What Is Form 5558

What Is Form 5558 - Web form 5558 is an application used by employers to request more time to file certain employee plan returns. Our website is dedicated to providing you with a wide range of materials about irs form 5558, including detailed instructions, guidelines, and additional resources. For example, this form 5558 (rev. Form 5558 applies to three tax forms including: While the form allows for a filing. When employers need more time to file employee plan returns, they need to fill out form 5558 from the irs, which gives them an extension of 2 1/2 months. Considering the penalties for failure to file, it’s more than worth the time and effort when an extension is needed. Web form 5558, application for extension of time to file certain employee plan returns The annual return/report of employee benefit plan Web generally, any business that sponsors a retirement savings plan must file a form 5500 each year that the plan holds assets.

Form 5558 applies to three tax forms including: What conditions are required to receive an extension? Web form 5558, application for extension of time to file certain employee plan returns Web in this article, we discuss how to file for a filing extension with a form 5558, the limitations of this extension, and mistakes to avoid. Considering the penalties for failure to file, it’s more than worth the time and effort when an extension is needed. When employers need more time to file employee plan returns, they need to fill out form 5558 from the irs, which gives them an extension of 2 1/2 months. While the form allows for a filing. The purpose of the form is to provide the irs and dol with information about the plan's operation and compliance with government regulations. Web form 5558 is an application used by employers to request more time to file certain employee plan returns. Web the form 5500 is filed with the dol and contains information about a 401(k) plan's financial condition, plan qualifications, and operation.

Employers use form 5558 when they need more time to file other forms; While the form allows for a filing. To avoid processing delays, the most recent version of this form 5558 should always be used. Web in this article, we discuss how to file for a filing extension with a form 5558, the limitations of this extension, and mistakes to avoid. Web form 5558, application for extension of time to file certain employee plan returns Web form 5558 is an application used by employers to request more time to file certain employee plan returns. Employers can file form 5558 for one extension. What conditions are required to receive an extension? When employers need more time to file employee plan returns, they need to fill out form 5558 from the irs, which gives them an extension of 2 1/2 months. For example, this form 5558 (rev.

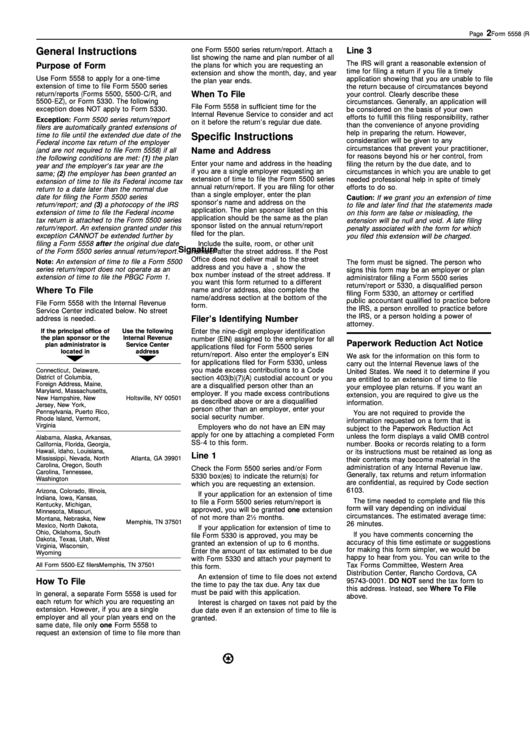

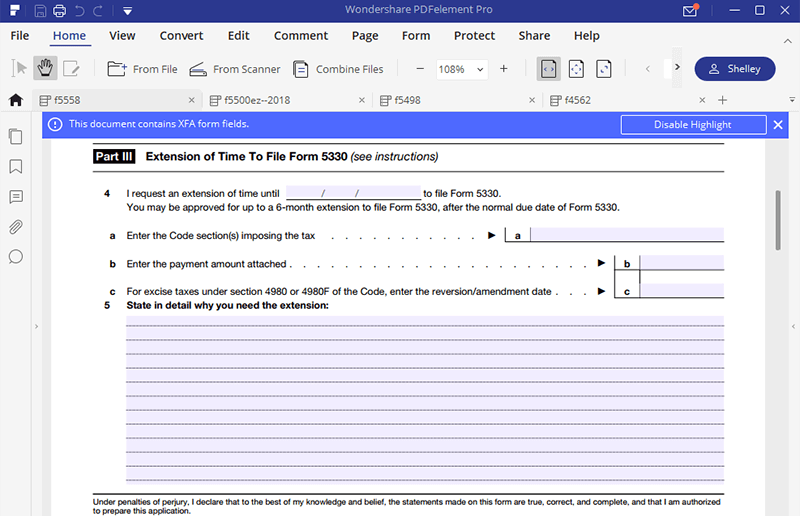

Instructions For Form 5558 Application For Extension Of Time To File

To avoid processing delays, the most recent version of this form 5558 should always be used. Web in this article, we discuss how to file for a filing extension with a form 5558, the limitations of this extension, and mistakes to avoid. When employers need more time to file employee plan returns, they need to fill out form 5558 from.

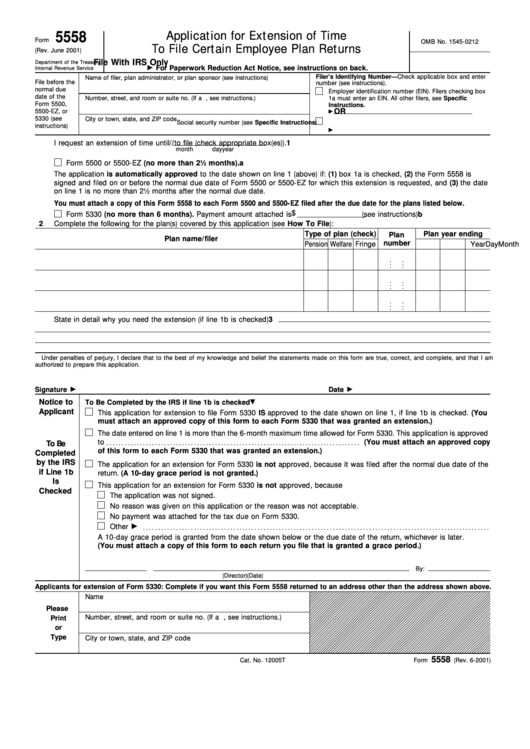

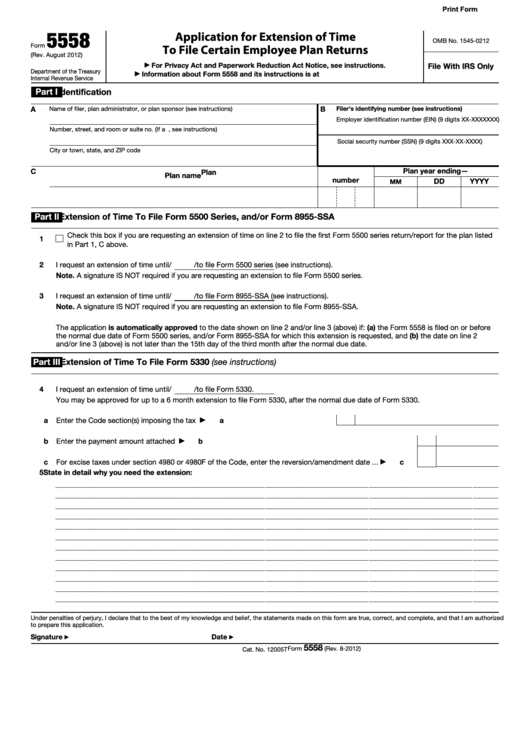

Form 5558 Application for Extension of Time to File Certain Employee

Our website is dedicated to providing you with a wide range of materials about irs form 5558, including detailed instructions, guidelines, and additional resources. For example, this form 5558 (rev. Form 5558 applies to three tax forms including: Considering the penalties for failure to file, it’s more than worth the time and effort when an extension is needed. The annual.

Form 5558 Application For Extension Of Time To File Certain Employee

Considering the penalties for failure to file, it’s more than worth the time and effort when an extension is needed. Web form 5558 is an application used by employers to request more time to file certain employee plan returns. Web form 5558, application for extension of time to file certain employee plan returns Our website is dedicated to providing you.

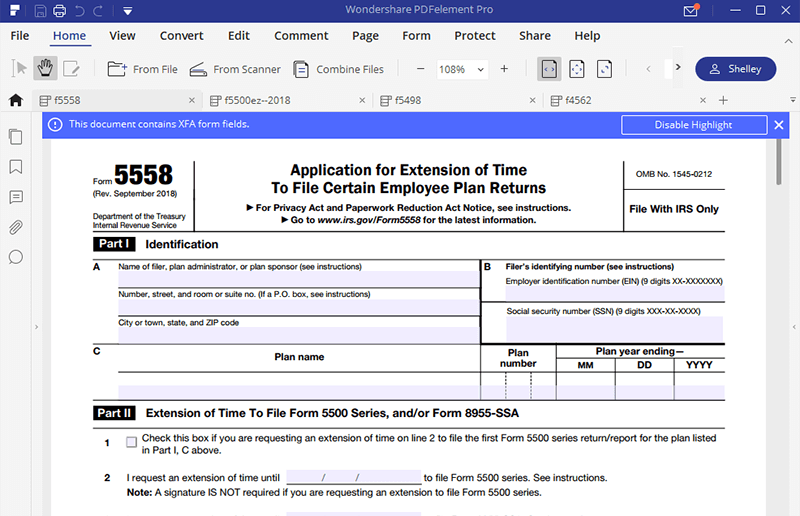

IRS Form 5558 A Guide to Fill it the Right Way

Web form 5558 is an application used by employers to request more time to file certain employee plan returns. Considering the penalties for failure to file, it’s more than worth the time and effort when an extension is needed. While the form allows for a filing. What conditions are required to receive an extension? Form 5558 applies to three tax.

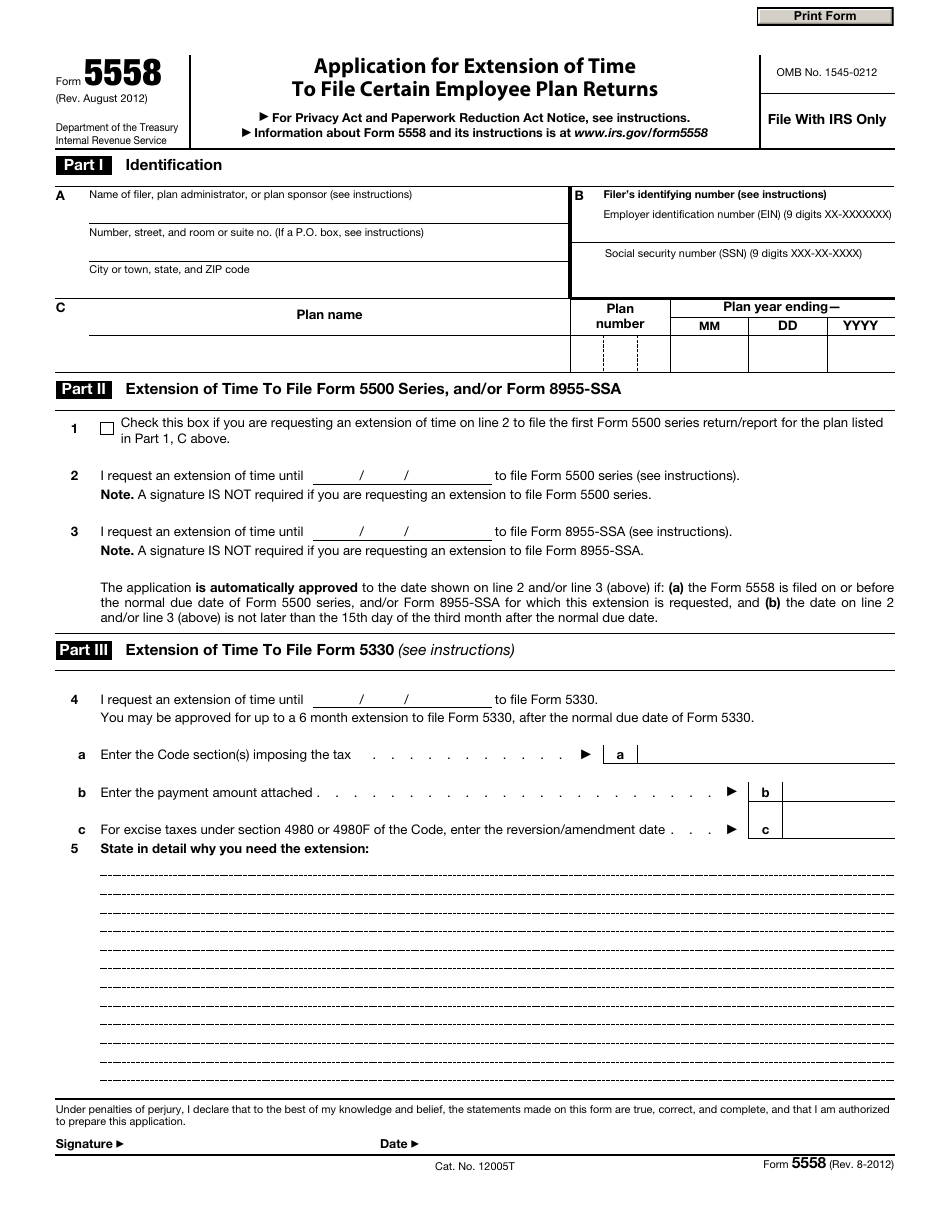

IRS Form 5558 Download Fillable PDF or Fill Online Application for

September 2018) should be used instead of the august 2012 version or any. While the form allows for a filing. For example, this form 5558 (rev. What conditions are required to receive an extension? Web form 5558 is an application used by employers to request more time to file certain employee plan returns.

Form 10 Due Date 10 10 Ugly Truth About Form 1010108 Due Date 10 AH

September 2018) should be used instead of the august 2012 version or any. While the form allows for a filing. What conditions are required to receive an extension? Web in this article, we discuss how to file for a filing extension with a form 5558, the limitations of this extension, and mistakes to avoid. Employers can file form 5558 for.

Form 5558 Application for Extension of Time to File Certain Employee

The annual return/report of employee benefit plan Web generally, any business that sponsors a retirement savings plan must file a form 5500 each year that the plan holds assets. Web form 5558 is an application used by employers to request more time to file certain employee plan returns. The purpose of the form is to provide the irs and dol.

Fill Free fillable Form 5558 2018 Application for Extension of Time

Web in this article, we discuss how to file for a filing extension with a form 5558, the limitations of this extension, and mistakes to avoid. Employers can file form 5558 for one extension. Considering the penalties for failure to file, it’s more than worth the time and effort when an extension is needed. Employers use form 5558 when they.

Fillable Form 5558 Application For Extension Of Time To File Certain

Our website is dedicated to providing you with a wide range of materials about irs form 5558, including detailed instructions, guidelines, and additional resources. Web form 5558 is an application used by employers to request more time to file certain employee plan returns. While the form allows for a filing. The purpose of the form is to provide the irs.

Form 5558 Application for Extension of Time to File Certain Employee

Employers use form 5558 when they need more time to file other forms; Our website is dedicated to providing you with a wide range of materials about irs form 5558, including detailed instructions, guidelines, and additional resources. For example, this form 5558 (rev. What conditions are required to receive an extension? When employers need more time to file employee plan.

While The Form Allows For A Filing.

When employers need more time to file employee plan returns, they need to fill out form 5558 from the irs, which gives them an extension of 2 1/2 months. Employers can file form 5558 for one extension. What conditions are required to receive an extension? Form 5558 applies to three tax forms including:

Web In This Article, We Discuss How To File For A Filing Extension With A Form 5558, The Limitations Of This Extension, And Mistakes To Avoid.

Employers use form 5558 when they need more time to file other forms; The purpose of the form is to provide the irs and dol with information about the plan's operation and compliance with government regulations. For example, this form 5558 (rev. Web form 5558, application for extension of time to file certain employee plan returns

Web The Form 5500 Is Filed With The Dol And Contains Information About A 401(K) Plan's Financial Condition, Plan Qualifications, And Operation.

September 2018) should be used instead of the august 2012 version or any. Web form 5558 is an application used by employers to request more time to file certain employee plan returns. To avoid processing delays, the most recent version of this form 5558 should always be used. Our website is dedicated to providing you with a wide range of materials about irs form 5558, including detailed instructions, guidelines, and additional resources.

Web Generally, Any Business That Sponsors A Retirement Savings Plan Must File A Form 5500 Each Year That The Plan Holds Assets.

Considering the penalties for failure to file, it’s more than worth the time and effort when an extension is needed. The annual return/report of employee benefit plan