The Balance Sheet Account That Depreciation Is Recorded To Is

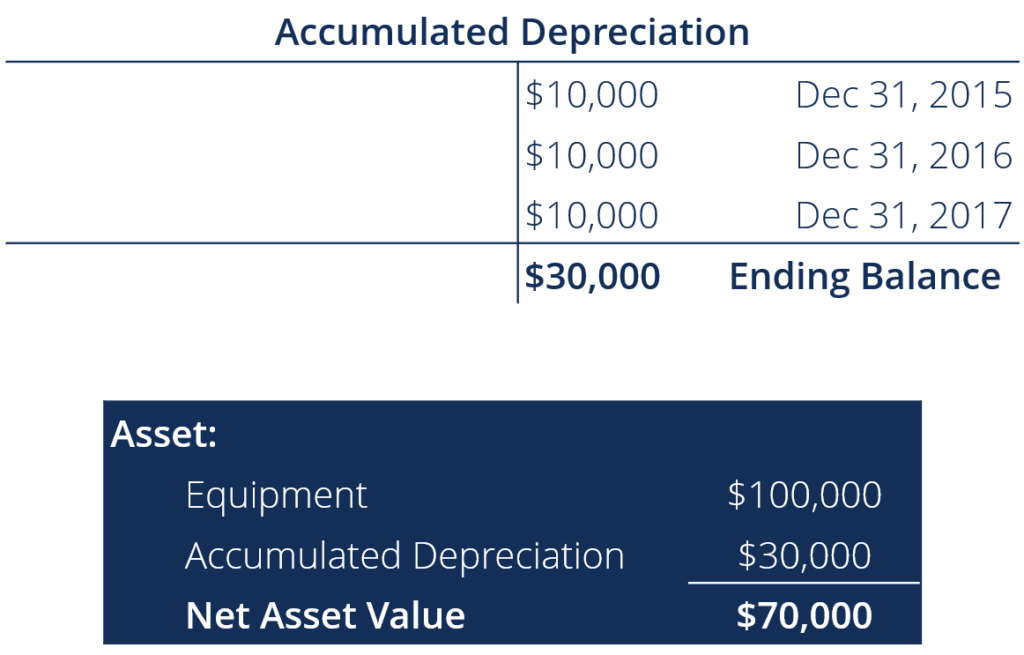

The Balance Sheet Account That Depreciation Is Recorded To Is - Web key takeaways accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Also, fixed assets are recorded on the balance sheet, and since accumulated. Web the accumulated depreciation account is a contra asset account on a company's balance sheet. It represents a credit balance. Web your balance sheet will record depreciation for all of your fixed assets. It appears as a reduction from the gross amount of fixed. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement.

It represents a credit balance. Also, fixed assets are recorded on the balance sheet, and since accumulated. It appears as a reduction from the gross amount of fixed. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which. Web the accumulated depreciation account is a contra asset account on a company's balance sheet. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Web key takeaways accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date. Web your balance sheet will record depreciation for all of your fixed assets. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement.

Web the accumulated depreciation account is a contra asset account on a company's balance sheet. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Web your balance sheet will record depreciation for all of your fixed assets. Also, fixed assets are recorded on the balance sheet, and since accumulated. It appears as a reduction from the gross amount of fixed. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. It represents a credit balance. Web key takeaways accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which.

😍 State the formula for the accounting equation. What Is the Accounting

Web key takeaways accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date. Web your balance sheet will record depreciation for all of your fixed assets. It represents a credit balance. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Web the accumulated depreciation account.

8 ways to calculate depreciation in Excel Journal of Accountancy

Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which. This means you’ll see more overall depreciation on your balance sheet than you will on an.

template for depreciation worksheet

Web your balance sheet will record depreciation for all of your fixed assets. Also, fixed assets are recorded on the balance sheet, and since accumulated. Web key takeaways accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date. It represents a credit balance. Accumulated depreciation represents the total depreciation of a company's fixed assets.

Accumulated Depreciation Definition, Example, Sample

Also, fixed assets are recorded on the balance sheet, and since accumulated. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. It represents a credit balance. Web key takeaways accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date. Accumulated depreciation represents the total depreciation.

What Is a Financial Statement? Detailed Overview of Main Statements

Also, fixed assets are recorded on the balance sheet, and since accumulated. It represents a credit balance. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Web your balance sheet will record depreciation for all of your fixed assets. Web the basic journal entry for depreciation is to debit the depreciation.

Accumulated Depreciation on Balance Sheet Financial

Web the accumulated depreciation account is a contra asset account on a company's balance sheet. Web key takeaways accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Also, fixed assets are recorded on the balance.

Where is accumulated depreciation on the balance sheet? Financial

This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Web the accumulated depreciation account is a contra asset account on a company's balance sheet. Also, fixed assets are recorded on the balance sheet, and since accumulated. Web key takeaways accumulated depreciation is the sum of all recorded depreciation on an asset.

Where is accumulated depreciation on the balance sheet? Financial

Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. It represents a credit balance. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which. It appears as a reduction from the gross amount of fixed..

Pourquoi l'amortissement cumulé estil un solde créditeur

Also, fixed assets are recorded on the balance sheet, and since accumulated. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which. It represents a credit balance. Web your balance sheet will record depreciation for all of your fixed assets. Accumulated depreciation represents.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

Web your balance sheet will record depreciation for all of your fixed assets. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Web key takeaways accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date. Web the accumulated depreciation account is a contra asset account.

Web The Accumulated Depreciation Account Is A Contra Asset Account On A Company's Balance Sheet.

This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. It represents a credit balance. It appears as a reduction from the gross amount of fixed.

Also, Fixed Assets Are Recorded On The Balance Sheet, And Since Accumulated.

Web your balance sheet will record depreciation for all of your fixed assets. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which. Web key takeaways accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)