Virginia Estimated Tax Form

Virginia Estimated Tax Form - Web form 760es is used by individuals to make estimated income tax payments. Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax. Web spouse adjustment tax calculator; Web this report will show the difference between the amount of tax the corporation would pay if it filed as part of a unitary combined group and the amount of tax based on how they currently file. To receive the status of your filed income tax refund, enter your social security number and the expected refund amount (to the nearest dollar) for the tax year you select on this refund status form. (c) you are married, filing separately, and your separate expected virginia adjusted gross income (line 1, estimated income tax worksheet on page 3) is less than $11,950; Web this includes all payments for estimated taxes, extensions of time to file, and any other amounts due when a return is filed. Both the irs and state taxing authorities require you pay your taxes throughout the year. Request a copy of a tax return; Web virginia state income tax form 760 must be postmarked by may 1, 2023 in order to avoid penalties and late fees.

Web 2021 virginia form 760 *va0760121888* resident income tax return 2601031 file by may 1, 2022 — use black ink rev. Estimated income tax payments must be made in full on or before may 1, 2020, or in equal installments on or before may 1, 2020, june 15, 2020, september 15, 2020, and january 15, 2021. Estates, trusts, and the deceased. Virginia state income tax forms for tax year 2022 (jan. An authorized person is an individual who is accessing their own. 07/21 your first name m.i. Web virginia state income tax form 760 must be postmarked by may 1, 2023 in order to avoid penalties and late fees. If you are required to make estimated income tax payments, but do not, you may be liable for an additional charge, which is explained in section viii. You must file this form with your employer when your employment begins. Web form 760es is used by individuals to make estimated income tax payments.

Insurance premiums license tax estimated payment vouchers file online: Filing is required only for individuals whose income and net tax due exceed the amounts specified in section i. The virginia income tax rate for tax year 2022 is progressive from a low of 2% to a high of. (c) you are married, filing separately, and your separate expected virginia adjusted gross income (line 1, estimated income tax worksheet on page 3) is less than $11,950; Web this includes all payments for estimated taxes, extensions of time to file, and any other amounts due when a return is filed. 1st quarter (q1) 2nd quarter (q2) 3rd quarter (q3) 4th quarter (q4) demographics your social security number (ssn) first name mi last name spouse's ssn (if filing a joint return) first name mi last name address city state zip change of. Web form 760es is used by individuals to make estimated income tax payments. Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax. Web virginia state income tax form 760 must be postmarked by may 1, 2023 in order to avoid penalties and late fees. Web taxformfinder provides printable pdf copies of 136 current virginia income tax forms.

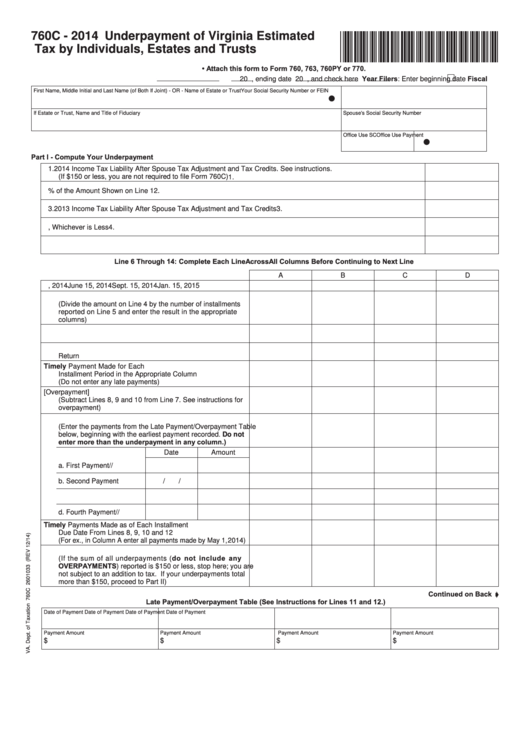

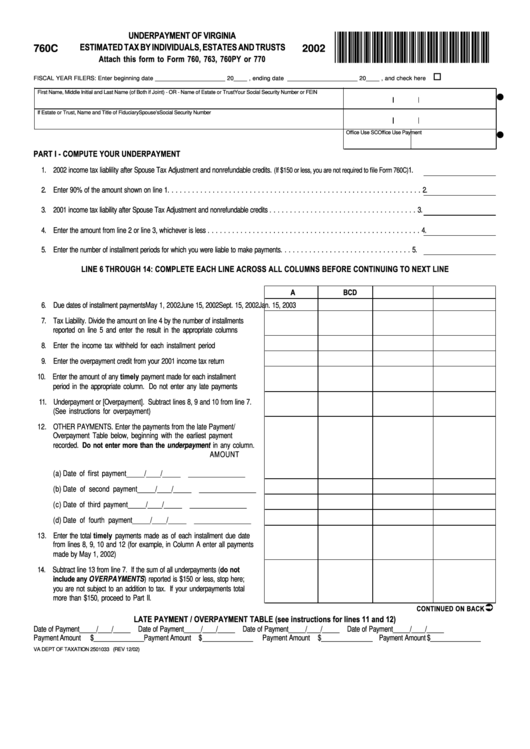

Fillable Form 760c Underpayment Of Virginia Estimated Tax By

Details on how to only prepare and print a virginia 2022 tax return. The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Virginia department of taxation, p.o. Estimated income tax payments must be made in full on or before may 1, 2020, or in equal installments on or before.

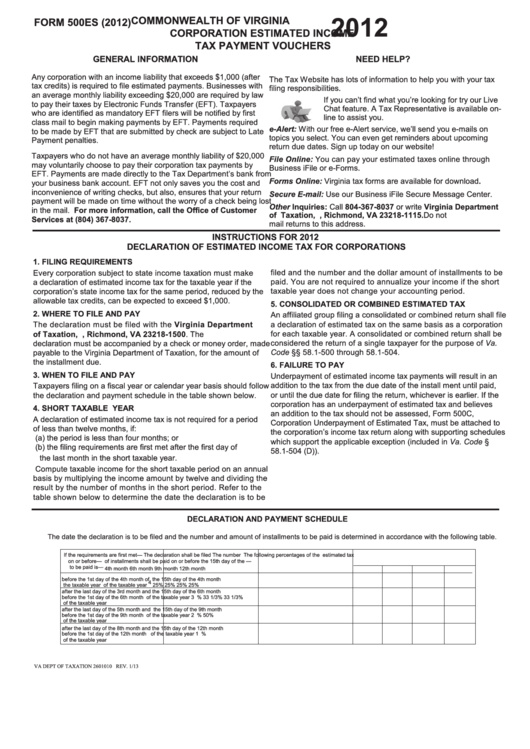

Form 500es Commonwealth Of Virginia Corporation Estimated Tax

07/21 your first name m.i. This commonwealth of virginia system belongs to the department of taxation (virginia tax) and is intended for use by authorized persons to interact with virginia tax in order to submit and retrieve confidential tax information. Web 2021 virginia form 760 *va0760121888* resident income tax return 2601031 file by may 1, 2022 — use black ink.

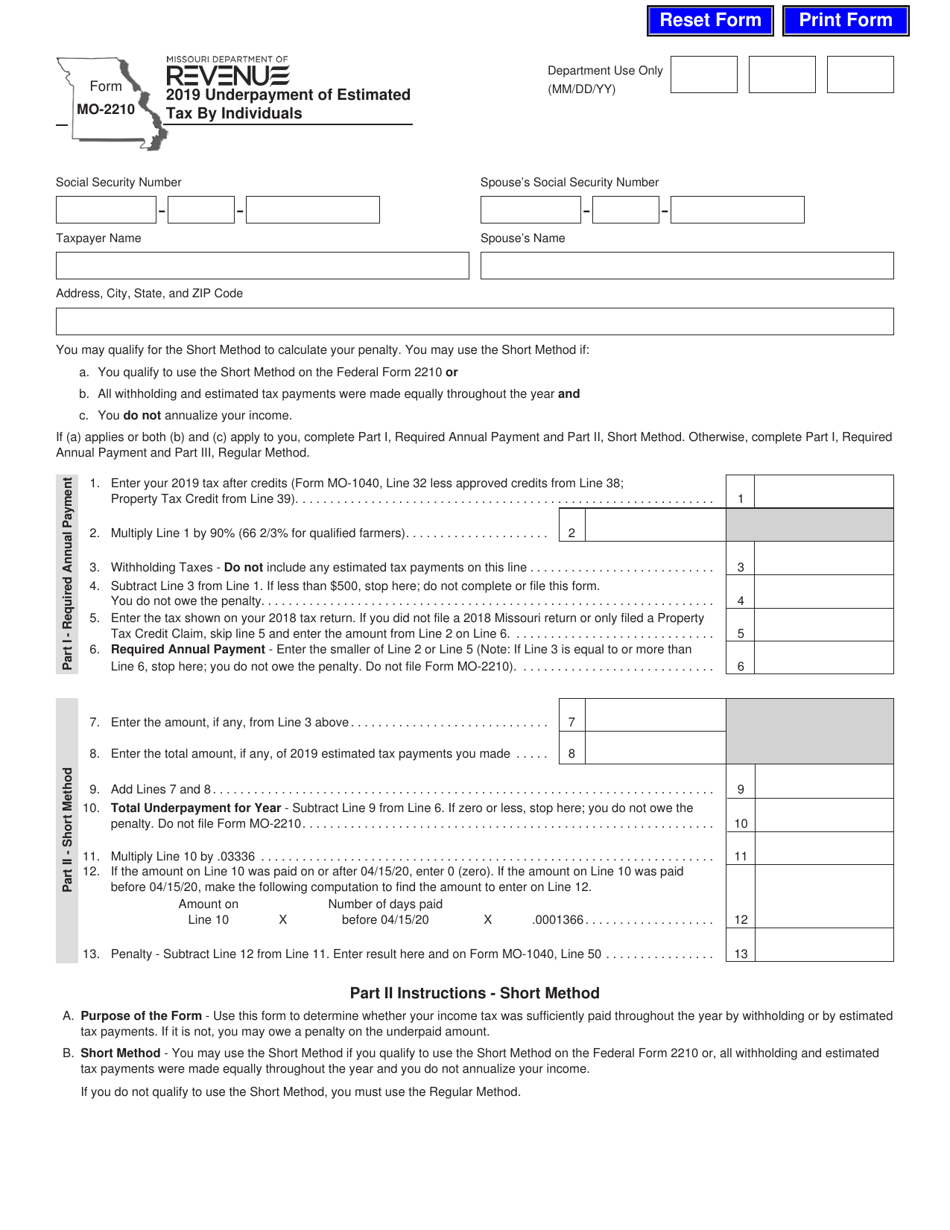

Penalty For Underpayment Of Estimated Tax Virginia TAXIRIN

Web tax due returns: Web when to file make estimated payments online or file form 760es payment voucher 1 by may 1, 2020. Web taxformfinder provides printable pdf copies of 136 current virginia income tax forms. Estates, trusts, and the deceased. Individual income tax forms (37) corporate income tax forms (85) other forms (15)

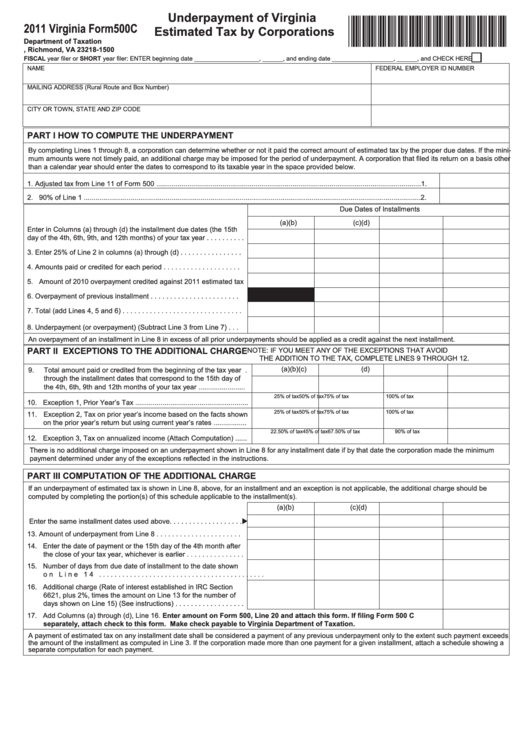

Virginia Form 500c Underpayment Of Virginia Estimated Tax By

The virginia income tax rate for tax year 2022 is progressive from a low of 2% to a high of. Web spouse adjustment tax calculator; Voucher number estimated tax for the year amount of this payment payment sign & confirm While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is.

Form 760c Underpayment Of Virginia Estimated Tax By Individuals

You must file this form with your employer when your employment begins. How do i know if i need to complete form 760c? Web forms and instructions for declaration of estimated income tax file online: Filing is required only for individuals whose income and net tax due exceed the amounts specified in section i. Web tax due returns:

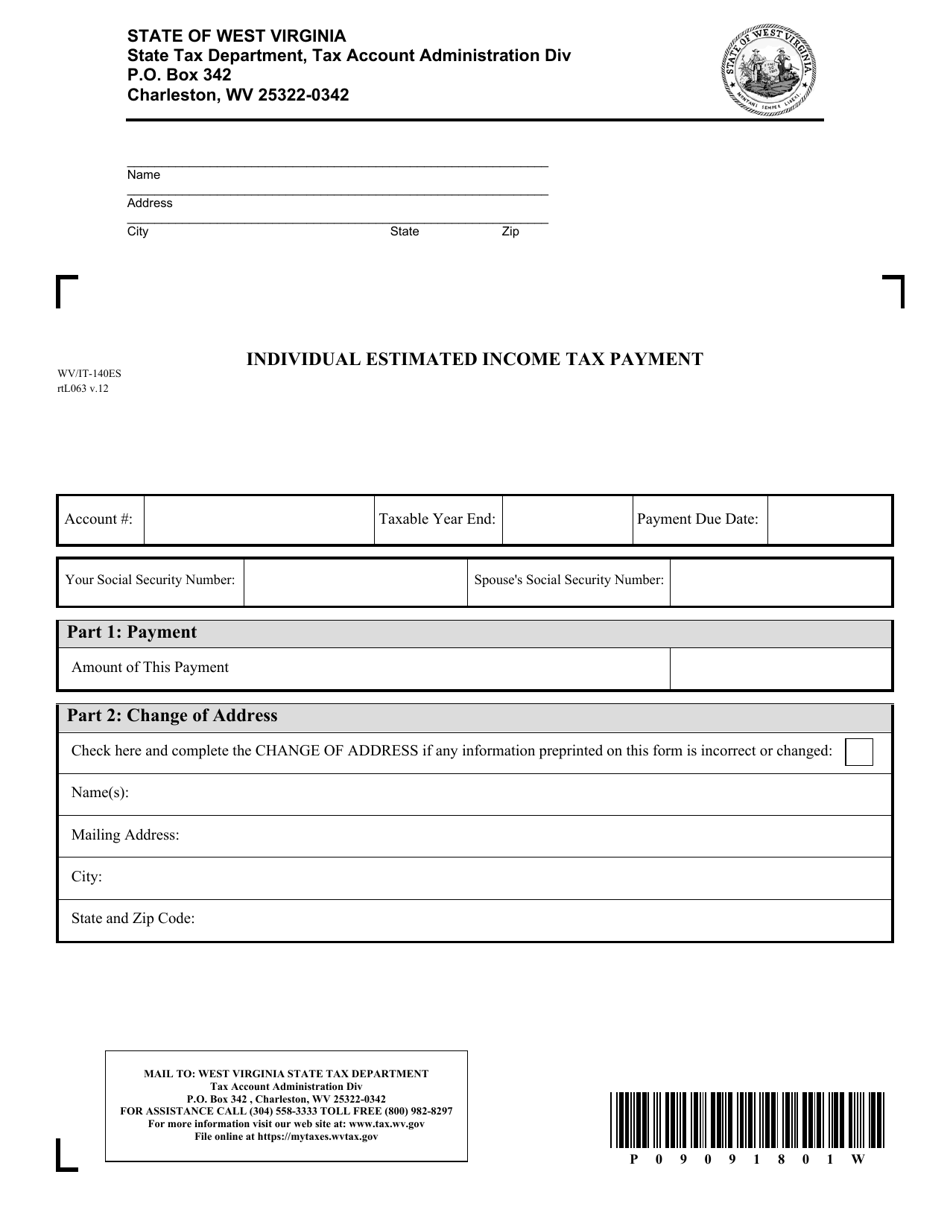

Form WV/IT140ES Fill Out, Sign Online and Download Printable PDF

Web this includes all payments for estimated taxes, extensions of time to file, and any other amounts due when a return is filed. Filing is required only for individuals whose income and net tax due exceed the amounts specified in section i. 1st quarter (q1) 2nd quarter (q2) 3rd quarter (q3) 4th quarter (q4) demographics your social security number (ssn).

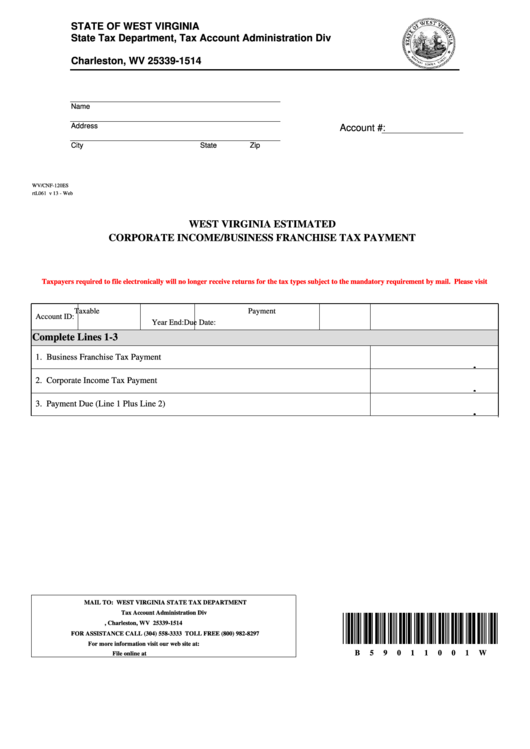

Fillable Form Wv/cnf120es West Virginia Estimated Corporate

Last name including suffix spouse’s first name (joint returns only)m.i. Estimated income tax payments must be made in full on or before may 1, 2020, or in equal installments on or before may 1, 2020, june 15, 2020, september 15, 2020, and january 15, 2021. Web 760es for taxable year for taxable year voucher numbers do not submit form 760es.

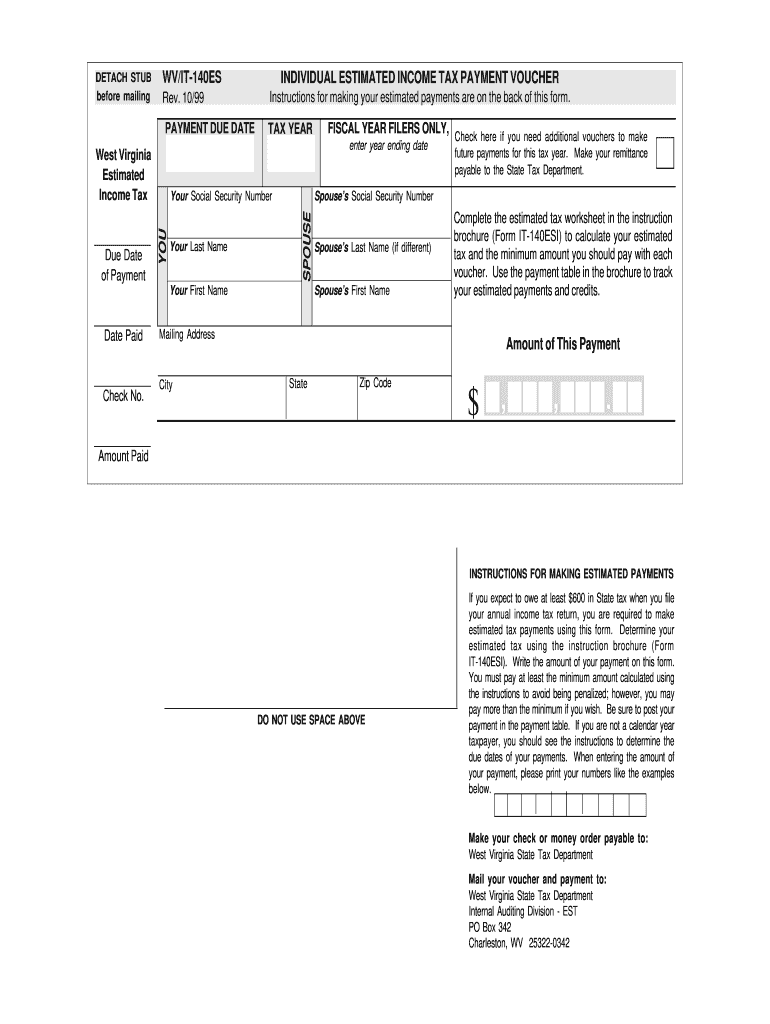

1999 Form WV DoR WV/IT140ES Fill Online, Printable, Fillable, Blank

You must file this form with your employer when your employment begins. The virginia income tax rate for tax year 2022 is progressive from a low of 2% to a high of. To receive the status of your filed income tax refund, enter your social security number and the expected refund amount (to the nearest dollar) for the tax year.

1040 Form 2021

File your state tax return. Web virginia state income tax form 760 must be postmarked by may 1, 2023 in order to avoid penalties and late fees. Estimated income tax payments must be made in full on or before may 1, 2020, or in equal installments on or before may 1, 2020, june 15, 2020, september 15, 2020, and january.

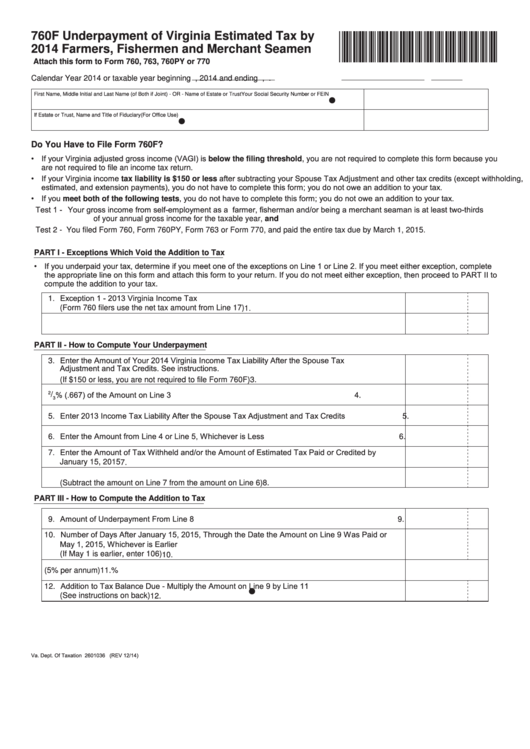

Fillable Form 760f Underpayment Of Virginia Estimated Tax By Farmers

Web form 760es is a virginia individual income tax form. Web this includes all payments for estimated taxes, extensions of time to file, and any other amounts due when a return is filed. How do i know if i need to complete form 760c? To receive the status of your filed income tax refund, enter your social security number and.

Web Virginia State Income Tax Form 760 Must Be Postmarked By May 1, 2023 In Order To Avoid Penalties And Late Fees.

Estates, trusts, and the deceased. Filing is required only for individuals whose income and net tax due exceed the amounts specified in section i. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web 760es for taxable year for taxable year voucher numbers do not submit form 760es if no amount is due.

Printable Virginia State Tax Forms For The 2022 Tax Year Will Be Based On Income Earned Between January 1, 2022 Through December 31, 2022.

Voucher number estimated tax for the year amount of this payment payment sign & confirm Web virginia tax individual online account application. Or (d) your expected estimated tax liability exceeds your withholding and tax credits by $150 or less. An authorized person is an individual who is accessing their own.

Power Of Attorney And Tax Information.

Both the irs and state taxing authorities require you pay your taxes throughout the year. This commonwealth of virginia system belongs to the department of taxation (virginia tax) and is intended for use by authorized persons to interact with virginia tax in order to submit and retrieve confidential tax information. Individual income tax forms (37) corporate income tax forms (85) other forms (15) Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax.

How Do I Know If I Need To Complete Form 760C?

Web spouse adjustment tax calculator; Web form 760es is used by individuals to make estimated income tax payments. You must pay at least 90% of your tax liability during the year by having income tax withheld and/or making timely payments of. Last name including suffix spouse’s first name (joint returns only)m.i.