The Debt Snowball Chapter 4 Lesson 6

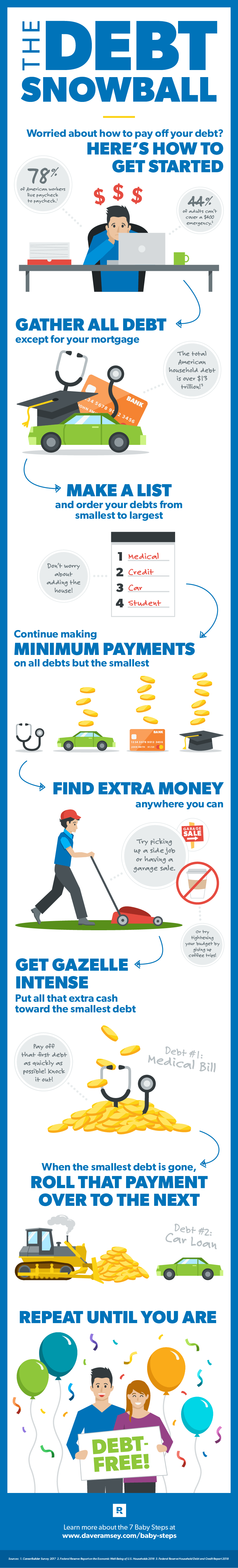

The Debt Snowball Chapter 4 Lesson 6 - Get out of debt with the debt snowball plan; Explain the debt snowball method as a debt repayment strategy b. A method of debt repayment in which the debtor lists each of his/her debts from smallest to largest (not including the mortgage), then devotes extra money each month to. Web names the debt snowball chapter 4, lesson 6 debt interest rate current balance minimum payment mastercard 19.90% $600 $22 visa 23.95% $2,545 $39 car loan 4.80% $16,800 $465 student loan 6… Pay as much as possible on your smallest debt. Minimum payments are made to all debts except for the smallest, which is attacked with the. Discuss its effectiveness in paying off debts quickly c. Web 59 votes how to fill out and sign chapter 4 lesson 6 the debt snowball online? Web web completing the the debt snowball chapter 4 student activity sheet answers with signnow will give greater confidence that the output form will be legally binding and safeguarded handy tips for filling out the debt snowball worksheet answers chapter 4 lesson 6 online chapter 4 student activity sheet the debt snowball. Chapter 4, lesson 6 answers a.

Small groups of three to four students 30 minutes material: A method of debt repayment in which the debtor lists each of his/her debts from smallest to largest (not including the mortgage), then devotes extra money each month to. Commit to increasing the minimum payment on your smallest debt. Pay as much as possible on your smallest debt. The key to success is identifying a dollar amount that you can commit to debt reduction each month ($100. Web names the debt snowball chapter 4, lesson 6 debt interest rate current balance minimum payment mastercard 19.90% $600 $22 visa 23.95% $2,545 $39 car loan 4.80% $16,800 $465 student loan 6… Minimum payments are made to all debts except for the smallest, which is attacked. The debt snowball chapter 4, lesson 6 names mason brady date 9/20/21 directions work with your group to evaluate the financial information listed below and create a plan to pay off the debt in the least amount of time possible using the debt snowball… Web dave ramsey chapter 4: Get your online template and fill it in using progressive features.

Web use the debt snowball form to create a plan to pay off the debt.namesthe debt snowball chapter 4,lesson 6 debt interest rate current balance minimum payment mastercard 19.90% $600 $22 visa 23.95% $2,545 $39 car loan 4.80% $16,800 $465 student loan 6… Web debt snowball preferred method of debt repayment; Select the document you want to sign and click upload. Get out of debt with the debt snowball plan; Commit to increasing the minimum payment on your smallest debt. Web names the debt snowball chapter 4, lesson 6 debt interest rate current balance minimum payment mastercard 19.90% $600 $22 visa 23.95% $2,545 $39 car loan 4.80% $16,800 $465 student loan 6… List your debts from smallest to largest regardless of interest rate. Includes a list of all debts organized from smallest to largest balance; Minimum payments are made to all debts except for the smallest, which is attacked with the. 1 of 4 the debt snowball 4 activity:

How the Debt Snowball Method Works

Minimum payments are made to all debts except for the smallest, which is attacked. Web debt snowball dave's suggested method of paying off debts; 1 of 4 the debt snowball 4 activity: Select the document you want to sign and click upload. Minimum payments are made to all debts except for the smallest, which is attacked with the.

Debt Snowball MethodPay Your Debts FasterThe Daily Change Jar

Includes a list of all debts organized from smallest to largest balance; The key to success is identifying a dollar amount that you can commit to debt reduction each month ($100. Select the my signature button. Web debt snowball dave's suggested method of paying off debts; Discuss its effectiveness in paying off debts quickly c.

Debt Snowball Printable Sheet Dave Ramsey Inspired Debt Etsy

Includes a list of all debts organized from smallest to largest balance; Select the my signature button. Chapter 4, lesson 6 answers a. Make minimum payments on all your debts except the smallest. How do i determine the order in which to pay off my debts?.

Debt Snowball Calculator Debt Snowball Dave Ramsey Debt Etsy

Get out of debt with the debt snowball plan; Includes a list of all debts organized from smallest to largest balance; Enjoy smart fillable fields and interactivity. The debt snowball chapter 4, lesson 6 names mason brady date 9/20/21 directions work with your group to evaluate the financial information listed below and create a plan to pay off the debt.

Download Dave Ramsey Debt Snowball Gantt Chart Excel Template

Web debt snowball dave's suggested method of paying off debts; Highlight the importance of prioritizing debts based on their balances. Web names the debt snowball chapter 4, lesson 6 debt interest rate current balance minimum payment mastercard 19.90% $600 $22 visa 23.95% $2,545 $39 car loan 4.80% $16,800 $465. The key to success is identifying a dollar amount that you.

Debt Snowball Example YouTube

1 of 4 the debt snowball 4 activity: Explain the debt snowball method as a debt repayment strategy b. The debt snowball chapter 4, lesson 6 names mason brady date 9/20/21 directions work with your group to evaluate the financial information listed below and create a plan to pay off the debt in the least amount of time possible using.

Chapter 4 The Debt Snowball Worksheet Answers [EXCLUSIVE]

Web names the debt snowball chapter 4, lesson 6 debt interest rate current balance minimum payment mastercard 19.90% $600 $22 visa 23.95% $2,545 $39 car loan 4.80% $16,800 $465 student loan 6… Web debt snowball preferred method of debt repayment; The debt snowball chapter 4, lesson 6 names mason brady date 9/20/21 directions work with your group to evaluate the.

Debt Avalanche vs Debt Snowball Best Way to Pay off Debt

Web dave ramsey chapter 4: Explain the debt snowball method as a debt repayment strategy b. Discuss its effectiveness in paying off debts quickly c. Web debt snowball preferred method of debt repayment; How do i determine the order in which to pay off my debts?.

How the Debt Snowball Method Works

Includes a list of all debts organized from smallest to largest balance; A method of debt repayment in which the debtor lists each of his/her debts from smallest to largest (not including the mortgage), then devotes extra money each month to. Minimum payments are made to all debts except for the smallest, which is attacked. Web use the debt snowball.

Debt Snowball Pdf Fill Online, Printable, Fillable, Blank pdfFiller

Web names the debt snowball chapter 4, lesson 6 debt interest rate current balance minimum payment mastercard 19.90% $600 $22 visa 23.95% $2,545 $39 car loan 4.80% $16,800 $465. Explain the debt snowball method as a debt repayment strategy b. Chapter 4, lesson 6 answers a. Get your online template and fill it in using progressive features. Web how does.

Small Groups Of Three To Four Students 30 Minutes Material:

1 of 4 the debt snowball 4 activity: Web names the debt snowball chapter 4, lesson 6 debt interest rate current balance minimum payment mastercard 19.90% $600 $22 visa 23.95% $2,545 $39 car loan 4.80% $16,800 $465. Minimum payments are made to all debts except for the smallest, which is attacked with the. Get your online template and fill it in using progressive features.

Web 59 Votes How To Fill Out And Sign Chapter 4 Lesson 6 The Debt Snowball Online?

Highlight the importance of prioritizing debts based on their balances. Commit to increasing the minimum payment on your smallest debt. The key to success is identifying a dollar amount that you can commit to debt reduction each month ($100. Web debt snowball preferred method of debt repayment;

Web How Does The Debt Snowball Method Work?

Pay as much as possible on your smallest debt. Web names the debt snowball chapter 4, lesson 6 debt interest rate current balance minimum payment mastercard 19.90% $600 $22 visa 23.95% $2,545 $39 car loan 4.80% $16,800 $465 student loan 6… Chapter 4, lesson 6 answers a. Web web completing the the debt snowball chapter 4 student activity sheet answers with signnow will give greater confidence that the output form will be legally binding and safeguarded handy tips for filling out the debt snowball worksheet answers chapter 4 lesson 6 online chapter 4 student activity sheet the debt snowball.

Get Out Of Debt With The Debt Snowball Plan;

List your debts from smallest to largest regardless of interest rate. Minimum payments are made to all debts except for the smallest, which is attacked. Decide on what kind of electronic signature. Discuss its effectiveness in paying off debts quickly c.

![Chapter 4 The Debt Snowball Worksheet Answers [EXCLUSIVE]](http://hairfad.com/wp-content/uploads/2019/08/snowball-budget-template-debt-snowball-spreadsheet-16.jpg)