What Is Form 7203

What Is Form 7203 - Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, [1] to be used to report s. S corporation shareholders use form 7203 to figure the potential. Web by cooper melvin, jd, cpa. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. Form 7203 and the instructions are attached to this article. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. Web form 7203 was released by the irs in december 2021 to keep track of stock and debt basis. Web form 7203 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form7203. View solution in original post february 23,.

Web form 7203 is filed by s corporation shareholders who: Form 7203 and the instructions are attached to this article. Web form 7203 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form7203. What’s new new items on form 7203. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. I have read all of the instructions for form 7203,. Web what is form 7203? S corporation shareholders use form 7203 to figure the potential. Web by cooper melvin, jd, cpa. Claiming a deduction for their share.

What’s new new items on form 7203. View solution in original post february 23,. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. Web 1 best answer patriciav expert alumni in order to add a second form 7203, you must be in forms mode (available only in turbotax cd/download for desktop). Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. I have read all of the instructions for form 7203,. Web form 7203 is filed by s corporation shareholders who: Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc.

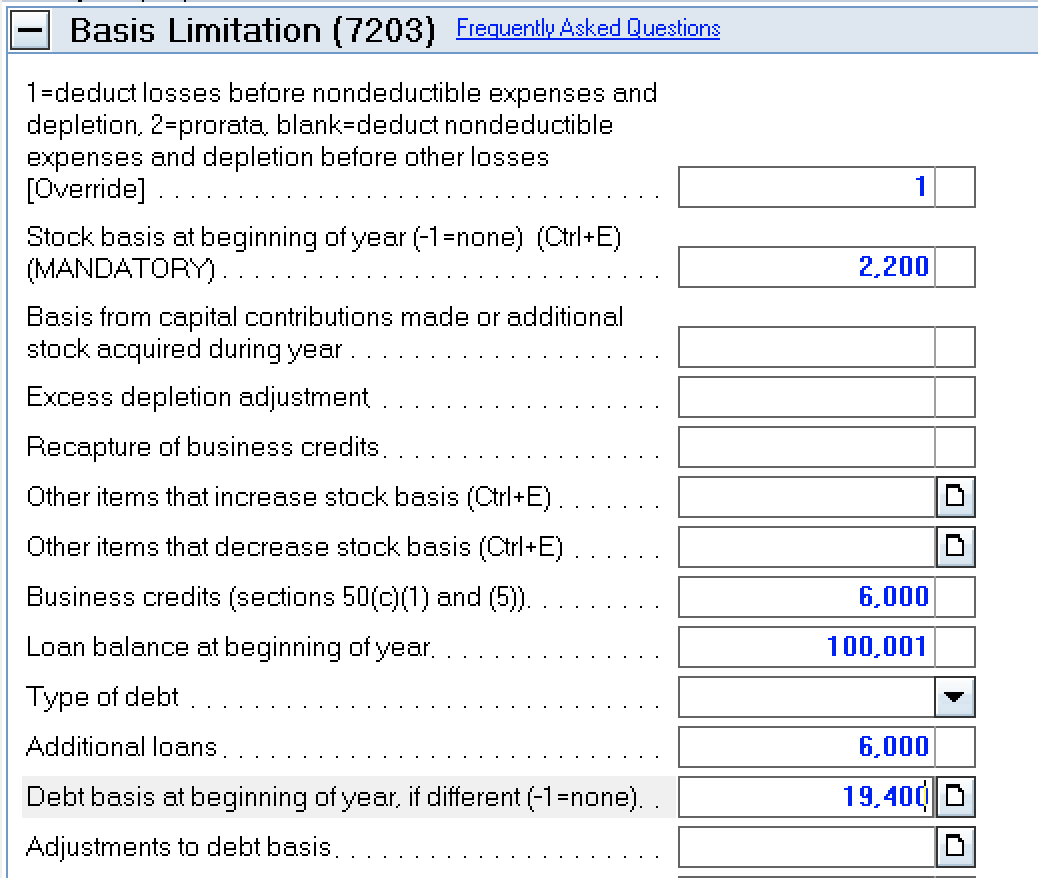

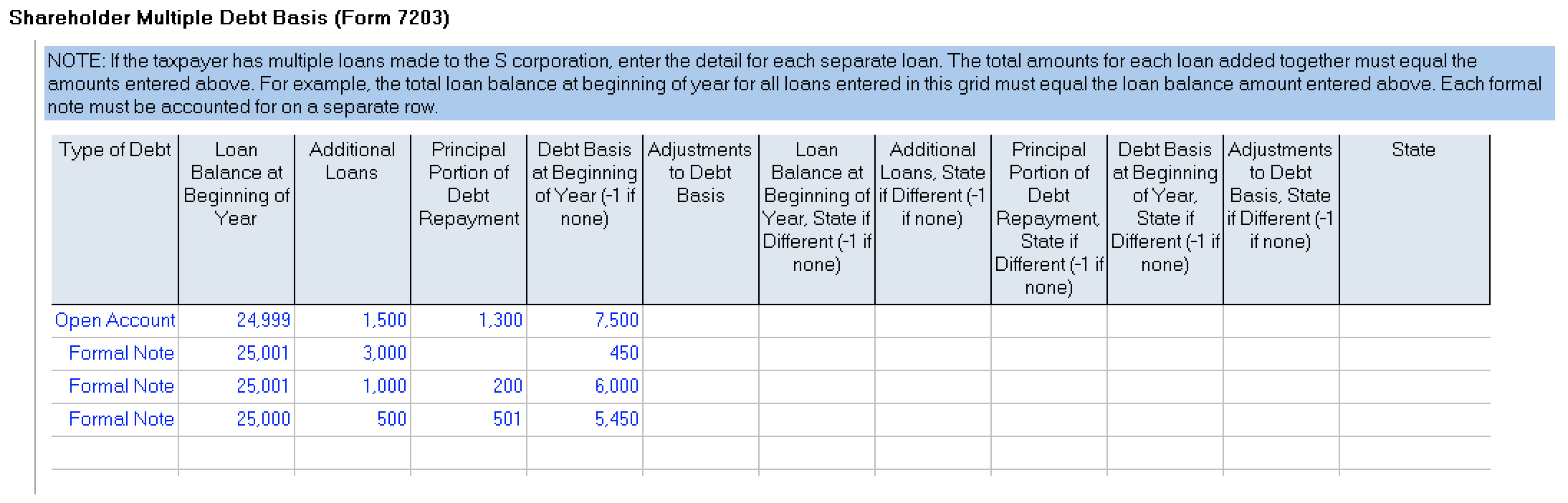

How to complete Form 7203 in Lacerte

Web form 7203 is filed by s corporation shareholders who: Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. How do i clear ef messages 5486 and 5851? S corporation shareholders use form 7203 to figure the potential. What’s new new items on form 7203.

Form7203PartI PBMares

View solution in original post february 23,. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an. I have read all of the instructions for form.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. Web form 7203 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form7203. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. Web the irs has.

National Association of Tax Professionals Blog

Web about form 7203, s corporation shareholder stock and debt basis limitations. Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an. Web the irs published a notice in the federal register on.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

View solution in original post february 23,. Web about form 7203, s corporation shareholder stock and debt basis limitations. Web form 7203 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form7203. Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. Are claiming a.

IRS Issues New Form 7203 for Farmers and Fishermen

Web form 7203 is filed by s corporation shareholders who: Web by cooper melvin, jd, cpa. S corporation shareholders use form 7203 to figure the potential. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an. Web form 7203 and its instructions, such as legislation enacted after they were published, go to irs.gov/.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in. Web form 7203 is filed by s corporation shareholders who: Claiming a deduction for their share. S corporation shareholders use form 7203 to figure the potential. Web form 7203 is used to figure.

National Association of Tax Professionals Blog

Web s corporation shareholders use form 7203 to calculate their stock and debt basis. View solution in original post february 23,. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. Web the irs has released.

How to complete Form 7203 in Lacerte

I have read all of the instructions for form 7203,. View solution in original post february 23,. Web the irs has released the official draft of the proposed form 7203, s corporation shareholder stock and debt basis limitations, [1] to be used to report s. The irs changes for s corporations form 7203 was developed to replace the worksheet for.

More Basis Disclosures This Year for S corporation Shareholders Need

Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. View solution in original post february 23,. Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. Are claiming a deduction for their.

View Solution In Original Post February 23,.

Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. Web form 7203 is filed by s corporation shareholders who:

Web The Irs Has Released The Official Draft Of The Proposed Form 7203, S Corporation Shareholder Stock And Debt Basis Limitations, [1] To Be Used To Report S.

Claiming a deduction for their share. Web what is form 7203? Are claiming a deduction for their share of an aggregate loss from an s corporation (including an. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a.

Web By Cooper Melvin, Jd, Cpa.

The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in. Web s corporation shareholders use form 7203 to calculate their stock and debt basis. Web form 7203 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form7203. What’s new new items on form 7203.

Web The Irs Published A Notice In The Federal Register On July 19, 2021 Asking For Comments On A New Form 7203, S Corporation Shareholder Stock And Debt Basis.

Web form 7203 is filed by s corporation shareholders who: S corporation shareholders use form 7203 to figure the potential. Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. Form 7203 and the instructions are attached to this article.