Td Ameritrade Removal Of Excess Form

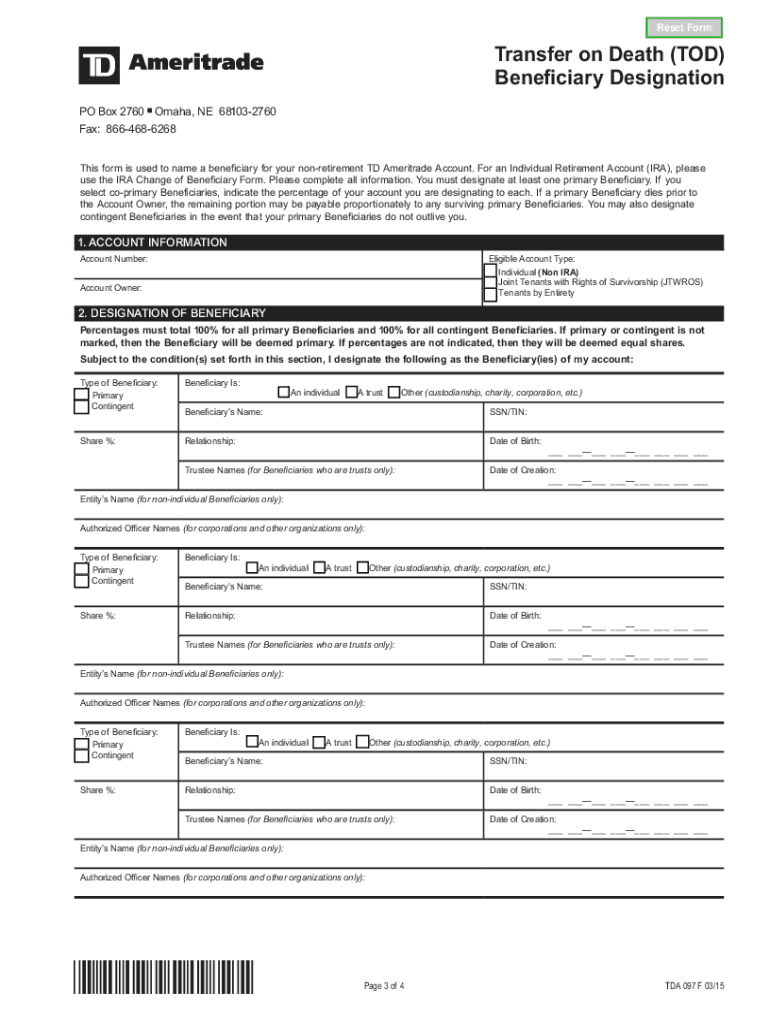

Td Ameritrade Removal Of Excess Form - Web removal of excess contribution distributions investment advisor authority (required) name of the advisory firm you wish to have move money authorization on. Roth ira withdrawal rules allow you to get rid of excess contribution amounts without penalty—as long as you take care. *tda3630* i hereby authorize td ameritrade to return a check for $ as a “mistake of. If the account has margin and/or options privileges, please complete. Therefore you must remove $5,201.41 from the ira account in which the excess. Web obtain receiving custodian’s transfer form. Do not sign in section 11, and please only sign in section 12. Find, download, and print important brokerage forms, agreements, pdf files, and disclosures from our form library. Web deadline to remove excess or recharacterize ira contributions made for 2022 if you filed your return by april 18, 2023 If you have investments you can either sell them (you might face tax consequences in.

By my signature below, i certify that the information. *tda3630* i hereby authorize td ameritrade to return a check for $ as a “mistake of. Do not sign in section 11, and please only sign in section 12. If you have investments you can either sell them (you might face tax consequences in. Find, download, and print important brokerage forms, agreements, pdf files, and disclosures from our form library. English deutsch français español português italiano român nederlands latina dansk svenska norsk magyar. Ad no hidden fees or minimum trade requirements. Web get going on the removal with td ameritrade, your custodian. Since it is so close to the start of the year, and you haven’t filed, it likely won’t be subject to the 6%. Web obtain receiving custodian’s transfer form.

If the account has margin and/or options privileges, please complete. Web that’s called an excess contribution, and the penalty is 6%. Do not sign in section 11, and please only sign in section 12. Therefore you must remove $5,201.41 from the ira account in which the excess. Ad no hidden fees or minimum trade requirements. Web what if i withdraw an excess contribution? English deutsch français español português italiano român nederlands latina dansk svenska norsk magyar. Web firm or clearing firm may refuse to approve, or remove, the authorized agent(s) from acting as the account owner(s)' agent on this, or any other account. Web obtain receiving custodian’s transfer form. If the account has margin and/or options privileges, please complete.

Td Ameritrade Estate Department Form Fill Out and Sign Printable PDF

By my signature below, i certify that the information. Web to cancel td ameritrade account, you first move your cash to your bank or another broker. Since it is so close to the start of the year, and you haven’t filed, it likely won’t be subject to the 6%. Therefore you must remove $5,201.41 from the ira account in which.

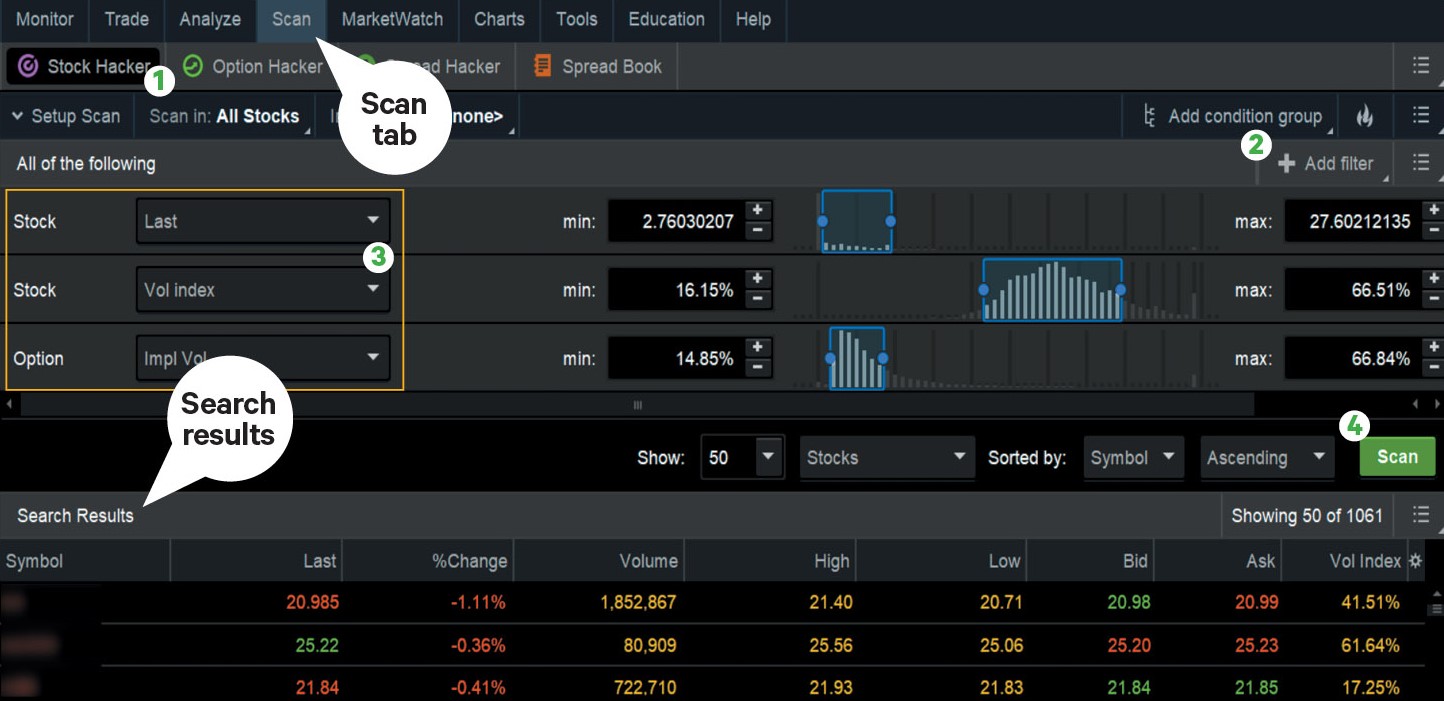

TD Ameritrade In A 0 Commission World TD Ameritrade Holding

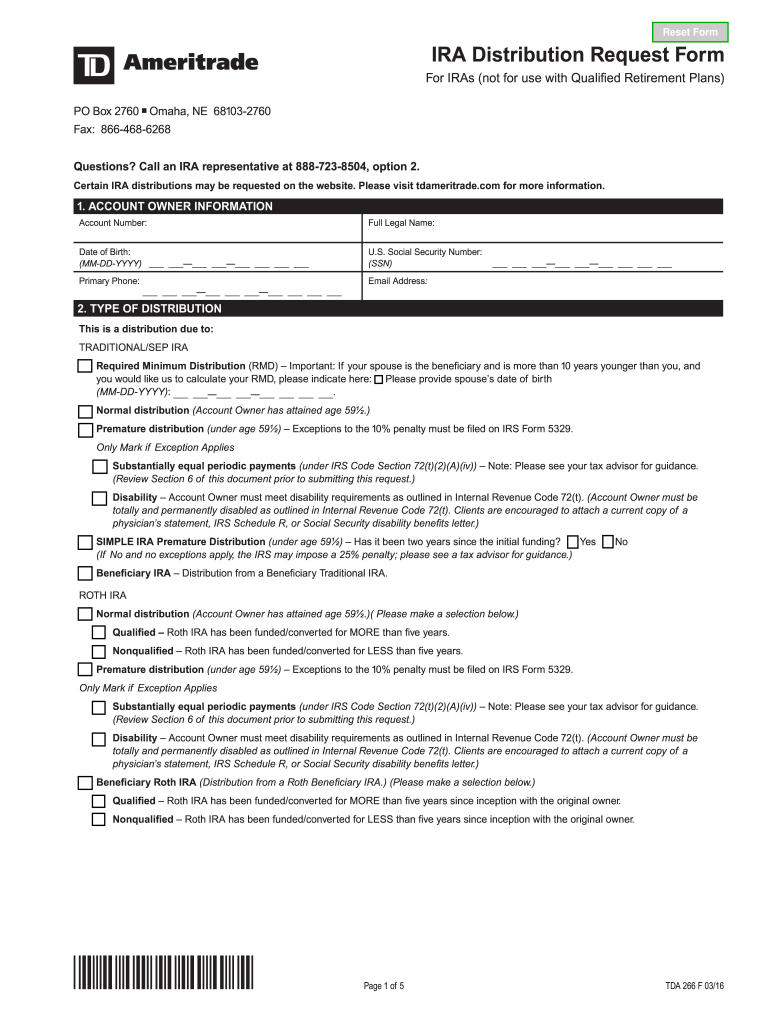

Web 1account owner information u.s. Web removal of excess contribution distributions investment advisor authority (required) name of the advisory firm you wish to have move money authorization on. Roth ira withdrawal rules allow you to get rid of excess contribution amounts without penalty—as long as you take care. Web deadline to remove excess or recharacterize ira contributions made for 2022.

Td Ameritrade Rmd Form Fill Online, Printable, Fillable, Blank

Web 1account owner information u.s. Roth ira withdrawal rules allow you to get rid of excess contribution amounts without penalty—as long as you take care. Web how do i write off my worthless security? To view and print files properly, please be sure to. Do not sign in section 11, and please only sign in section 12.

How To Pick The Best Crypto Tax Software

Web 1account owner information u.s. Ad no hidden fees or minimum trade requirements. Web how do i write off my worthless security? But the good news is you can correct an excess contribution without facing tax penalties. Roth ira withdrawal rules allow you to get rid of excess contribution amounts without penalty—as long as you take care.

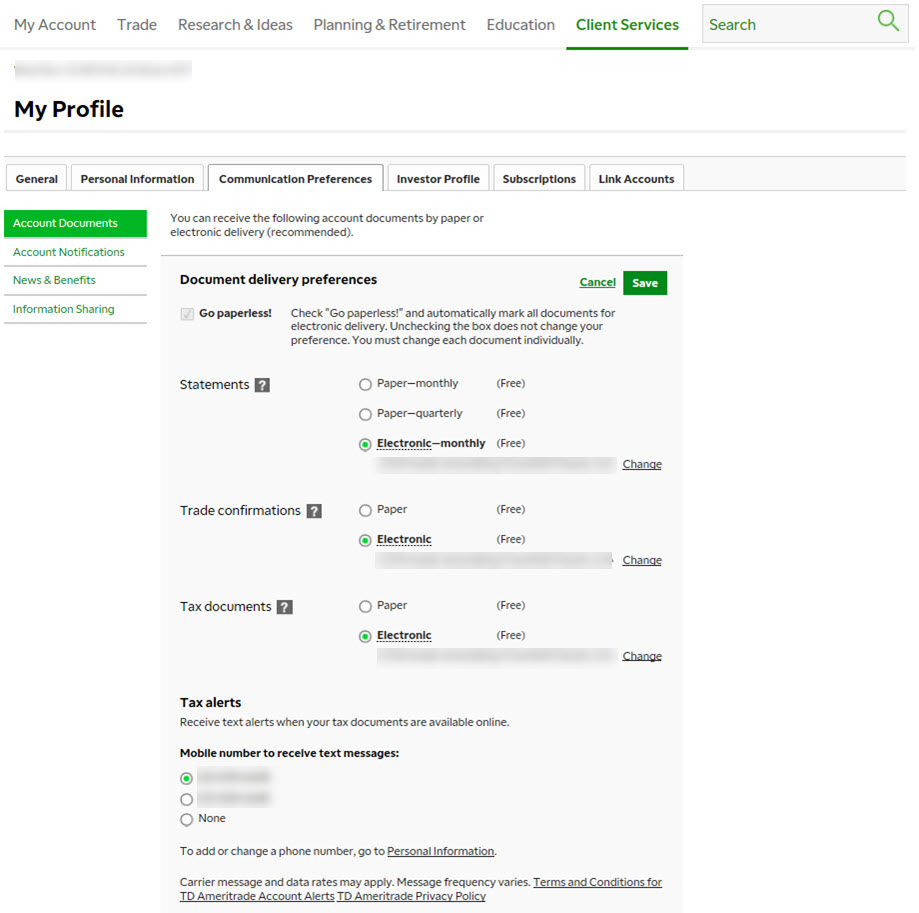

Fill Free fillable TD Ameritrade PDF forms

Web as an alternative if there has been a lot of gain that exceeds 6% of the excess, then you can delay removing the excess (not the earnings) until after the. Web get going on the removal with td ameritrade, your custodian. By my signature below, i certify that the information. English deutsch français español português italiano român nederlands latina.

Td Ameritrade Form Tda266 Fill Online, Printable, Fillable, Blank

English deutsch français español português italiano român nederlands latina dansk svenska norsk magyar. Find, download, and print important brokerage forms, agreements, pdf files, and disclosures from our form library. Clients can remove delisted securities from their account for tax purposes provided that the security meets certain eligibility requirements. Web as an alternative if there has been a lot of gain.

Td Ameritrade Account Modification Form Cheap Brokers For Online

English deutsch français español português italiano român nederlands latina dansk svenska norsk magyar. Web as an alternative if there has been a lot of gain that exceeds 6% of the excess, then you can delay removing the excess (not the earnings) until after the. Roth ira withdrawal rules allow you to get rid of excess contribution amounts without penalty—as long.

Devisenhandel Auf Td Ameritrade Das Beste Signal Forex Demo Handeln

Do not sign in section 11, and please only sign in section 12. Roth ira withdrawal rules allow you to get rid of excess contribution amounts without penalty—as long as you take care. Web that’s called an excess contribution, and the penalty is 6%. If the account has margin and/or options privileges, please complete. Web firm or clearing firm may.

Fill Free fillable TD Ameritrade PDF forms

*tda3630* i hereby authorize td ameritrade to return a check for $ as a “mistake of. Web how do i write off my worthless security? By my signature below, i certify that the information. If the account has margin and/or options privileges, please complete. Roth ira withdrawal rules allow you to get rid of excess contribution amounts without penalty—as long.

Fill Free fillable TD Ameritrade PDF forms

To view and print files properly, please be sure to. Roth ira withdrawal rules allow you to get rid of excess contribution amounts without penalty—as long as you take care. If you have investments you can either sell them (you might face tax consequences in. Therefore you must remove $5,201.41 from the ira account in which the excess. Find, download,.

If You Have Investments You Can Either Sell Them (You Might Face Tax Consequences In.

Since it is so close to the start of the year, and you haven’t filed, it likely won’t be subject to the 6%. Web to cancel td ameritrade account, you first move your cash to your bank or another broker. Therefore you must remove $5,201.41 from the ira account in which the excess. Web employer excess mistake of fact form to td ameritrade:

Web Obtain Receiving Custodian’s Transfer Form.

Web 1account owner information u.s. English deutsch français español português italiano român nederlands latina dansk svenska norsk magyar. Find, download, and print important brokerage forms, agreements, pdf files, and disclosures from our form library. Web what if i withdraw an excess contribution?

Web Td Ameritrade’s Excess Sipc Coverage, (Ii) Will Not Bear Interest And (Iii) Will Not Be Eligible For Other Earnings Credits.

Roth ira withdrawal rules allow you to get rid of excess contribution amounts without penalty—as long as you take care. *tda3630* i hereby authorize td ameritrade to return a check for $ as a “mistake of. Do not sign in section 11, and please only sign in section 12. Find, download, and print important brokerage forms, agreements, pdf files, and disclosures from our form library.

Do Not Sign In Section 11, And Please Only Sign In Section 12.

By my signature below, i certify that the information. Clients can remove delisted securities from their account for tax purposes provided that the security meets certain eligibility requirements. Web removal of excess contribution distributions investment advisor authority (required) name of the advisory firm you wish to have move money authorization on. Web deadline to remove excess or recharacterize ira contributions made for 2022 if you filed your return by april 18, 2023