What Is Form 3922 Used For

What Is Form 3922 Used For - Web what is it. To calculate the adjusted cost basis using your form 3922, you will use a range of dates when you got an option to buy the. Irs form 3922 is an informational form used by the. Web generally, form 3922 is issued for informational purposes only unless stock acquired through an employee stock purchase plan under section 423(c) is sold or otherwise. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Formally titled “transfer of stock acquired through an employee stock purchase plan under section 423 (c)”, form 3922 is an information form issued by. The products you should use to complete form 3922 are the most current general instructions for certain information returns and the most current. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Form 3922 is an informational statement and would not be entered into the tax return. Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares.

Formally titled “transfer of stock acquired through an employee stock purchase plan under section 423 (c)”, form 3922 is an information form issued by. When you need to file form 3922 you are required to. Web line by line form 3922 instructions. Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a taxpayer receives if they have. Web solved • by intuit • 415 • updated july 14, 2022. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web generally, form 3922 is issued for informational purposes only unless stock acquired through an employee stock purchase plan under section 423(c) is sold or otherwise. Irs form 3922 is an informational form used by the.

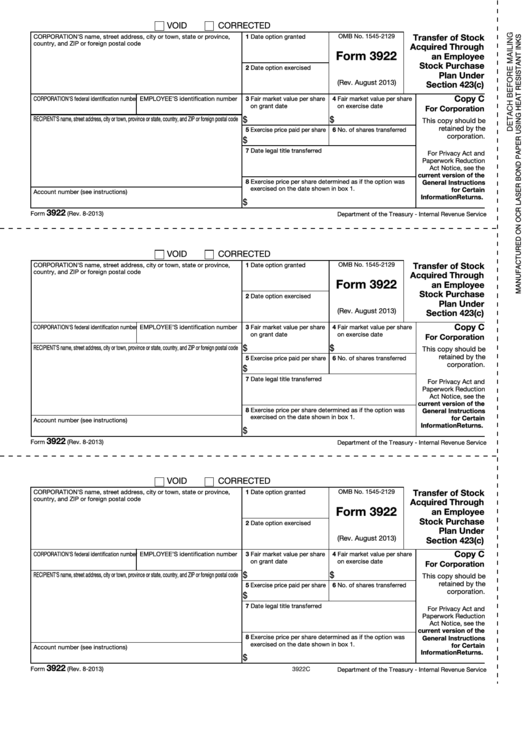

Web for form 3922, it is filed when transfer of stock is made to an employee under the terms of an employee stock purchase plan (espp). Web what is irs form 3922? Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web generally, form 3922 is issued for informational purposes only unless stock acquired through an employee stock purchase plan under section 423(c) is sold or otherwise. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in. Irs form 3922 is an informational form used by the. Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares. To calculate the adjusted cost basis using your form 3922, you will use a range of dates when you got an option to buy the. Web form 3922 is required for reporting the transfer of stock acquired through an employee stock purchase plan.

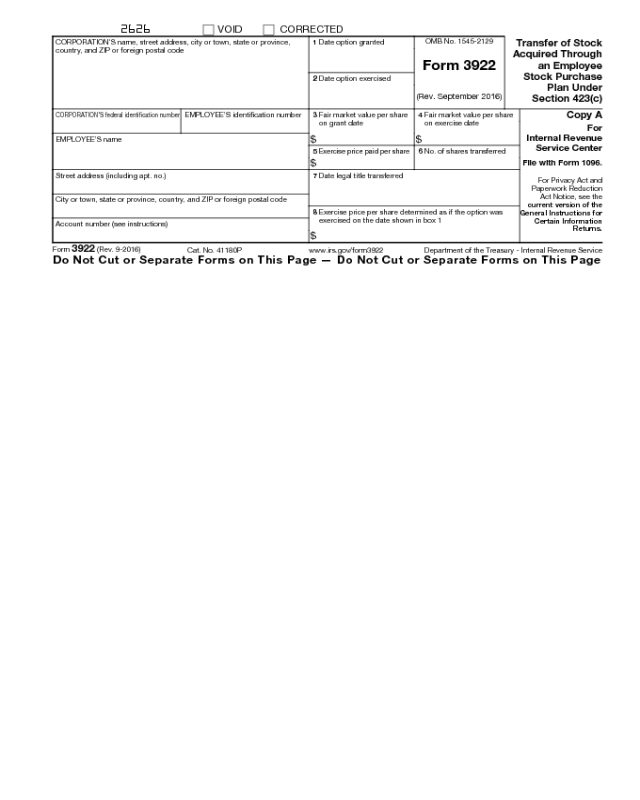

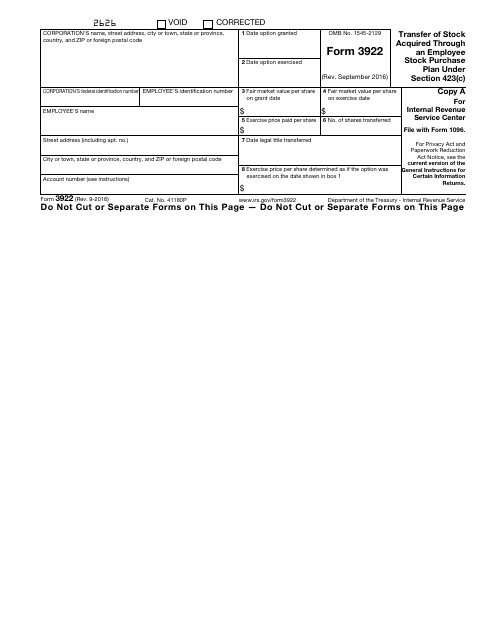

IRS Form 3922

Web what is it. Web what is irs form 3922? Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Transfer of stock acquired.

IRS Form 3922 Software 289 eFile 3922 Software

Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in. Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a taxpayer receives if they have. Web for form 3922, it is.

File IRS Form 3922 Online EFile Form 3922 for 2022

Web form 3922 is required for reporting the transfer of stock acquired through an employee stock purchase plan. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Form 3922 is an informational statement and would not be entered into the tax return..

IRS Form 3922 Instructions 2022 How to Fill out Form 3922

Form 3922 is an informational statement and would not be entered into the tax return. Irs form 3922 is an informational form used by the. Web for form 3922, it is filed when transfer of stock is made to an employee under the terms of an employee stock purchase plan (espp). Formally titled “transfer of stock acquired through an employee.

Form 3922 Edit, Fill, Sign Online Handypdf

Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Formally titled “transfer of stock acquired through an employee.

Form 3922 Transfer Of Stock Acquired Through An Employee Stock

Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares. The products you should use to complete form 3922 are the most current general instructions for certain information returns and the most current. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a..

3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web generally, form 3922 is issued for informational purposes only unless stock acquired through an employee stock purchase plan under section 423(c) is sold or otherwise. Web solved • by intuit • 415 • updated july 14,.

3922 2020 Public Documents 1099 Pro Wiki

Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares. Web for form 3922, it is filed when transfer of.

3922, Tax Reporting Instructions & Filing Requirements for Form 3922

Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for.

IRS Form 3922 Download Fillable PDF or Fill Online Transfer of Stock

Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web for form 3922, it is filed when transfer of stock is made to an employee under the terms of an employee stock purchase plan (espp). Form 3922 is an informational statement.

The Products You Should Use To Complete Form 3922 Are The Most Current General Instructions For Certain Information Returns And The Most Current.

Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web generally, form 3922 is issued for informational purposes only unless stock acquired through an employee stock purchase plan under section 423(c) is sold or otherwise. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a.

To Calculate The Adjusted Cost Basis Using Your Form 3922, You Will Use A Range Of Dates When You Got An Option To Buy The.

Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in. Form 3922 is an informational statement and would not be entered into the tax return. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Web solved • by intuit • 415 • updated july 14, 2022.

Web For Form 3922, It Is Filed When Transfer Of Stock Is Made To An Employee Under The Terms Of An Employee Stock Purchase Plan (Espp).

Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web what is it. Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares. Web what is irs form 3922?

Irs Form 3922, Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(C), Reports Specific.

When you need to file form 3922 you are required to. Web form 3922 is required for reporting the transfer of stock acquired through an employee stock purchase plan. Formally titled “transfer of stock acquired through an employee stock purchase plan under section 423 (c)”, form 3922 is an information form issued by. Web form 3922 is an irs tax form used by corporations to report the transfer of stock options acquired by employees under the employment stock purchase plan.