Texas Ag Exempt Form

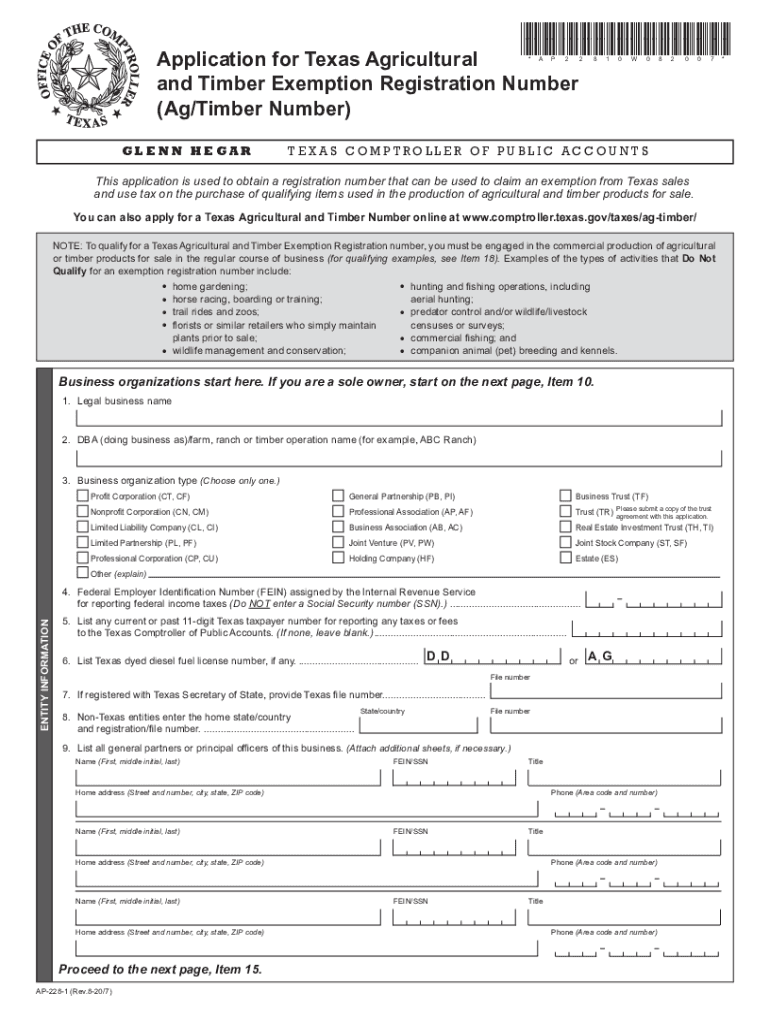

Texas Ag Exempt Form - Form download (alternative format) instructions download. Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be. Web select ag/timber account maintenance to update your current (active) exemption including: Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice). Web this application is used to obtain a registration number that can be used to claim an exemption from texas sales and use tax on the purchase of qualifying items used in the. Your mailing address and contact information; Web “ag exemption” common term used to explain the central appraisal district’s (cad) appraised value of the land is not an exemption is a special use appraisal based on the. Web how many acres do you need for a special ag valuation? Registration number (must enter 11 numbers) or. Dba (farm, ranch, or timber operation.

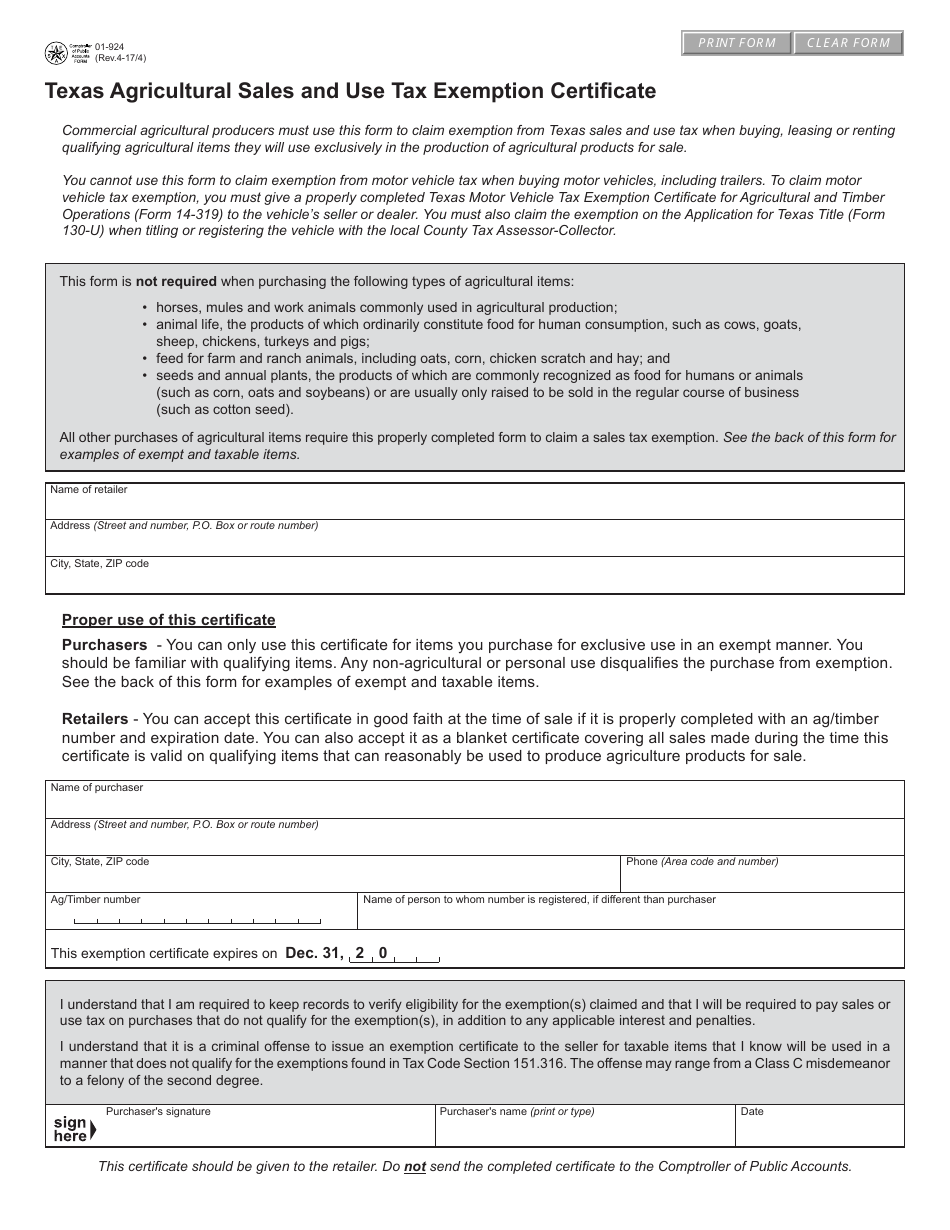

Web “ag exemption” common term used to explain the central appraisal district’s (cad) appraised value of the land is not an exemption is a special use appraisal based on the. For other texas sales tax exemption. Web the form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below. Application for commercial pesticide applicator license. Web to claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (ag/timber number) from the comptroller. Web select ag/timber account maintenance to update your current (active) exemption including: Web application for certified and insured prescribed burn manager. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice). Middle name (optional) last name. Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be.

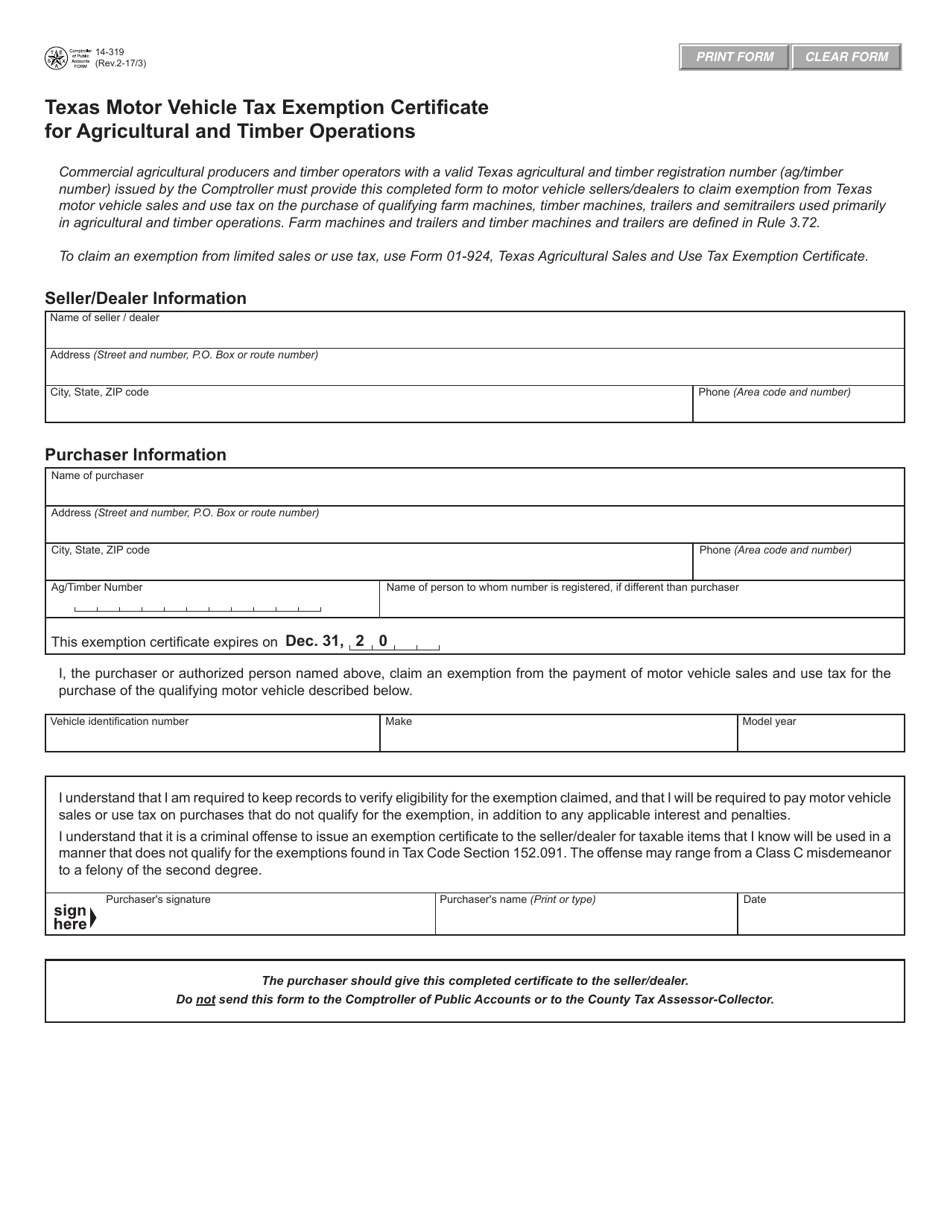

Web how many acres do you need for a special ag valuation? Web commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting qualifying agricultural items they will use. Web application for certified and insured prescribed burn manager. Web commercial agricultural producers and timber operators with a valid texas agricultural and timber registration number (ag/timber number) issued by the comptroller must. Web to claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (ag/timber number) from the comptroller. Web select ag/timber account maintenance to update your current (active) exemption including: Form download (alternative format) instructions download. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice). Ad complete tax forms online or print official tax documents. Dba (farm, ranch, or timber operation.

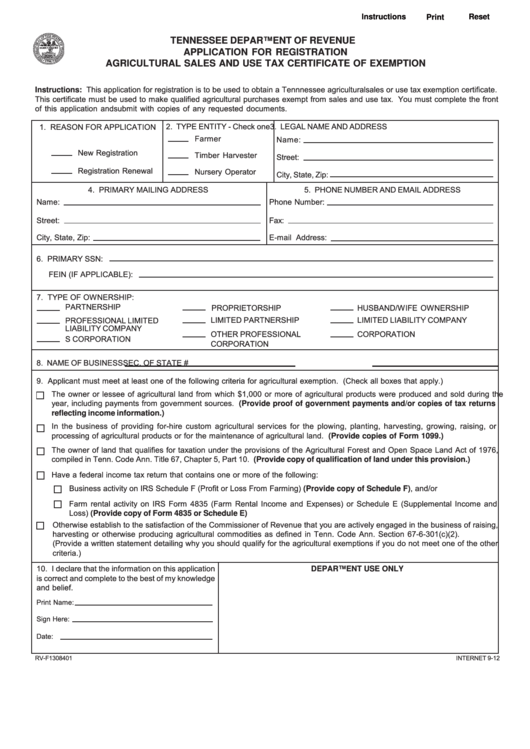

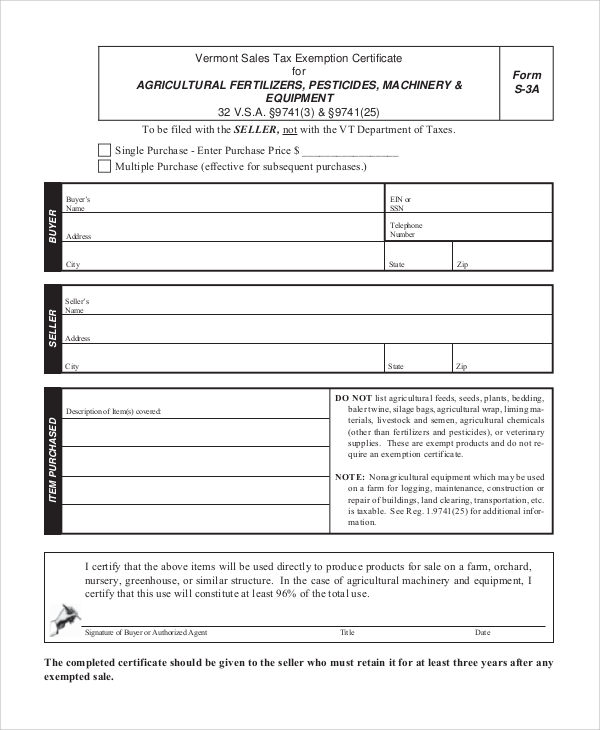

Fillable Agricultural Sales And Use Tax Certificate Of Exemption

Form download (alternative format) instructions download. Web to claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (ag/timber number) from the comptroller. Web application for certified and insured prescribed burn manager. Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be. Application.

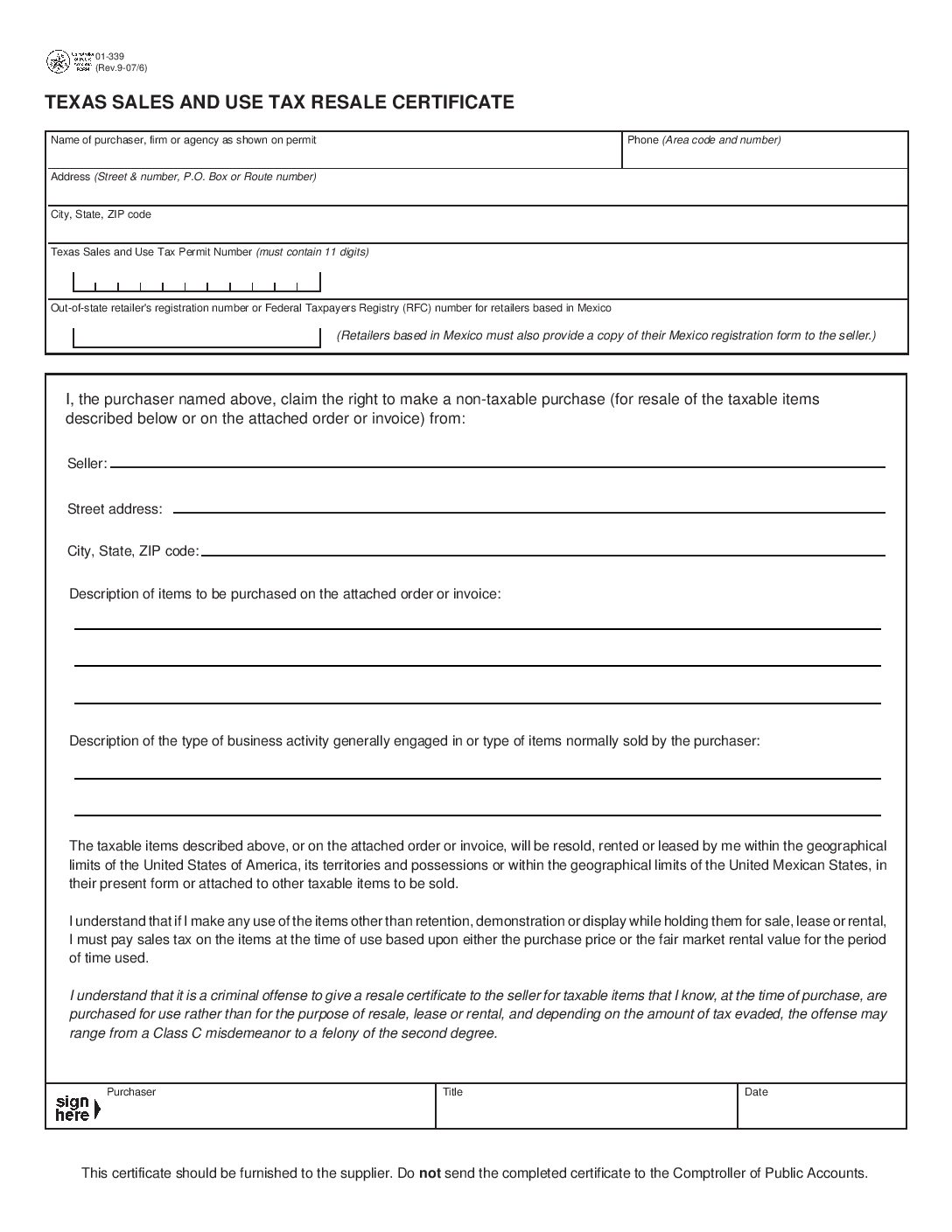

Forms Texas Crushed Stone Co.

Web commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting qualifying agricultural items they will use. Web the form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below. Your mailing address and contact.

Farmers Tax Exempt Certificate Farmer Foto Collections

For other texas sales tax exemption. Ad complete tax forms online or print official tax documents. Web the form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below. Registration number (must enter 11 numbers) or. Web i, the purchaser named above, claim an exemption from.

Texas Sr 22 Form Pdf Resume Examples

Complete, edit or print tax forms instantly. Web select ag/timber account maintenance to update your current (active) exemption including: Middle name (optional) last name. Form download (alternative format) instructions download. Registration number (must enter 11 numbers) or.

Form 01924 Download Fillable PDF or Fill Online Texas Agricultural

Web the form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below. Web how many acres do you need for a special ag valuation? Form download (alternative format) instructions download. Ad complete tax forms online or print official tax documents. For other texas sales tax.

AG exemption how many acres Grayson county TX YouTube

Web commercial agricultural producers and timber operators with a valid texas agricultural and timber registration number (ag/timber number) issued by the comptroller must. Web to claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (ag/timber number) from the comptroller. Web how many acres do you need for a special ag valuation? Ad.

Ag Exempt Form Water Logistics

Web this application is used to obtain a registration number that can be used to claim an exemption from texas sales and use tax on the purchase of qualifying items used in the. Web to claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (ag/timber number) from the comptroller. Web select ag/timber.

FREE 10+ Sample Tax Exemption Forms in PDF

Web to claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (ag/timber number) from the comptroller. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice). Web select ag/timber account maintenance.

20202022 Form TX AP2281 Fill Online, Printable, Fillable, Blank

Web how many acres do you need for a special ag valuation? Web commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting qualifying agricultural items they will use. Your mailing address and contact information; Ag exemption requirements vary by county, but generally you need at least 10 acres.

Printable Tax Exempt Form Fill Online, Printable, Fillable, Blank

Web this application is used to obtain a registration number that can be used to claim an exemption from texas sales and use tax on the purchase of qualifying items used in the. Ad complete tax forms online or print official tax documents. Web “ag exemption” common term used to explain the central appraisal district’s (cad) appraised value of the.

Web “Ag Exemption” Common Term Used To Explain The Central Appraisal District’s (Cad) Appraised Value Of The Land Is Not An Exemption Is A Special Use Appraisal Based On The.

Your mailing address and contact information; Web application for certified and insured prescribed burn manager. Web the form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below. Dba (farm, ranch, or timber operation.

Web I, The Purchaser Named Above, Claim An Exemption From Payment Of Sales And Use Taxes (For The Purchase Of Taxable Items Described Below Or On The Attached Order Or Invoice).

Complete, edit or print tax forms instantly. Web this application is used to obtain a registration number that can be used to claim an exemption from texas sales and use tax on the purchase of qualifying items used in the. Web how many acres do you need for a special ag valuation? Application for commercial pesticide applicator license.

Web Commercial Agricultural Producers Must Use This Form To Claim Exemption From Texas Sales And Use Tax When Buying, Leasing Or Renting Qualifying Agricultural Items They Will Use.

Web to claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (ag/timber number) from the comptroller. Form download (alternative format) instructions download. Ad complete tax forms online or print official tax documents. Application for section 18 emergency exemption.

Middle Name (Optional) Last Name.

Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be. Web commercial agricultural producers and timber operators with a valid texas agricultural and timber registration number (ag/timber number) issued by the comptroller must. Registration number (must enter 11 numbers) or. For other texas sales tax exemption.