Tax Form For Charitable Donations

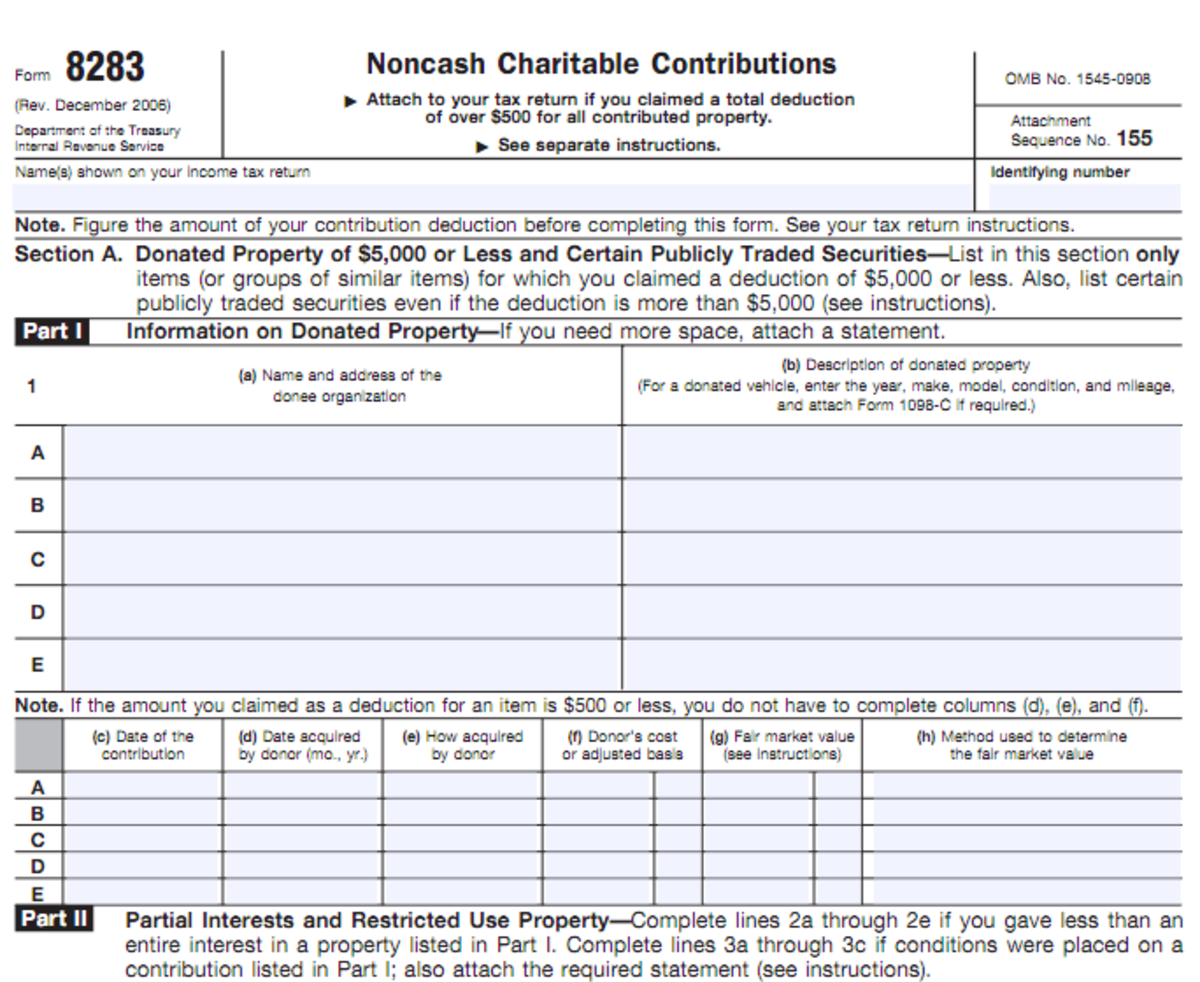

Tax Form For Charitable Donations - Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of. Not only does the charity benefit, but taxpayers enjoy tax savings by deducting part or all of their. Web to claim a deduction for charitable donations on your taxes, you must have received nothing in return for your gift, and you must itemize on your tax return by filing schedule a of irs form 1040. Key takeaways the irs allows taxpayers to deduct donations of cash and property to. If you claim a deduction of more than $500, but not more than $5,000 per item (or a group of similar items), you must fill out form 8283, section a. Web in most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized deduction is limited to a percentage (usually 60 percent) of the taxpayer’s adjusted gross income (agi). The irs requires donors that donated at least $250 must file include bank records or written receipts from the nonprofit. To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions, use tax exempt organization search. Web what charitable donation tax forms do your donors need?

Web you must fill out one or more forms 8283, noncash charitable contributions and attach them to your return, if your deduction for each noncash contribution is more than $500. Web what charitable donation tax forms do your donors need? Not only does the charity benefit, but taxpayers enjoy tax savings by deducting part or all of their. Web in most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized deduction is limited to a percentage (usually 60 percent) of the taxpayer’s adjusted gross income (agi). Taxpayers who have a specific charity in mind can make sure that it is an eligible charity by doing a search on irs.gov. Donors must receive these receipts by the time they file their taxes or the due date of their return. Key takeaways the irs allows taxpayers to deduct donations of cash and property to. Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Each donation type requires different information. Qualified contributions are not subject to this limitation.

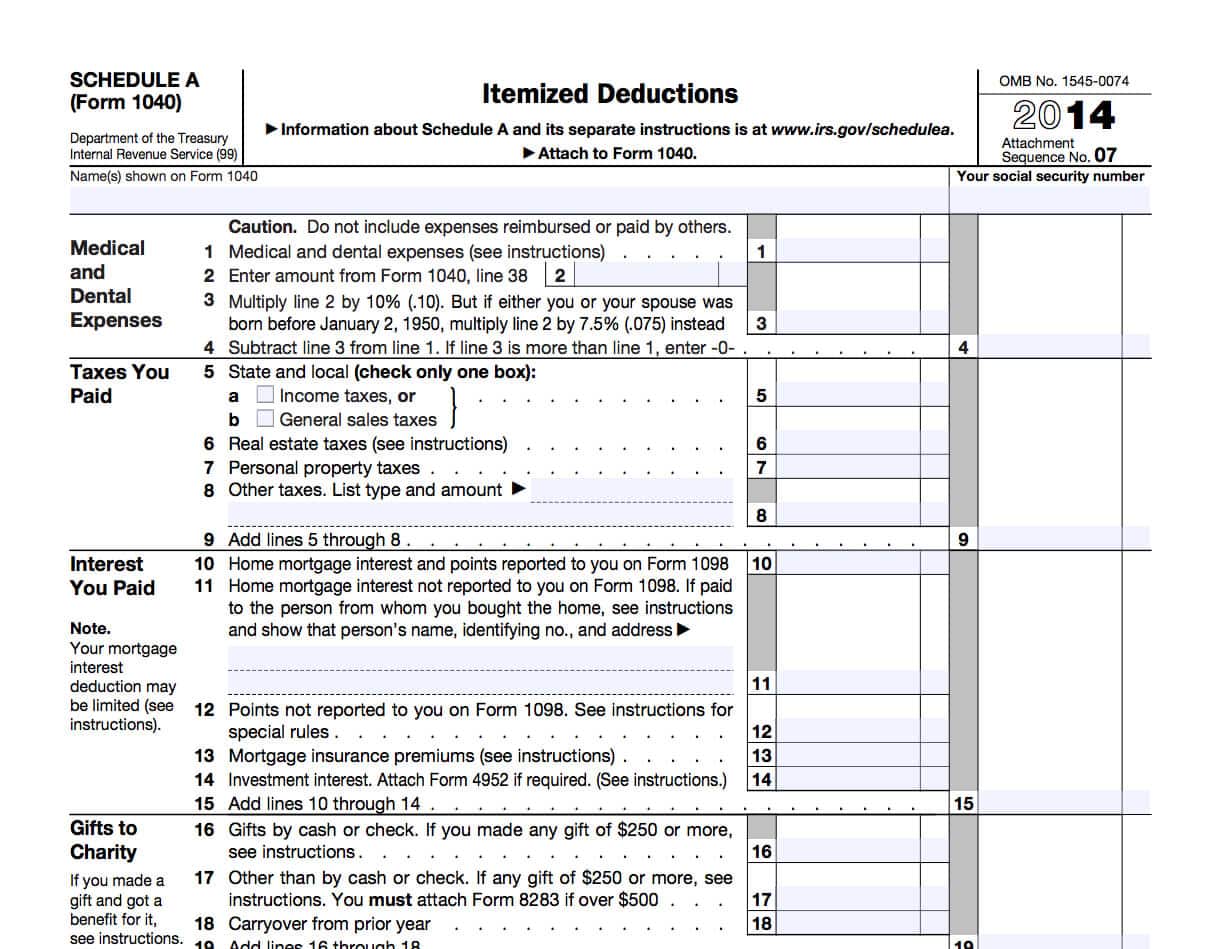

Web in most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized deduction is limited to a percentage (usually 60 percent) of the taxpayer’s adjusted gross income (agi). Qualified contributions are not subject to this limitation. Not only does the charity benefit, but taxpayers enjoy tax savings by deducting part or all of their. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Some organizations, such as churches or. Web to claim a deduction for charitable donations on your taxes, you must have received nothing in return for your gift, and you must itemize on your tax return by filing schedule a of irs form 1040. Web charitable contributions to qualified organizations may be deductible if you itemize deductions on schedule a (form 1040), itemized deductions pdf. Each donation type requires different information. Web what charitable donation tax forms do your donors need? To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions, use tax exempt organization search.

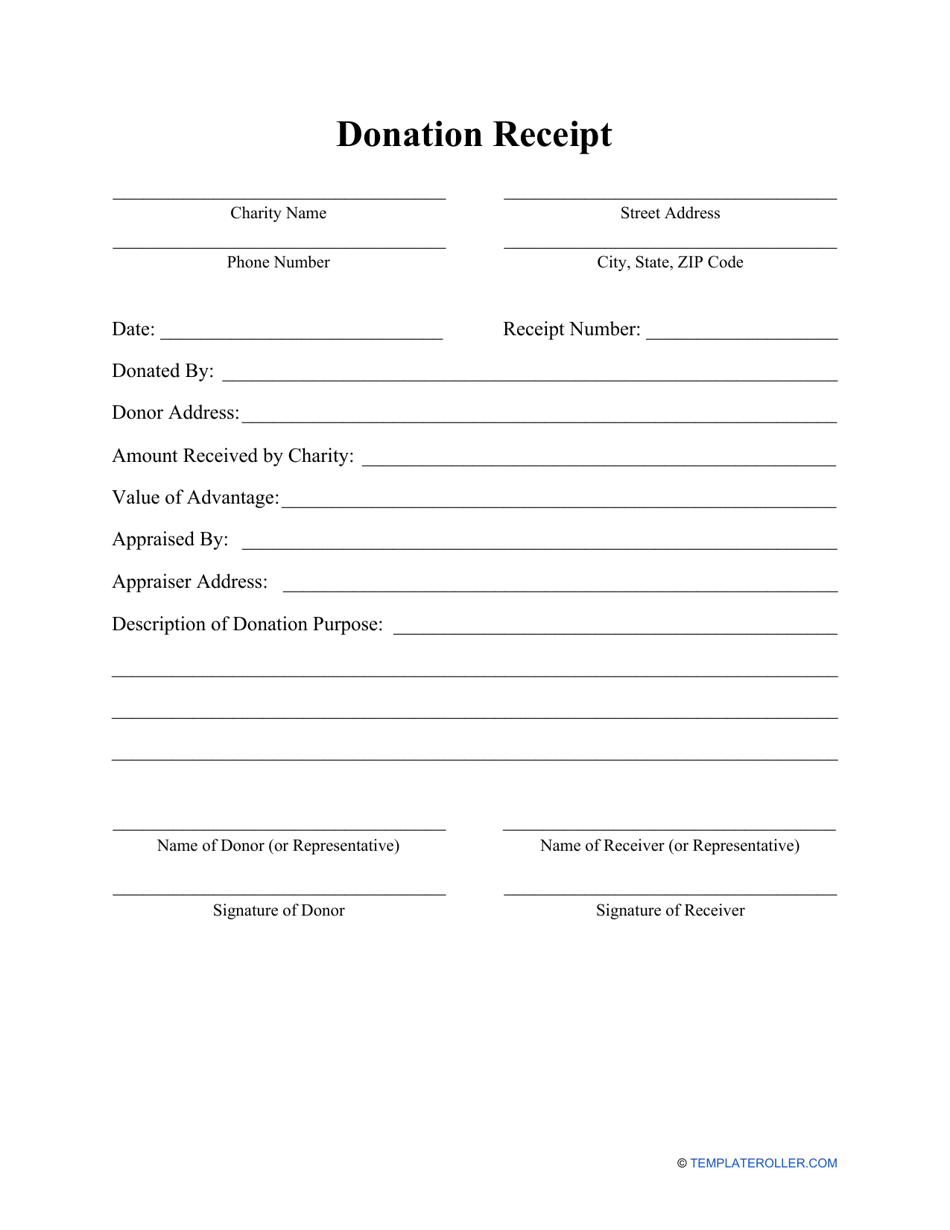

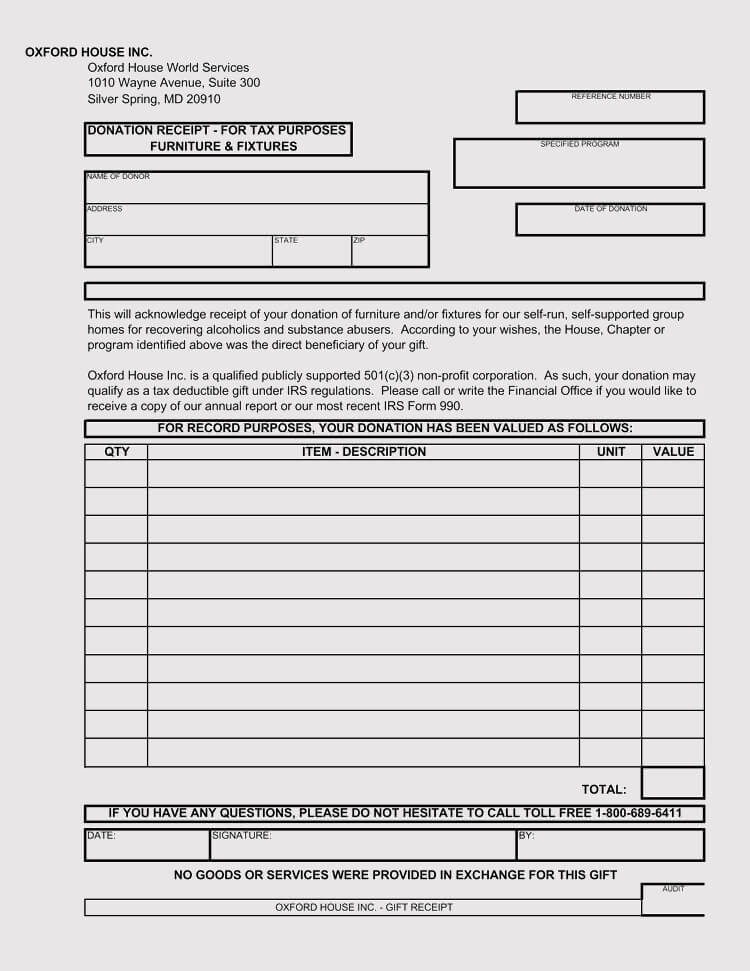

Donation Tax Receipt Template Inspirational 10 Donation Receipt

Web charitable contributions to qualified organizations may be deductible if you itemize deductions on schedule a (form 1040), itemized deductions pdf. Web what charitable donation tax forms do your donors need? Taxpayers who have a specific charity in mind can make sure that it is an eligible charity by doing a search on irs.gov. Not only does the charity benefit,.

Charitable Donation Spreadsheet within Charitable Donation Worksheet

Qualified contributions are not subject to this limitation. Web in most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized deduction is limited to a percentage (usually 60 percent) of the taxpayer’s adjusted gross income (agi). To see if the organization you have contributed to qualifies as a charitable organization for income tax.

Tax Deductions Tip Charitable Donations Small Business Accounting Blog

Key takeaways the irs allows taxpayers to deduct donations of cash and property to. Donors must receive these receipts by the time they file their taxes or the due date of their return. Each donation type requires different information. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the.

Donation Receipt Template Download Printable PDF Templateroller

Donors must receive these receipts by the time they file their taxes or the due date of their return. Web updated june 03, 2022 a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Each donation type requires different information. Web charitable contributions to qualified organizations.

Charitable Donation Spreadsheet throughout Charitable Donation

Web to claim a deduction for charitable donations on your taxes, you must have received nothing in return for your gift, and you must itemize on your tax return by filing schedule a of irs form 1040. Some organizations, such as churches or. Web updated june 03, 2022 a 501 (c) (3) donation receipt is required to be completed by.

How to Get a Clothing Donation Tax Deduction hubpages

Each donation type requires different information. Qualified contributions are not subject to this limitation. Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. If you claim a deduction of more than $500, but not more than $5,000 per item (or a group of similar items), you must fill out form.

Charitable Contributions and How to Handle the Tax Deductions

Donors must receive these receipts by the time they file their taxes or the due date of their return. Web updated june 03, 2022 a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Qualified contributions are not subject to this limitation. Web information about form.

Addictionary

Not only does the charity benefit, but taxpayers enjoy tax savings by deducting part or all of their. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web what charitable donation tax forms do your donors need? Web to claim a deduction for.

45+ Free Donation Receipt Templates (501c3, NonProfit, Charity)

Web what charitable donation tax forms do your donors need? To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions, use tax exempt organization search. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Some.

Charitable Donation Worksheet Irs MBM Legal

Donors must receive these receipts by the time they file their taxes or the due date of their return. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Key takeaways the irs allows taxpayers to deduct donations of cash and property to. Web.

Web To Claim A Deduction For Charitable Donations On Your Taxes, You Must Have Received Nothing In Return For Your Gift, And You Must Itemize On Your Tax Return By Filing Schedule A Of Irs Form 1040.

Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Web in most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized deduction is limited to a percentage (usually 60 percent) of the taxpayer’s adjusted gross income (agi). It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web updated june 03, 2022 a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more.

Some Organizations, Such As Churches Or.

Taxpayers who have a specific charity in mind can make sure that it is an eligible charity by doing a search on irs.gov. If you claim a deduction of more than $500, but not more than $5,000 per item (or a group of similar items), you must fill out form 8283, section a. Each donation type requires different information. Donors must receive these receipts by the time they file their taxes or the due date of their return.

Form 8283 Is Used To Claim A Deduction For A Charitable Contribution Of Property Or Similar Items Of Property, The Claimed Value Of.

Not only does the charity benefit, but taxpayers enjoy tax savings by deducting part or all of their. Qualified contributions are not subject to this limitation. Key takeaways the irs allows taxpayers to deduct donations of cash and property to. To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions, use tax exempt organization search.

The Irs Requires Donors That Donated At Least $250 Must File Include Bank Records Or Written Receipts From The Nonprofit.

Web you must fill out one or more forms 8283, noncash charitable contributions and attach them to your return, if your deduction for each noncash contribution is more than $500. Web what charitable donation tax forms do your donors need? Web charitable contributions to qualified organizations may be deductible if you itemize deductions on schedule a (form 1040), itemized deductions pdf.