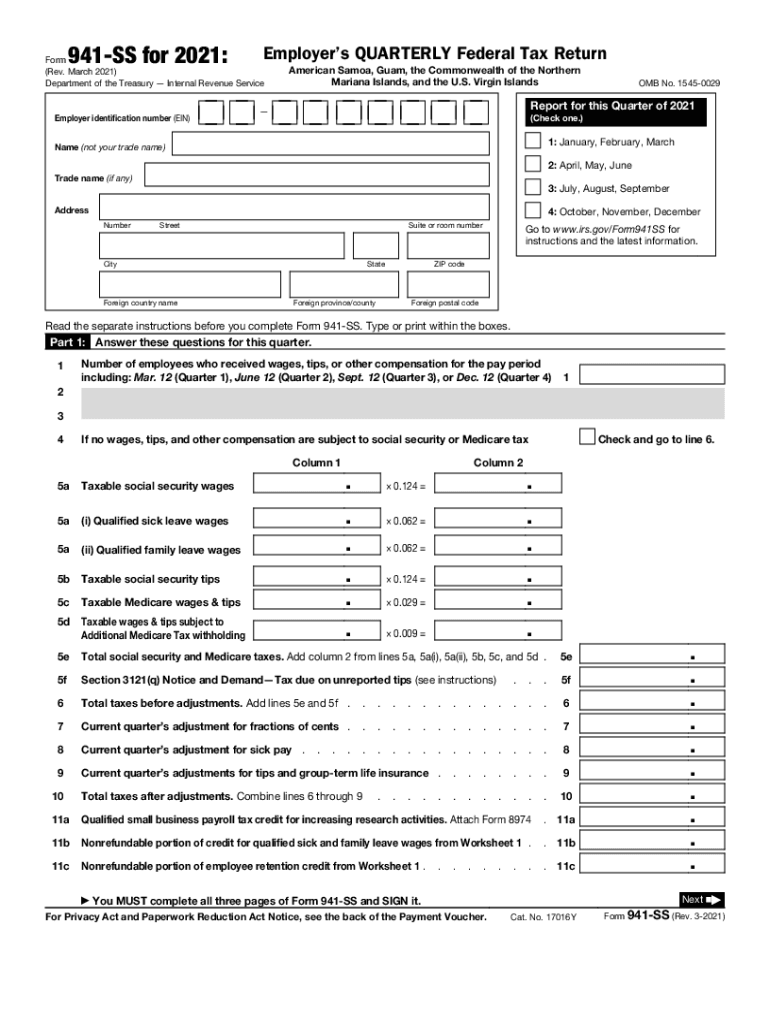

form 941 Fill out & sign online DocHub

Web when and where to file. Form 56 differs from a form 2848,. Advertisement fiduciary supplemental forms when a fiduciary files form 56. Form 56 must be attached as a pdf file for electronic returns. Generally, you should file form 56 when you create (or terminate) a fiduciary relationship.

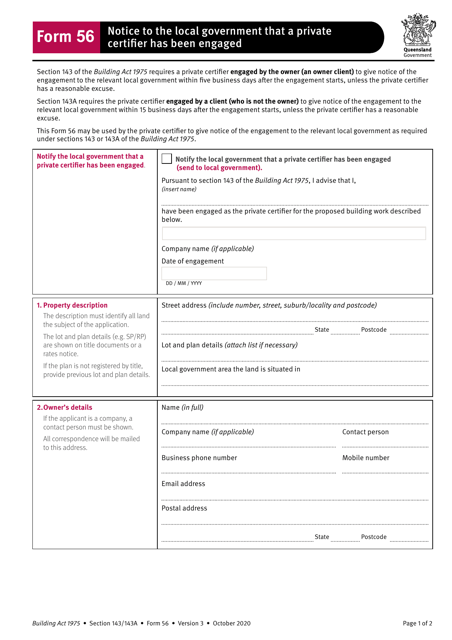

Form 56 Download Fillable PDF or Fill Online Notice to the Local

Web information about form 56, notice concerning fiduciary relationship, including recent updates, related forms, and instructions on how to file. Web the trustee can file form 56 for a bankrupt company or a bankrupt individual. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web form 56 should be filed by a fiduciary (see definitions.

Publication 947 Practice Before the IRS and Power of Attorney

Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Web 6.

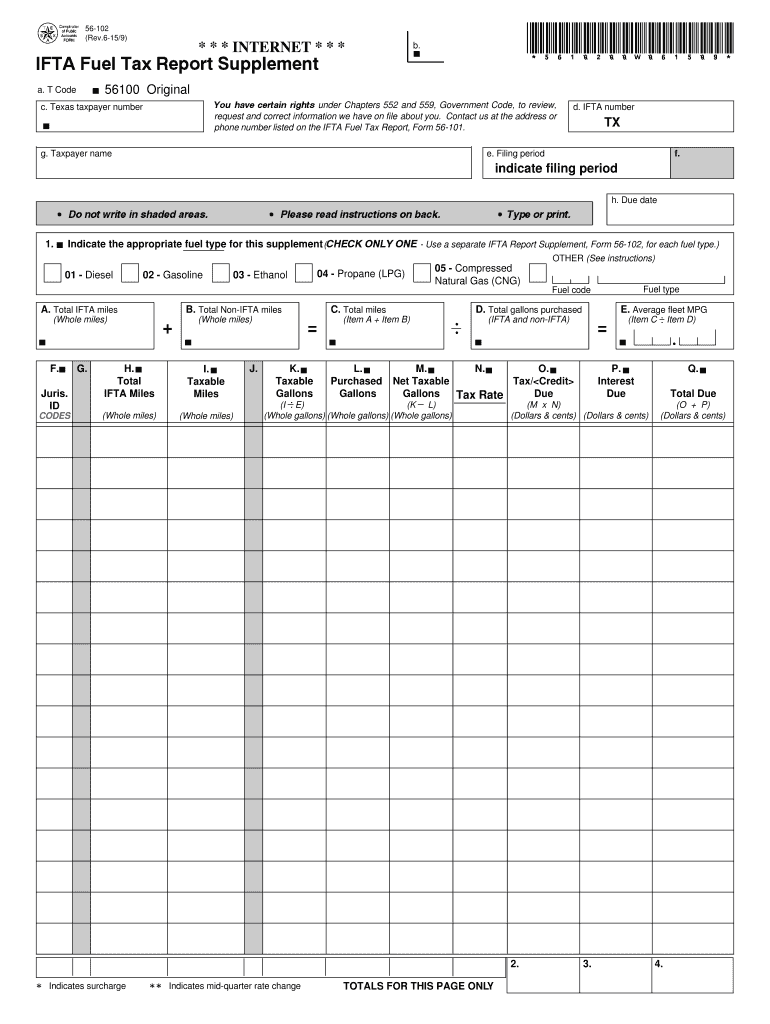

TX Comptroller 56102 2015 Fill out Tax Template Online US Legal Forms

Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. You can print form 56 directly to a pdf from within the program and attach it to the return in. Ad access irs tax forms. Web information about form 56, notice concerning.

Web When And Where To File.

Web 6 rows file form 56 at internal revenue service center where the person for whom you are acting is. You can print form 56 directly to a pdf from within the program and attach it to the return in. For more information on which 1040 and 1041 forms are not included in the. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903.

Form 56 Must Be Attached As A Pdf File For Electronic Returns.

At this time, the irs does not accept form 56 electronically. Knott 9.86k subscribers join subscribe 208 share save 10k views 1 year ago #irs #estatetax. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Complete, edit or print tax forms instantly.

Form 56 Differs From A Form 2848,.

Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Web 1 best answer davef1006 expert alumni it depends. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Advertisement fiduciary supplemental forms when a fiduciary files form 56.

According To Publication 559 Form The Irs, Form 1310 Doesn't Have To Be Filed If You Are Claiming A Refund And.

Web information about form 56, notice concerning fiduciary relationship, including recent updates, related forms, and instructions on how to file. Web this form is typically filed when an individual becomes incapacitated, decides to delegate his or her tax responsibilities, or the individual dies. Ad access irs tax forms. Web the trustee can file form 56 for a bankrupt company or a bankrupt individual.