What Happens After You File Chapter 13

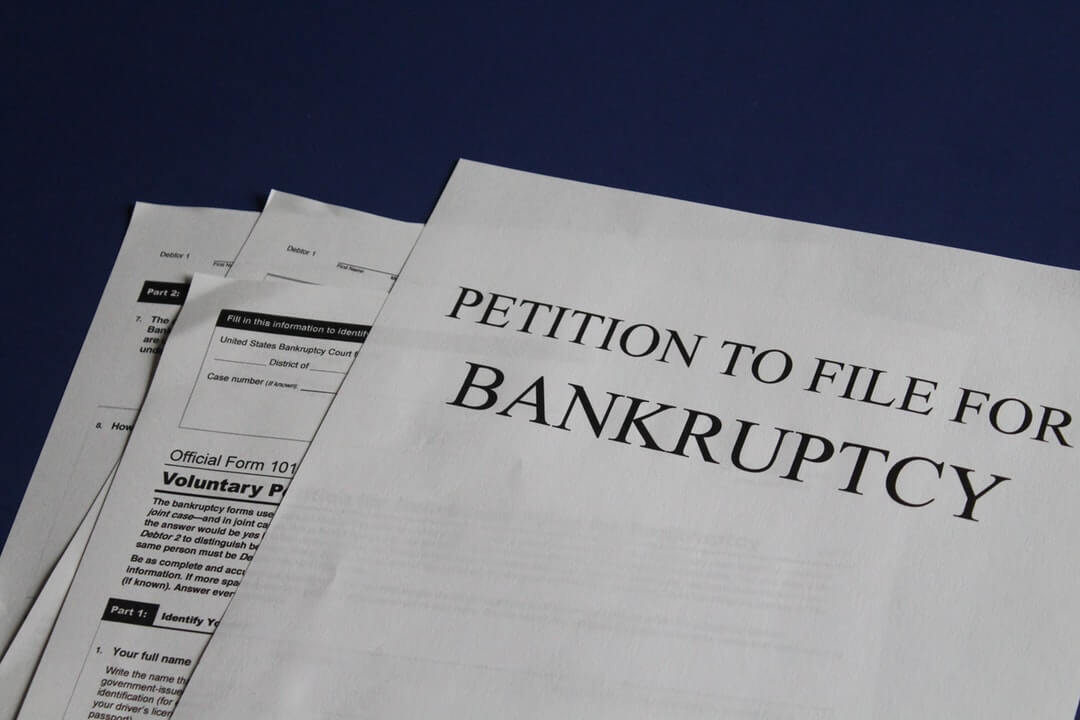

What Happens After You File Chapter 13 - Often, the chapter 13 plan will not provide. Web the downside to this option is that if you received a chapter 13 discharge, you must wait six years to file for chapter 7 relief. Web after filing your chapter 13, the initial stages, at least, are not that different from a chapter 7. Credit card balances, personal loans, medical bills, and utility payments fit here. Web what happens to debts incurred after filing the chapter 13 case? Web you must begin making payments on your proposed plan within 30 days after you file a chapter 13 bankruptcy. Web during chapter 13, your monthly payments will be made either voluntarily, or directly through a paycheck withdrawal. However, you can take steps to. Web updated july 26, 2023 table of contents what kind of small business do you have? Web when you are deciding whether to file for bankruptcy, there is a lot to take into consideration.

In either case, the payment is sent to your bankruptcy trustee, and the. An exception exists if you repaid your creditors 70 to 100 percent of what you owed under your chapter 13. Web your bankruptcy payment will become due the month after your bankruptcy is filed. But you can skip that step if you’re evicting the tenant because of illegal drug use on the property or you. Web when you are deciding whether to file for bankruptcy, there is a lot to take into consideration. Web if you want to evict after the tenant files a chapter 13 case, your first stop is the bankruptcy court to ask the judge to lift the automatic stay. Web what happens to debts incurred after filing the chapter 13 case? Web people usually choose chapter 13 bankruptcy because they make too much to pass the chapter 7 means test, don't want to lose a house or car after falling behind on the monthly payment, or want to avoid wage. Web chapter 13, sometimes called a wage earner's plan, allows you to keep more of your assets, including saving your home from foreclosure. Web you must begin making payments on your proposed plan within 30 days after you file a chapter 13 bankruptcy.

However, you can take steps to. Findlaw.com has resources to help you navigate the bankruptcy process, and understand what happens after bankruptcy. The first thing that happens is your attorney files the case electronically (or if you are filing pro se, meaning without an attorney, then you file the case in person at the courthouse), and you. Web your bankruptcy payment will become due the month after your bankruptcy is filed. But you can skip that step if you’re evicting the tenant because of illegal drug use on the property or you. Web after filing your chapter 13, the initial stages, at least, are not that different from a chapter 7. Under the bankruptcy code, if you incur new debt through no fault of your own after you file a chapter 13 but before you convert it to a chapter. Web the majority of debts discharged in chapter 13 bankruptcy are nonpriority unsecured debts. Web if you want to evict after the tenant files a chapter 13 case, your first stop is the bankruptcy court to ask the judge to lift the automatic stay. During your bankruptcy you must continue to file, or get an extension of time to file…

cares act bankruptcy chapter 13 brooksvuillemot

Web during chapter 13, your monthly payments will be made either voluntarily, or directly through a paycheck withdrawal. Web what happens to debts incurred after filing the chapter 13 case? Web after filing your chapter 13, the initial stages, at least, are not that different from a chapter 7. In either case, the payment is sent to your bankruptcy trustee,.

What happens if you file ITR after the deadline? KDK Softwares

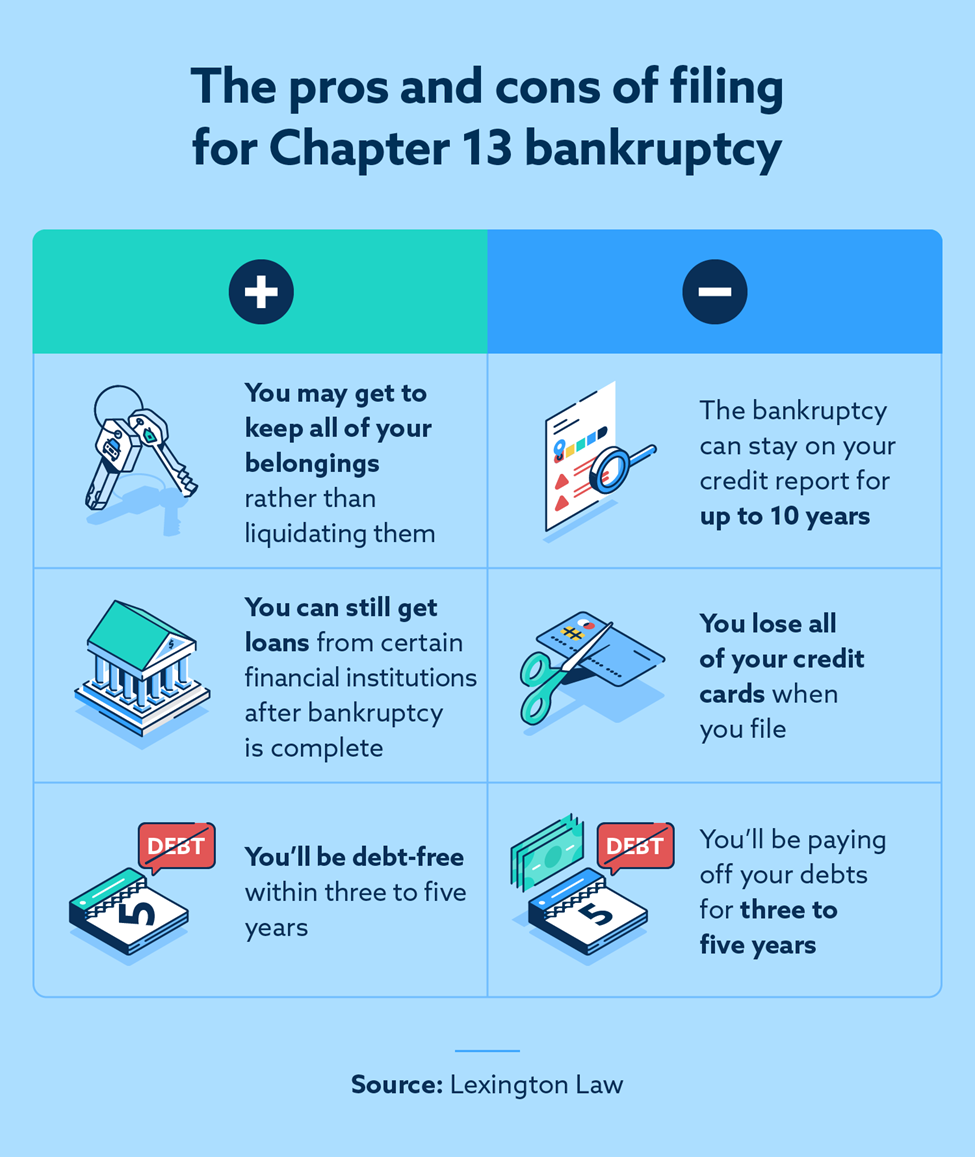

Web your credit will suffer when you file a chapter 13 case, but it will drop from your credit report years before a chapter 7 case would. Web since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing..

File Chapter 13 Bankruptcy Best California Education Lawyer

Thus, if you enter into a five year chapter 13 repayment plan, you. During your bankruptcy you must continue to file, or get an extension of time to file… Chapter 7 bankruptcy eliminating business debt through chapter 13 bankruptcy other. You must file all required tax returns for tax periods ending within four years of your bankruptcy filing. The court.

The Pros and Cons of Filing for Chapter 13 Bankruptcy My AZ Lawyers

Can i convert to chapter 7 to avoid a dismissed chapter 13 case? However, you can take steps to. Web the majority of debts discharged in chapter 13 bankruptcy are nonpriority unsecured debts. But you can skip that step if you’re evicting the tenant because of illegal drug use on the property or you. Web what happens after a chapter.

What Happens After You File for Bankruptcy?

Web after completing chapter 13 bankruptcy, debtors emerge with their accounts current and property intact. Web if you want to evict after the tenant files a chapter 13 case, your first stop is the bankruptcy court to ask the judge to lift the automatic stay. However, you can take steps to. Thus, if you enter into a five year chapter.

What Happens After You Die?

An exception exists if you repaid your creditors 70 to 100 percent of what you owed under your chapter 13. Credit card balances, personal loans, medical bills, and utility payments fit here. Web updated july 26, 2023 table of contents what kind of small business do you have? Web completed chapter 13 cases, on the other hand, are removed from.

Benefits Of Chapter 13 Bankruptcy Chris Mudd & Associates

Chapter 7 bankruptcy eliminating business debt through chapter 13 bankruptcy other. Web what happens after a chapter 13 case is dismissed? Web updated july 26, 2023 table of contents what kind of small business do you have? Findlaw.com has resources to help you navigate the bankruptcy process, and understand what happens after bankruptcy. Credit card balances, personal loans, medical bills,.

File Chapter 13 Bankruptcy Best California Education Lawyer

Even though the court has not confirmed or approved your plan, asking you to begin. However, you can take steps to. Web people usually choose chapter 13 bankruptcy because they make too much to pass the chapter 7 means test, don't want to lose a house or car after falling behind on the monthly payment, or want to avoid wage..

What Happens After You File An FIR? Process after FIR StrictlyLegal

An exception exists if you repaid your creditors 70 to 100 percent of what you owed under your chapter 13. Web during chapter 13, your monthly payments will be made either voluntarily, or directly through a paycheck withdrawal. Web the majority of debts discharged in chapter 13 bankruptcy are nonpriority unsecured debts. Web when you are deciding whether to file.

Can You File Chapter 13 and Keep Your House? Bonnie Buys Houses

Web before you consider filing a chapter 13 here are some things you should know: Web chapter 13, sometimes called a wage earner's plan, allows you to keep more of your assets, including saving your home from foreclosure. Web when you are deciding whether to file for bankruptcy, there is a lot to take into consideration. The first thing that.

Can I Convert To Chapter 7 To Avoid A Dismissed Chapter 13 Case?

Filing a chapter 7 case after a dismissed chapter 13 case filing a chapter. Under the bankruptcy code, if you incur new debt through no fault of your own after you file a chapter 13 but before you convert it to a chapter. Despite its benefits, chapter 13 bankruptcy can harm a filer's credit. Chapter 7 bankruptcy eliminating business debt through chapter 13 bankruptcy other.

The First Thing That Happens Is Your Attorney Files The Case Electronically (Or If You Are Filing Pro Se, Meaning Without An Attorney, Then You File The Case In Person At The Courthouse), And You.

Web the downside to this option is that if you received a chapter 13 discharge, you must wait six years to file for chapter 7 relief. Can i refile chapter 13 after my case is dismissed? Web before you consider filing a chapter 13 here are some things you should know: Web what happens to debts incurred after filing the chapter 13 case?

Web Your Bankruptcy Payment Will Become Due The Month After Your Bankruptcy Is Filed.

However, you can take steps to. Web updated july 26, 2023 table of contents what kind of small business do you have? Often, the chapter 13 plan will not provide. Web the majority of debts discharged in chapter 13 bankruptcy are nonpriority unsecured debts.

Web Completed Chapter 13 Cases, On The Other Hand, Are Removed From Your Credit By All Three Major Credit Reporting Agencies 7 Years After Filing Your Bankruptcy Case.

Web chapter 13, sometimes called a wage earner's plan, allows you to keep more of your assets, including saving your home from foreclosure. Credit card balances, personal loans, medical bills, and utility payments fit here. Web your credit will suffer when you file a chapter 13 case, but it will drop from your credit report years before a chapter 7 case would. Web what happens after a chapter 13 case is dismissed?