What Is Form 8801

What Is Form 8801 - Web when the irs received your form 8801 (to claim your refundable credit of $40,000) it would have first deducted the amount you owed ($11,425) and then mailed. Form 8801 is used to calculate a taxpayer's refundable (in applicable years only) and nonrefundable (for all years) minimum tax credit (mtc) and mtc carryforward to. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax. Web the corrected form 8801 is expected to be release later today (release 20). Form 6781 has two sections. Web department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts go to www.irs.gov/form8801 for instructions and. Web minimum tax credit explained this page contains an explanation of the general concept of the minimum tax credit (mtc), when a taxpayer is entitled to the credit, and how it is. Adding the 6781 form to your tax return will likely save you money. Web generating individual form 8801, credit for prior year minimum tax. This article will assist you with entering.

Web form 8801 is used to calculate your minimum tax credit for amt that you incurred in prior tax years and to figure any credit carryforward. Web not to be confused with irs form 6251, which is the form you submit in the year you actually pay the amt, form 8801 is specifically called “credit for prior year. You need to check on it this weekend. Solved•by intuit•3•updated july 13, 2022. Citizen or resident who participates in or receives annuities from a registered canadian retirement. You can obtain copies of all irs forms at www.irs.gov, and then follow the link to “forms &. Web if that tax form is the 6781, then the answer is ‘yes.’. Web form 8801 (2011) page 3 part iii tax computation using maximum capital gains rates caution. Adding the 6781 form to your tax return will likely save you money. This article will assist you with entering.

Form 8801 is used to calculate a taxpayer's refundable (in applicable years only) and nonrefundable (for all years) minimum tax credit (mtc) and mtc carryforward to. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax. Web the corrected form 8801 is expected to be release later today (release 20). Web if that tax form is the 6781, then the answer is ‘yes.’. Form 6781 has two sections. Web minimum tax credit explained this page contains an explanation of the general concept of the minimum tax credit (mtc), when a taxpayer is entitled to the credit, and how it is. Web generating individual form 8801, credit for prior year minimum tax. If you did not complete the 2010 qualified dividends and capital gain tax. Web form 8801 is used to calculate the minimum tax credit, if any, for alternative minimum tax (amt) incurred in prior tax years and to calculate any credit carryforward. Citizen or resident who participates in or receives annuities from a registered canadian retirement.

What Is A 8801 Form cloudshareinfo

Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax. Form 8801 is used to calculate a taxpayer's refundable (in applicable years only) and nonrefundable (for all years) minimum tax credit (mtc) and mtc carryforward to. An.

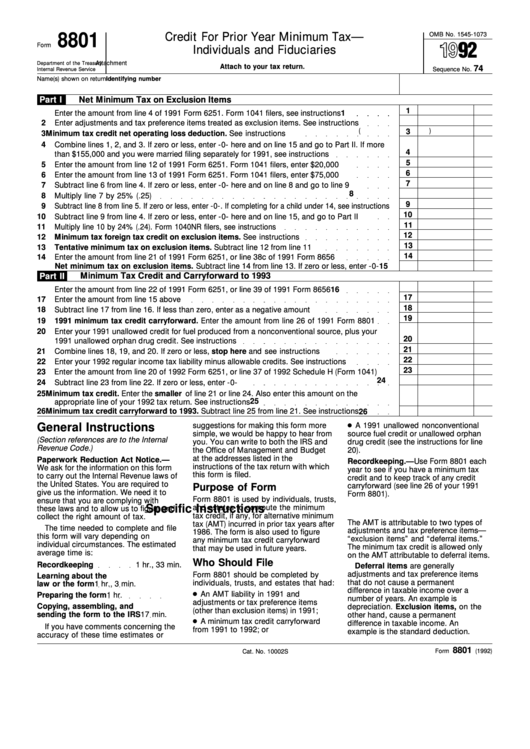

Form 8801 Credit For Prior Year Minimum Tax Individuals And

Web minimum tax credit explained this page contains an explanation of the general concept of the minimum tax credit (mtc), when a taxpayer is entitled to the credit, and how it is. Form 6781 has two sections. Web if that tax form is the 6781, then the answer is ‘yes.’. If you did not complete the 2010 qualified dividends and.

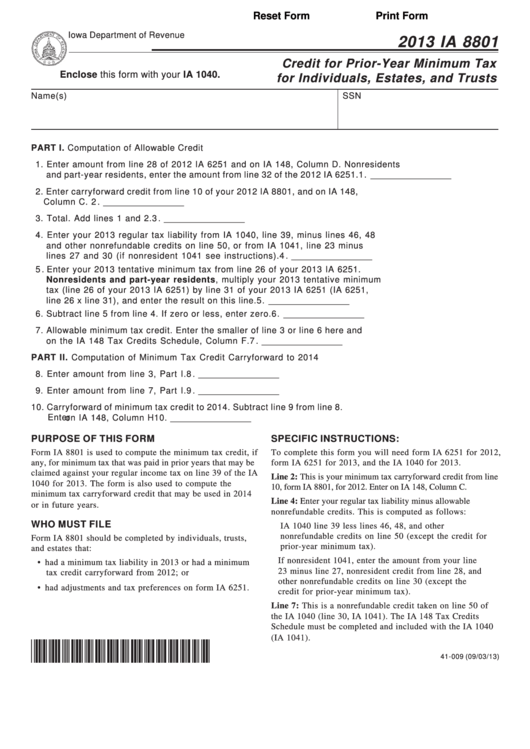

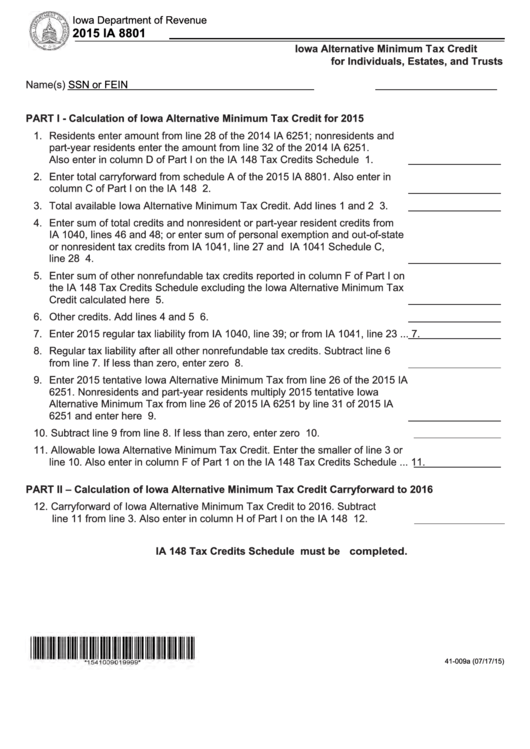

Fillable Form Ia 8801 Credit For PriorYear Minimum Tax For

Web form 8801 is also called the credit for prior year minimum tax form. An irs form that must be completed by any u.s. You need to check on it this weekend. Web generating individual form 8801, credit for prior year minimum tax. Solved•by intuit•3•updated july 13, 2022.

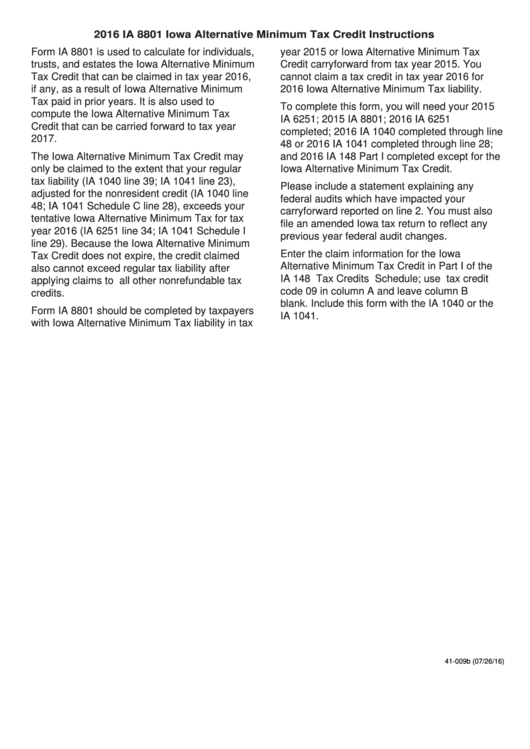

2016 Ia 8801 Iowa Alternative Minimum Tax Credit Instructions printable

Web when the irs received your form 8801 (to claim your refundable credit of $40,000) it would have first deducted the amount you owed ($11,425) and then mailed. Web form 8801 (2011) page 3 part iii tax computation using maximum capital gains rates caution. If you did not complete the 2010 qualified dividends and capital gain tax. Web department of.

AMT and Credit YouTube

This article will assist you with entering. Web form 8801 (2011) page 3 part iii tax computation using maximum capital gains rates caution. Solved•by intuit•3•updated july 13, 2022. An irs form that must be completed by any u.s. You can obtain copies of all irs forms at www.irs.gov, and then follow the link to “forms &.

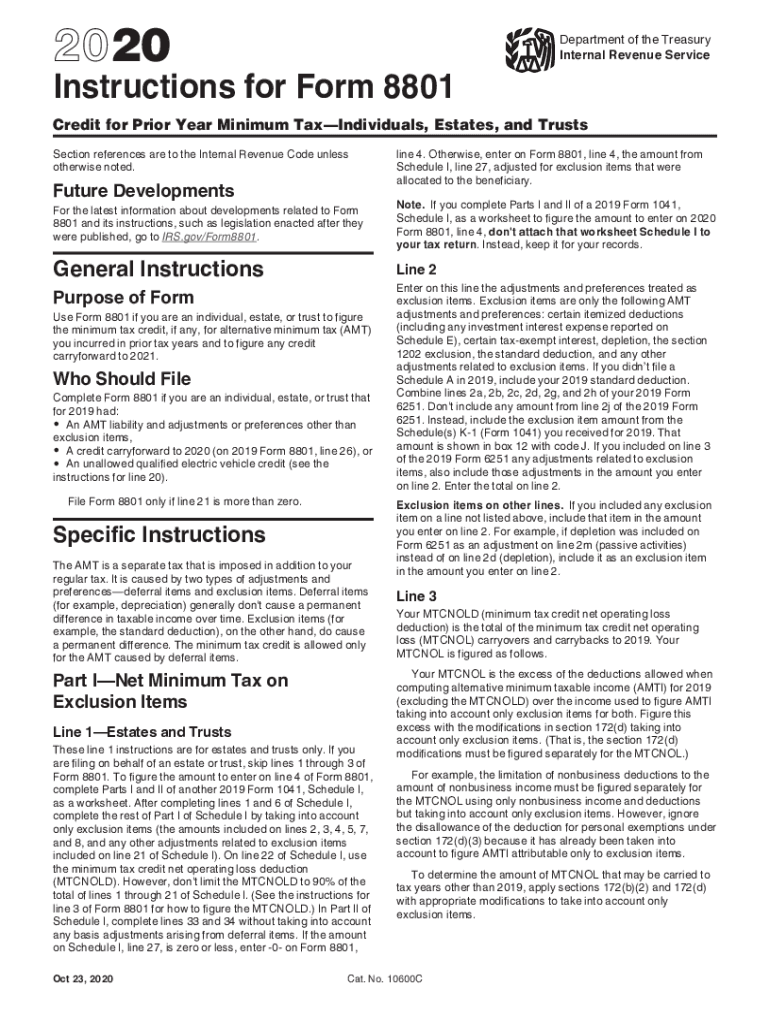

IRS 8801 Instructions 2020 Fill out Tax Template Online US Legal Forms

You need to check on it this weekend. Form 6781 has two sections. You can obtain copies of all irs forms at www.irs.gov, and then follow the link to “forms &. Form 8801 is used to calculate a taxpayer's refundable (in applicable years only) and nonrefundable (for all years) minimum tax credit (mtc) and mtc carryforward to. Web if that.

Fillable Form Ia 8801 Iowa Alternative Minimum Tax Credit For

Web use form 8801, credit for prior year minimum tax to calculate how much of the amt you've paid was related to deferral items, which generate credit for future years,. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred.

Form 8801 Credit for Prior Year Minimum Tax Individuals, Estates

Web department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts go to www.irs.gov/form8801 for instructions and. Web when the irs received your form 8801 (to claim your refundable credit of $40,000) it would have first deducted the amount you owed ($11,425) and then mailed. Form 8801 is used to calculate a.

Form 8801 Irs Memo on the Piece of Paper. Stock Image Image of form

Web the corrected form 8801 is expected to be release later today (release 20). You should delete the form in your return. Adding the 6781 form to your tax return will likely save you money. Form 8801 is used to calculate a taxpayer's refundable (in applicable years only) and nonrefundable (for all years) minimum tax credit (mtc) and mtc carryforward.

Form 8801 Credit for Prior Year Minimum Tax Individuals, Estates

Web generating individual form 8801, credit for prior year minimum tax. An irs form that must be completed by any u.s. This article will assist you with entering. Web use form 8801, credit for prior year minimum tax to calculate how much of the amt you've paid was related to deferral items, which generate credit for future years,. Web minimum.

Web Form 8801 Is Used To Calculate Your Minimum Tax Credit For Amt That You Incurred In Prior Tax Years And To Figure Any Credit Carryforward.

Web form 8801 is also called the credit for prior year minimum tax form. You need to check on it this weekend. Form 8801 is used to calculate a taxpayer's refundable (in applicable years only) and nonrefundable (for all years) minimum tax credit (mtc) and mtc carryforward to. This article will assist you with entering.

Form 6781 Has Two Sections.

Web the corrected form 8801 is expected to be release later today (release 20). If you did not complete the 2010 qualified dividends and capital gain tax. Web minimum tax credit explained this page contains an explanation of the general concept of the minimum tax credit (mtc), when a taxpayer is entitled to the credit, and how it is. Adding the 6781 form to your tax return will likely save you money.

Web When The Irs Received Your Form 8801 (To Claim Your Refundable Credit Of $40,000) It Would Have First Deducted The Amount You Owed ($11,425) And Then Mailed.

An irs form that must be completed by any u.s. Web form 8801 is used to calculate the minimum tax credit, if any, for alternative minimum tax (amt) incurred in prior tax years and to calculate any credit carryforward. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax. Web department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts go to www.irs.gov/form8801 for instructions and.

Web Generating Individual Form 8801, Credit For Prior Year Minimum Tax.

Web not to be confused with irs form 6251, which is the form you submit in the year you actually pay the amt, form 8801 is specifically called “credit for prior year. Web form 8801 (2011) page 3 part iii tax computation using maximum capital gains rates caution. You should delete the form in your return. Solved•by intuit•3•updated july 13, 2022.