What Happens To Secured Debt In Chapter 7

What Happens To Secured Debt In Chapter 7 - 1) “dischargeability,” and 2) asset distribution. To resolve your secured debts, the property held as collateral may be ordered returned to the creditor. How do i choose the best secured credit card? Learn about secured debts, what happens to them in bankruptcy, and your options for keeping or giving up the property that serves as collateral for secured debts. Dec 31st, 2020 in many chapter 7. Web liens create secured debt in chapter 7 bankruptcy if you've started preparing your bankruptcy paperwork, you'll have noticed that you must categorize your debts as either secured or unsecured. Find out what you should know about chapter 7 and business debt, including: By cara o'neill, attorney bankruptcy helps you get out of debt by breaking the contract between you. What happens to secured credit card debt in bankruptcy? Web pros of switching to chapter 7.

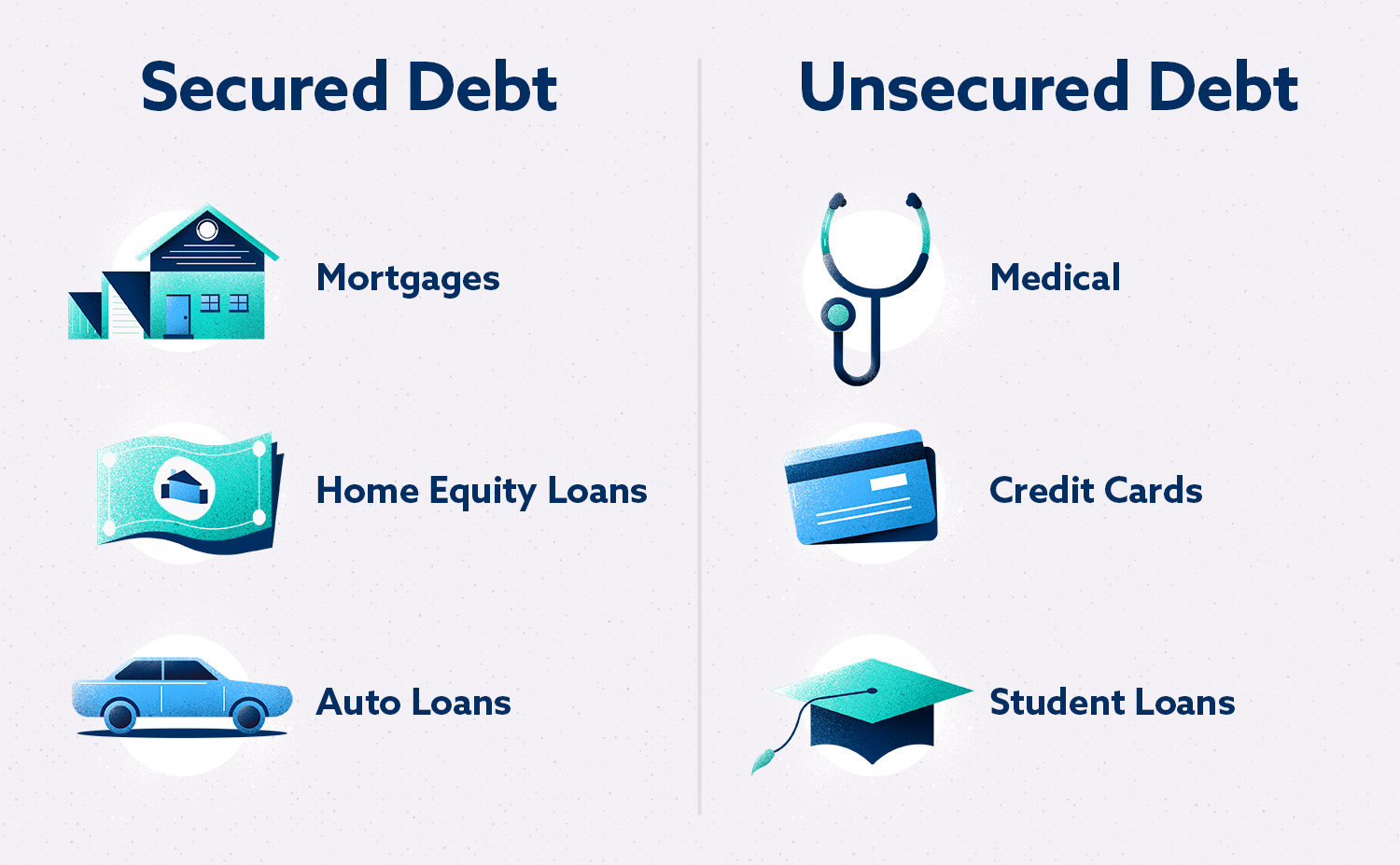

Web a secured debt is one that is secured by property, which the creditor can take if you default. You can't discharge some debts like child support, student loans, recent tax debt, and fines or penalties for violations of the law. A debt with a lien on it? Web what happens to secured debt in a chapter 7 bankruptcy? Or you may be able to redeem the collateral (you pay the creditor what it’s. Is a secured credit card right for me? Web liens create secured debt in chapter 7 bankruptcy if you've started preparing your bankruptcy paperwork, you'll have noticed that you must categorize your debts as either secured or unsecured. Furthermore, secured creditors may have some rights to seize property that secures an underlying debt… Web most debts, such as medical bills, credit cards, and payday loans, can be discharged in a chapter 7 bankruptcy. Web “secured debt” is created via liens in chapter 7 bankruptcy you must classify your debts as either secured or unsecured if you have already begun putting together your bankruptcy petition.

But, if you want to keep the property that the bank has a. Web when will the trustee pay secured debt in chapter 7 bankruptcy? Web in chapter 7 bankruptcy, you can keep property secured by collateral (such as your car) by reaffirming the debt. Up to five years for chapter 13). Learn about secured debts, what happens to them in bankruptcy, and your options for keeping or giving up the property that serves as collateral for secured debts. In chapter 7 bankruptcy, you can keep property secured by collateral (such as your car) by reaffirming the debt. Learn when a bankruptcy trustee will sell your home or car and use the proceeds to pay other creditors. Web bear in mind that if you reaffirm and later fall behind on payments, the creditor has the option of going to court and seeking a deficiency judgment for the outstanding balance. The creditor will still be able to take the property if the debt. By cara o'neill, attorney bankruptcy helps you get out of debt by breaking the contract between you.

The Pros and Cons of Secured Debt In Newsweekly

Web what happens to your “general unsecured debts” in a chapter 7 case depends on two very different considerations: The creditor will still be able to take the property if the debt. Discharging most unsecured debts such as credit card balances and medical debt, which saves money. Up to five years for chapter 13). Dec 31st, 2020 in many chapter.

Secured and Unsecured Debt Limitations Under Chapter 13

Because the attached lien won't go away in bankruptcy. 1) “dischargeability,” and 2) asset distribution. Web learn about secured debts, what happens to them in bankruptcy, and your options for keeping or giving up the property that serves as collateral for secured debts. A loan with a charge against it? When a creditor has a secured interest in your loan,.

What Happens if Someone Dies With Debt? SeekersGuidance

Web most debts, such as medical bills, credit cards, and payday loans, can be discharged in a chapter 7 bankruptcy. Web “secured debt” is created via liens in chapter 7 bankruptcy you must classify your debts as either secured or unsecured if you have already begun putting together your bankruptcy petition. Discharging most unsecured debts such as credit card balances.

Secured Debt Investments

Web keeping secured property: Web in chapter 7 bankruptcy, you can keep property secured by collateral (such as your car) by reaffirming the debt. Here are more details about these important terms: You can't discharge some debts like child support, student loans, recent tax debt, and fines or penalties for violations of the law. Discharging most unsecured debts such as.

Secured Debt Free of Charge Creative Commons Typewriter image

Web keeping secured property: Discharging most unsecured debts such as credit card balances and medical debt, which saves money. Dec 31st, 2020 in many chapter 7. Find out what you should know about chapter 7 and business debt, including: A loan with a charge against it?

What Happens to Debt When You Die?

Furthermore, secured creditors may have some rights to seize property that secures an underlying debt… Because the attached lien won't go away in bankruptcy. Web secured debts in chapter 7 bankruptcy: How are secured credit cards treated in chapter 7 bankruptcy? Web pros of switching to chapter 7.

What Happens After You File Bankruptcy

Web those bills are unsecured. Learn about secured debts, what happens to them in bankruptcy, and your options for keeping or giving up the property that serves as collateral for secured debts. Because the attached lien won't go away in bankruptcy. What happens to secured credit card debt in bankruptcy? By cara o'neill, attorney updated:

What Is The Difference Between Secured and Unsecured Debt

Debt reaffirmation it is harder to discharge secured debt than it is to discharge unsecured debt. Web “secured debt” is created via liens in chapter 7 bankruptcy you must classify your debts as either secured or unsecured if you have already begun putting together your bankruptcy petition. Web abuse is presumed if the debtor's current monthly income over 5 years,.

What's the Difference Between Unsecured and Secured Debts?

A loan with a charge against it? How do i choose the best secured credit card? Web when you can discharge secured debts in chapter 7 bankruptcy. Web learn about secured debts, what happens to them in bankruptcy, and your options for keeping or giving up the property that serves as collateral for secured debts. Any secured debt can always.

What Happens if You Default on a Secured Debt? dealstruck

Furthermore, secured creditors may have some rights to seize property that secures an underlying debt… Debt reaffirmation it is harder to discharge secured debt than it is to discharge unsecured debt. Web learn about secured debts, what happens to them in bankruptcy, and your options for keeping or giving up the property that serves as collateral for secured debts. Web.

Any Secured Debt Can Always Be Discharged, But You Won't Be Able To Keep The Property Serving As Collateral, Such As Your House Or Car.

Web most debts, such as medical bills, credit cards, and payday loans, can be discharged in a chapter 7 bankruptcy. In chapter 7 bankruptcy, you can keep property secured by collateral (such as your car) by reaffirming the debt. Web keeping secured property: Web “secured debt” is created via liens in chapter 7 bankruptcy you must classify your debts as either secured or unsecured if you have already begun putting together your bankruptcy petition.

Web Those Bills Are Unsecured.

How do i choose the best secured credit card? Find out what you should know about chapter 7 and business debt, including: For example, your mortgage is secured by your home. Web a secured debt is one that is secured by property, which the creditor can take if you default.

The Creditor Will Still Be Able To Take The Property If The Debt.

A loan with a charge against it? Learn about secured debts, what happens to them in bankruptcy, and your options for keeping or giving up the property that serves as collateral for secured debts. Web updated july 25, 2023 table of contents what is a secured credit card? Web any business or personal debt that qualifies for a chapter 7 discharge will be erased as long as an individual or sole proprietor files for chapter 7 bankruptcy.

Web What Happens To Secured Debt In A Chapter 7 Bankruptcy?

Here are more details about these important terms: Web pros of switching to chapter 7. Web abuse is presumed if the debtor's current monthly income over 5 years, net of certain statutorily allowed expenses and secured debt payments, is not less than the lesser of (i) 25% of the debtor's nonpriority unsecured debt… To resolve your secured debts, the property held as collateral may be ordered returned to the creditor.