Virginia Form 760 Instructions 2022

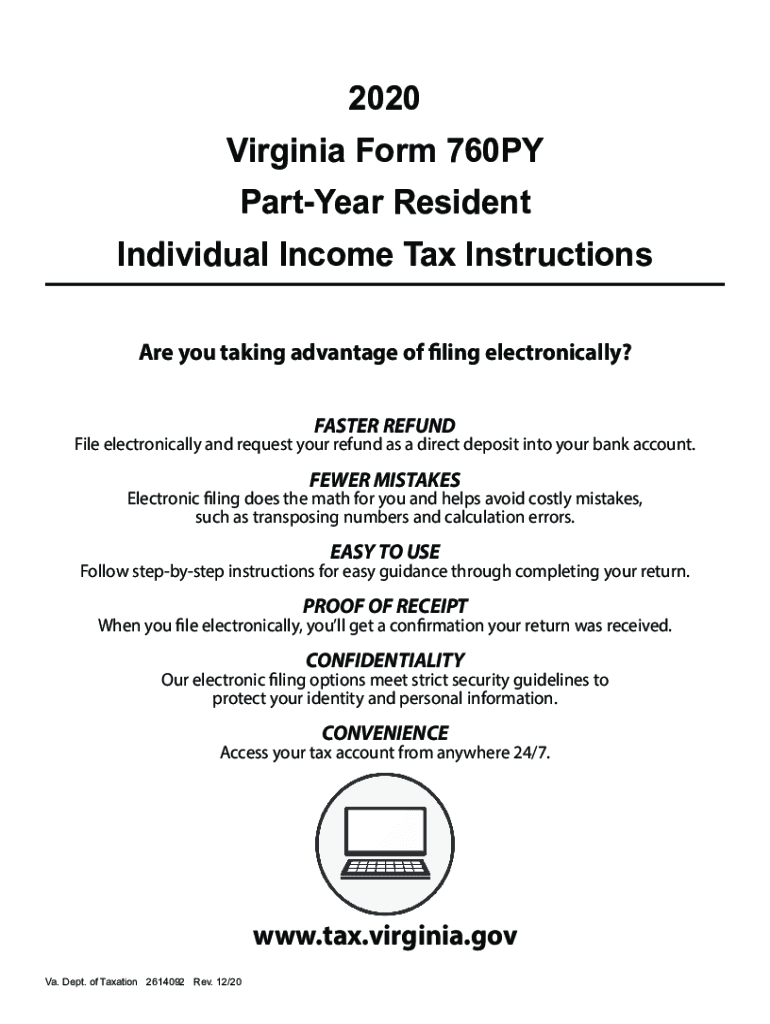

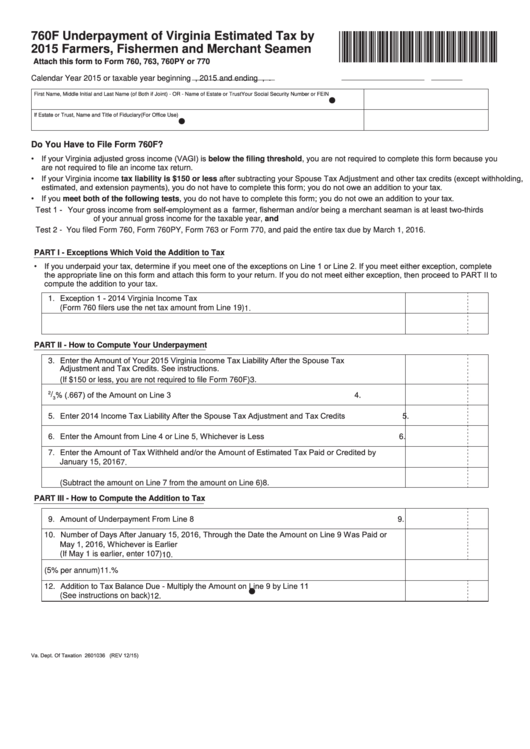

Virginia Form 760 Instructions 2022 - (if $150 or less, you are not required to file form 760f) 3. Web this booklet includes instructions for filling out and filing your form 760 income tax return. Since underpayments are determined as of each installment due date, Virginia form 760 *va0760122888* resident income tax return. Web we last updated the resident individual income tax return in january 2023, so this is the latest. Virginia fiduciary income tax return instructions 760es: Web free printable 2022 virginia form 760 and 2022 virginia form 760 instructions. Here are 6 advantages of filing electronically: Enter 66 2/3% (.667) of the amount on line 3 4. Web enter the amount of your 2022 virginia income tax liability after the spouse tax adjustment and tax credits.

Here are 6 advantages of filing electronically: Web free printable 2022 virginia form 760 and 2022 virginia form 760 instructions. Web home | virginia tax The form must be filed even if you are due a refund when you file your tax return. Virginia fiduciary income tax return instructions 760es: Web find forms & instructions by category. Web enter the amount of your 2022 virginia income tax liability after the spouse tax adjustment and tax credits. If your tax is underpaid as of any installment due date, you must file form 760c. Since underpayments are determined as of each installment due date, Web fiscal year filers should refer to virginia form 760es and the instructions to determine their installment due dates.

Since underpayments are determined as of each installment due date, Virginia fiduciary income tax return instructions 760es: Web find forms & instructions by category. Web 2022 form 760 resident individual income tax booklet uplease file electronically!u filing on paper means waiting longer for your refund. The form must be filed even if you are due a refund when you file your tax return. Web home | virginia tax Web we last updated the resident individual income tax return in january 2023, so this is the latest. Web free printable 2022 virginia form 760 and 2022 virginia form 760 instructions. Corporation and pass through entity tax. Enter 66 2/3% (.667) of the amount on line 3 4.

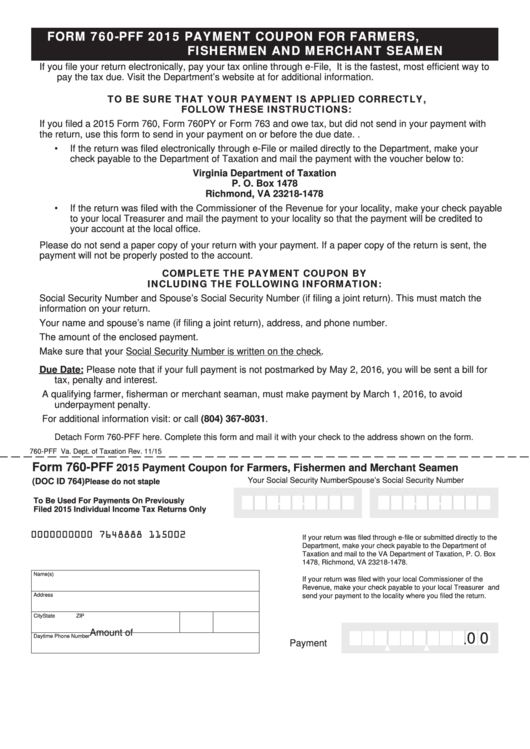

Top 22 Virginia Form 760 Templates free to download in PDF format

Web fiscal year filers should refer to virginia form 760es and the instructions to determine their installment due dates. Web free printable 2022 virginia form 760 and 2022 virginia form 760 instructions. Web find forms & instructions by category. Web 2022 form 760 resident individual income tax booklet uplease file electronically!u filing on paper means waiting longer for your refund..

Virginia Tax Instructions Form Fill Out and Sign Printable PDF

Corporation and pass through entity tax. Here are 6 advantages of filing electronically: Web enter the amount of your 2022 virginia income tax liability after the spouse tax adjustment and tax credits. Web 2022 form 760 resident individual income tax booklet uplease file electronically!u filing on paper means waiting longer for your refund. Virginia fiduciary income tax return instructions 760es:

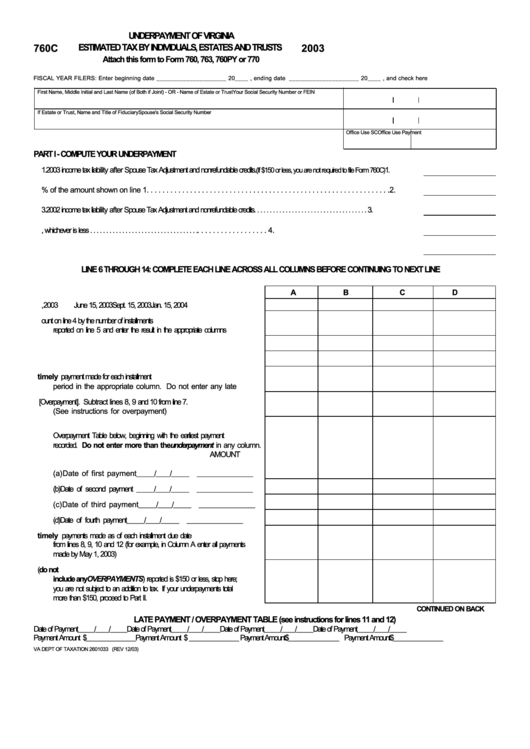

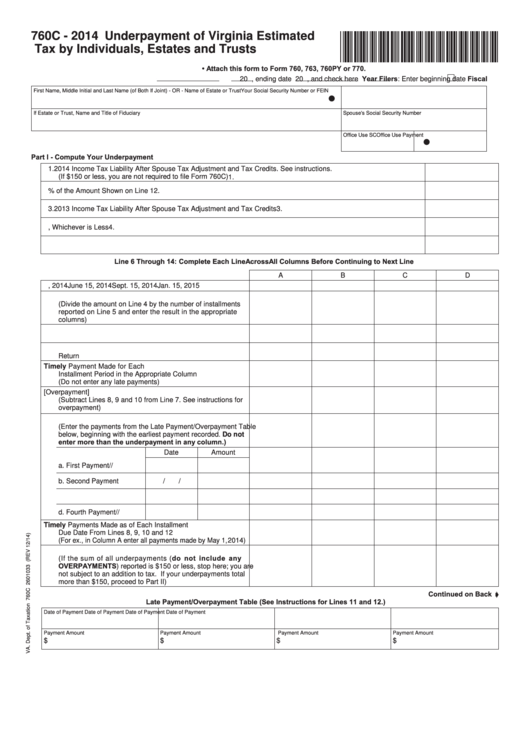

Form 760c Underpayment Of Virginia Estimated Tax By Individuals

If your tax is underpaid as of any installment due date, you must file form 760c. Web find forms & instructions by category. Web fiscal year filers should refer to virginia form 760es and the instructions to determine their installment due dates. Web free printable 2022 virginia form 760 and 2022 virginia form 760 instructions. Since underpayments are determined as.

VA 760 Instructions 20212022 Fill and Sign Printable Template Online

Enter 66 2/3% (.667) of the amount on line 3 4. Web find forms & instructions by category. (if $150 or less, you are not required to file form 760f) 3. Here are 6 advantages of filing electronically: Web home | virginia tax

Top 22 Virginia Form 760 Templates free to download in PDF format

Corporation and pass through entity tax. If your tax is underpaid as of any installment due date, you must file form 760c. Since underpayments are determined as of each installment due date, Web we last updated the resident individual income tax return in january 2023, so this is the latest. The form must be filed even if you are due.

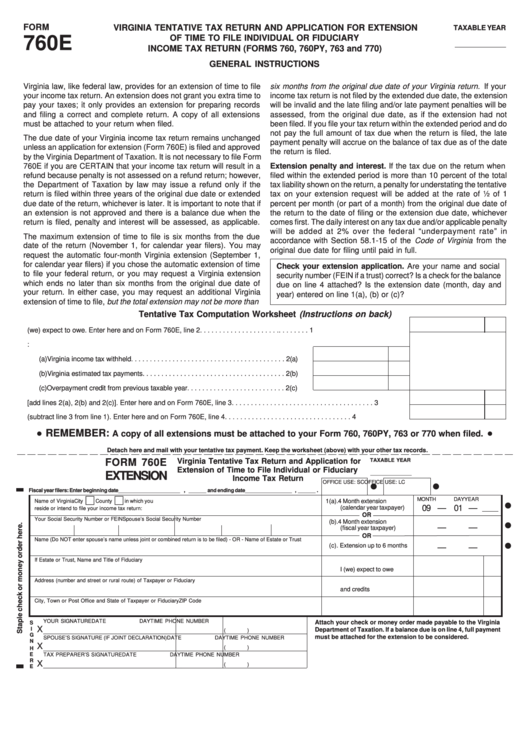

Form 760e Virginia Tentative Tax Return And Application For Extension

Corporation and pass through entity tax. Enter 66 2/3% (.667) of the amount on line 3 4. Web 2022 form 760 resident individual income tax booklet uplease file electronically!u filing on paper means waiting longer for your refund. Virginia form 760 *va0760122888* resident income tax return. Here are 6 advantages of filing electronically:

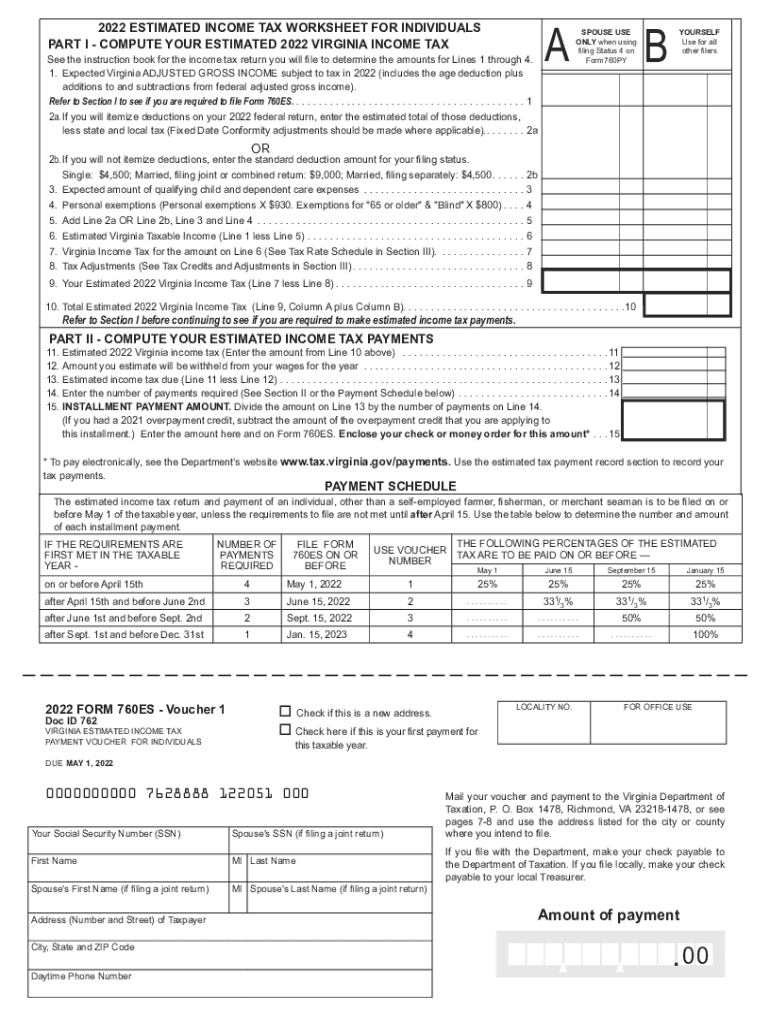

2022 Form VA DoT 760ES Fill Online, Printable, Fillable, Blank pdfFiller

Here are 6 advantages of filing electronically: Web home | virginia tax Web find forms & instructions by category. (if $150 or less, you are not required to file form 760f) 3. Virginia form 760 *va0760122888* resident income tax return.

Fillable Form 760c Underpayment Of Virginia Estimated Tax By

Virginia fiduciary income tax return instructions 760es: Corporation and pass through entity tax. Web 2022 form 760 resident individual income tax booklet uplease file electronically!u filing on paper means waiting longer for your refund. Here are 6 advantages of filing electronically: Web home | virginia tax

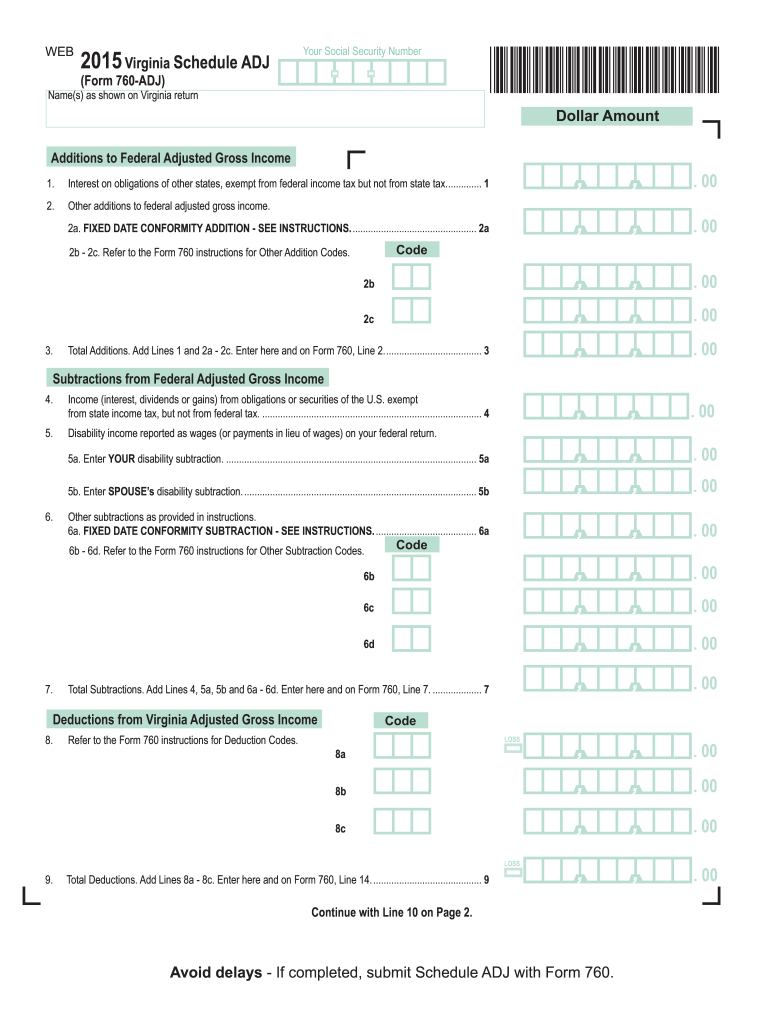

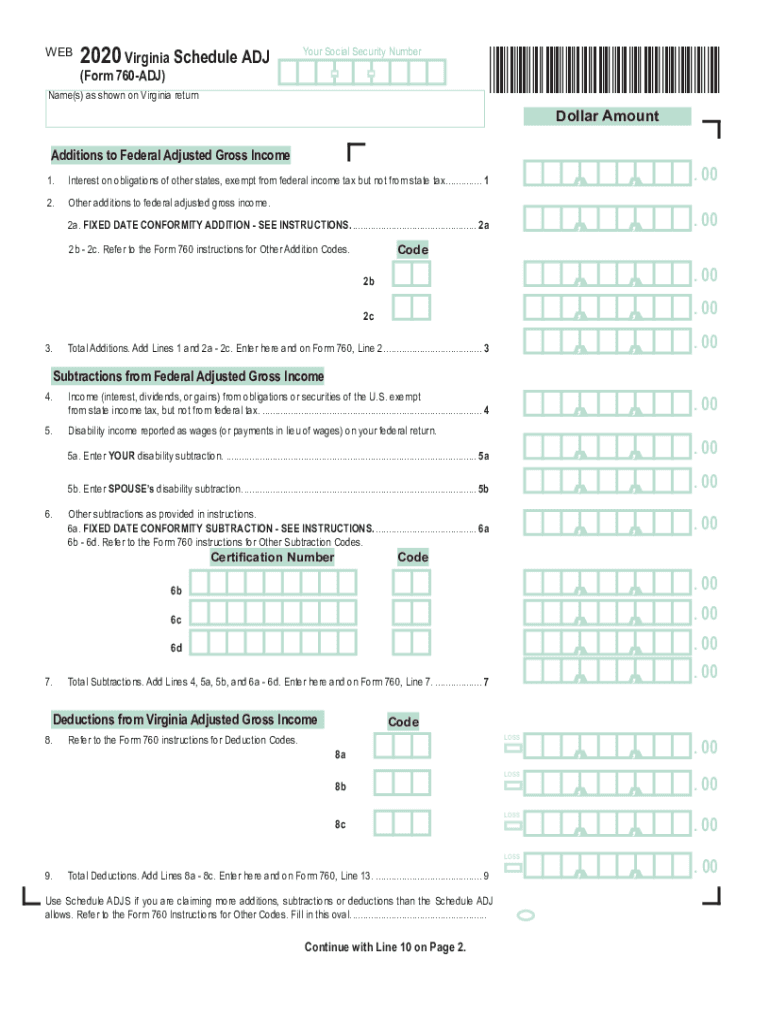

2015 Form VA 760ADJ Fill Online, Printable, Fillable, Blank pdfFiller

Web 2022 form 760 resident individual income tax booklet uplease file electronically!u filing on paper means waiting longer for your refund. Web fiscal year filers should refer to virginia form 760es and the instructions to determine their installment due dates. Here are 6 advantages of filing electronically: Web free printable 2022 virginia form 760 and 2022 virginia form 760 instructions..

Va760 Form Fill Out and Sign Printable PDF Template signNow

If your tax is underpaid as of any installment due date, you must file form 760c. Enter 66 2/3% (.667) of the amount on line 3 4. Virginia fiduciary income tax return instructions 760es: The form must be filed even if you are due a refund when you file your tax return. Virginia form 760 *va0760122888* resident income tax return.

(If $150 Or Less, You Are Not Required To File Form 760F) 3.

Web 2022 form 760 resident individual income tax booklet uplease file electronically!u filing on paper means waiting longer for your refund. Web find forms & instructions by category. Web free printable 2022 virginia form 760 and 2022 virginia form 760 instructions. Since underpayments are determined as of each installment due date,

Corporation And Pass Through Entity Tax.

If your tax is underpaid as of any installment due date, you must file form 760c. Web this booklet includes instructions for filling out and filing your form 760 income tax return. Virginia form 760 *va0760122888* resident income tax return. Web home | virginia tax

Web Fiscal Year Filers Should Refer To Virginia Form 760Es And The Instructions To Determine Their Installment Due Dates.

Here are 6 advantages of filing electronically: Enter 66 2/3% (.667) of the amount on line 3 4. Web we last updated the resident individual income tax return in january 2023, so this is the latest. Web enter the amount of your 2022 virginia income tax liability after the spouse tax adjustment and tax credits.

Virginia Fiduciary Income Tax Return Instructions 760Es:

The form must be filed even if you are due a refund when you file your tax return.