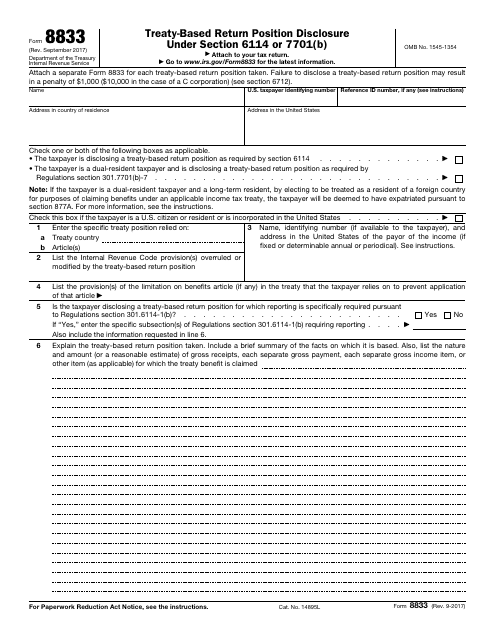

Tax Form 8833

Tax Form 8833 - You claim a reduction or modification in the taxation of gain or loss from the disposition of a. Ad access irs tax forms. Check your federal tax withholding. Get answers to your tax questions. Taxpayers may have the option of filing irs form 8833 to pay federal taxes at a reduced rate than they otherwise would pay under u.s. The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return. Web what is form 8833? A reduction or modification in the taxation of gain or loss from the disposition of a. Tax return and form 8833 if you claim the following treaty benefits. Web the payee must file a u.s.

Web in some cases, u.s. Check your federal tax withholding. The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return. Taxpayer wants to rely on an international tax treaty that the united states has entered into regarding tax law, sometimes they have to file an. Ad avalara avatax can help you automate sales tax rate calculation and filing preparation. Here’s a quick look at the information. If you are located in. Web form 8833 is used to show the irs that you’re applying a particular tax treaty position correctly. Get the benefit of tax research and calculation experts with avalara avatax software. You claim a reduction or modification in the taxation of gain or loss from the disposition of a.

Ad access irs tax forms. Web form 8833 is used to show the irs that you’re applying a particular tax treaty position correctly. Use this address if you are not enclosing a payment use this. A reduction or modification in the taxation of gain or loss from the disposition of a. Get the benefit of tax research and calculation experts with avalara avatax software. Ad avalara avatax can help you automate sales tax rate calculation and filing preparation. If you are located in. Address to mail form to irs: Don't miss this 50% discount. The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return.

IRS Form 8833 Download Fillable PDF or Fill Online TreatyBased Return

Web the payee must file a u.s. The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return. For more information about identifying numbers, see the. Web get your refund status. Web form 8833 is used to show the irs that you’re applying a particular.

Form 8833 & Tax Treaties Understanding Your US Tax Return

Use this address if you are not enclosing a payment use this. Web you must file a u.s. You claim a reduction or modification in the taxation of gain or loss from the disposition of a. Ad access irs tax forms. File your 2290 tax now and receive schedule 1 in minutes.

Form 8833 & Tax Treaties Understanding Your US Tax Return

Web the payee must file a u.s. Tax return and form 8833 if you claim the following treaty benefits. Ad avalara avatax can help you automate sales tax rate calculation and filing preparation. Address to mail form to irs: The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833.

U.S. Tax Form 8833 Guidelines Expat US Tax

A reduction or modification in the taxation of gain or loss from the disposition of a. Use this address if you are not enclosing a payment use this. Tax return and form 8833 if you claim the following treaty benefits. Web get your refund status. Complete, edit or print tax forms instantly.

Form 8833 TreatyBased Return Position Disclosure under Section 6114

Address to mail form to irs: You claim a reduction or modification in the taxation of gain or loss from the disposition of a. Taxpayers may have the option of filing irs form 8833 to pay federal taxes at a reduced rate than they otherwise would pay under u.s. Get answers to your tax questions. Check your federal tax withholding.

Form 8833, TreatyBased Return Position Disclosure Under Section 6114

Web what is form 8833? You claim a reduction or modification in the taxation of gain or loss from the disposition of a. Web get your refund status. Don't miss this 50% discount. The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return.

Tax Treaty Benefits & Form 8833 What You Need to Know (From a CPA!)

Ad access irs tax forms. Web you must file a u.s. Here’s a quick look at the information. Tax return and form 8833 if claiming the following treaty benefits: Don't miss this 50% discount.

Form 8833 PDF Samples for Online Tax Managing

Tax return and form 8833 if claiming the following treaty benefits: Taxpayers may have the option of filing irs form 8833 to pay federal taxes at a reduced rate than they otherwise would pay under u.s. Web you must file a u.s. The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit.

Form 8833 TreatyBased Return Position Disclosure under Section 6114

Get the benefit of tax research and calculation experts with avalara avatax software. Tax return and form 8833 if you claim the following treaty benefits. If you are located in. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. A reduction or modification in the taxation of gain or loss from the disposition of a.

Video Form 8833 Tax Treaty Disclosure US Global Tax

Address to mail form to irs: Don't miss this 50% discount. Check your federal tax withholding. Get answers to your tax questions. Taxpayers may have the option of filing irs form 8833 to pay federal taxes at a reduced rate than they otherwise would pay under u.s.

If You Are Located In.

Get the benefit of tax research and calculation experts with avalara avatax software. Taxpayer wants to rely on an international tax treaty that the united states has entered into regarding tax law, sometimes they have to file an. Web the payee must file a u.s. Web to claim treaty benefits on your tax return, you must file form 8833 to the irs each tax year with your annual filing.

Web You Must File A U.s.

Address to mail form to irs: Tax return and form 8833 if claiming the following treaty benefits: Taxpayers may have the option of filing irs form 8833 to pay federal taxes at a reduced rate than they otherwise would pay under u.s. Web form 8833 is used to show the irs that you’re applying a particular tax treaty position correctly.

Ad Access Irs Tax Forms.

The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return. Ad avalara avatax can help you automate sales tax rate calculation and filing preparation. Use this address if you are not enclosing a payment use this. Web in some cases, u.s.

Web Get Your Refund Status.

Web what is form 8833? Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Tax return and form 8833 if you claim the following treaty benefits. Check your federal tax withholding.