Travel Expenses Form

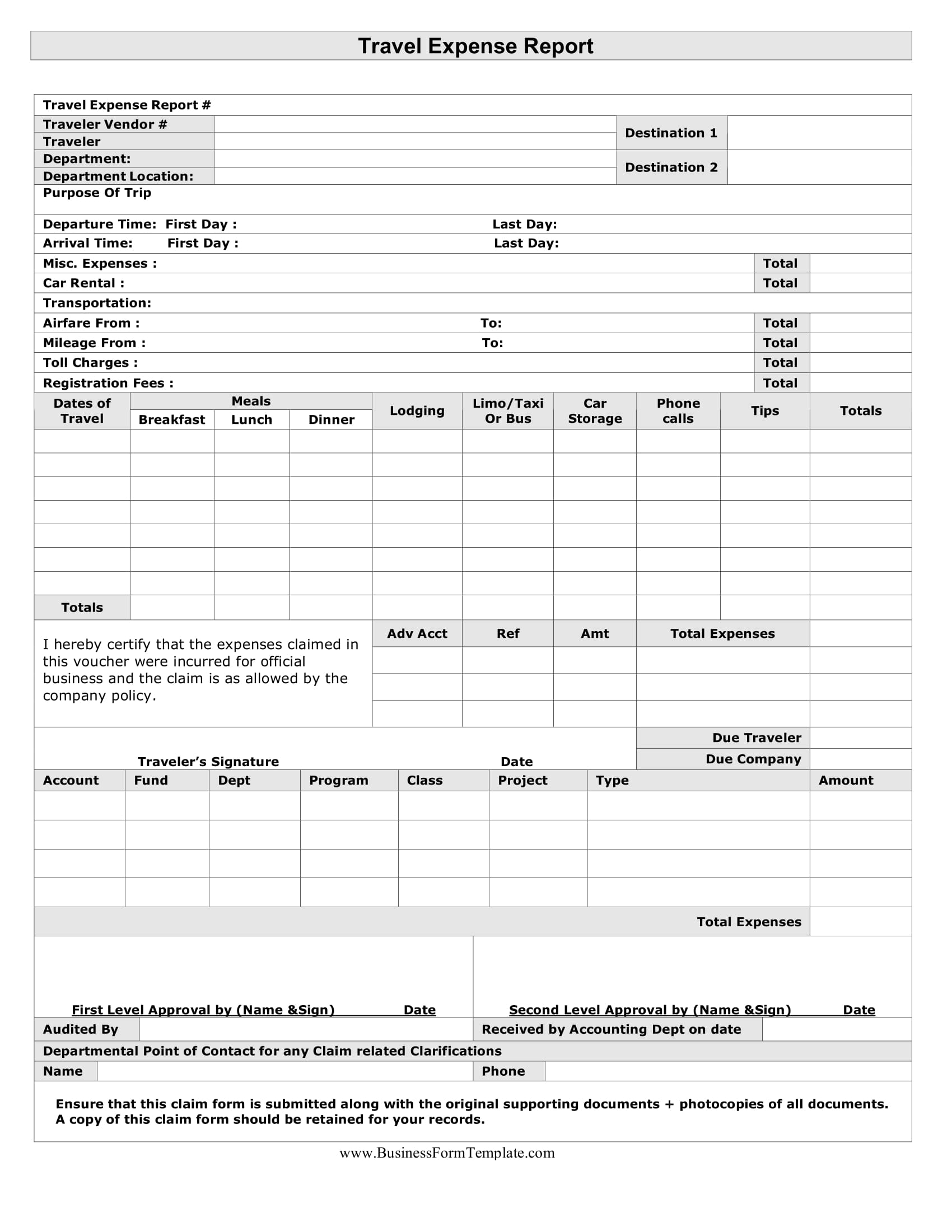

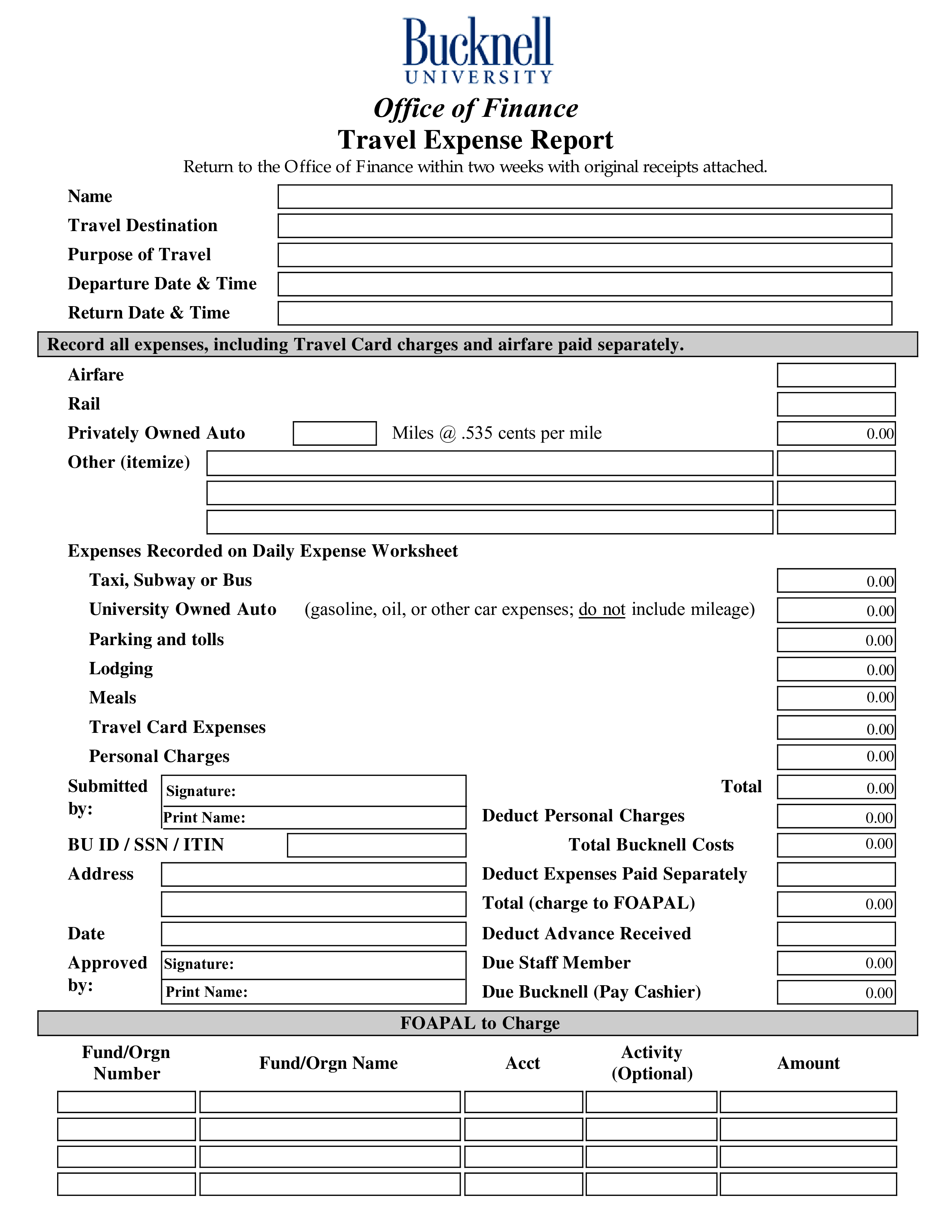

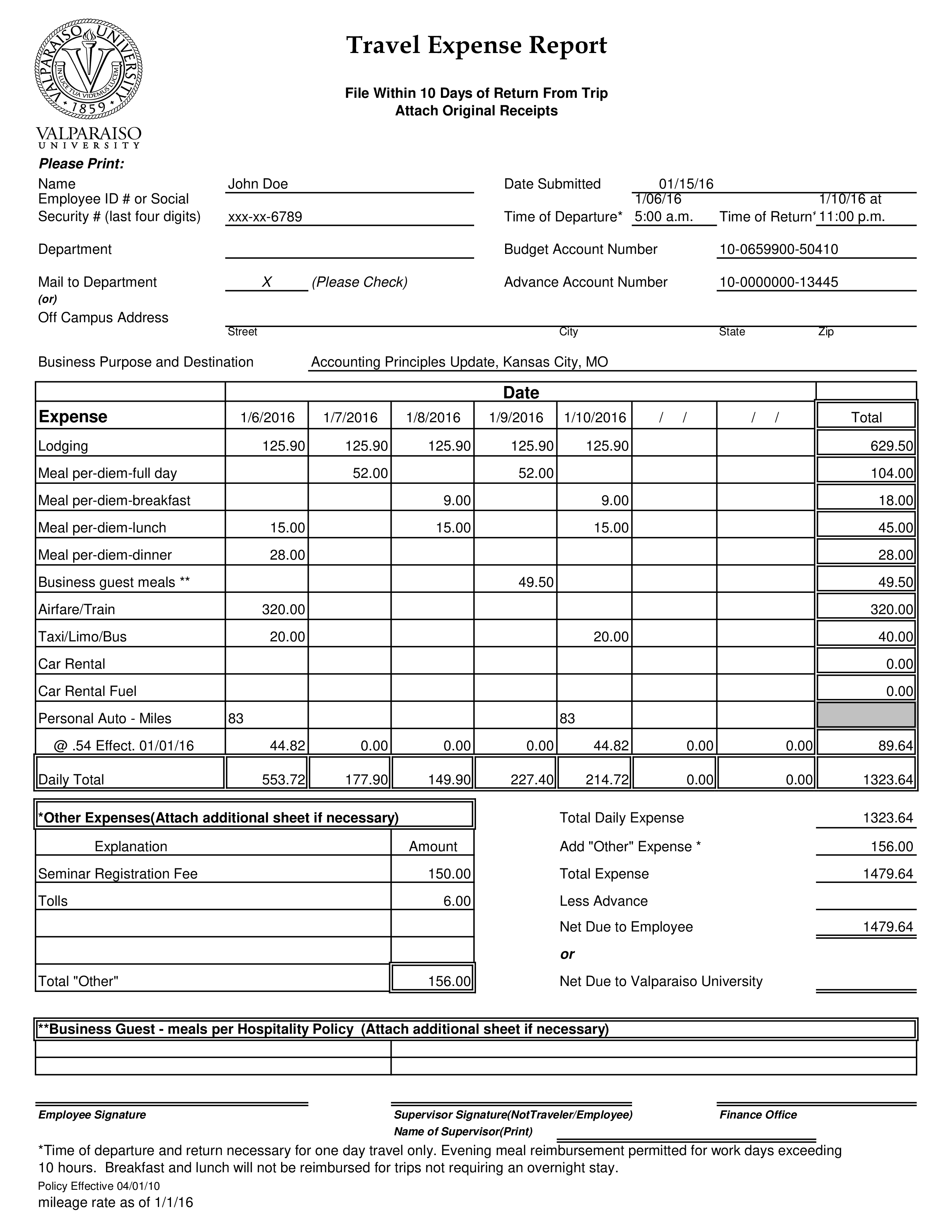

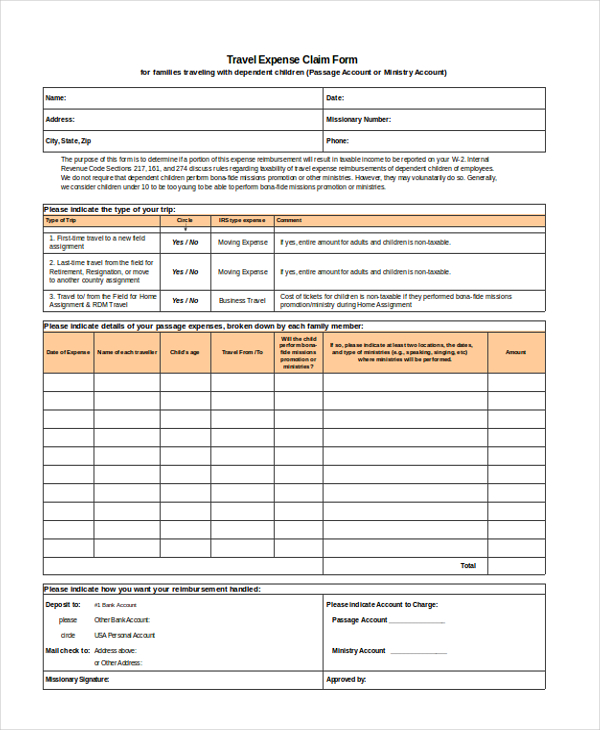

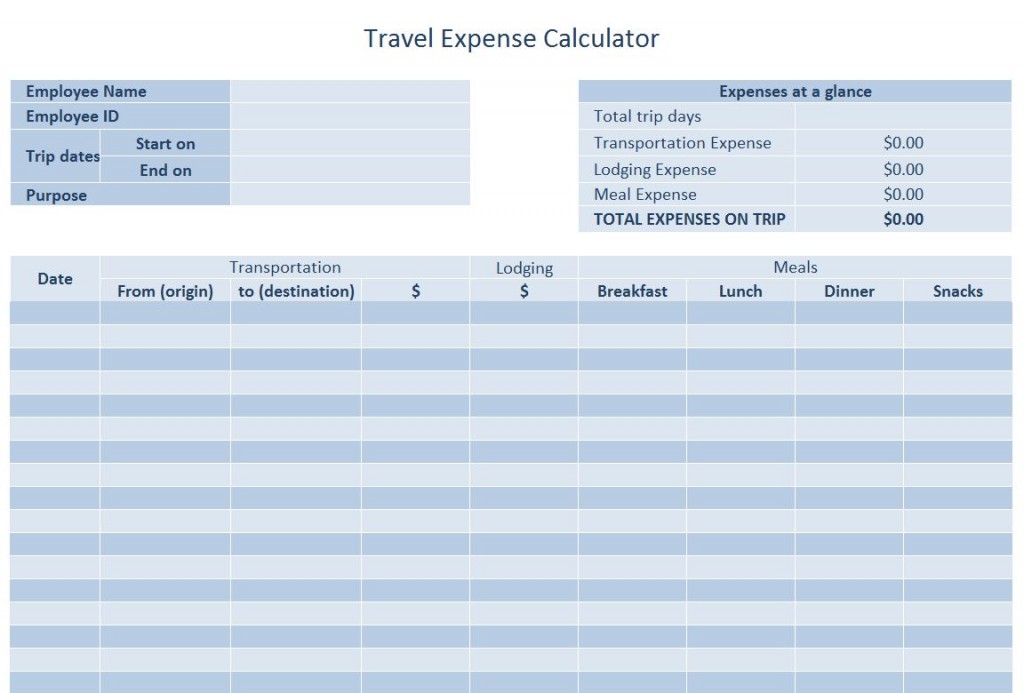

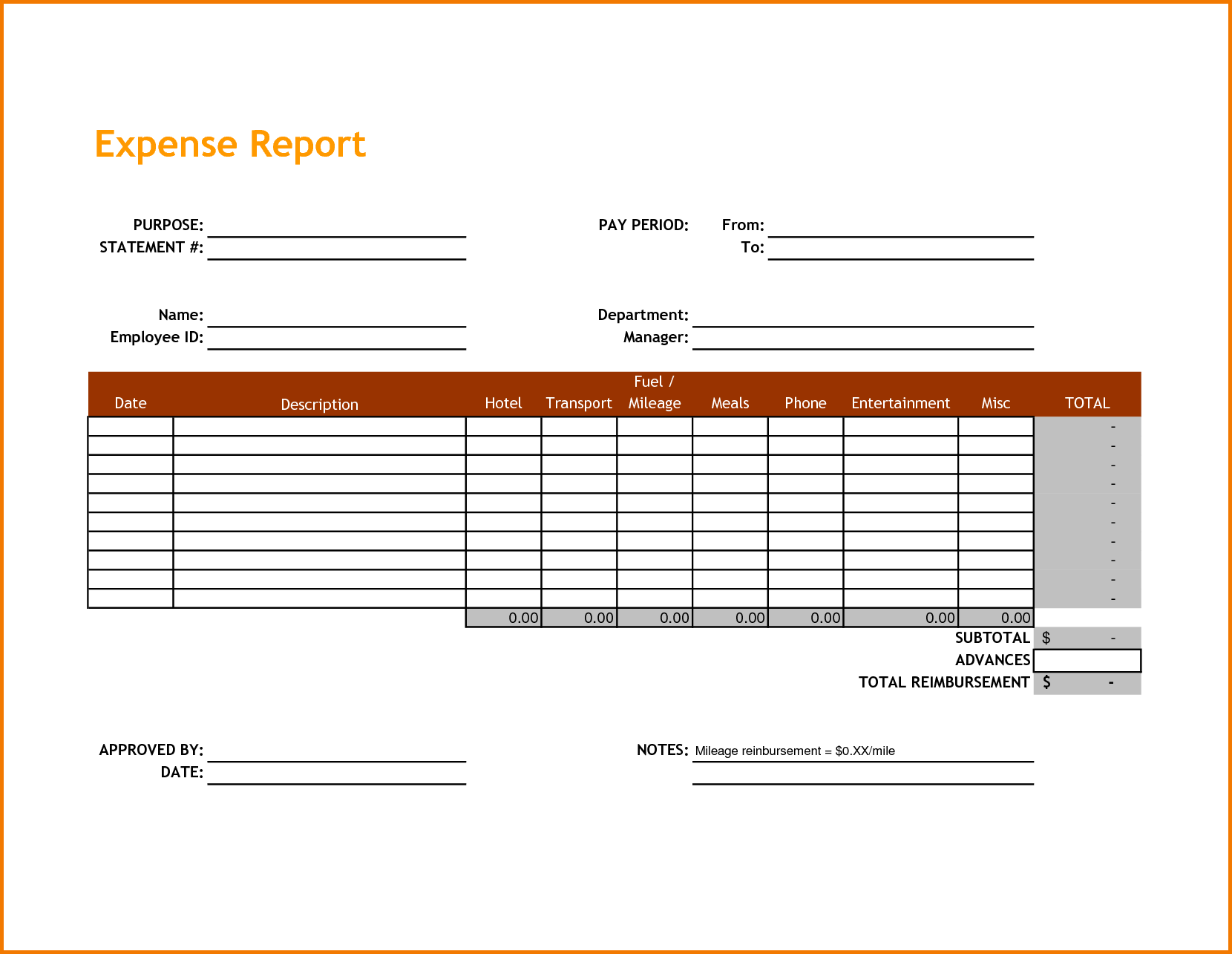

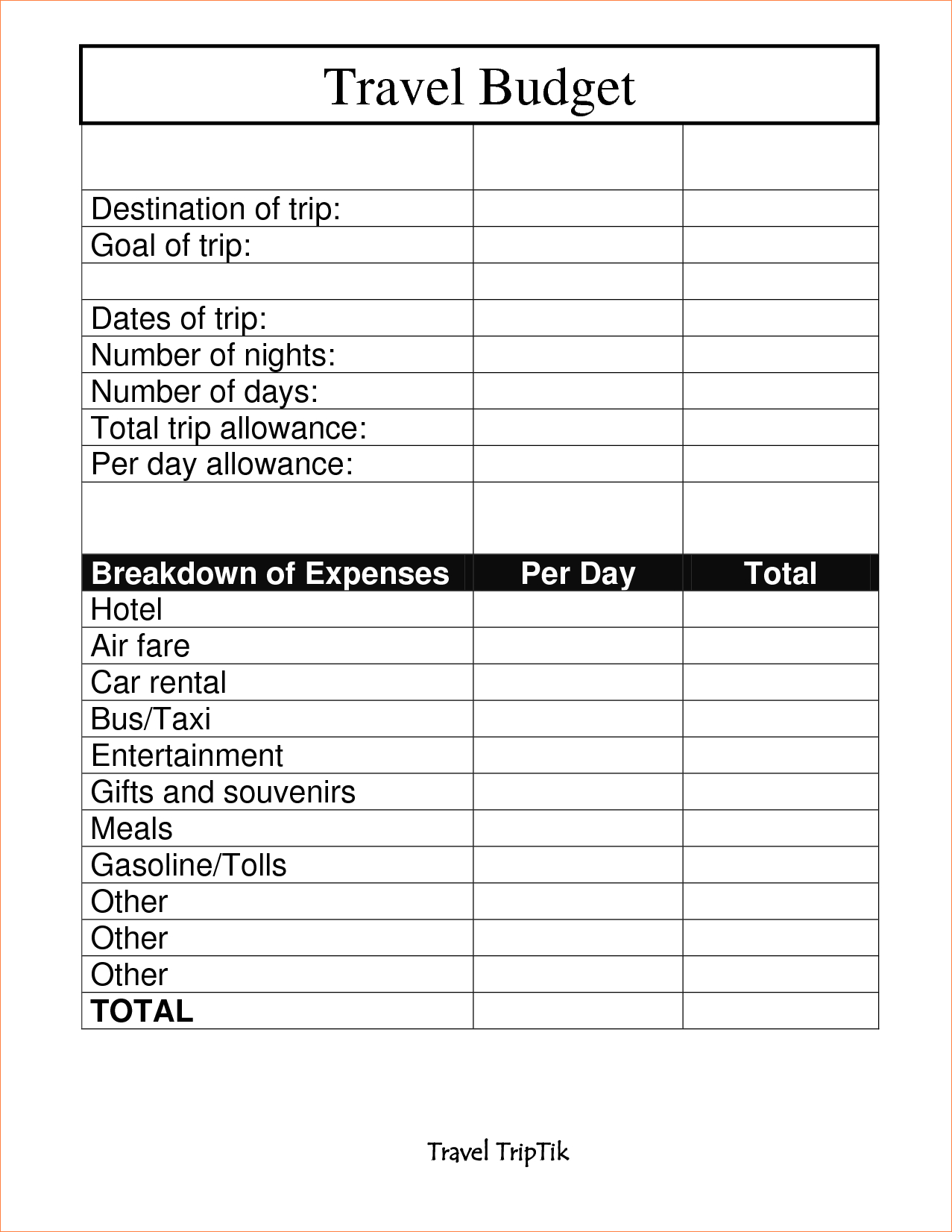

Travel Expenses Form - Publication 463 explains what expenses are deductible, how to report them, what records you'll need, and how to treat expense reimbursements. An ordinary expense is one that is common and accepted in your trade or business. Web a travel request form should indicate the trip’s estimated expenses, including costs of meals and accommodation, transportation expenses, travel expenses, and car rentals, among others. This report includes entries for typical business travel costs in addition to detailed employee information. Web an expense report is commonly used for recording business travel expenses such as transportation, food, lodging, and conference fees. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes. Web our travel expense report template is available as a free download in word format. The expense columns represent lodging, fuel, meals, entertainment and other expenses. If the trip is being sponsored, remember to include the contact information and details of the sponsors. Web download the simple printable expense report form for adobe pdf this basic printable expense report template simplifies the expense reporting process for employees and ensures that managers can issue reimbursement quickly.

The expense columns represent lodging, fuel, meals, entertainment and other expenses. Web download the simple printable expense report form for adobe pdf this basic printable expense report template simplifies the expense reporting process for employees and ensures that managers can issue reimbursement quickly. Web a travel request form should indicate the trip’s estimated expenses, including costs of meals and accommodation, transportation expenses, travel expenses, and car rentals, among others. A travel expenses form is a document used for reimbursing the expenses that the employee spent during his/her trip. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes. Web for tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. Trips that are approved by the management are covered financially by the company. Publication 463 explains what expenses are deductible, how to report them, what records you'll need, and how to treat expense reimbursements. Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. Web our travel expense report template is available as a free download in word format.

But an expense report can also be used to document any business expense for which an employee needs to be reimbursed. This travel expenses form contains form fields that ask for employee's name, position or title, unit or department, contact. This report includes entries for typical business travel costs in addition to detailed employee information. Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. Web a travel request form should indicate the trip’s estimated expenses, including costs of meals and accommodation, transportation expenses, travel expenses, and car rentals, among others. If the trip is being sponsored, remember to include the contact information and details of the sponsors. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes. Web this printable travel expense report can be used to organize travel expenses on a business trip. Web download the simple printable expense report form for adobe pdf this basic printable expense report template simplifies the expense reporting process for employees and ensures that managers can issue reimbursement quickly. For each expense, enter the date, description, and type (e.g., lodging, travel, fuel or mileage).

FREE 13+ Expense Report Forms in MS Word PDF Excel

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. Employees can either print out the template and fill it out manually or complete the sections of the form directly on their pc. Trips that are approved by the management are covered financially by the company. But an expense report can.

Travel Expense Report Templates at

You can't deduct expenses that are lavish or extravagant, or that are for personal purposes. For each expense, enter the date, description, and type (e.g., lodging, travel, fuel or mileage). Web this printable travel expense report can be used to organize travel expenses on a business trip. Web download the simple printable expense report form for adobe pdf this basic.

Sample Travel Expense Report Templates at

Web an expense report is commonly used for recording business travel expenses such as transportation, food, lodging, and conference fees. Employees can either print out the template and fill it out manually or complete the sections of the form directly on their pc. A travel expenses form is a document used for reimbursing the expenses that the employee spent during.

FREE 11+ Sample Travel Expense Claim Forms in MS Word PDF MS Excel

Simply customize the form to suit your business, embed it on. This travel expenses form contains form fields that ask for employee's name, position or title, unit or department, contact. Web download the simple printable expense report form for adobe pdf this basic printable expense report template simplifies the expense reporting process for employees and ensures that managers can issue.

Travel Expense Report Template Travel Expenses Template

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. If the trip is being sponsored, remember to include the contact information and details of the sponsors. For each expense, enter the date, description, and type (e.g., lodging, travel, fuel or mileage). But an expense report can also be used to.

4+ Travel Expense Report Template SampleTemplatess SampleTemplatess

If the trip is being sponsored, remember to include the contact information and details of the sponsors. Web for tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. This report includes entries for typical business travel costs in addition to detailed employee information. You can't deduct expenses that.

Travel Expense Forms

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. If the trip is being sponsored, remember to include the contact information and details of the sponsors. Web information about publication 463, travel, entertainment, gift, and car expenses, including recent updates. This travel expenses form contains form fields that ask for.

Travel Expense Claim Form California Free Download

The expense columns represent lodging, fuel, meals, entertainment and other expenses. For each expense, enter the date, description, and type (e.g., lodging, travel, fuel or mileage). Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. Web this printable travel expense report can be used to organize travel expenses on a.

travel expense report template 1 —

Employees can either print out the template and fill it out manually or complete the sections of the form directly on their pc. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes. But an expense report can also be used to document any business expense for which an employee needs to be reimbursed. Trips.

Travel Expenses Spreadsheet Template Regarding Example Of Travel Budget

If the trip is being sponsored, remember to include the contact information and details of the sponsors. An ordinary expense is one that is common and accepted in your trade or business. This travel expenses form contains form fields that ask for employee's name, position or title, unit or department, contact. Web our travel expense report template is available as.

Web Download The Simple Printable Expense Report Form For Adobe Pdf This Basic Printable Expense Report Template Simplifies The Expense Reporting Process For Employees And Ensures That Managers Can Issue Reimbursement Quickly.

This report includes entries for typical business travel costs in addition to detailed employee information. Trips that are approved by the management are covered financially by the company. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes. But an expense report can also be used to document any business expense for which an employee needs to be reimbursed.

Publication 463 Explains What Expenses Are Deductible, How To Report Them, What Records You'll Need, And How To Treat Expense Reimbursements.

Web a travel request form should indicate the trip’s estimated expenses, including costs of meals and accommodation, transportation expenses, travel expenses, and car rentals, among others. Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. Web this printable travel expense report can be used to organize travel expenses on a business trip. Web for tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job.

Simply Customize The Form To Suit Your Business, Embed It On.

An ordinary expense is one that is common and accepted in your trade or business. Employees can either print out the template and fill it out manually or complete the sections of the form directly on their pc. Web our travel expense report template is available as a free download in word format. This travel expenses form contains form fields that ask for employee's name, position or title, unit or department, contact.

Web Information About Publication 463, Travel, Entertainment, Gift, And Car Expenses, Including Recent Updates.

The expense columns represent lodging, fuel, meals, entertainment and other expenses. Web an expense report is commonly used for recording business travel expenses such as transportation, food, lodging, and conference fees. If the trip is being sponsored, remember to include the contact information and details of the sponsors. For each expense, enter the date, description, and type (e.g., lodging, travel, fuel or mileage).