What Is Irs Form 5471

What Is Irs Form 5471 - Persons with respect to certain foreign corporations,” is a document that reports information about u.s. Web on form 5471 and separate schedules, in entry spaces that request identifying information with respect to a foreign entity, taxpayers will no longer have the option to enter “foreignus” or “applied for.” instead, if a foreign entity does not have an ein, the taxpayer must enter a reference id number that uniquely identifies the foreign entity. Form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company. Residents who are officers, directors, or shareholders in certain foreign corporations are responsible for filing form 5471, information return of u.s. Taxpayers with shares or interest in a foreign entity and their transactions. Web form 5471, officially called the information return of u.s. December 2022) department of the treasury internal revenue service. Web instructions for form 5471(rev. However, in the case of a consolidated return, enter the name of the u.s. Persons with respect to certain foreign corporations.

Persons with respect to certain foreign corporations. Web the name of the person filing form 5471 is generally the name of the u.s. Residents who are officers, directors, or shareholders in certain foreign corporations are responsible for filing form 5471, information return of u.s. Web instructions for form 5471(rev. Persons with respect to certain foreign corporations. Form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Such taxpayers must file this information return. December 2022) department of the treasury internal revenue service. Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function as a roadmap for the irs on transfer pricing.

December 2022) department of the treasury internal revenue service. Web information about form 5471, information return of u.s. Taxpayers with shares or interest in a foreign entity and their transactions. Persons with respect to certain foreign corporations,” is a document that reports information about u.s. Persons with respect to certain foreign corporations. Persons with respect to certain foreign corporations, is an information statement (information return) (as opposed to a tax return) for certain u.s. Residents who are officers, directors, or shareholders in certain foreign corporations are responsible for filing form 5471, information return of u.s. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Information furnished for the foreign corporation’s annual accounting period (tax year required by Web on form 5471 and separate schedules, in entry spaces that request identifying information with respect to a foreign entity, taxpayers will no longer have the option to enter “foreignus” or “applied for.” instead, if a foreign entity does not have an ein, the taxpayer must enter a reference id number that uniquely identifies the foreign entity.

irs form 5471 Fill Online, Printable, Fillable Blank

Parent in the field for “name of person filing form 5471.”. Web information about form 5471, information return of u.s. Web the name of the person filing form 5471 is generally the name of the u.s. Form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company. Web form 5471, information return of u.s.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Person described in the category or categories of filers (see categories of filers, earlier). For instructions and the latest information. And the december 2012 revision of separate schedule o.) December 2022) department of the treasury internal revenue service. Residents who are officers, directors, or shareholders in certain foreign corporations are responsible for filing form 5471, information return of u.s.

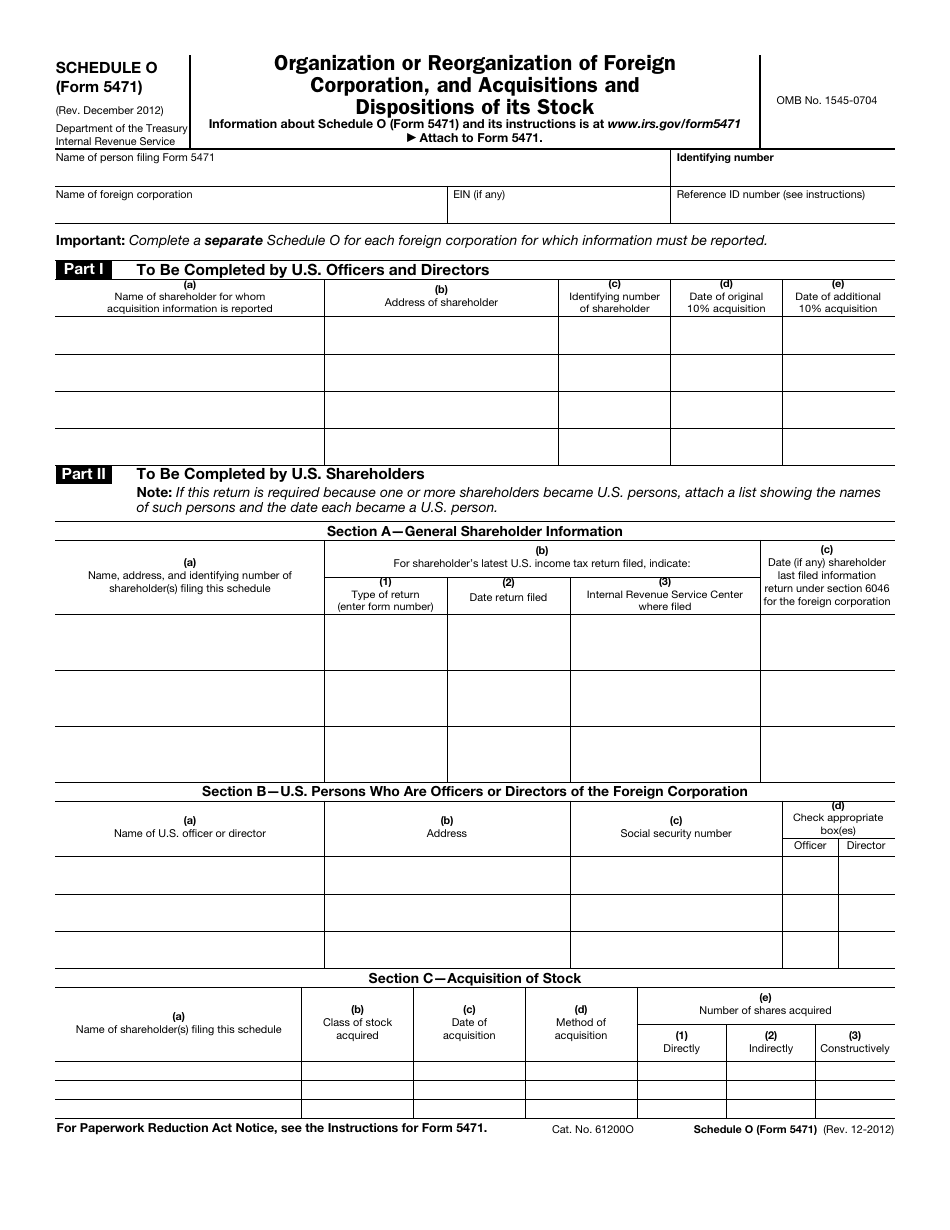

IRS Form 5471 Schedule O Download Fillable PDF or Fill Online

File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company. The december 2018 revision of schedule m; Parent in the field for “name of person filing form 5471.”. Persons with respect to certain foreign corporations, is an information.

Demystifying the All New 2020 Tax Year IRS Form 5471 Schedule E

For instructions and the latest information. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Web on form 5471 and separate schedules, in entry spaces that request identifying information with respect to a foreign entity, taxpayers will no longer have the option to enter “foreignus” or “applied for.” instead, if a.

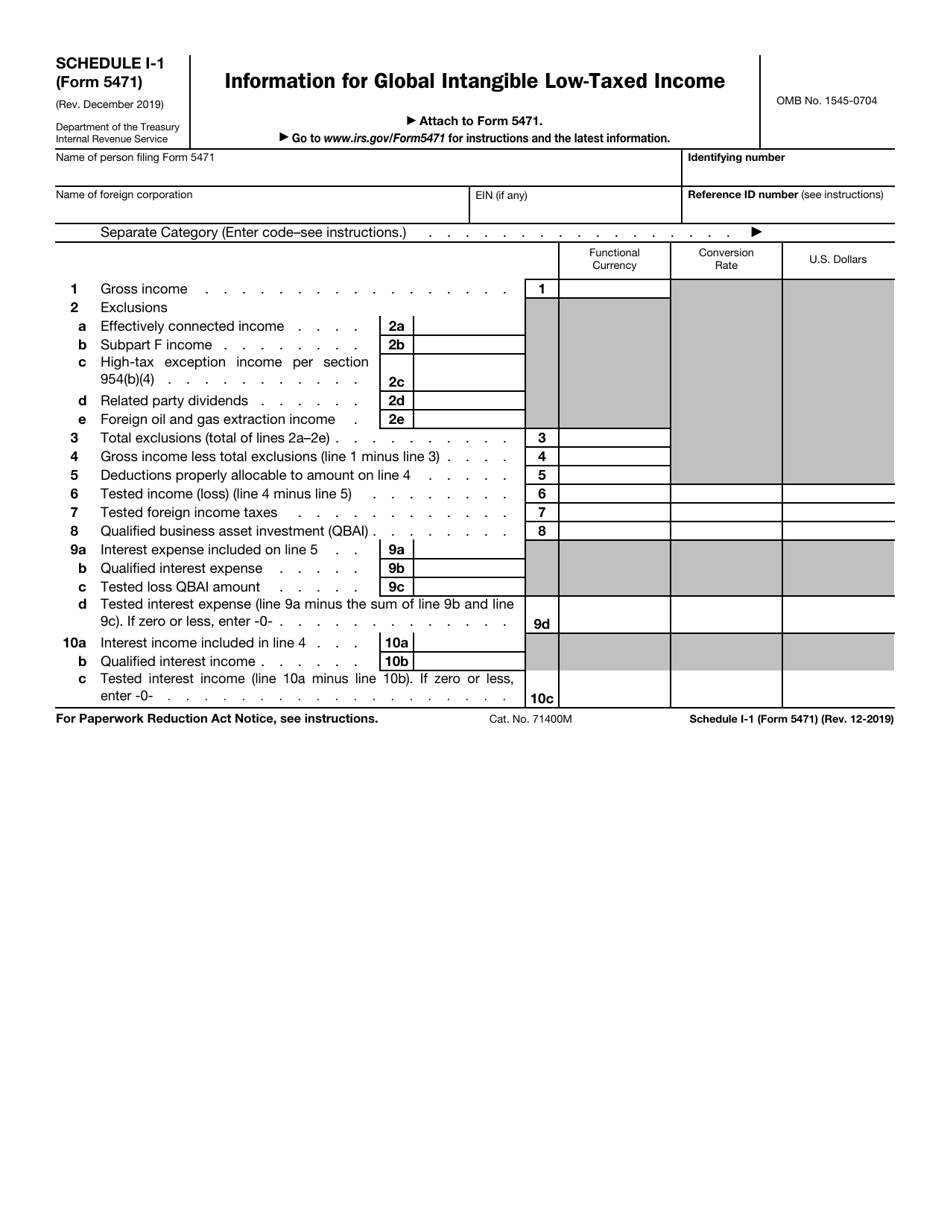

IRS Form 5471 Schedule I1 Download Fillable PDF or Fill Online

January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Persons with respect to certain foreign corporations. For instructions and the latest information. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Persons with respect to certain foreign corporations.

IRS Issues Updated New Form 5471 What's New?

Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function as a roadmap for the irs on transfer pricing. Residents who are officers, directors, or shareholders in certain foreign corporations are responsible for filing form 5471, information return of u.s. Web internal revenue service (irs) form 5471 is required by.

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

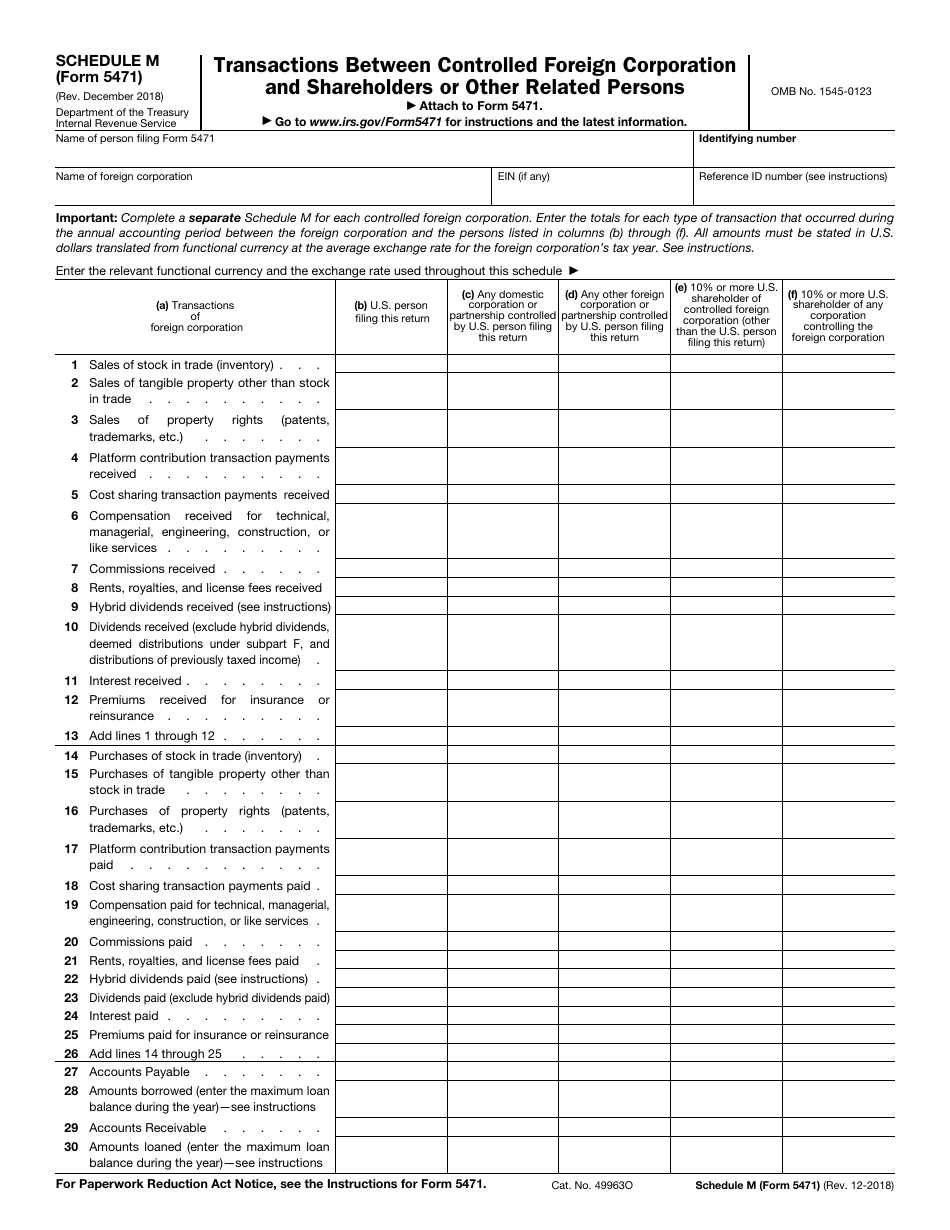

The december 2018 revision of schedule m; Web information about form 5471, information return of u.s. And the december 2012 revision of separate schedule o.) File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Taxpayers with shares or interest in a foreign entity and their transactions.

IRS Form 5471 Carries Heavy Penalties and Consequences

The december 2018 revision of schedule m; Web information about form 5471, information return of u.s. Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function as a roadmap for the irs on transfer pricing. Web form 5471, information return of u.s. Web on form 5471 and separate schedules, in.

IRS Form 5471 Schedule M Download Fillable PDF or Fill Online

Web form 5471, or “information return of u.s. For instructions and the latest information. Parent in the field for “name of person filing form 5471.”. Persons with respect to certain foreign corporations. Taxpayers with shares or interest in a foreign entity and their transactions.

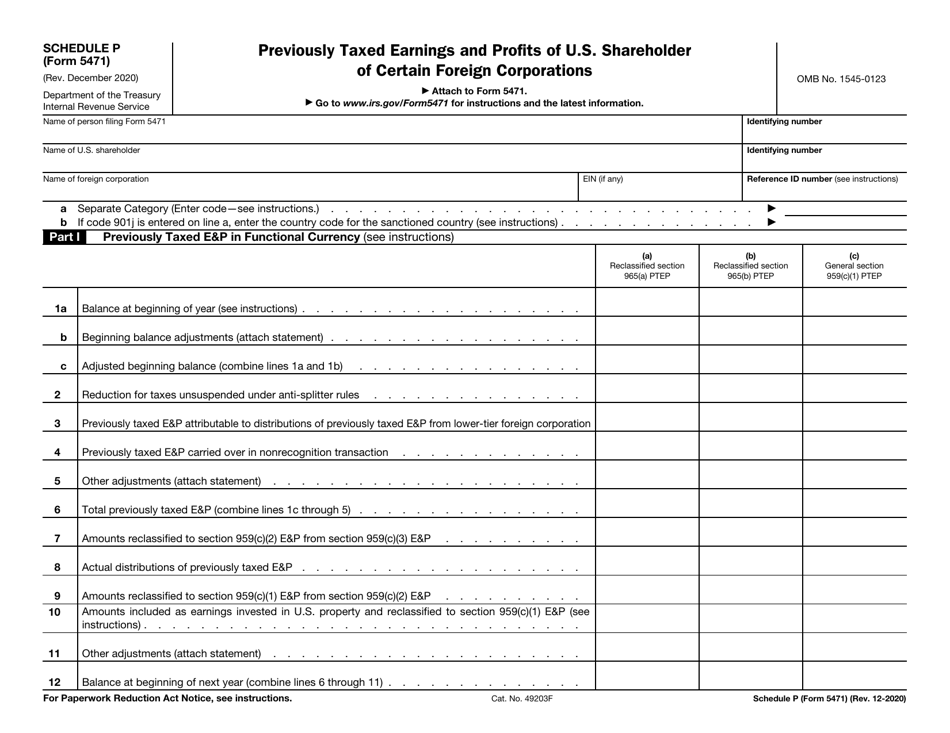

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Residents who are officers, directors, or shareholders in certain foreign corporations are responsible for filing form 5471, information return of u.s. However, in the case of a consolidated return, enter the name of the u.s. Web instructions for form 5471(rev. Web information about form 5471, information return of u.s. December 2022) department of the treasury internal revenue service.

Residents Who Are Officers, Directors, Or Shareholders In Certain Foreign Corporations Are Responsible For Filing Form 5471, Information Return Of U.s.

Web information about form 5471, information return of u.s. Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function as a roadmap for the irs on transfer pricing. Person described in the category or categories of filers (see categories of filers, earlier). Web form 5471, information return of u.s.

Parent In The Field For “Name Of Person Filing Form 5471.”.

The december 2018 revision of schedule m; Web form 5471, officially called the information return of u.s. Web form 5471, or “information return of u.s. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations.

Web The Name Of The Person Filing Form 5471 Is Generally The Name Of The U.s.

Persons with respect to certain foreign corporations. Taxpayers with shares or interest in a foreign entity and their transactions. Such taxpayers must file this information return. Persons with respect to certain foreign corporations.

Web On Form 5471 And Separate Schedules, In Entry Spaces That Request Identifying Information With Respect To A Foreign Entity, Taxpayers Will No Longer Have The Option To Enter “Foreignus” Or “Applied For.” Instead, If A Foreign Entity Does Not Have An Ein, The Taxpayer Must Enter A Reference Id Number That Uniquely Identifies The Foreign Entity.

Form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company. For instructions and the latest information. December 2022) department of the treasury internal revenue service. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file.