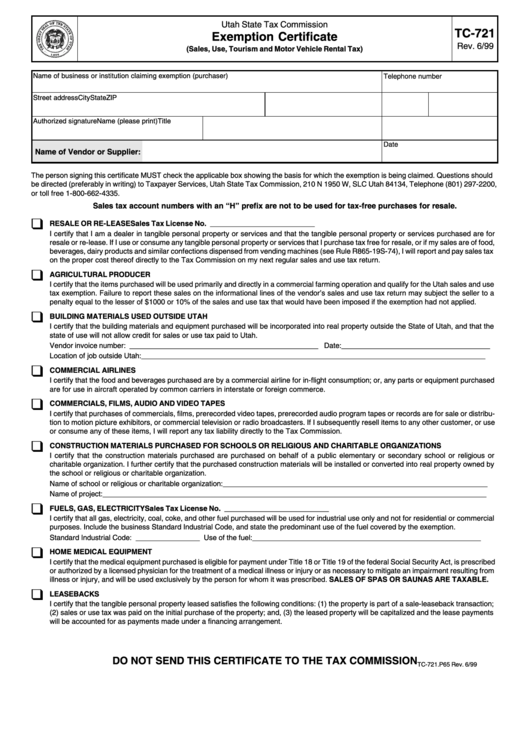

Utah State Withholding Form 2022

Utah State Withholding Form 2022 - Do not use the temporary account number provided at completion of the application. Web utah state tax commission withholding account id: Web how to file you may file your withholding electronically* through: Urs will not make retroactive adjustments. Web how to file and pay you may file your withholding returns online at tap.utah.gov *. Find an existing withholding account number: Bond requirements for utah you may have to post a bond of $25,000 to $500,000 if You can pay electronically* by: Web the old form will no longer be accepted after december 31, 2022. The revisions to the withholding tax tables reflect legislation enacted earlier this year that lowers the state's personal income tax rate.

They may charge a transaction fee. You can pay electronically* by: Web the old form will no longer be accepted after december 31, 2022. Web how to file and pay you may file your withholding returns online at tap.utah.gov *. Urs will not make retroactive adjustments. Utah fiduciary income tax return: Web withholding on behalf of nonresident partners, shareholders, or owners. Web utah state tax commission withholding account id: Utah fiduciary income tax instructions. Web how to file you may file your withholding electronically* through:

You can pay electronically* by: 99999999999 + wth (11 digits + wth) apply to receive a withholding account number within 2 weeks. Utah fiduciary income tax instructions. State of utah withholding to have state of utah taxes withheld, submit separate form(s). 2023 unaffiliated certificate of nomination. Urs will not make retroactive adjustments. Do not use the temporary account number provided at completion of the application. Web withholding on behalf of nonresident partners, shareholders, or owners. 2023 qualified political party declaration of candidacy. Bond requirements for utah you may have to post a bond of $25,000 to $500,000 if

Utah State Tax Withholding Form 2022

Find an existing withholding account number: The revisions to the withholding tax tables reflect legislation enacted earlier this year that lowers the state's personal income tax rate. 2023 qualified political party declaration of candidacy. You can pay electronically* by: Web the old form will no longer be accepted after december 31, 2022.

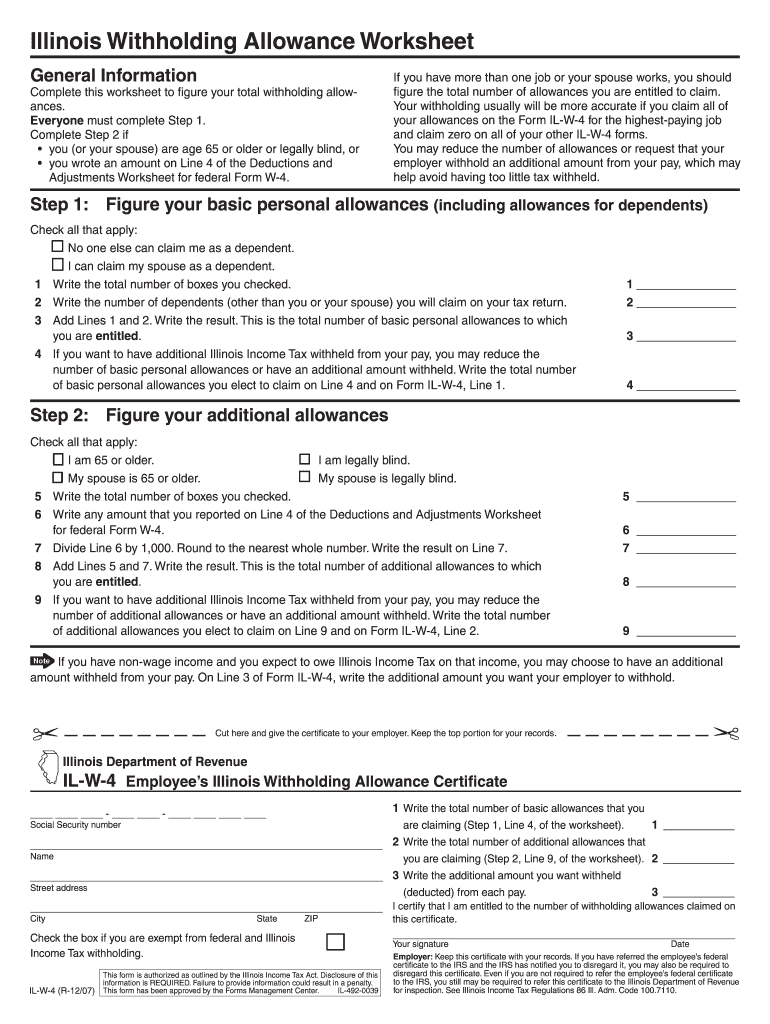

Utah Employee Withholding Tax Form 2023

Bond requirements for utah you may have to post a bond of $25,000 to $500,000 if 2023 qualified political party declaration of candidacy. Do not use the temporary account number provided at completion of the application. The revisions to the withholding tax tables reflect legislation enacted earlier this year that lowers the state's personal income tax rate. State of utah.

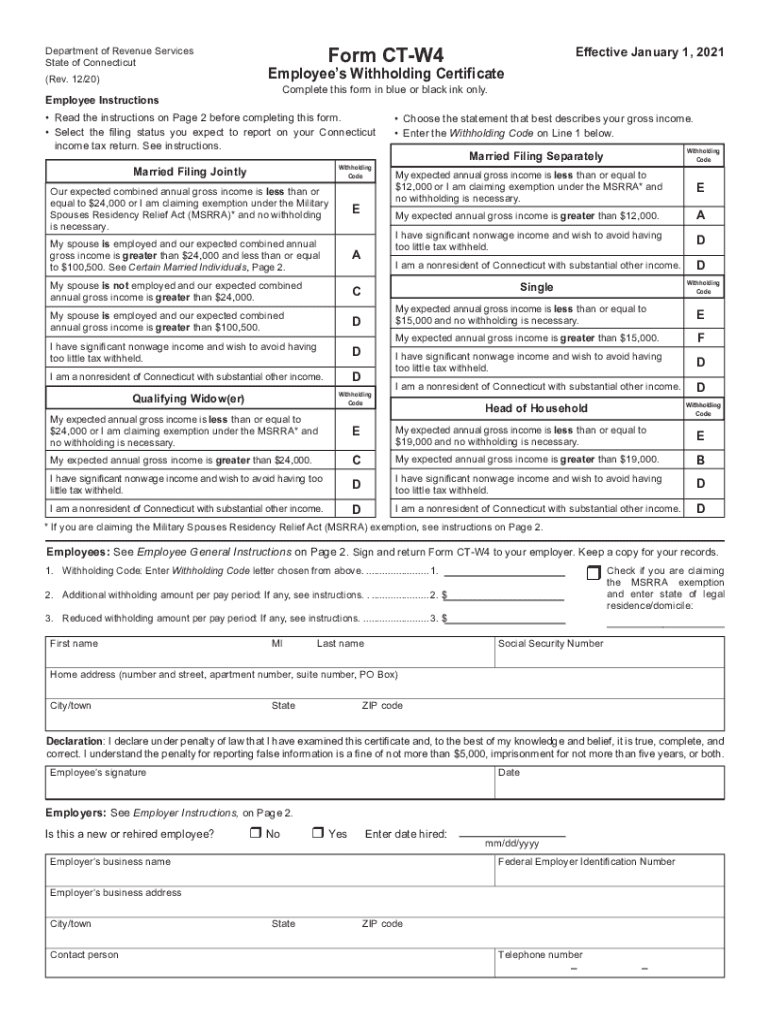

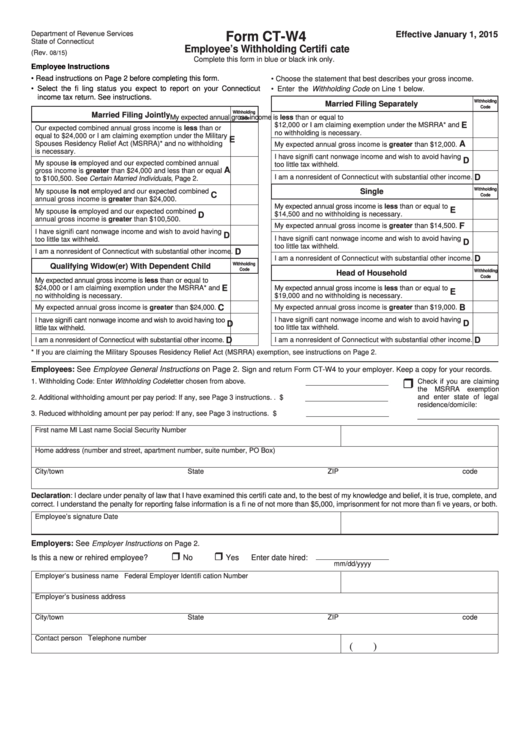

Ct W4 Fill Out and Sign Printable PDF Template signNow

They may charge a transaction fee. Web withholding on behalf of nonresident partners, shareholders, or owners. State of utah withholding to have state of utah taxes withheld, submit separate form(s). Web utah state tax commission withholding account id: Web the old form will no longer be accepted after december 31, 2022.

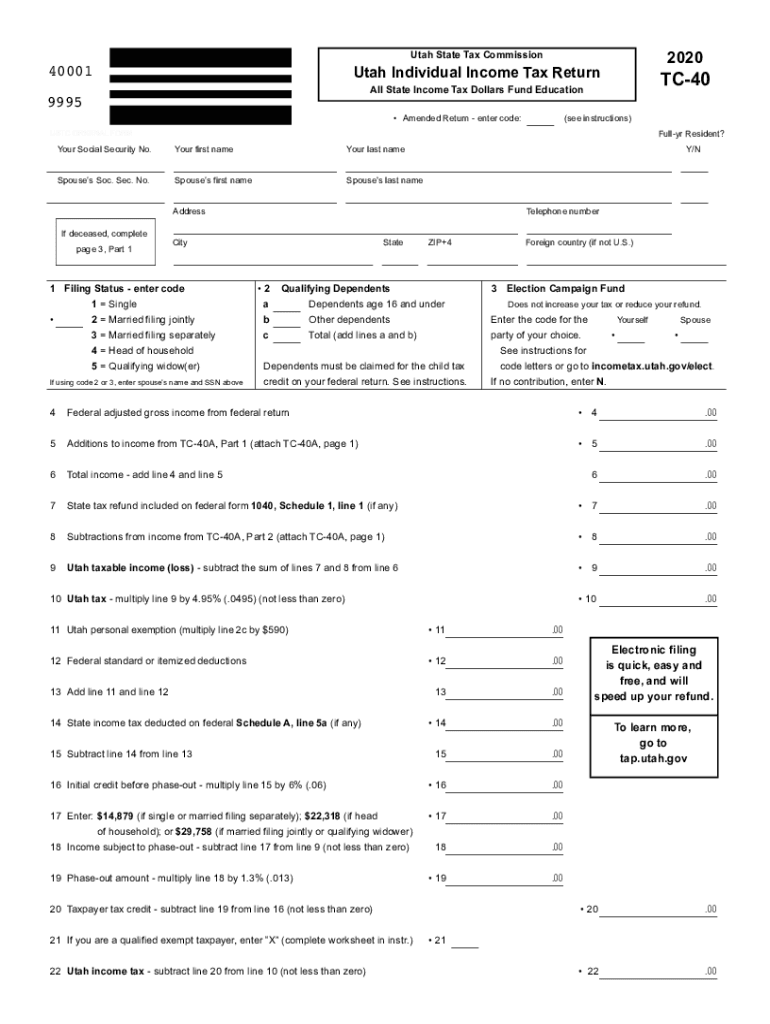

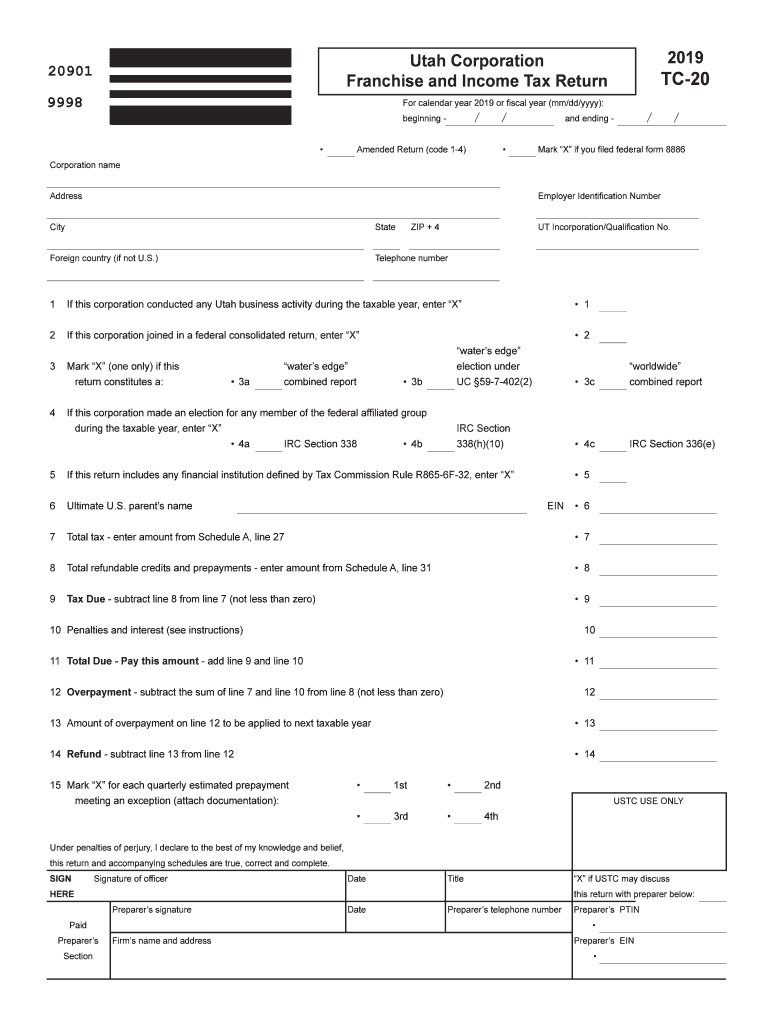

Utah 2015 individual tax return form Fill out & sign online DocHub

Web utah state tax commission withholding account id: Web withholding on behalf of nonresident partners, shareholders, or owners. 2023 qualified political party declaration of candidacy. Web the old form will no longer be accepted after december 31, 2022. Urs will not make retroactive adjustments.

Ct Withholding W4 W4 Form 2021

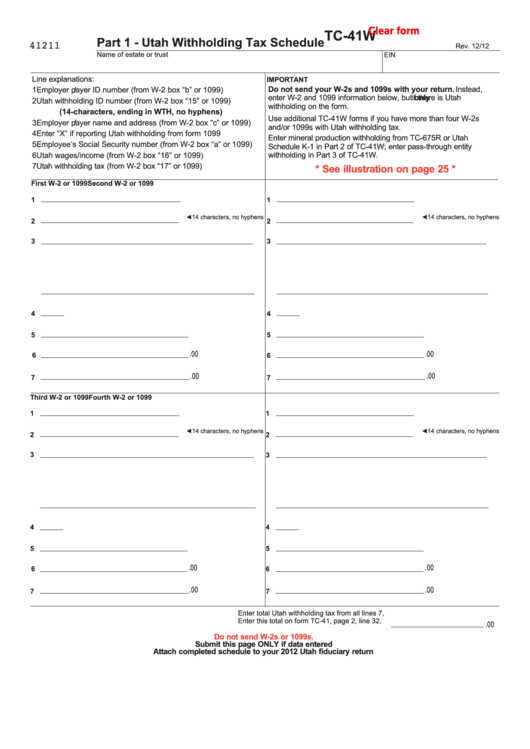

Web the old form will no longer be accepted after december 31, 2022. Web withholding on behalf of nonresident partners, shareholders, or owners. Web utah withholding tax schedule: Web utah state tax commission withholding account id: Urs will not make retroactive adjustments.

North Carolina Tax Withholding Form 2022

See balancing the reconciliation below. 99999999999 + wth (11 digits + wth) apply to receive a withholding account number within 2 weeks. Do not use the temporary account number provided at completion of the application. 2023 qualified political party declaration of candidacy. Web the utah tax commission has updated its withholding tax guide to reflect revised income tax withholding tables.

Utah State Employee Withholding Form 2022

Web how to file and pay you may file your withholding returns online at tap.utah.gov *. Web utah withholding tax schedule: Utah fiduciary income tax instructions. Bond requirements for utah you may have to post a bond of $25,000 to $500,000 if See balancing the reconciliation below.

Arkansas Employee Tax Withholding Form 2023

Web utah state tax commission withholding account id: Utah fiduciary income tax instructions. You can pay electronically* by: They may charge a transaction fee. The revisions to the withholding tax tables reflect legislation enacted earlier this year that lowers the state's personal income tax rate.

Vadrs Utah Form Fill Out and Sign Printable PDF Template signNow

Web withholding on behalf of nonresident partners, shareholders, or owners. Web utah withholding tax schedule: Urs will not make retroactive adjustments. See balancing the reconciliation below. Do not use the temporary account number provided at completion of the application.

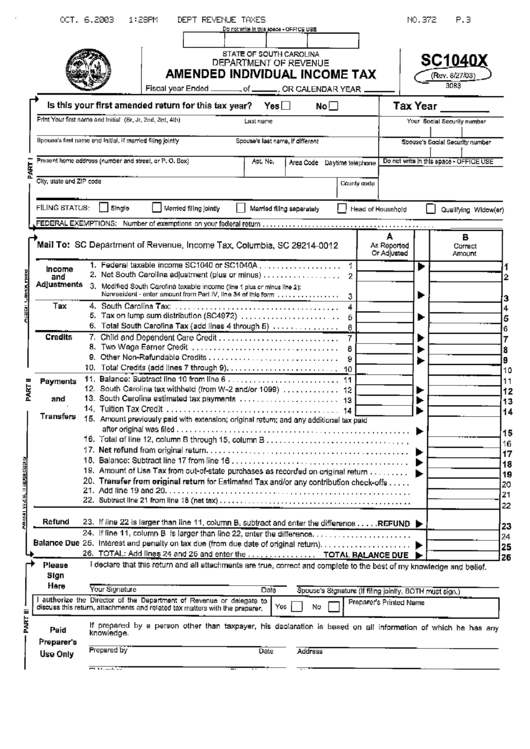

South Carolina Employee Withholding Form

Bond requirements for utah you may have to post a bond of $25,000 to $500,000 if Urs will not make retroactive adjustments. The revisions to the withholding tax tables reflect legislation enacted earlier this year that lowers the state's personal income tax rate. You can pay electronically* by: See balancing the reconciliation below.

The Revisions To The Withholding Tax Tables Reflect Legislation Enacted Earlier This Year That Lowers The State's Personal Income Tax Rate.

See balancing the reconciliation below. Do not use the temporary account number provided at completion of the application. 99999999999 + wth (11 digits + wth) apply to receive a withholding account number within 2 weeks. You can pay electronically* by:

Utah Fiduciary Income Tax Return:

Web how to file and pay you may file your withholding returns online at tap.utah.gov *. 2023 unaffiliated certificate of nomination. Web utah state tax commission withholding account id: Utah fiduciary income tax instructions.

Bond Requirements For Utah You May Have To Post A Bond Of $25,000 To $500,000 If

2023 qualified political party declaration of candidacy. You must include your fein and withholding account id number on each return. Find an existing withholding account number: They may charge a transaction fee.

Urs Will Not Make Retroactive Adjustments.

Web utah withholding tax schedule: Web how to file you may file your withholding electronically* through: Web the utah tax commission has updated its withholding tax guide to reflect revised income tax withholding tables that apply for payroll periods beginning on and after may 1, 2022. Web the old form will no longer be accepted after december 31, 2022.