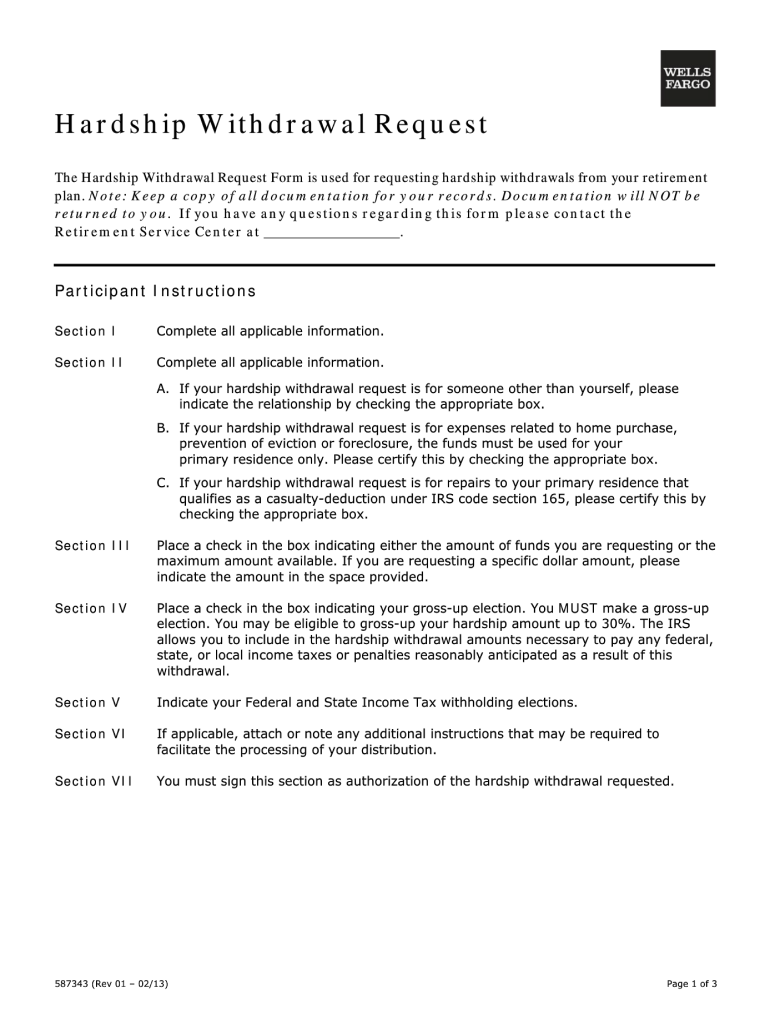

Wells Fargo 401K Hardship Withdrawal Form 2019

Wells Fargo 401K Hardship Withdrawal Form 2019 - Web here’s another reason why employers should limit (or even eliminate altogether) workers’ opportunities for 401(k) hardship withdrawals. Web the final regulations permit, but do not require, 401 (k) plans to allow hardship distributions of elective contributions, qnecs, qmacs, and safe harbor contributions and earnings. You may qualify for a loan against your 401(k), that would have the least adverse tax consequences as long as you pay it back. You must report your withdrawal as. On the other hand, 401k hardship withdrawal does not come without a price. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. With respect to the distribution of elective deferrals, a hardship is defined as an. Withdrawing from 401 (k) without penalty is possible. Usually, money can be distributed from your 401 (k) if you die, retire, reach age 59 1/2, become. Web or, when you are considering rolling money over from a 401(k) to an ira, you may wish to roll over only a portion of your retirement savings and take the rest in cash.

Web the final regulations permit, but do not require, 401 (k) plans to allow hardship distributions of elective contributions, qnecs, qmacs, and safe harbor contributions and earnings. Roll over your assets into an individual retirement account (ira) leave your assets in your former employer’s qrp, if the plan allows. For example, some 401 (k). Withdrawing from 401 (k) without penalty is possible. Web a 401(k) plan may permit distributions to be made on account of a hardship. To add features to your current account, simply download, print, and fill out the appropriate form or application and submit it via the provided fax number or. On the other hand, 401k hardship withdrawal does not come without a price. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Both the dol and the. Web plans are not required to do so.

Web you generally have four options: Web december 22, 2020 full y completed and signed paper work for dis tribution reques t s , withdrawal reques t s and loan reques t s subjec t to qualified joint & survivor annuity. Web there are other exceptions to the 10% additional tax including: Web death disability substantially equal periodic payments made over life expectancy termination of service after five years and reaching age 55 qualified military reservist. Web or, when you are considering rolling money over from a 401(k) to an ira, you may wish to roll over only a portion of your retirement savings and take the rest in cash. Web for questions regarding this form, refer to the attached participant hardship withdrawal guide (guide), visit the website at www.retirementlink.jpmorgan.com or contact service. To add features to your current account, simply download, print, and fill out the appropriate form or application and submit it via the provided fax number or. Both the dol and the. You may qualify for a loan against your 401(k), that would have the least adverse tax consequences as long as you pay it back. Your death, being disabled, eligible medical expenses, taking substantially equal periodic payments (sepp), qualified.

The ABC's of a Forebearance Plan

Web 401 (k) or other qualified employer sponsored retirement plan (qrp) early distribution costs calculator. On the other hand, 401k hardship withdrawal does not come without a price. Your death, being disabled, eligible medical expenses, taking substantially equal periodic payments (sepp), qualified. Both the dol and the. Web death disability substantially equal periodic payments made over life expectancy termination of.

Ach Authorization Form Wells Fargo Universal Network

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Both the dol and the. You can’t repay a hardship distribution to your retirement plan. Web for questions regarding this form, refer to the attached participant hardship withdrawal guide (guide), visit the website at www.retirementlink.jpmorgan.com or contact service. Web many 401.

Wells Fargo Qdro Form Free Universal Network

Web the final regulations permit, but do not require, 401 (k) plans to allow hardship distributions of elective contributions, qnecs, qmacs, and safe harbor contributions and earnings. Roll over your assets into an individual retirement account (ira) leave your assets in your former employer’s qrp, if the plan allows. Web 401 (k) or other qualified employer sponsored retirement plan (qrp).

Wells fargo 401k hardship withdrawal form 2013 Fill out & sign online

Web yes, you can. Web there are other exceptions to the 10% additional tax including: On the other hand, 401k hardship withdrawal does not come without a price. Web many 401 (k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. Use this calculator to estimate how much.

Principal acquires Wells Fargo 401k accounts... what's next?

Web a 401(k) plan may permit distributions to be made on account of a hardship. Web there are other exceptions to the 10% additional tax including: You may qualify for a loan against your 401(k), that would have the least adverse tax consequences as long as you pay it back. Web many 401 (k) plans allow you to withdraw money.

401k Rollover Form Wells Fargo Form Resume Examples Rg8DARew1M

You may qualify for a loan against your 401(k), that would have the least adverse tax consequences as long as you pay it back. Web a 401k hardship withdrawal can cost you more than once. Your death, being disabled, eligible medical expenses, taking substantially equal periodic payments (sepp), qualified. Web december 22, 2020 full y completed and signed paper work.

401K Hardship Letter Template Resume Letter

Web plans are not required to do so. Withdrawing from 401 (k) without penalty is possible. Use this calculator to estimate how much in taxes you could owe if you. Usually, money can be distributed from your 401 (k) if you die, retire, reach age 59 1/2, become. Web you generally have four options:

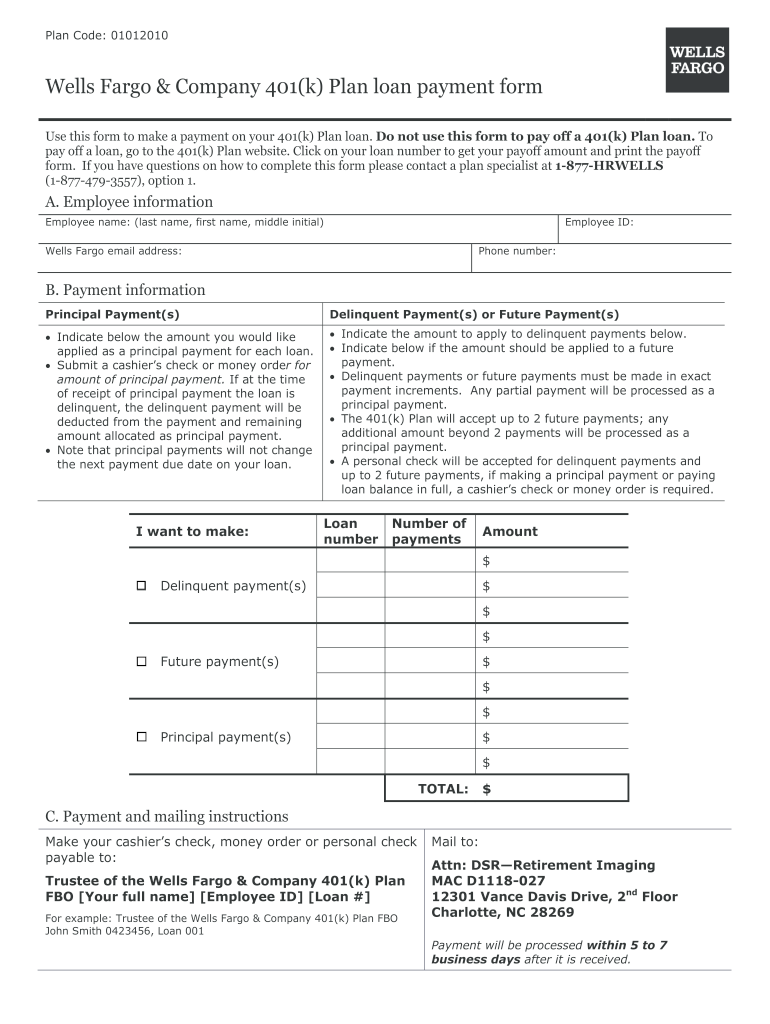

Wells Fargo Loan Payoff Form Fill Out and Sign Printable PDF Template

Web plans are not required to do so. Web a 401k hardship withdrawal can cost you more than once. Web many 401 (k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. Web here’s another reason why employers should limit (or even eliminate altogether) workers’ opportunities for 401(k).

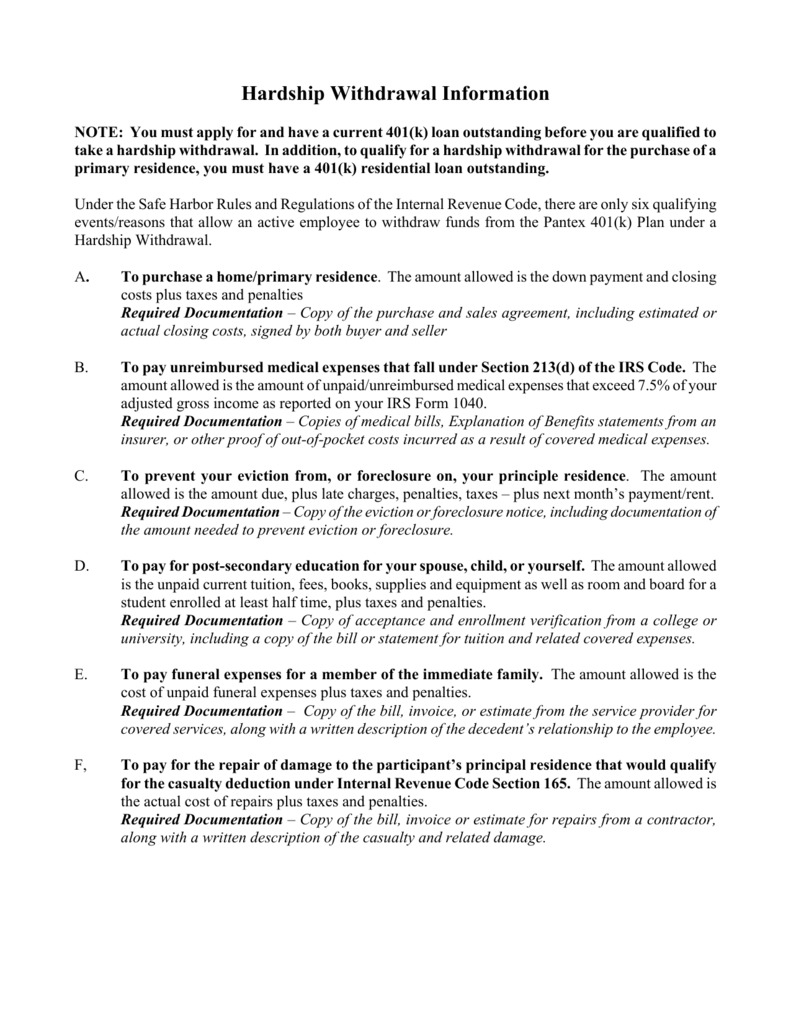

Hardship Withdrawal Information

You may qualify for a loan against your 401(k), that would have the least adverse tax consequences as long as you pay it back. Web 401 (k) or other qualified employer sponsored retirement plan (qrp) early distribution costs calculator. Web december 22, 2020 full y completed and signed paper work for dis tribution reques t s , withdrawal reques t.

Wells Fargo Shifting from Run the Bank to Change the Bank

You may qualify for a loan against your 401(k), that would have the least adverse tax consequences as long as you pay it back. To add features to your current account, simply download, print, and fill out the appropriate form or application and submit it via the provided fax number or. Web answer (1 of 6): Web the final regulations.

You Can’t Repay A Hardship Distribution To Your Retirement Plan.

Your death, being disabled, eligible medical expenses, taking substantially equal periodic payments (sepp), qualified. Web 401 (k) or other qualified employer sponsored retirement plan (qrp) early distribution costs calculator. Hardship distributions also come with substantial financial strings attached. Web or, when you are considering rolling money over from a 401(k) to an ira, you may wish to roll over only a portion of your retirement savings and take the rest in cash.

Web Here’s Another Reason Why Employers Should Limit (Or Even Eliminate Altogether) Workers’ Opportunities For 401(K) Hardship Withdrawals.

Usually, money can be distributed from your 401 (k) if you die, retire, reach age 59 1/2, become. Web yes, you can. Web many 401 (k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. Web there are other exceptions to the 10% additional tax including:

Web Plans Are Not Required To Do So.

Web a hardship distribution is a withdrawal from a participant’s elective deferral account made because of an immediate and heavy financial need, and limited to the amount necessary. Use this calculator to estimate how much in taxes you could owe if you. Web for questions regarding this form, refer to the attached participant hardship withdrawal guide (guide), visit the website at www.retirementlink.jpmorgan.com or contact service. If you’re over 59 1/2 years old the.

With Respect To The Distribution Of Elective Deferrals, A Hardship Is Defined As An.

Web you generally have four options: Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web a 401k hardship withdrawal can cost you more than once. Web december 22, 2020 full y completed and signed paper work for dis tribution reques t s , withdrawal reques t s and loan reques t s subjec t to qualified joint & survivor annuity.