What Is The Debt Limit For Chapter 13

What Is The Debt Limit For Chapter 13 - Davis lin and michael benoist. Web previously, a debtor needed to have under $465,275 in noncontingent, liquidated [1] unsecured debt and under $1,395,875 in noncontingent, liquidated secured debt to file under chapter 13. If your total debt burden is too high, you'll be ineligible, but you can file an individual chapter 11. Chapter 13 is available to individual debtors with less than $419,275 in unsecured debt (debts that are not secured by property, such as credit card debt and medical bills) and less than $1,257,850 in secured debt. Filing for chapter 13 bankruptcy is a powerful move if you have regular income and can manage to repay some of your debts. Web until today, 11 usc §109 (e) limited the eligibility for chapter 13 proceedings to individuals with unsecured debts of no more than $465,275 and secured debts of no more than $1,395,875. To qualify for chapter 13, you must have regular income, have filed all. Similarly, a debtor’s secured debt. Web chapter 13 plans are usually three to five years in length and may not exceed five years. If you had filed chapter 7, hypothetically, the trustee would have sold your car, paid you your exemption, and paid the remaining $6,550 to your general unsecured creditors pro rata.

If you had filed chapter 7, hypothetically, the trustee would have sold your car, paid you your exemption, and paid the remaining $6,550 to your general unsecured creditors pro rata. It's more likely that a chapter 13 debtor will have a problem with. Chapter 13 cases are now permitted for individuals with unsecured debts of no more than $465,275 and secured debts of no more than $1,395,875. Web to qualify for chapter 13 bankruptcy, you must have less than $1,395,875 in secured debt for cases filed between april 1, 2022, and march 31, 2025. Web previously, a debtor needed to have under $465,275 in noncontingent, liquidated [1] unsecured debt and under $1,395,875 in noncontingent, liquidated secured debt to file under chapter 13. For example, the debt limit for unsecured debt is around $400,000, while the debt limit for secured debt. Under sb 3823, debtors no longer are required to limit. This is an increase of more. Web chapter 13 requirements impose a limit on the amount of a filer's debt. Filing for chapter 13 bankruptcy is a powerful move if you have regular income and can manage to repay some of your debts.

If your total debt burden is too high, you'll be ineligible, but you can file an individual chapter 11. Filing for chapter 13 bankruptcy is a powerful move if you have regular income and can manage to repay some of your debts. Web what are chapter 13 debt limits and why are the limits important? Web to qualify for chapter 13 bankruptcy, you must have less than $1,395,875 in secured debt for cases filed between april 1, 2022, and march 31, 2025. Web below, we’ll discuss debt limits, how they work, and what you can do if you owe more than the chapter 13 debt limits allow. It's more likely that a chapter 13 debtor will have a problem with. Web previously, a debtor needed to have under $465,275 in noncontingent, liquidated [1] unsecured debt and under $1,395,875 in noncontingent, liquidated secured debt to file under chapter 13. Web chapter 13 debt eligibility limits in order to be eligible to file for chapter 13 bankruptcy, the filing individual(s) must owe less than $1,184,200 in liquidated, noncontingent secured debts, and less than $394,725 in. For example, the debt limit for unsecured debt is around $400,000, while the debt limit for secured debt. § 109 (e), a debtor may not have more than $419,275 in unsecured, liquidated, noncontingent debt (updated yearly to reflect changes in the consumer price index).

What Is The Unsecured Debt Limit For Chapter 13? John Vitela

Web chapter 13 plans are usually three to five years in length and may not exceed five years. This is an increase of more. Davis lin and michael benoist. To qualify for chapter 13, you must have regular income, have filed all. Chapter 13 is available to individual debtors with less than $419,275 in unsecured debt (debts that are not.

debtlimit Fed Savvy

Web chapter 13 debt eligibility limits in order to be eligible to file for chapter 13 bankruptcy, the filing individual(s) must owe less than $1,184,200 in liquidated, noncontingent secured debts, and less than $394,725 in. If you had filed chapter 7, hypothetically, the trustee would have sold your car, paid you your exemption, and paid the remaining $6,550 to your.

Chapter 13 Bankruptcy Debt Limits Steiner Law Group

Web until today, 11 usc §109 (e) limited the eligibility for chapter 13 proceedings to individuals with unsecured debts of no more than $465,275 and secured debts of no more than $1,395,875. Chapter 13 cases are now permitted for individuals with unsecured debts of no more than $465,275 and secured debts of no more than $1,395,875. If your total debt.

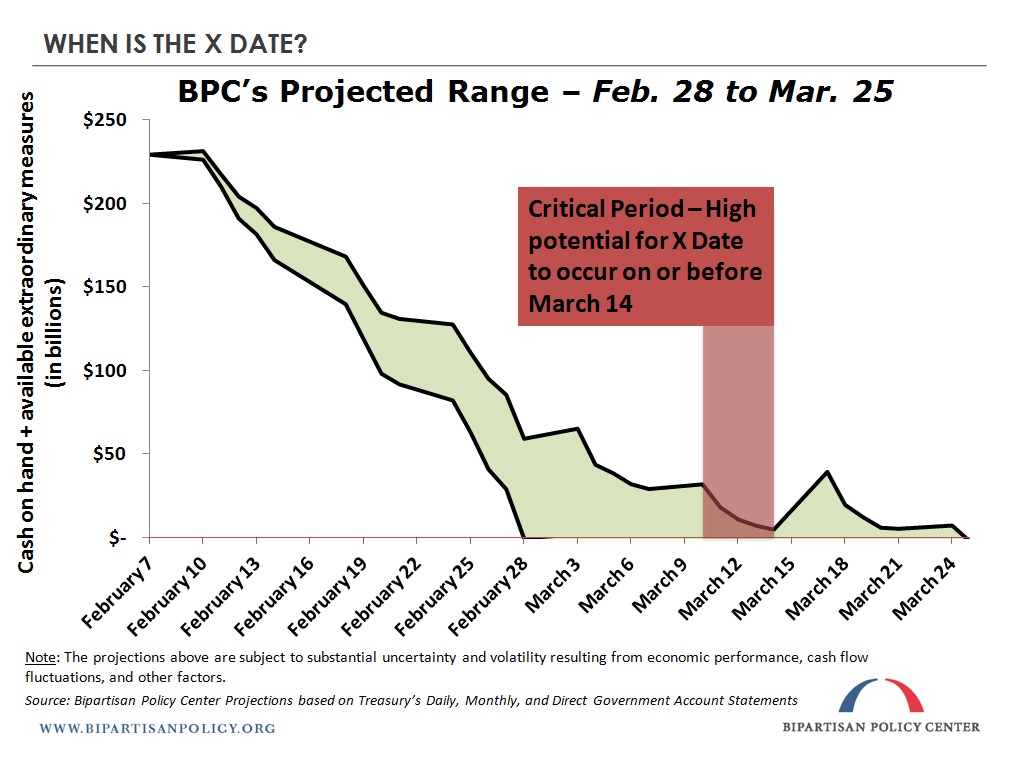

Risking the Recovery Debt Limit Uncertainty Returns

Web until today, 11 usc §109 (e) limited the eligibility for chapter 13 proceedings to individuals with unsecured debts of no more than $465,275 and secured debts of no more than $1,395,875. Web to qualify for chapter 13 bankruptcy, you must have less than $1,395,875 in secured debt for cases filed between april 1, 2022, and march 31, 2025. Web.

No Games With the Debt Limit Committee for a Responsible Federal Budget

Discharging most unsecured debts such as credit card balances and medical debt, which saves money. Web to qualify for chapter 13 bankruptcy, you must have less than $1,395,875 in secured debt for cases filed between april 1, 2022, and march 31, 2025. Davis lin and michael benoist. § 109 (e), a debtor may not have more than $419,275 in unsecured,.

Watch This — The Debt Limit Explained

Web pros of switching to chapter 7. Web one little known fact of a chapter 13 case is that, under 11 u.s.c. Web what are chapter 13 debt limits and why are the limits important? Davis lin and michael benoist. $1,257,850 these chapter 13 debt limits adjust every 3 years under section 104(a).

America's Impending Debt Crisis Seeking Alpha

Davis lin and michael benoist. As of april 1, 2019, chapter 13 debt limits are: $1,257,850 these chapter 13 debt limits adjust every 3 years under section 104(a). Web pros of switching to chapter 7. If you had filed chapter 7, hypothetically, the trustee would have sold your car, paid you your exemption, and paid the remaining $6,550 to your.

Will GOP Settle for a Clean Debt Limit Win?

If your total debt burden is too high, you'll be ineligible, but you can file an individual chapter 11. Filing for chapter 13 bankruptcy is a powerful move if you have regular income and can manage to repay some of your debts. Web chapter 13 plans are usually three to five years in length and may not exceed five years..

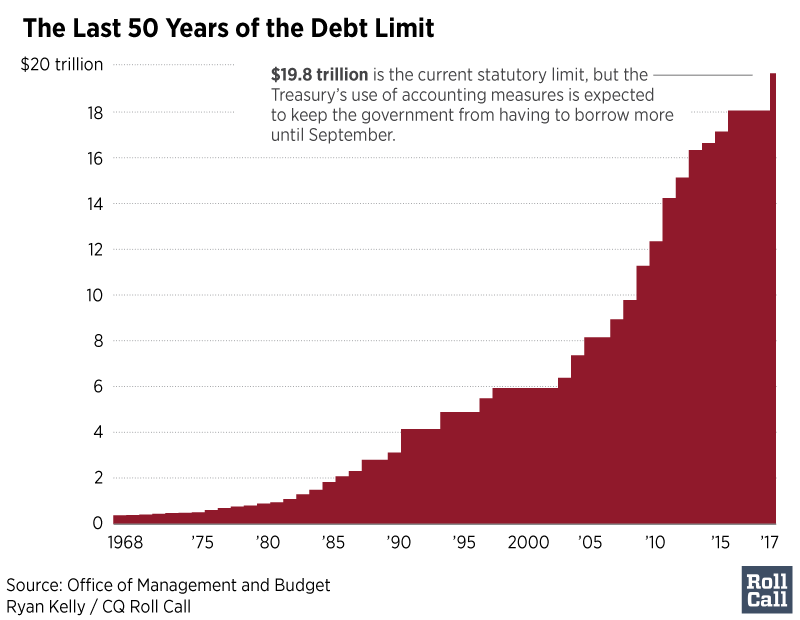

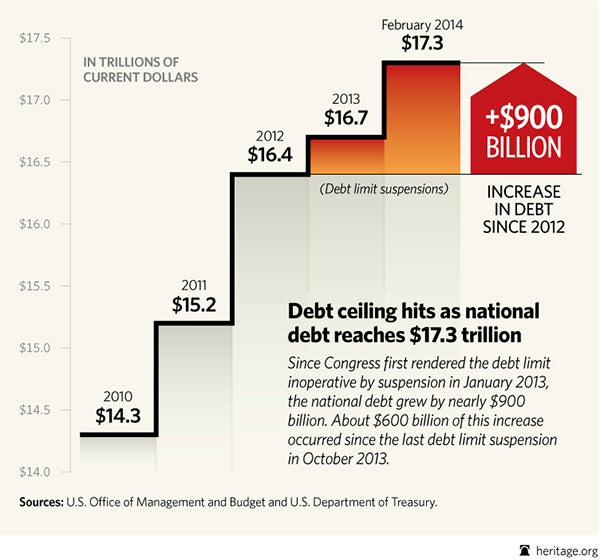

The Debt Ceiling Returns as National Debt Reaches 17.3 Trillion

| may 9, 2022 | chapter 13 bankruptcy while there are several kinds of bankruptcy, most people file either a chapter 7 or a chapter 13. Web what are chapter 13 debt limits and why are the limits important? This is an increase of more. Up to five years for chapter 13). Web home | chapter 13 bankruptcy | new.

Infographic The Debt Limit

Web you can have only so much debt in chapter 13 bankruptcy—you'll find the chapter 13 bankruptcy debt limitations here. If you had filed chapter 7, hypothetically, the trustee would have sold your car, paid you your exemption, and paid the remaining $6,550 to your general unsecured creditors pro rata. Web chapter 13 bankruptcy is used to reorganize debt, which.

Web The Nonexempt Value Is $6,550.

Web unsecured debt limit: Chapter 13 is available to individual debtors with less than $419,275 in unsecured debt (debts that are not secured by property, such as credit card debt and medical bills) and less than $1,257,850 in secured debt. Web below, we’ll discuss debt limits, how they work, and what you can do if you owe more than the chapter 13 debt limits allow. Web one little known fact of a chapter 13 case is that, under 11 u.s.c.

Under Sb 3823, Debtors No Longer Are Required To Limit.

§ 109 (e), a debtor may not have more than $419,275 in unsecured, liquidated, noncontingent debt (updated yearly to reflect changes in the consumer price index). Web pros of switching to chapter 7. $1,257,850 these chapter 13 debt limits adjust every 3 years under section 104(a). Web what are chapter 13 debt limits and why are the limits important?

Web Beginning April 1, 2019, The Chapter 13 Debt Limit Increased To (A) $419,275 For A Debtor’s Noncontingent, Liquidated Unsecured Debts, And (B) $1,257,850 For A Debtor’s Noncontingent,.

Similarly, a debtor’s secured debt. If you had filed chapter 7, hypothetically, the trustee would have sold your car, paid you your exemption, and paid the remaining $6,550 to your general unsecured creditors pro rata. Web home | chapter 13 bankruptcy | new debt limits for chapter 13 became effective april 1, 2022 new debt limits for chapter 13 became effective april 1, 2022 on behalf of levitt & slafkes, p.c. Filing for chapter 13 bankruptcy is a powerful move if you have regular income and can manage to repay some of your debts.

Web To Qualify For Chapter 13 Bankruptcy, You Must Have Less Than $1,395,875 In Secured Debt For Cases Filed Between April 1, 2022, And March 31, 2025.

Web chapter 13 requirements impose a limit on the amount of a filer's debt. Web what are the chapter 13 debt limits? Davis lin and michael benoist. Web therefore, it is important for any creditor in a chapter 13 case to consult with a bankruptcy attorney to carefully consider whether the debtor has exceeded the debt limit under section 109(e) of the bankruptcy code at the onset of the chapter 13.