What Is A 8919 Tax Form

What Is A 8919 Tax Form - Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Form 8959, additional medicare tax. The first step of filing itr is to collect all the documents related to the process. Form 8959, additional medicare tax. Web the date you file form 8919. The taxpayer performed services for an individual or a firm. Web form 8919 is a powerful tool for misclassified workers who owe uncollected social security and medicare taxes. An individual having salary income should collect.

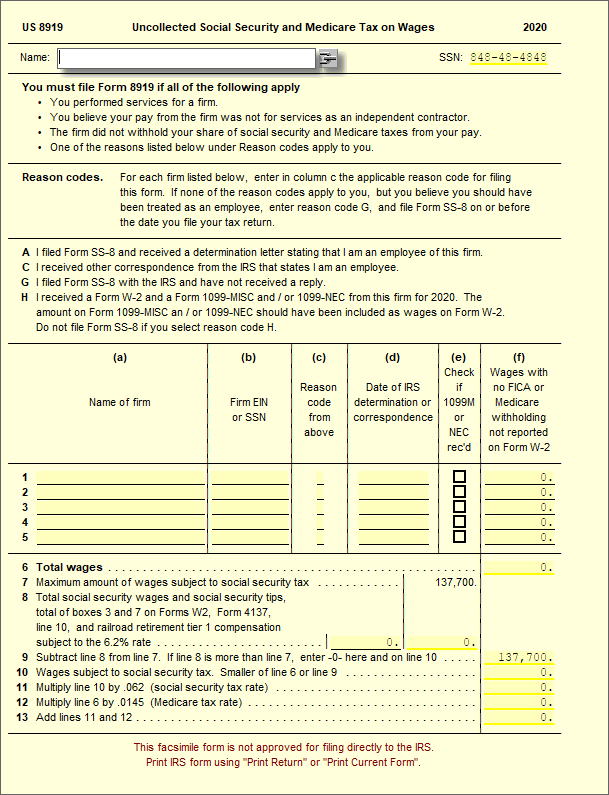

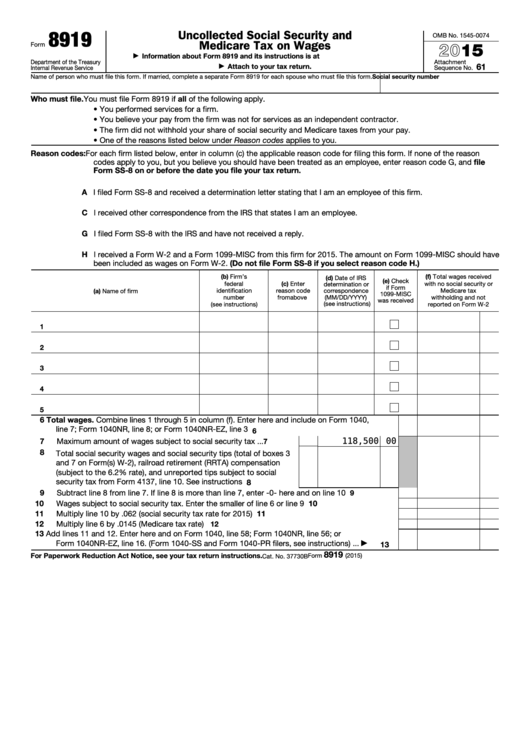

Complete a separate line on form 8919 for each employer you’ve worked for. Web the date you file form 8919. They must report the amount on irs form 8919. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. A 0.9% additional medicare tax. Form 8959, additional medicare tax. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages a go to www.irs.gov/form8919 for the latest. The first step of filing itr is to collect all the documents related to the process.

The first step of filing itr is to collect all the documents related to the process. Web documents needed to file itr; Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by. Form 8959, additional medicare tax. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web start by filling in your name and social security number on the top section of the form. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. They must report the amount on irs form 8919. A 0.9% additional medicare tax.

how to fill out form 8919 Fill Online, Printable, Fillable Blank

A 0.9% additional medicare tax. Web the date you file form 8919. The taxpayer performed services for an individual or a firm. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. Web irs form 8819, uncollected social security and medicare.

8919 Uncollected SS and Medicare Tax on Wages UltimateTax Solution

The first step of filing itr is to collect all the documents related to the process. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by. This includes their name, address, employer identification number (ein),. You can potentially reduce the taxes you owe.

During 2017, Cassandra Albright, who is single, worked parttime at a

Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. Form 8959, additional medicare tax. Web documents needed to file itr; Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. The taxpayer performed services for an individual.

Form 1099NEC Nonemployee Compensation (1099NEC)

They must report the amount on irs form 8919. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. This includes their name, address, employer identification number (ein),. Web the date you file form 8919. The taxpayer performed services.

About Lori DiMarco CPA, PLLC

Web start by filling in your name and social security number on the top section of the form. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were. Web information about form 8919, uncollected social security and medicare tax on wages,.

Fillable Form 8919 Uncollected Social Security And Medicare Tax On

Web the date you file form 8919. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. This includes their name, address, employer identification number (ein),. A 0.9% additional medicare tax. A 0.9% additional medicare tax.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were. Form 8959, additional medicare tax. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: You can potentially.

Form 8919 2021 Fill Online, Printable, Fillable, Blank pdfFiller

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web.

Form 945A Edit, Fill, Sign Online Handypdf

Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. An individual having salary income should collect. You performed services for a firm. A 0.9% additional medicare tax. Web form 8919, uncollected social security and medicare tax on wages, will need.

Form 8959 Additional Medicare Tax (2014) Free Download

Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. Web the date you file form 8919. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form.

Web Form 8919 Is A Powerful Tool For Misclassified Workers Who Owe Uncollected Social Security And Medicare Taxes.

Web start by filling in your name and social security number on the top section of the form. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages a go to www.irs.gov/form8919 for the latest. Complete a separate line on form 8919 for each employer you’ve worked for. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes.

Web Form 8919, Uncollected Social Security And Medicare Tax On Wages, Will Need To Be Filed If All Of The Following Are True:

Form 8959, additional medicare tax. Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. A 0.9% additional medicare tax. You can potentially reduce the taxes you owe by.

Web Information About Form 8919, Uncollected Social Security And Medicare Tax On Wages, Including Recent Updates, Related Forms, And Instructions On How To File.

Web the date you file form 8919. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. An individual having salary income should collect. They must report the amount on irs form 8919.

The Taxpayer Performed Services For An Individual Or A Firm.

Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by. Web the date you file form 8919. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were.