What Is A Form 8615

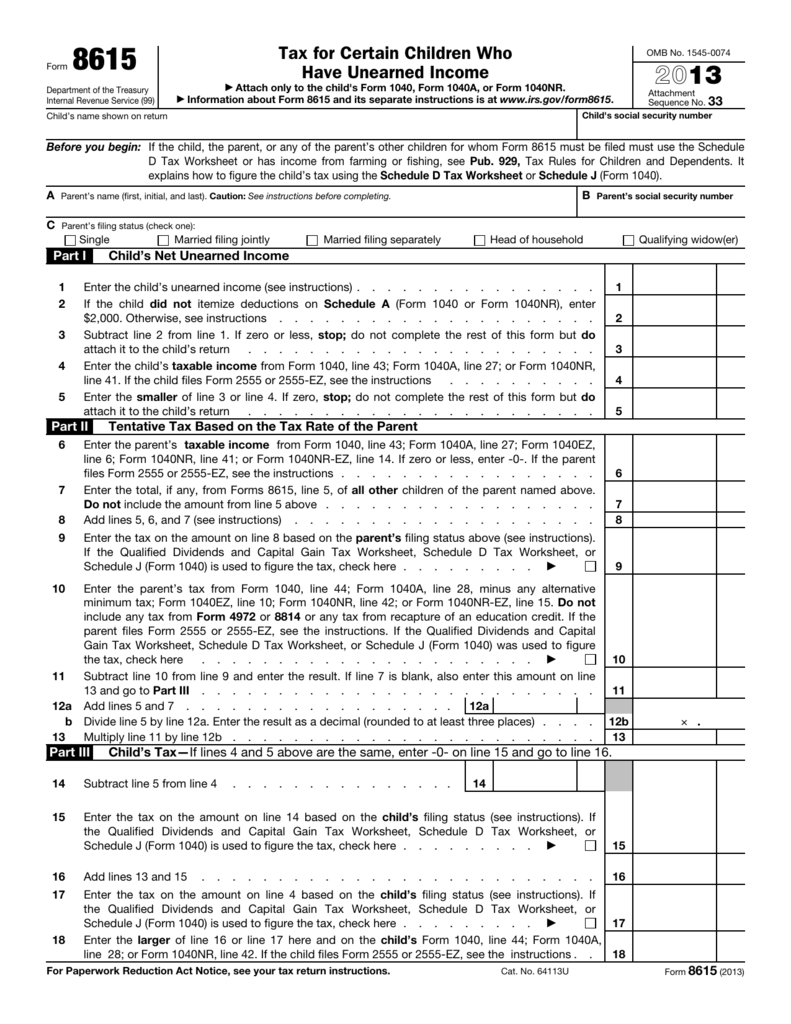

What Is A Form 8615 - When using form 8615 in proseries, you should enter the child as the taxpayer on the. Texas health and human services subject: Web form 8615, tax for certain children who have unearned income. The child is required to file a tax return. Web form 8615 must be filed for any child who meets all of the following conditions. Web what is form 8615, tax for children under age 18? Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Unearned income includes taxable interest, ordinary dividends, capital. Web form 8615 must be filed for any child who meets all of the following conditions.

Web from 8615 is for the kiddie tax, which calculates the tax on your investment income over $2,100 at your parent's tax rate. The form is only required to be included on your return if all of the conditions below are met: Web what is form 8615, tax for children under age 18? The service delivery logs are available for the documentation of a service event for individualized skills and socialization. When using form 8615 in proseries, you should enter the child as the taxpayer on the. The child had more than $2,300 of unearned income. The child is required to file a tax return. Web if the parent doesn't or can't choose to include the child's income on the parent's return, use form 8615 to figure the child's tax. Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Under age 18, age 18 and did.

The service delivery logs are available for the documentation of a service event for individualized skills and socialization. Attach the completed form to the. Web what is form 8615, tax for children under age 18? Under age 18, age 18 and did. Web form 8615 is used to figure your child's tax on unearned income. Refer to each child's taxpayer's information for use when. The child had more than $2,300 of unearned income. Texas health and human services subject: The child is required to file a tax return. Ad register and subscribe now to work on your irs 8615 form & more fillable forms.

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

Web form 8615 must be filed for any child who meets all of the following conditions. Web form 8615 is used to figure your child's tax on unearned income. See who must file, later. Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are.

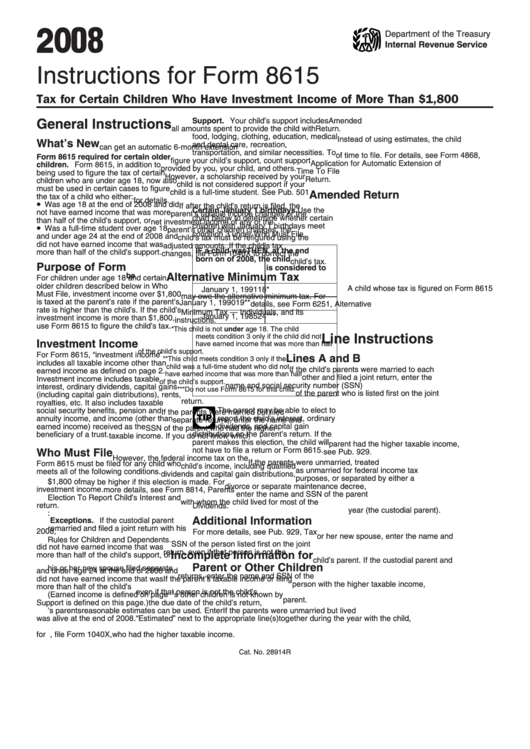

Instructions For Form 8615 Tax For Certain Children Who Have

Ad register and subscribe now to work on your irs 8615 form & more fillable forms. Web per the irs instructions, the following notes will appear at the top of printed versions of these forms: Web form 8615 is used to figure your child's tax on unearned income. The service delivery logs are available for the documentation of a service.

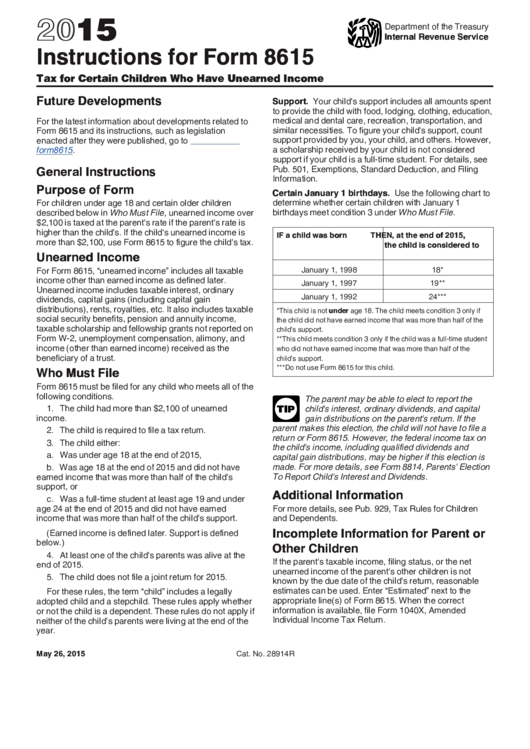

Form 8615 Instructions (2015) printable pdf download

Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. The form is only required to be included on your return if all of the conditions below are met: Web what is form 8615, tax for children under age 18? Web if the.

Form 8615 Kiddie Tax Question tax

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Web if the parent doesn't or can't choose to include the child's income on the parent's return, use form 8615 to figure the child's tax. Under age 18, age 18 and did. Web form 8615 must be filed for any child who meets.

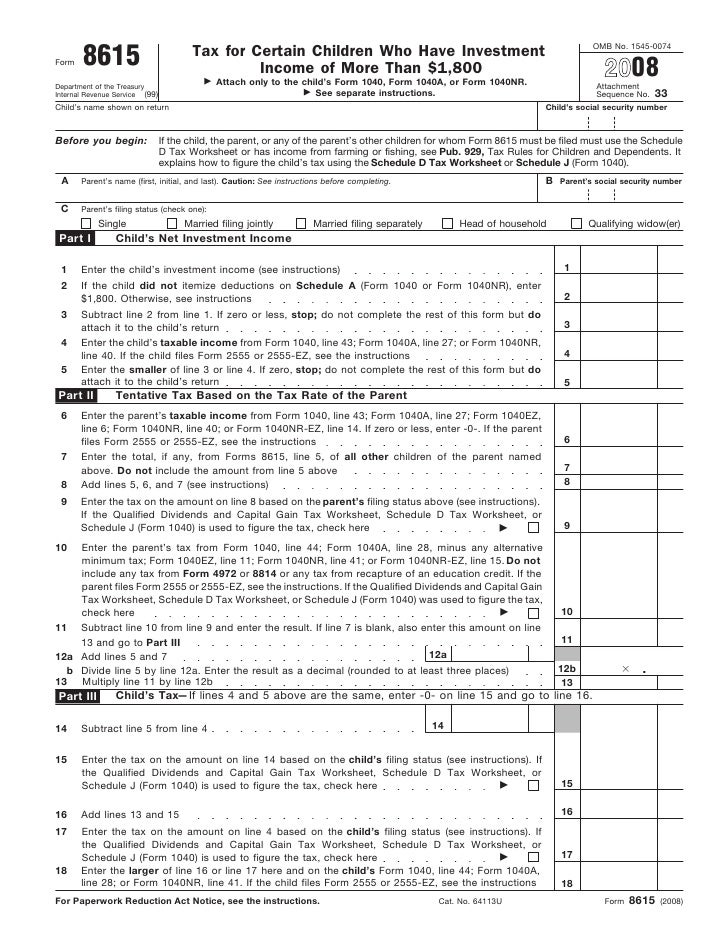

Form 8615Tax for Children Under Age 14 With Investment of Mor…

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Web per the irs instructions, the following notes will appear at the top of printed versions of these forms: The child had more than $2,300 of unearned income. Refer to each child's taxpayer's information for use when. Unearned income includes taxable interest, ordinary.

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

The child is required to file a tax return. Unearned income includes taxable interest, ordinary dividends, capital. Web form 8615 must be filed for any child who meets all of the following conditions. Web from 8615 is for the kiddie tax, which calculates the tax on your investment income over $2,100 at your parent's tax rate. Web form 8615 is.

What Is Form 8615 Used For?

Signnow allows users to edit, sign, fill and share all type of documents online. Web for form 8615, unearned income includes all taxable income other than earned income as defined later. The child had more than $2,300 of unearned income. Obviously, in order to calculate the tax at. Form 8615 must be filed with the child’s tax return if all.

DADS Or HHSC Form The Texas Department Of Aging And Dads State

Form 8615 must be filed with the child’s tax return if all of the following apply: When using form 8615 in proseries, you should enter the child as the taxpayer on the. Signnow allows users to edit, sign, fill and share all type of documents online. Web for form 8615, unearned income includes all taxable income other than earned income.

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

The child is required to file a tax return. Web what is form 8615, tax for children under age 18? Web form 8615 must be filed for any child who meets all of the following conditions. The child had more than $2,300 of unearned income. Refer to each child's taxpayer's information for use when.

Form 8615 Office Depot

When using form 8615 in proseries, you should enter the child as the taxpayer on the. Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web form 8615 must be filed for any child who meets all of the following conditions. Attach.

When Using Form 8615 In Proseries, You Should Enter The Child As The Taxpayer On The.

Web what is form 8615 used for. Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Web per the irs instructions, the following notes will appear at the top of printed versions of these forms: Refer to each child's taxpayer's information for use when.

Web The Line 5 Ratio Is The Last Line Of The Appropriate Line 5 Worksheet Divided By The First Line Of The Line 5 Worksheet.

Web form 8615 must be filed for any child who meets all of the following conditions. Unearned income includes taxable interest, ordinary dividends, capital. Web form 8615 is used to figure your child's tax on unearned income. Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older.

Web What Is Form 8615, Tax For Children Under Age 18?

Web for form 8615, unearned income includes all taxable income other than earned income as defined later. The child had more than $2,300 of unearned income. Ad register and subscribe now to work on your irs 8615 form & more fillable forms. Signnow allows users to edit, sign, fill and share all type of documents online.

Obviously, In Order To Calculate The Tax At.

The service delivery logs are available for the documentation of a service event for individualized skills and socialization. Web form 8615 must be filed for any child who meets all of the following conditions. The child is required to file a tax return. Web form 8615 must be filed for any child who meets all of the following conditions.