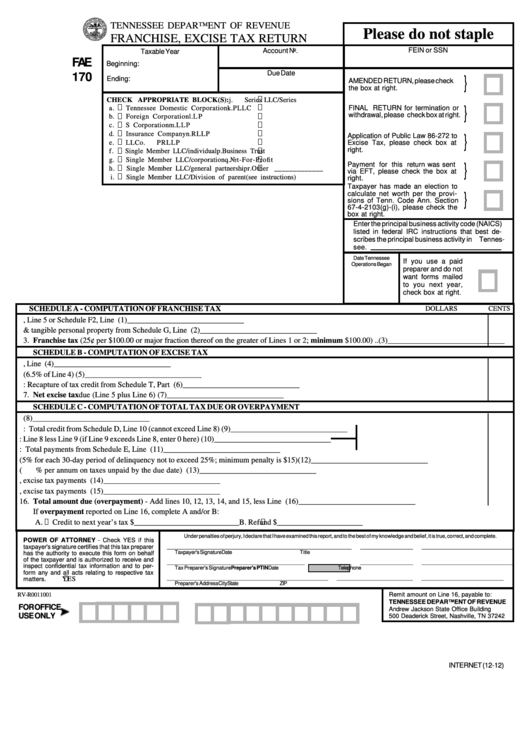

Tn Form Fae 170

Tn Form Fae 170 - Save or instantly send your ready documents. Web file a franchise and excise tax return (form fae170). Easily fill out pdf blank, edit, and sign them. Taxpayers incorporated or otherwise formed outside tennessee must prorate the franchise tax on the initial return. Form popularity tn fae 170 instructions form. Web complete tn form fae 170 online with us legal forms. Use our detailed instructions to fill out and esign your. Sign it in a few clicks draw your signature, type it,. Get, create, make and sign tennessee fae 170. Web fae 170 tennessee department of revenue franchise and excise tax return tax year beginning tax year ending amended return mailing address city legal name.

Easily fill out pdf blank, edit, and sign them. Fae 183 return types not accepted: Web date tennessee operations began, whichever occurred first. Web complete tn dor fae 170 within several minutes by simply following the recommendations below: Edit your fae170 online type text, add images, blackout confidential details, add comments, highlights and more. Get, create, make and sign tennessee fae 170. File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax. Web fae 170if this is an amended return, please} check the box at right. Use the tips on how to fill out the tn dor fae 170:. Use our detailed instructions to fill out and esign your.

Find the template you need from our collection of legal forms. Tips on how to fill out the tn fae 170 fillable form online: Web form fae170 returns, schedules and instructions for prior years. Web up to $40 cash back fill tn form fae 170: File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax. Web fae 170if this is an amended return, please} check the box at right. Get, create, make and sign tennessee fae 170. For tax years beginning on or after 1/1/21, and ending on or before 12/31/21. Web thinking of filing tennessee form fae 170? Use the tips on how to fill out the tn dor fae 170:.

Fae 170 Instructions 2020 Fill Out and Sign Printable PDF Template

Fae 183 return types not accepted: Web form fae 170, consolidated net worth election registration application tennessee franchise, excise fae 170 tax return if the partnership is inactive in tennessee, enter. Dollars cents tennessee department of revenue franchise, excise tax return if the. Save or instantly send your ready documents. Use the tips on how to fill out the tn.

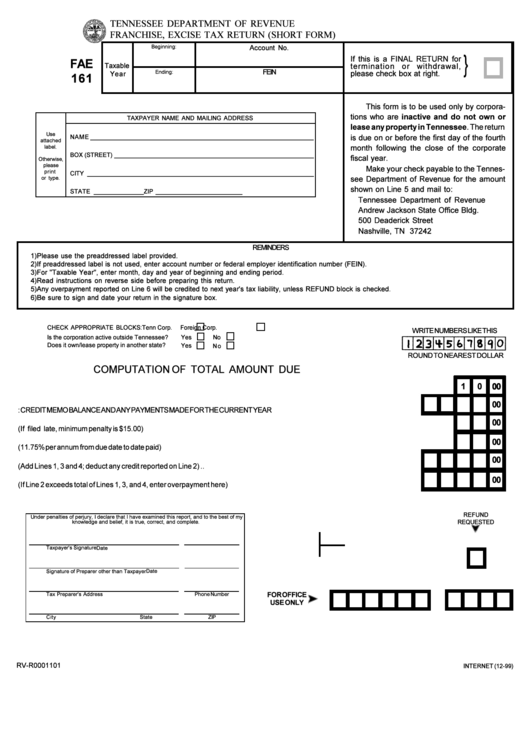

Form Fae 161 Franchise, Excise Tax Return (Short Form) printable pdf

Web taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date tennessee operations began,. Taxpayers incorporated or otherwise formed outside tennessee must prorate the franchise tax on the initial return. Web complete tn dor fae 170 within several minutes by simply following the recommendations below: Fae 183.

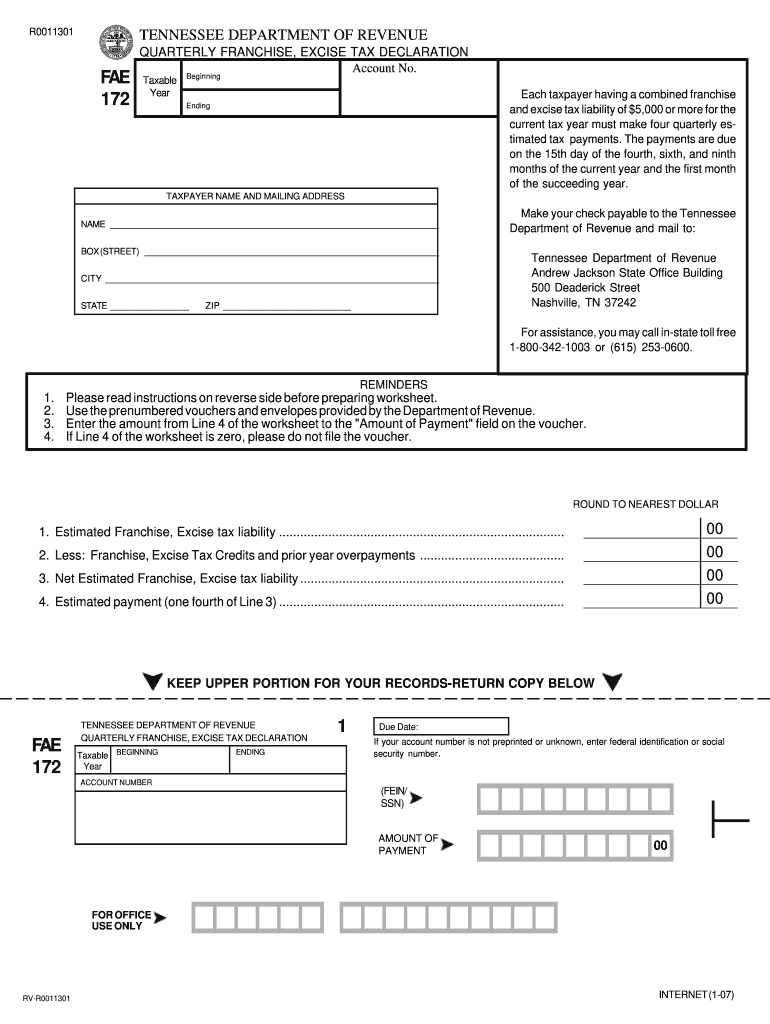

Tennessee Fae 172 Form ≡ Fill Out Printable PDF Forms Online

Web complete tn dor fae 170 within several minutes by simply following the recommendations below: Get, create, make and sign tennessee fae 170. Web thinking of filing tennessee form fae 170? Web date tennessee operations began, whichever occurred first. Use our detailed instructions to fill out and esign your.

Fae 170 Fill Online, Printable, Fillable, Blank pdfFiller

Web file a franchise and excise tax return (form fae170). Web thinking of filing tennessee form fae 170? Sign it in a few clicks draw your signature, type it,. Web form fae 170, consolidated net worth election registration application tennessee franchise, excise fae 170 tax return if the partnership is inactive in tennessee, enter. Taxpayers incorporated or otherwise formed outside.

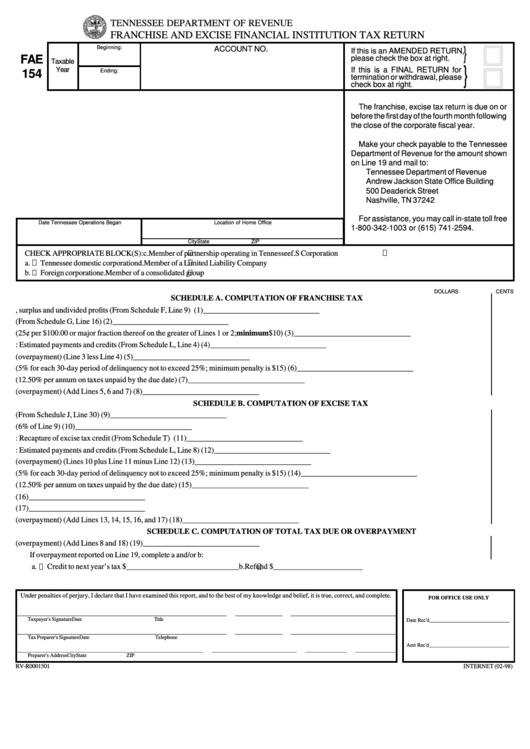

Fillable Form Fae 154 Franchise And Excise Financial Institution Tax

Taxpayers incorporated or otherwise formed outside tennessee must prorate the franchise tax on the initial return. Web file a franchise and excise tax return (form fae170). Easily fill out pdf blank, edit, and sign them. Form popularity tn fae 170 instructions form. Web fae 170if this is an amended return, please} check the box at right.

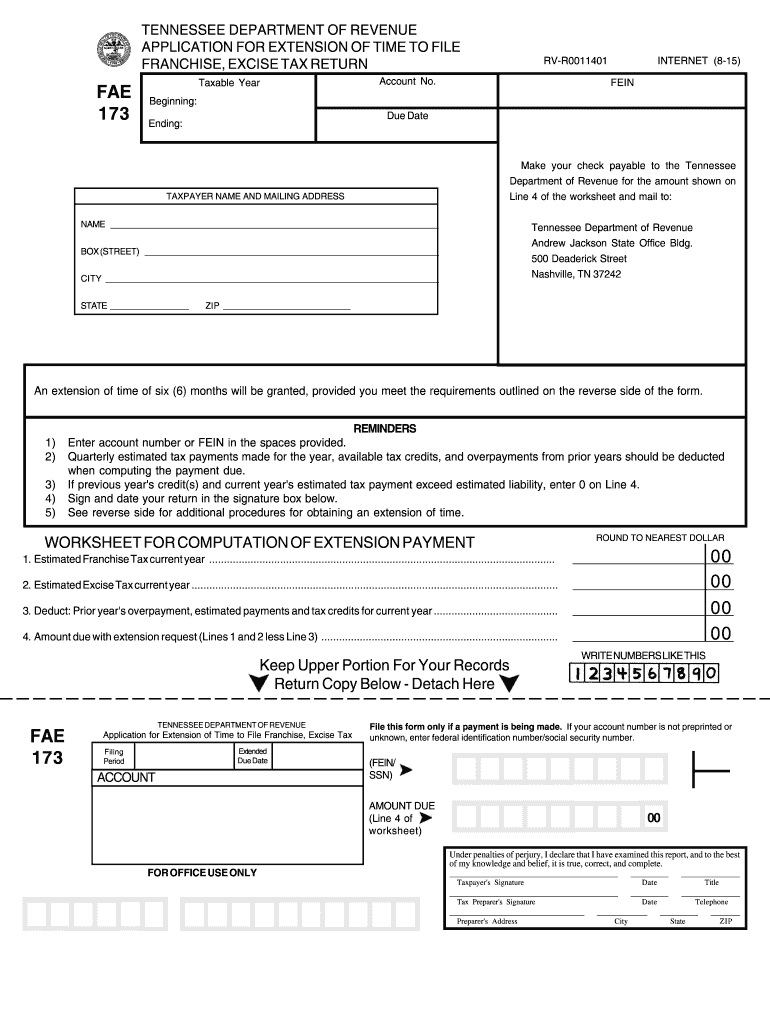

2015 Form TN DoR FAE 173 Fill Online, Printable, Fillable, Blank

For tax years beginning on or after 1/1/21, and ending on or before 12/31/21. Use the tips on how to fill out the tn dor fae 170:. Get, create, make and sign tennessee fae 170. Tips on how to fill out the tn fae 170 fillable form online: Web taxpayers incorporated or otherwise formed in tennessee must prorate the franchise.

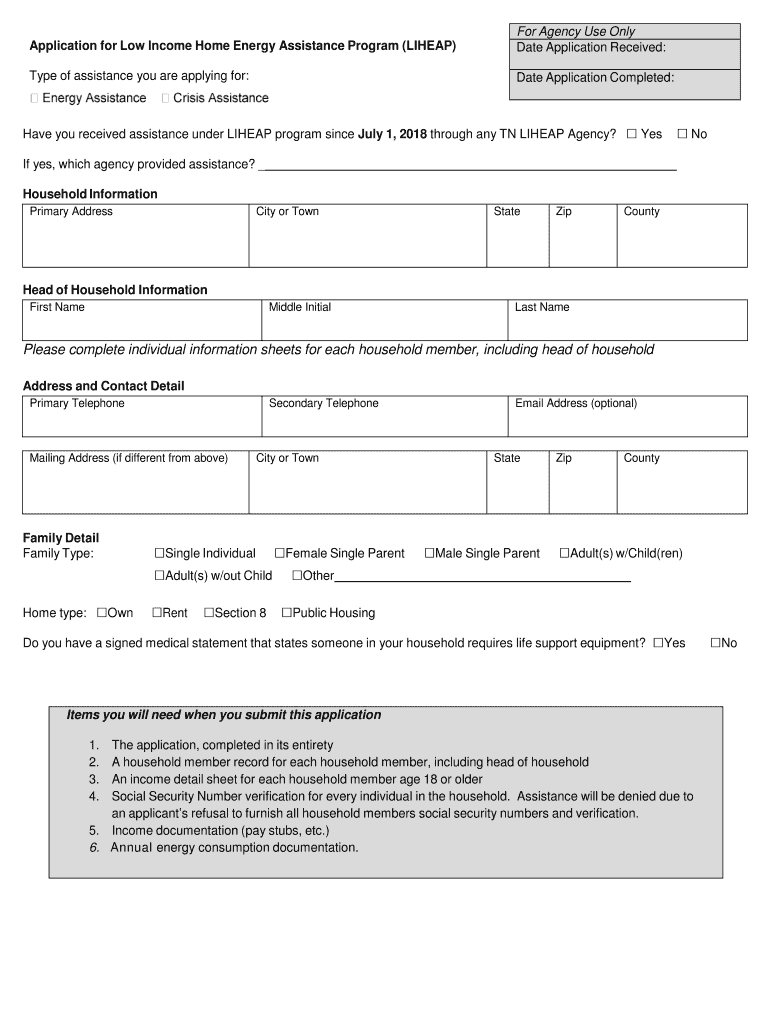

20182021 Form TN Application for Low Home Energy Assistance

Web file a franchise and excise tax return (form fae170). Web fae 170if this is an amended return, please} check the box at right. Web thinking of filing tennessee form fae 170? Fae 183 return types not accepted: Web form fae170 returns, schedules and instructions for prior years.

Tn Form Ucc Fill Online, Printable, Fillable, Blank pdfFiller

Web complete tn form fae 170 online with us legal forms. Use the tips on how to fill out the tn dor fae 170:. For tax years beginning on or after 1/1/21, and ending on or before 12/31/21. Tips on how to fill out the tn fae 170 fillable form online: Web fae 170if this is an amended return, please}.

Form Fae 170 Franchise, Excise Tax Return printable pdf download

Web fae 170if this is an amended return, please} check the box at right. Form popularity tn fae 170 instructions form. Edit your fae170 online type text, add images, blackout confidential details, add comments, highlights and more. Web date tennessee operations began, whichever occurred first. Use our detailed instructions to fill out and esign your.

20172020 Form TN DoR FAE 170 Fill Online, Printable, Fillable, Blank

Sign it in a few clicks draw your signature, type it,. Dollars cents tennessee department of revenue franchise, excise tax return if the. Fae 183 return types not accepted: Web thinking of filing tennessee form fae 170? Get, create, make and sign tennessee fae 170.

Web Fae 170If This Is An Amended Return, Please} Check The Box At Right.

Web up to $40 cash back fill tn form fae 170: Find the template you need from our collection of legal forms. This form is for income earned in tax year 2022, with tax. Tips on how to fill out the tn fae 170 fillable form online:

For Tax Years Beginning On Or After 1/1/21, And Ending On Or Before 12/31/21.

Dollars cents tennessee department of revenue franchise, excise tax return if the. Use our detailed instructions to fill out and esign your. Save or instantly send your ready documents. File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax.

Fae 183 Return Types Not Accepted:

Web complete tn form fae 170 online with us legal forms. Web date tennessee operations began, whichever occurred first. Form popularity tn fae 170 instructions form. Web complete tn dor fae 170 within several minutes by simply following the recommendations below:

Web Form Fae 170, Consolidated Net Worth Election Registration Application Tennessee Franchise, Excise Fae 170 Tax Return If The Partnership Is Inactive In Tennessee, Enter.

Use the tips on how to fill out the tn dor fae 170:. Get, create, make and sign tennessee fae 170. Web file a franchise and excise tax return (form fae170). Taxpayers incorporated or otherwise formed outside tennessee must prorate the franchise tax on the initial return.