Vanguard Rmd Form

Vanguard Rmd Form - Web but if you own a traditional ira, you must take your first required minimum distribution (rmd) by april 1 of the year following the year you reach rmd age. Web complete this form if you are the original account owner who needs to take a required minimum distribution (rmd). Make changes to an existing rmd payment schedule. If you’d like to know which tax. Brokerage assets are held by vanguard brokerage. Web forms & applications are you a client? Ad at vanguard we value you & your concerns about your financial future. You generally must start taking withdrawals. Add or maintain the required minimum distribution service. Personal advice from vanguard—built for all market conditions & personalized to you.

We want to be sure you get the item you're looking for, so if you're a client, please log on first. Web but if you own a traditional ira, you must take your first required minimum distribution (rmd) by april 1 of the year following the year you reach rmd age. Web required minimum distributions (rmds) annual withdrawals required by the irs from certain retirement accounts, beginning at age 73*. Here is a general list of the tax forms vanguard provides and the dates they’ll be available for the 2022 tax year. Web open an account forms & applications browse by topic search using title or keyword open a nonretirement account or establish margin/options trading open or transfer a. Your rmd is just the minimum amount you need to withdraw during the year. To request a prospectus for a non vanguard. Type of request (choose one option) request rmds from your employer plan. Rmds are intended to ensure that the. Web did you know that you can waive your 2020 required minimum distributions (rmds) as a result of the coronavirus aid, relief, and economic security (cares) act that was.

Ad at vanguard we value you & your concerns about your financial future. Select withdraw from ira to begin your distribution. Rmds are intended to ensure that the. To request a prospectus for a non vanguard. You generally must start taking withdrawals. Here is a general list of the tax forms vanguard provides and the dates they’ll be available for the 2022 tax year. Web vanguard tax form schedule. Add or maintain the required minimum distribution service. To request a prospectus for a non vanguard. Make changes to an existing rmd payment schedule.

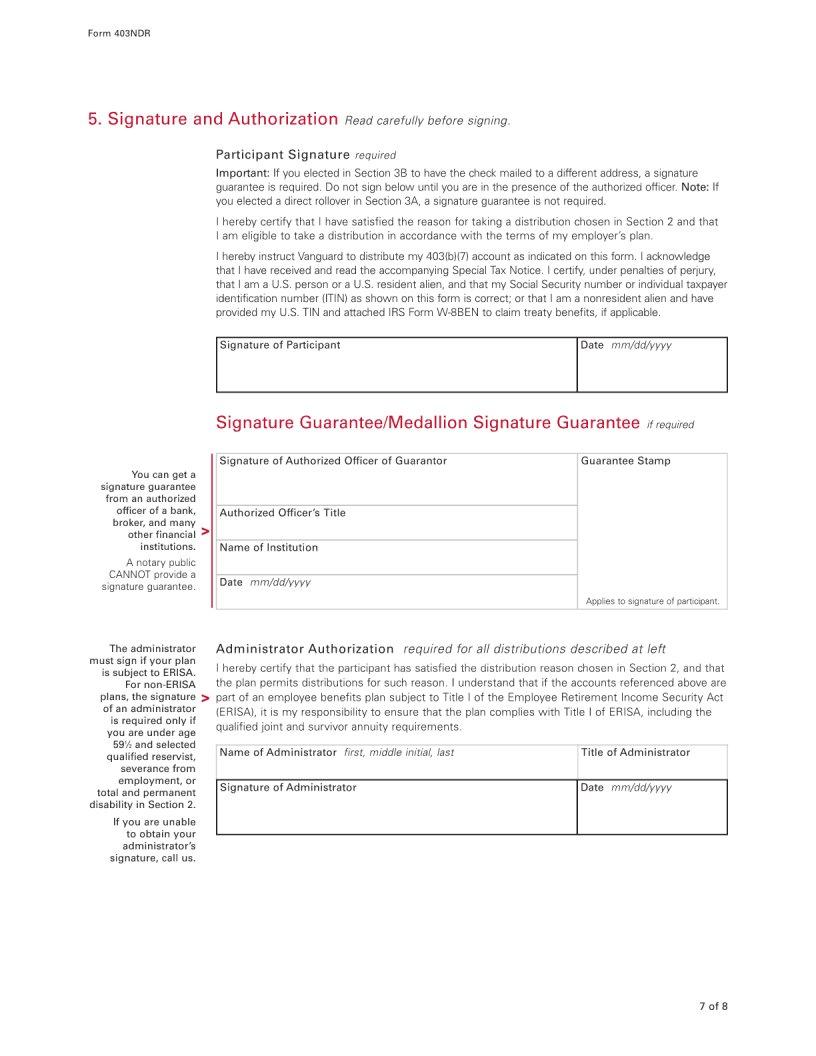

Vanguard 403 B Form ≡ Fill Out Printable PDF Forms Online

Ad at vanguard we value you & your concerns about your financial future. Web forms & applications are you a client? Personal advice from vanguard—built for all market conditions & personalized to you. Your rmd is just the minimum amount you need to withdraw during the year. Personal advice from vanguard—built for all market conditions & personalized to you.

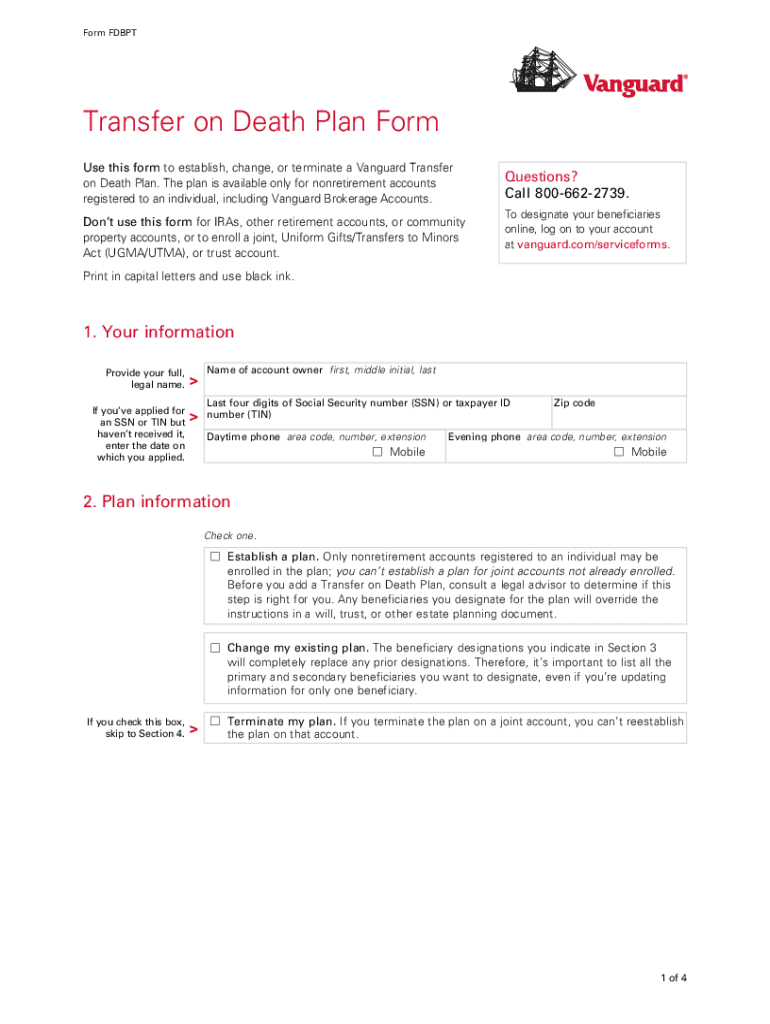

Vanguard Transfer On Death Form Pdf 20202022 Fill and Sign Printable

Web vanguard funds not held in a brokerage account are held by the vanguard group, inc., and are not protected by sipc. Web open an account forms & applications browse by topic search using title or keyword open a nonretirement account or establish margin/options trading open or transfer a. To request a prospectus for a non vanguard. Web did you.

Inherited ira rmd calculator vanguard GwynieraCairns

To request a prospectus for a non vanguard. Ad at vanguard we value you & your concerns about your financial future. Web learn more about the required minimum distribution (rmd) options available to you at vanguard. Web forms & applications are you a client? Web required minimum distributions (rmds) annual withdrawals required by the irs from certain retirement accounts, beginning.

Neat What Is Non Standard 1099r A Chronological Report About Tigers

Web rmds are required minimum distributions investors must take every year from their retirement savings accounts, including traditional iras and employer. Web did you know that you can waive your 2020 required minimum distributions (rmds) as a result of the coronavirus aid, relief, and economic security (cares) act that was. Personal advice from vanguard—built for all market conditions & personalized.

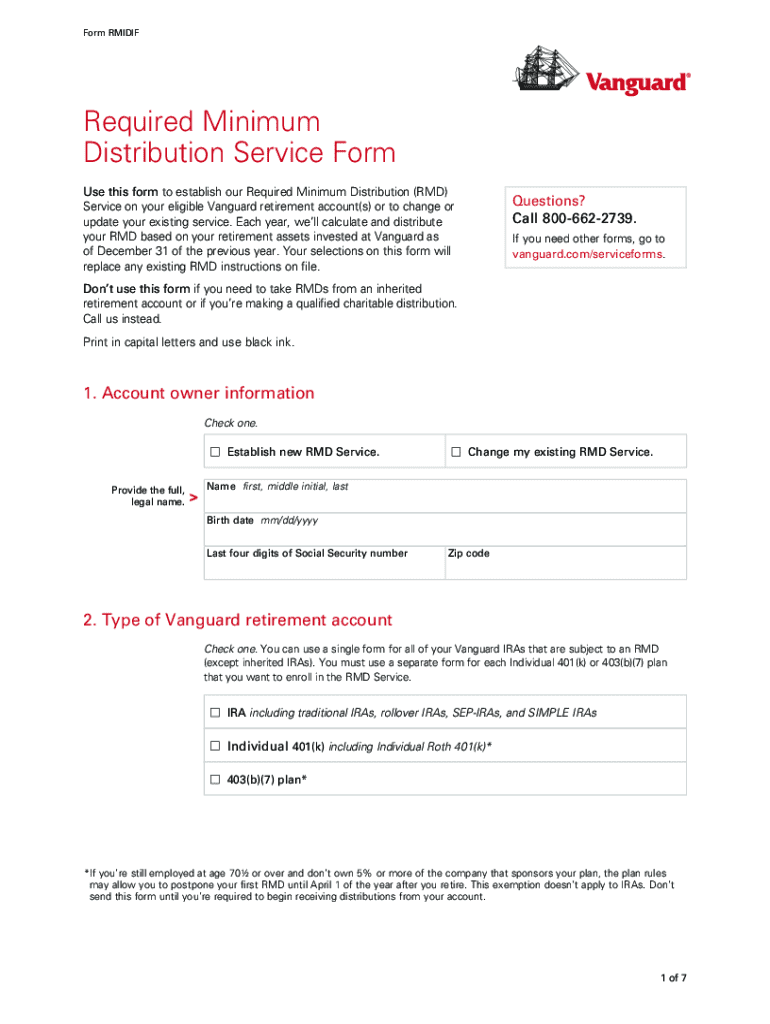

Vanguard required minimum distribution service form Fill out & sign

Step 2 on the sell vanguard funds page, select the ira you. Web forms & applications are you a client? Web forms & applications are you a client? If you complete this form, vanguard will. Here is a general list of the tax forms vanguard provides and the dates they’ll be available for the 2022 tax year.

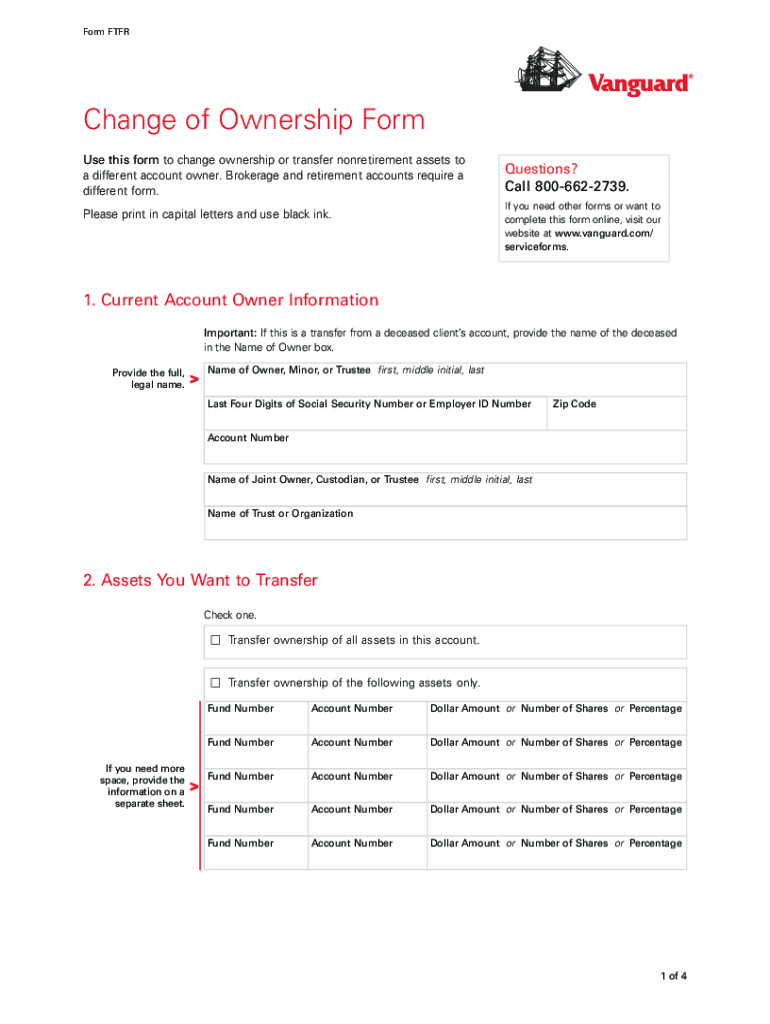

Vanguard Change Of Ownership Form 2020 Fill and Sign Printable

We want to be sure you get the item you're looking for, so if you're a client, please log on first. Brokerage assets are held by vanguard brokerage. Web but if you own a traditional ira, you must take your first required minimum distribution (rmd) by april 1 of the year following the year you reach rmd age. Type of.

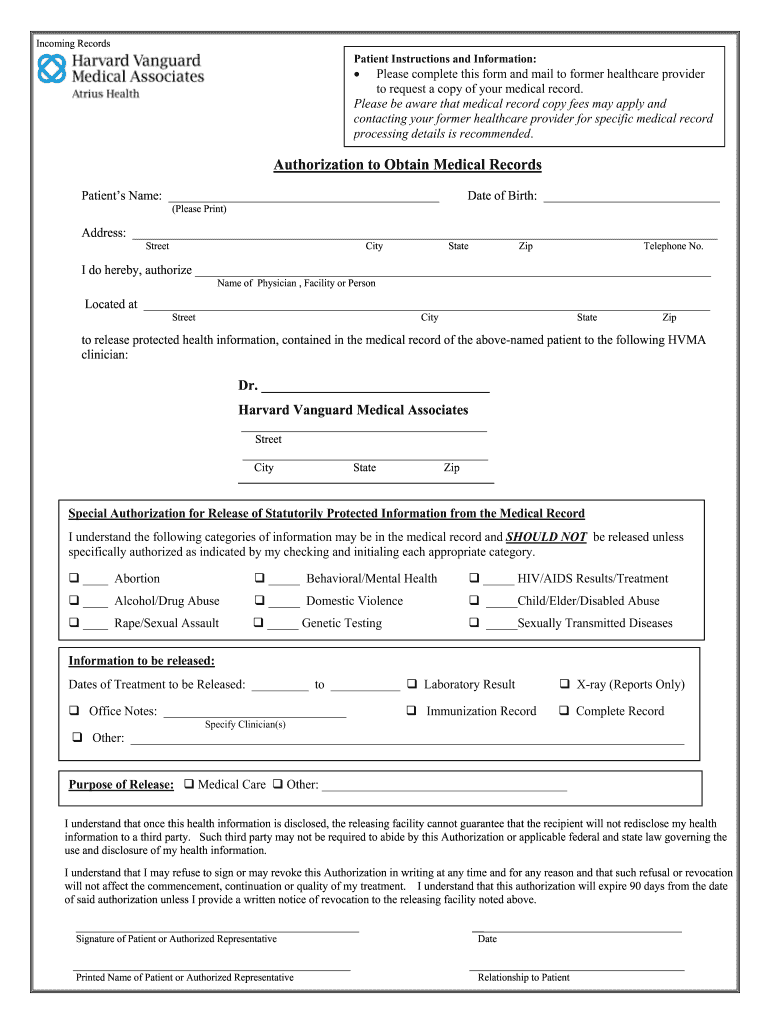

Harvard Vanguard Medical Records Fill Out and Sign Printable PDF

We want to be sure you get the item you're looking for, so if you're a client, please log on first. If you want to satisfy your required distribution by choosing. Your rmd is just the minimum amount you need to withdraw during the year. Add or maintain the required minimum distribution service. Web did you know that you can.

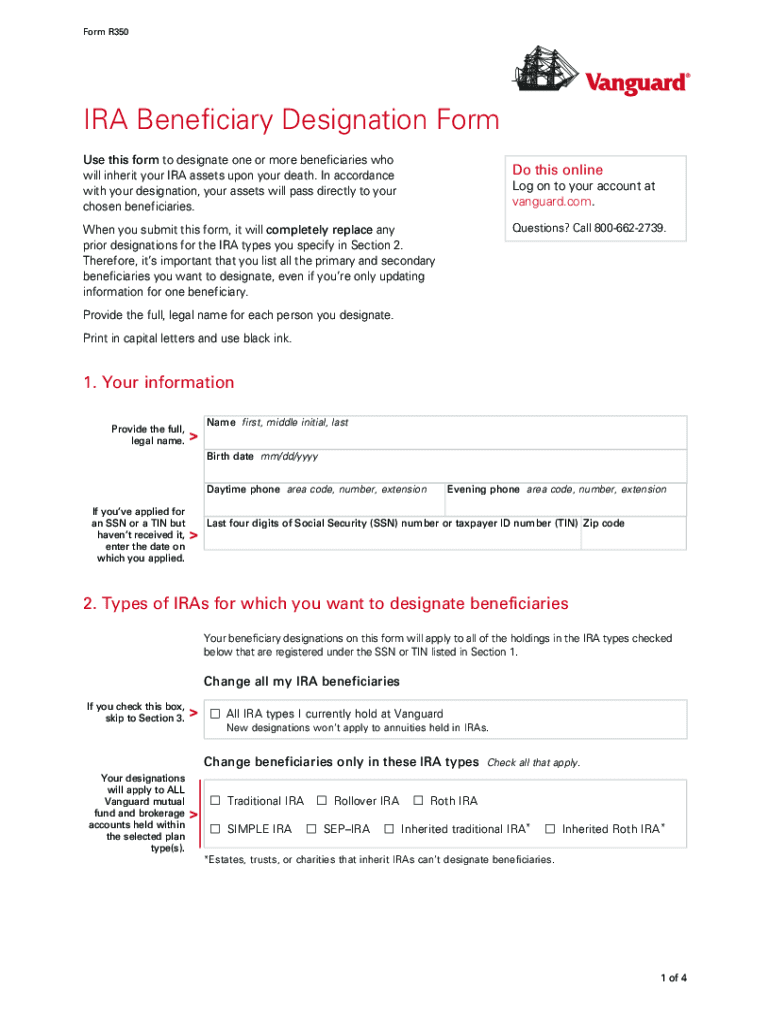

Vanguard Beneficiary Form Fill Out and Sign Printable PDF Template

To request a prospectus for a non vanguard. If you complete this form, vanguard will. Select withdraw from ira to begin your distribution. Personal advice from vanguard—built for all market conditions & personalized to you. Use this online process to maintain or establish our required minimum distribution service on your retirement.

Vanguard Archives Extreme Wheels

Add or maintain the required minimum distribution service. Web step 1 from the holdings tab, find the transact dropdown menu. Web learn more about the required minimum distribution (rmd) options available to you at vanguard. Web rmds are required minimum distributions investors must take every year from their retirement savings accounts, including traditional iras and employer. Web vanguard tax form.

Ira Rmd Table 2018 Review Home Decor

Ad at vanguard we value you & your concerns about your financial future. Brokerage assets are held by vanguard brokerage. Web rmds are required minimum distributions investors must take every year from their retirement savings accounts, including traditional iras and employer. We want to be sure you get the item you're looking for, so if you're a client, please log.

Web Services Rmd Calculation Vanguard Will Calculate Your Rmd Based On All Holdings In Your Eligible Retirement Plan Accounts, Excluding Any Nonpublicly Traded Securities, As Of The.

Make changes to an existing rmd payment schedule. Your rmd is just the minimum amount you need to withdraw during the year. Web did you know that you can waive your 2020 required minimum distributions (rmds) as a result of the coronavirus aid, relief, and economic security (cares) act that was. Brokerage assets are held by vanguard brokerage.

To Request A Prospectus For A Non Vanguard.

Type of request (choose one option) request rmds from your employer plan. Web open an account forms & applications browse by topic search using title or keyword open a nonretirement account or establish margin/options trading open or transfer a. Web rmds are required minimum distributions investors must take every year from their retirement savings accounts, including traditional iras and employer. Web required minimum distributions (rmds) are the minimum amounts you must withdraw from your retirement accounts each year.

Web Vanguard Tax Form Schedule.

Select withdraw from ira to begin your distribution. If you want to satisfy your required distribution by choosing. Personal advice from vanguard—built for all market conditions & personalized to you. Web vanguard funds not held in a brokerage account are held by the vanguard group, inc., and are not protected by sipc.

We Want To Be Sure You Get The Item You're Looking For, So If You're A Client, Please Log On First.

Here is a general list of the tax forms vanguard provides and the dates they’ll be available for the 2022 tax year. If you’d like to know which tax. Step 2 on the sell vanguard funds page, select the ira you. Web step 1 from the holdings tab, find the transact dropdown menu.