What Is Form 3949-A

What Is Form 3949-A - Provide as much information as you know about the person or business you are reporting. However, if money was stolen, why not call the local authorities? So, whether a business or an individual is allegedly attempting to violate tax laws, the form is a simple way to report it. A form that a law enforcement official may file with the irs to receive information on someone alleged to have violated tax laws. Related tax forms what do you think? The form includes information such as the taxpayer's name and contact details, the nature of the offense, and whether or not law enforcement considers the taxpayer dangerous. Make sure about the correctness of. My child father has not filed taxes in the last 5+ years, he is also making almost $20,000 a month under the table. Web posted on sep 13, 2013 selected as best answer attorney cohen's response is as correct as it is hysterical! We will keep your identity confidential when you file a tax fraud report.

Select the button get form to open it and begin modifying. If you suspect anyone of tax fraud, you will need to report the following: So, whether a business or an individual is allegedly attempting to violate tax laws, the form is a simple way to report it. Web posted on sep 13, 2013 selected as best answer attorney cohen's response is as correct as it is hysterical! Make sure about the correctness of. Fill in all necessary fields in your file with our advanced pdf editor. Related tax forms what do you think? The form includes information such as the taxpayer's name and contact details, the nature of the offense, and whether or not law enforcement considers the taxpayer dangerous. Information about the person or business you are reporting The form is known as an informational referral, and it will be used by citizens to report any instances of suspected tax fraud in the country.

Ad access irs tax forms. Web posted on sep 13, 2013 selected as best answer attorney cohen's response is as correct as it is hysterical! The irs never does anything in 30 days (unless you don't want them to do something!) you have done your duty and there is nothing more you can do with the irs. Use this form to report suspected tax law violations by a person or a business. Turn the wizard tool on to complete the procedure much easier. Get ready for tax season deadlines by completing any required tax forms today. A form that a law enforcement official may file with the irs to receive information on someone alleged to have violated tax laws. A form that a law enforcement official may file with the irs to receive information on someone alleged to have violated tax laws. So, whether a business or an individual is allegedly attempting to violate tax laws, the form is a simple way to report it. And many are also using the form for something other than.

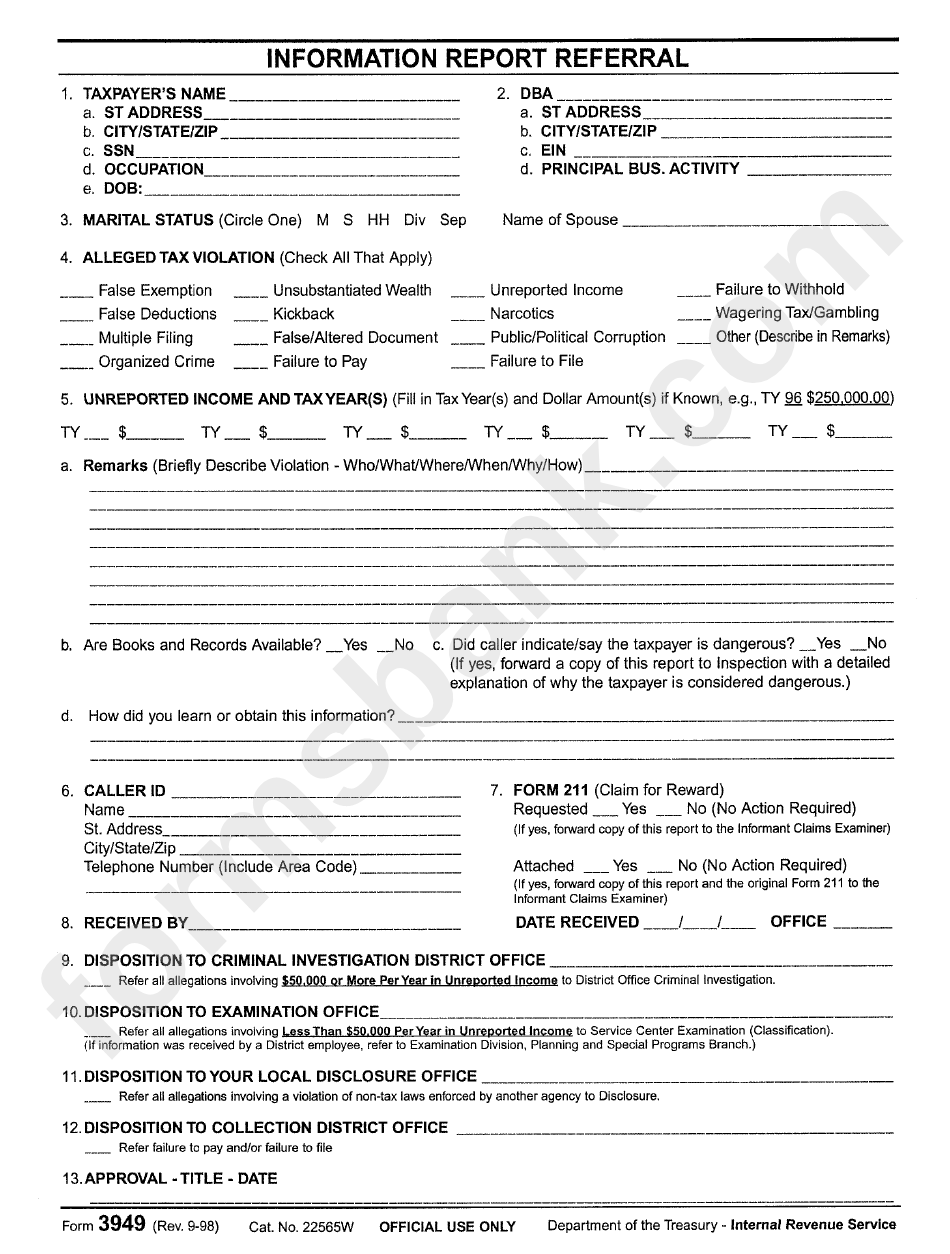

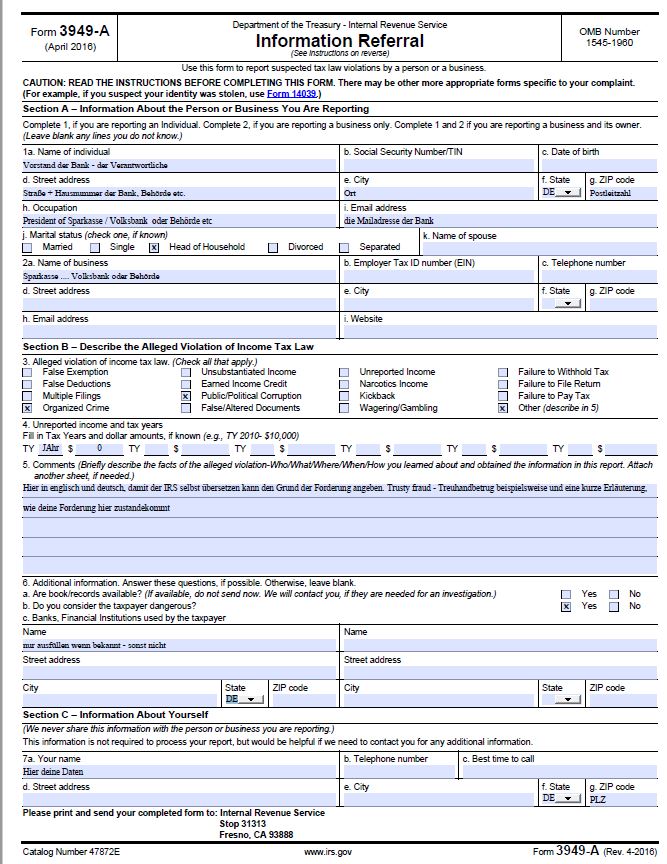

Form 3949A Information Referral (2014) Free Download

The form includes information such as the taxpayer's name and contact details, the nature of the offense, and whether or not law enforcement considers the taxpayer dangerous. Social security number (ssn) d. The form is known as an informational referral, and it will be used by citizens to report any instances of suspected tax fraud in the country. A form.

irs form 3949a 2022 Fill Online, Printable, Fillable Blank form

We don't take tax law violation referrals over the phone. We will keep your identity confidential when you file a tax fraud report. Use this form to report suspected tax law violations by a person or a business. Social security number (ssn) d. Fill in all necessary fields in your file with our advanced pdf editor.

Printable Irs Form 3949 A Master of Documents

Download past year versions of this tax form as pdfs here: Complete, edit or print tax forms instantly. A form that a law enforcement official may file with the irs to receive information on someone alleged to have violated tax laws. A form that a law enforcement official may file with the irs to receive information on someone alleged to.

Form 3949A Information Referral (2014) Free Download

Provide as much information as you know about the person or business you are reporting. We will keep your identity confidential when you file a tax fraud report. Complete, edit or print tax forms instantly. We don't take tax law violation referrals over the phone. Read the instructions before completing this form.

Form 3949 Information Report Referral Department Of The Tressury

Complete if you are reporting an individual. And many are also using the form for something other than. Child father getting paid under the table. Complete, edit or print tax forms instantly. So, whether a business or an individual is allegedly attempting to violate tax laws, the form is a simple way to report it.

Print Form 3949 A Fill Online, Printable, Fillable, Blank pdfFiller

Get ready for tax season deadlines by completing any required tax forms today. Web how it works open the 3949a and follow the instructions easily sign the form 3949 a with your finger send filled & signed 3949 a form or save rate the form 3949a 4.7 satisfied 151 votes handy tips for filling out 3949a form online printing and.

IRS Form 3949A Wiensworld

The form is known as an informational referral, and it will be used by citizens to report any instances of suspected tax fraud in the country. We don't take tax law violation referrals over the phone. Make sure about the correctness of. If you wish to report tax violations that you have observed, use. Complete, edit or print tax forms.

2013 Form IRS 3949A Fill Online, Printable, Fillable, Blank pdfFiller

However, if money was stolen, why not call the local authorities? Child father getting paid under the table. The irs never does anything in 30 days (unless you don't want them to do something!) you have done your duty and there is nothing more you can do with the irs. Select the button get form to open it and begin.

Form 8849 Edit, Fill, Sign Online Handypdf

The form is known as an informational referral, and it will be used by citizens to report any instances of suspected tax fraud in the country. Ad access irs tax forms. Child father getting paid under the table. The form includes information such as the taxpayer's name and contact details, the nature of the offense, and whether or not law.

Form 3949A Information Referral (2014) Free Download

And many are also using the form for something other than. Download past year versions of this tax form as pdfs here: So, whether a business or an individual is allegedly attempting to violate tax laws, the form is a simple way to report it. A form that a law enforcement official may file with the irs to receive information.

Information About The Person Or Business You Are Reporting

My child father has not filed taxes in the last 5+ years, he is also making almost $20,000 a month under the table. Web the form represents an easy way to report if someone (whether an entity or a person) is allegedly trying to breach the tax legislation. We will keep your identity confidential when you file a tax fraud report. Ad access irs tax forms.

Complete, Edit Or Print Tax Forms Instantly.

Read the instructions before completing this form. The irs never does anything in 30 days (unless you don't want them to do something!) you have done your duty and there is nothing more you can do with the irs. Social security number (ssn) d. Select the button get form to open it and begin modifying.

Web Posted On Sep 13, 2013 Selected As Best Answer Attorney Cohen's Response Is As Correct As It Is Hysterical!

Use this form to report suspected tax law violations by a person or a business. My question is, if i file a 3949a. The form is known as an informational referral, and it will be used by citizens to report any instances of suspected tax fraud in the country. Related tax forms what do you think?

Make Sure About The Correctness Of.

A form that a law enforcement official may file with the irs to receive information on someone alleged to have violated tax laws. Provide as much information as you know about the person or business you are reporting. A form that a law enforcement official may file with the irs to receive information on someone alleged to have violated tax laws. The form includes information such as the taxpayer's name and contact details, the nature of the offense, and whether or not law enforcement considers the taxpayer dangerous.