W2 Form Uiuc

W2 Form Uiuc - Review, edit and submit the address (s) listed for the address. Employees will receive a paper copy of. Web the tax information section of the payroll & benefits web site provides you with information relevant to tax forms, understanding tax withholdings, and accessing. University payroll & benefits (upb) is responsible for issuing the following forms: Web once in the selection screen, in the address/contact information section click on the edit button. Web december 1, 2020. If you are off campus you will also need to. Electronic versions of these forms are available through my.illinoisstate. And select your illinois withholding income. Web employee's wage and tax statement.

If you are off campus you will also need to. Web employee's wage and tax statement. University payroll & benefits (upb) is responsible for issuing the following forms: Web december 1, 2020. Web the tax information section of the payroll & benefits web site provides you with information relevant to tax forms, understanding tax withholdings, and accessing. And select your illinois withholding income. Review, edit and submit the address (s) listed for the address. Electronic versions of these forms are available through my.illinoisstate. Employees will receive a paper copy of. Web once in the selection screen, in the address/contact information section click on the edit button.

If you are off campus you will also need to. Electronic versions of these forms are available through my.illinoisstate. Web employee's wage and tax statement. Web december 1, 2020. Employees will receive a paper copy of. Login to your mytax illinois account. University payroll & benefits (upb) is responsible for issuing the following forms: Review, edit and submit the address (s) listed for the address. Web once in the selection screen, in the address/contact information section click on the edit button. Web the tax information section of the payroll & benefits web site provides you with information relevant to tax forms, understanding tax withholdings, and accessing.

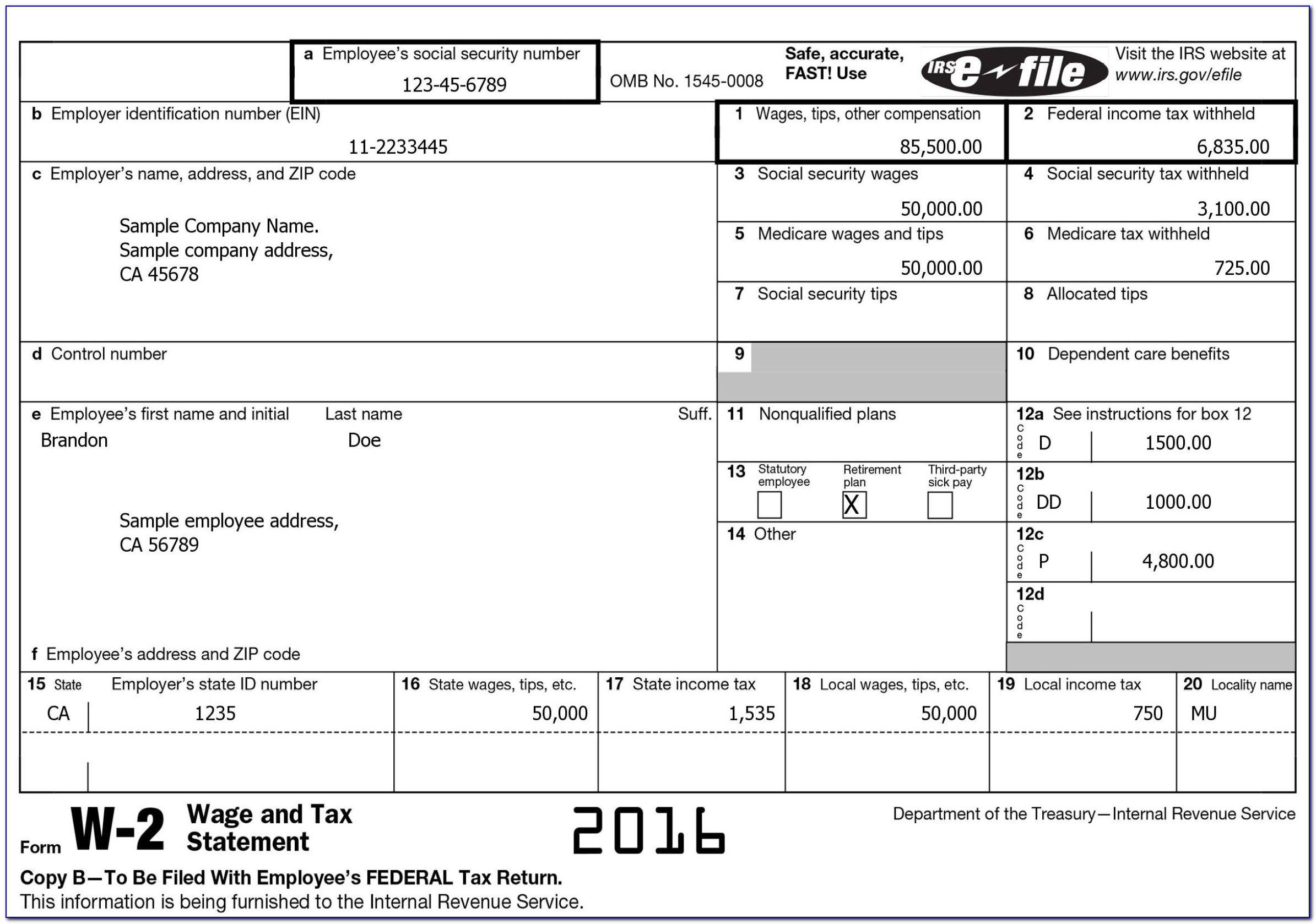

W2c Form 2016 Form Resume Examples enk6WBzDbv

And select your illinois withholding income. Review, edit and submit the address (s) listed for the address. University payroll & benefits (upb) is responsible for issuing the following forms: If you are off campus you will also need to. Web once in the selection screen, in the address/contact information section click on the edit button.

W8 Form California 8 Five Signs You’re In Love With W8 Form California

Web the tax information section of the payroll & benefits web site provides you with information relevant to tax forms, understanding tax withholdings, and accessing. Login to your mytax illinois account. Web employee's wage and tax statement. University payroll & benefits (upb) is responsible for issuing the following forms: Employees will receive a paper copy of.

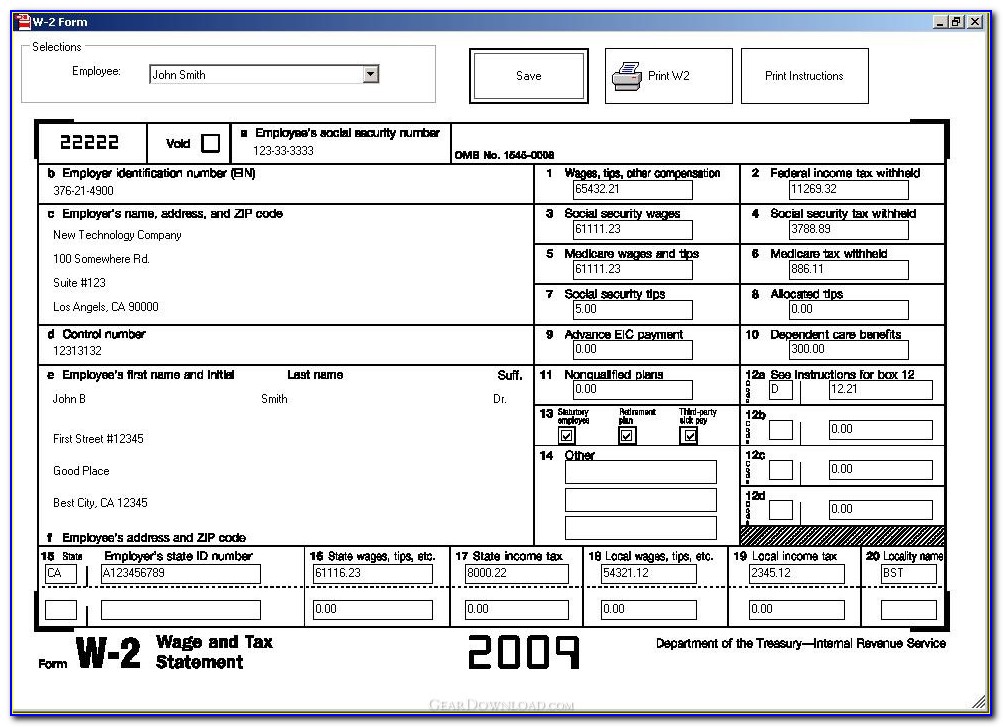

ezAccounting Payroll How to Print Form W2

Web once in the selection screen, in the address/contact information section click on the edit button. Web the tax information section of the payroll & benefits web site provides you with information relevant to tax forms, understanding tax withholdings, and accessing. Review, edit and submit the address (s) listed for the address. And select your illinois withholding income. Web december.

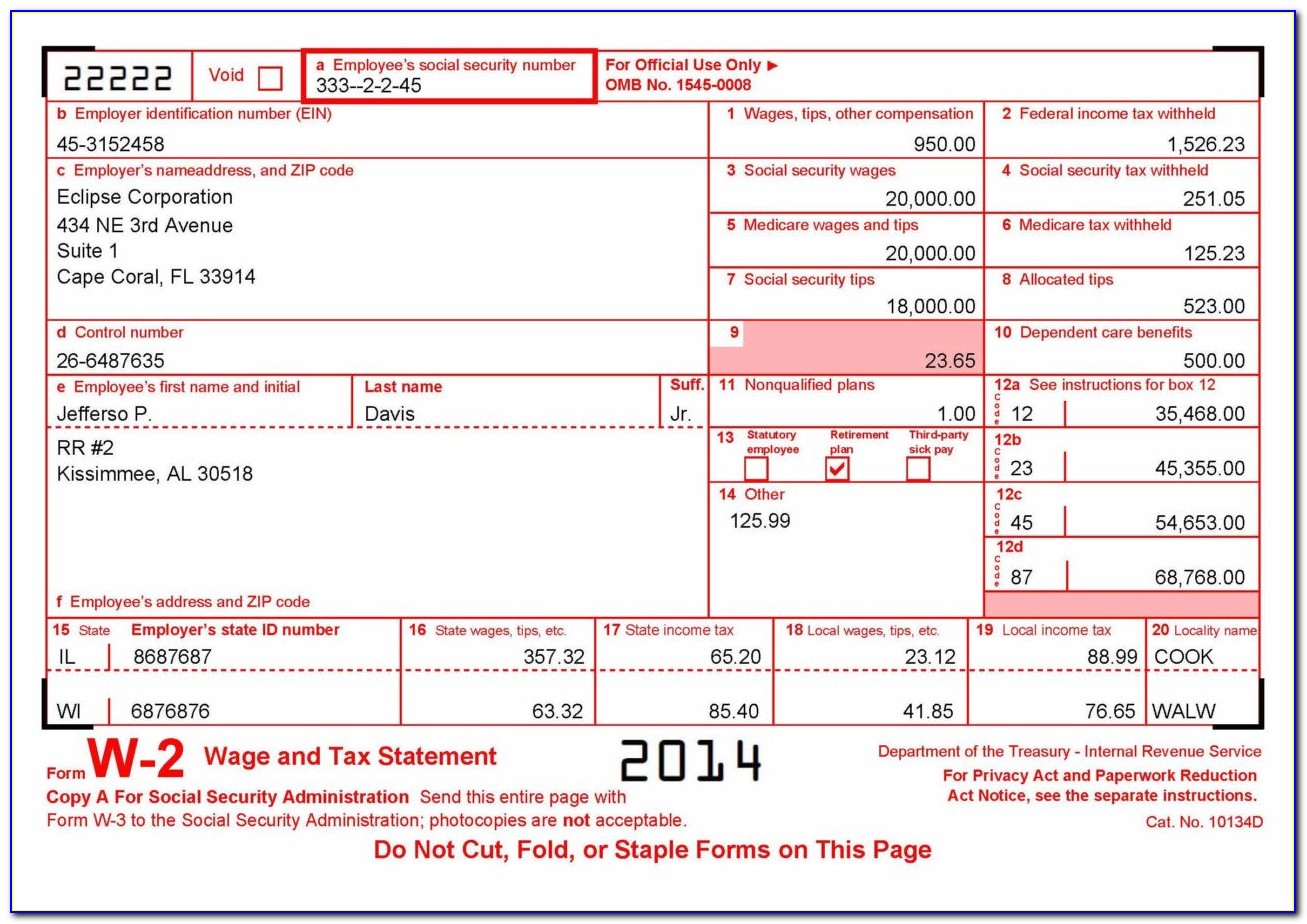

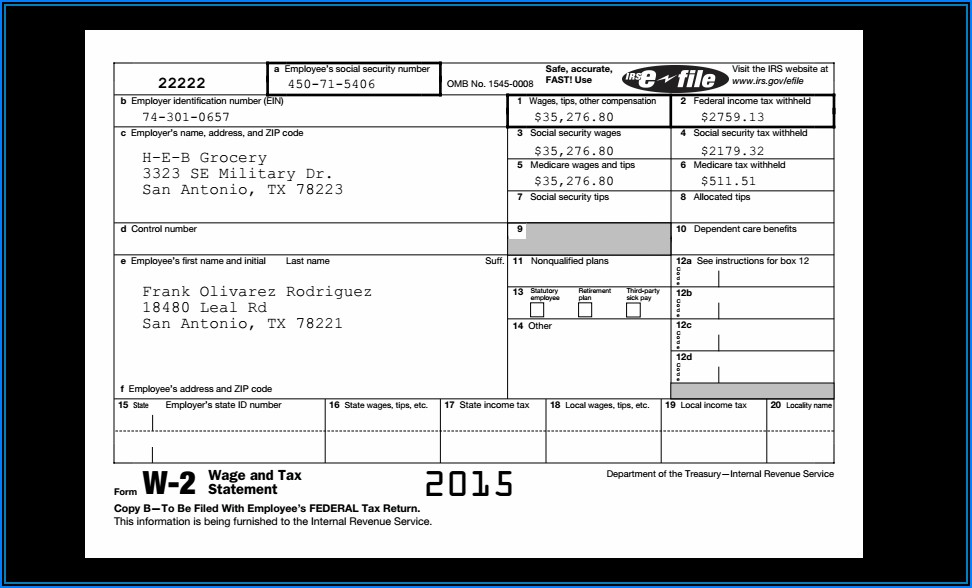

W2 Form For Employee Form Resume Examples mx2WDxG96E

Web employee's wage and tax statement. University payroll & benefits (upb) is responsible for issuing the following forms: Electronic versions of these forms are available through my.illinoisstate. Login to your mytax illinois account. Web once in the selection screen, in the address/contact information section click on the edit button.

How do I get my United Airlines W2 Form Online? W2 Form

Electronic versions of these forms are available through my.illinoisstate. And select your illinois withholding income. Web the tax information section of the payroll & benefits web site provides you with information relevant to tax forms, understanding tax withholdings, and accessing. Web once in the selection screen, in the address/contact information section click on the edit button. Web employee's wage and.

W2 Form Copy A 2018 Form Resume Examples MeVRB6LjVD

Login to your mytax illinois account. Employees will receive a paper copy of. And select your illinois withholding income. Review, edit and submit the address (s) listed for the address. University payroll & benefits (upb) is responsible for issuing the following forms:

W2 Form Fillable 2016 Form Resume Examples qQ5M09XDXg

Login to your mytax illinois account. Web once in the selection screen, in the address/contact information section click on the edit button. And select your illinois withholding income. If you are off campus you will also need to. Review, edit and submit the address (s) listed for the address.

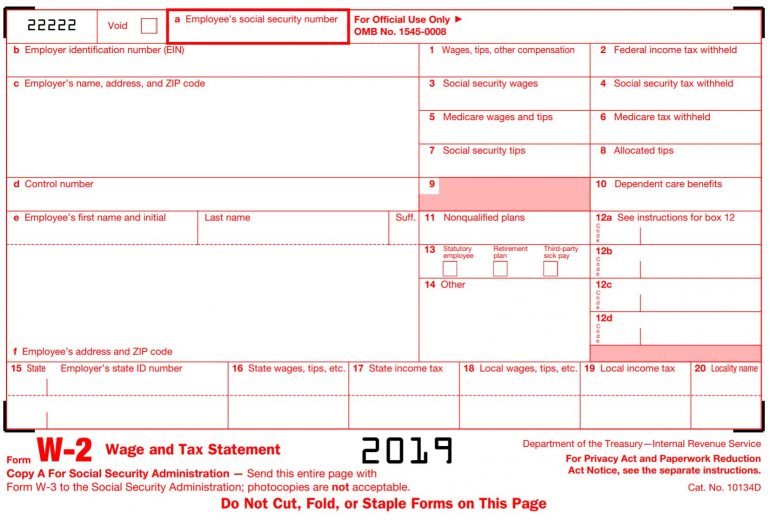

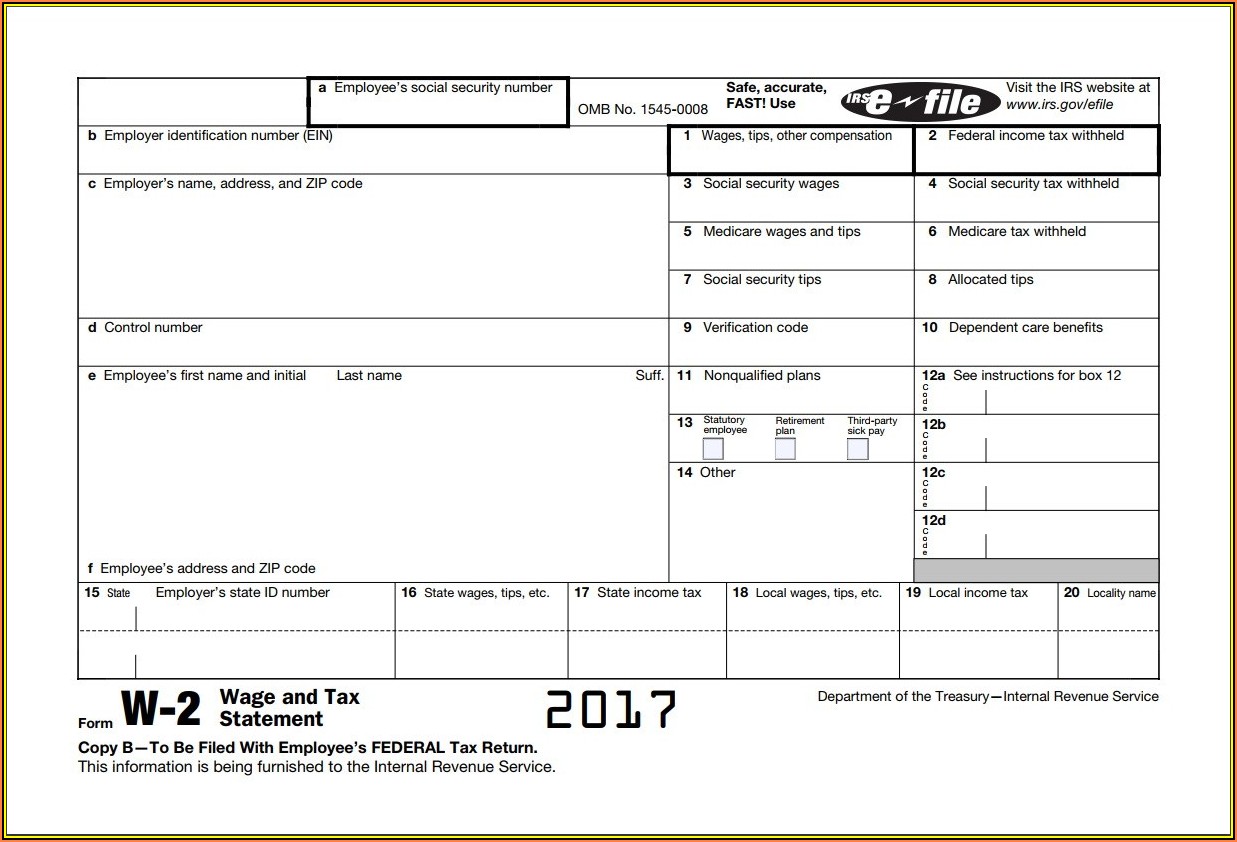

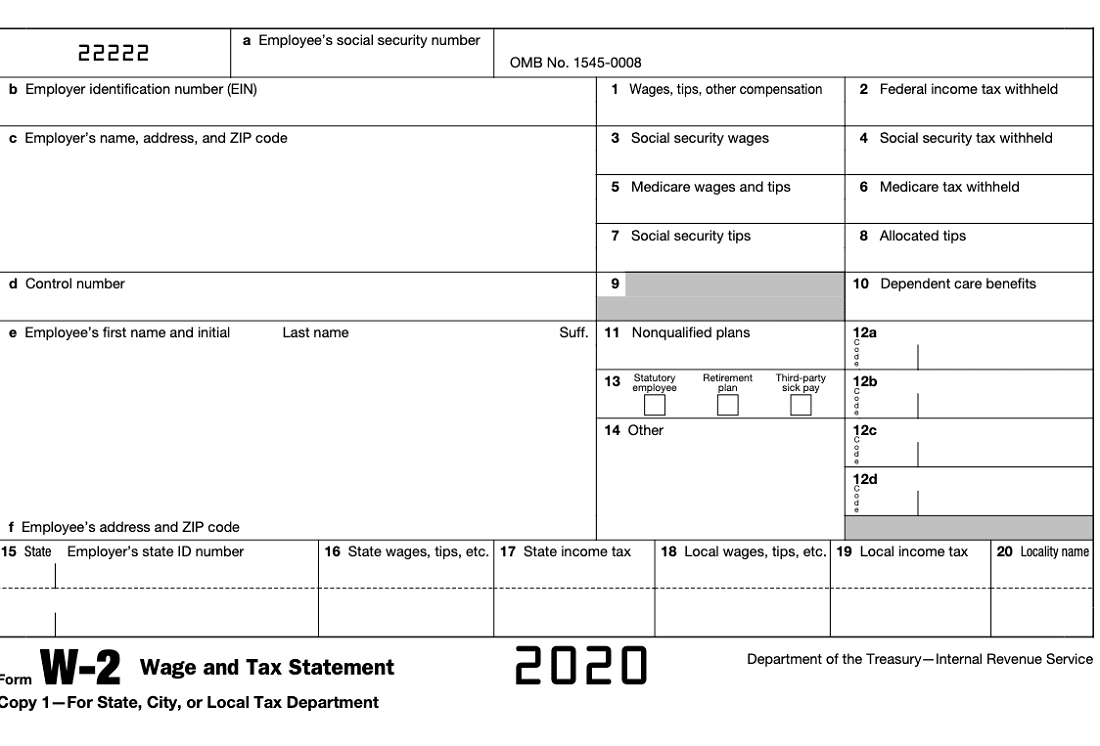

Sample W2 Tax Forms

Electronic versions of these forms are available through my.illinoisstate. Employees will receive a paper copy of. Web once in the selection screen, in the address/contact information section click on the edit button. University payroll & benefits (upb) is responsible for issuing the following forms: And select your illinois withholding income.

An Employer’s Guide to Easily Completing a W2 Form Gift CPAs

Electronic versions of these forms are available through my.illinoisstate. If you are off campus you will also need to. Web once in the selection screen, in the address/contact information section click on the edit button. And select your illinois withholding income. Login to your mytax illinois account.

If You Are Off Campus You Will Also Need To.

Login to your mytax illinois account. Review, edit and submit the address (s) listed for the address. And select your illinois withholding income. Web employee's wage and tax statement.

Web December 1, 2020.

Electronic versions of these forms are available through my.illinoisstate. University payroll & benefits (upb) is responsible for issuing the following forms: Employees will receive a paper copy of. Web the tax information section of the payroll & benefits web site provides you with information relevant to tax forms, understanding tax withholdings, and accessing.