Tax Form 8815

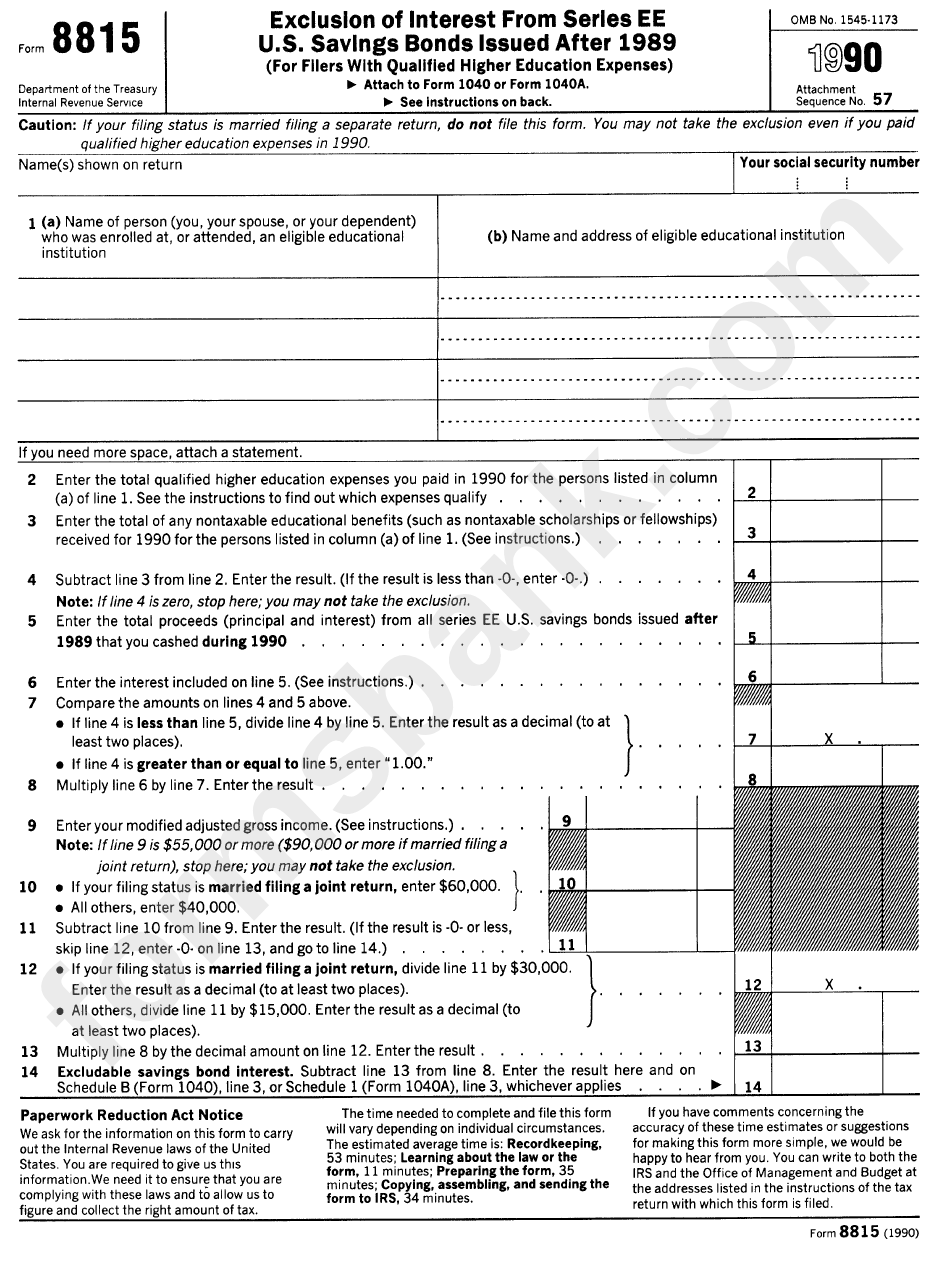

Tax Form 8815 - Web individual income tax forms. File and pay your taxes online. To access form 8815 exclusion of interest from series ee and i u.s. Savings bonds the taxpayer can exclude interest income from series ee and series i us savings. If using a private delivery service, send your returns to the street address above for the submission processing center. Savings bonds issued after 1989 (for filers with qualified higher. If you checked the box on line 2, send form 8822 to:. Web this number typically increases each year and irs form 8815 shows each year’s exclusion. If you meet all the conditions, fill out irs form 8815 and submit it with your tax return. You were already age 24 or older before your savings bonds were issued.

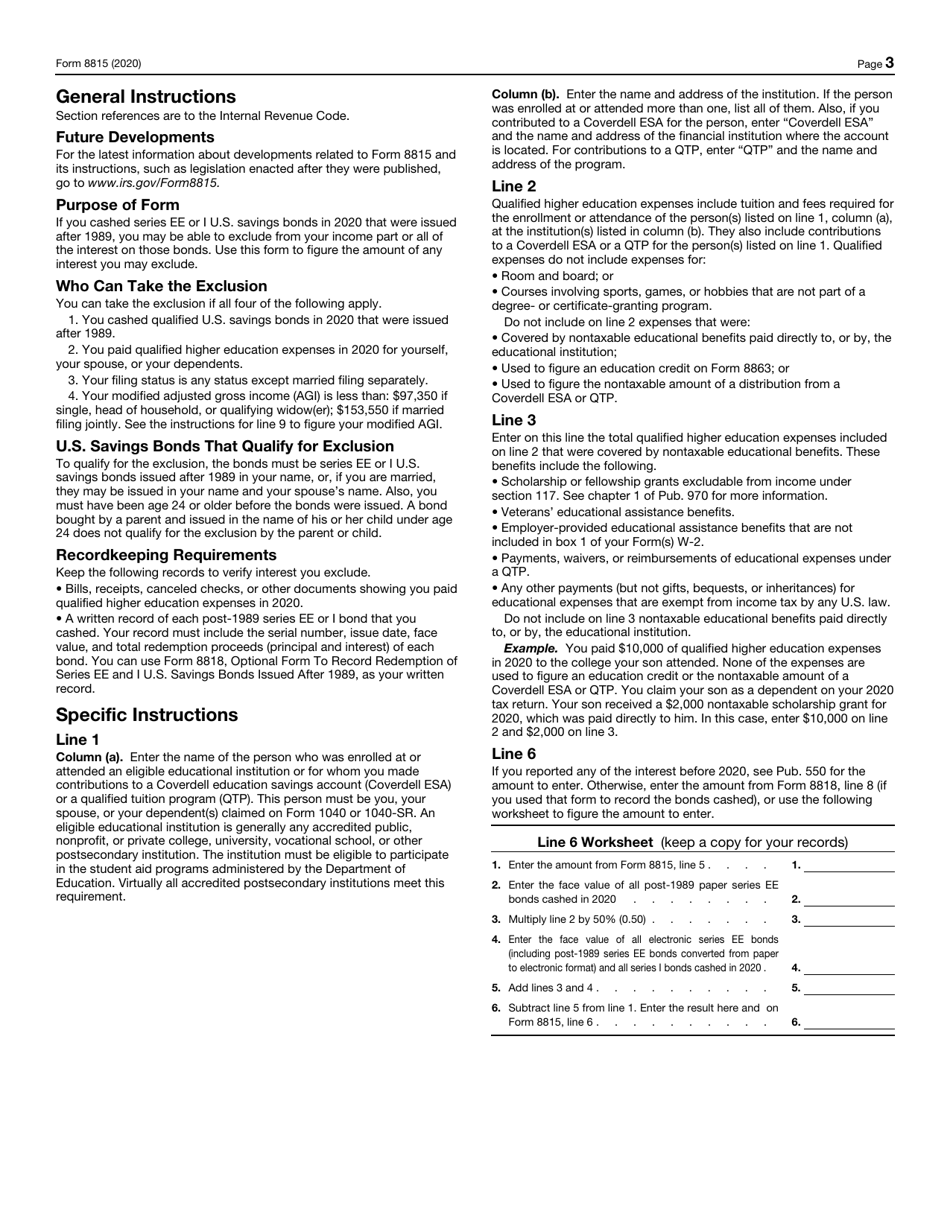

Web schedule b (form 1040), line 3, or schedule 1 (form 1040a), line 3, whichever applies' 14 cat. Web if you cashed series ee or i u.s. To access form 8815 exclusion of interest from series ee and i u.s. File and pay your taxes online. Savings bonds issued after 1989. Web specific instructions line 1 column (a). For example, the form 1040 page is at. Savings bonds issued after 1989 (for filers with qualified higher. Complete, edit or print tax forms instantly. Savings bonds issued after 1989 (for filers with.

For example, the form 1040 page is at. Savings bonds the taxpayer can exclude interest income from series ee and series i us savings. Complete, edit or print tax forms instantly. Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and i. Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and i u.s. You were already age 24 or older before your savings bonds were issued. Savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on. If you checked the box on line 2, send form 8822 to:. Web this number typically increases each year and irs form 8815 shows each year’s exclusion. Web irs form 8815 gives details and instructions.

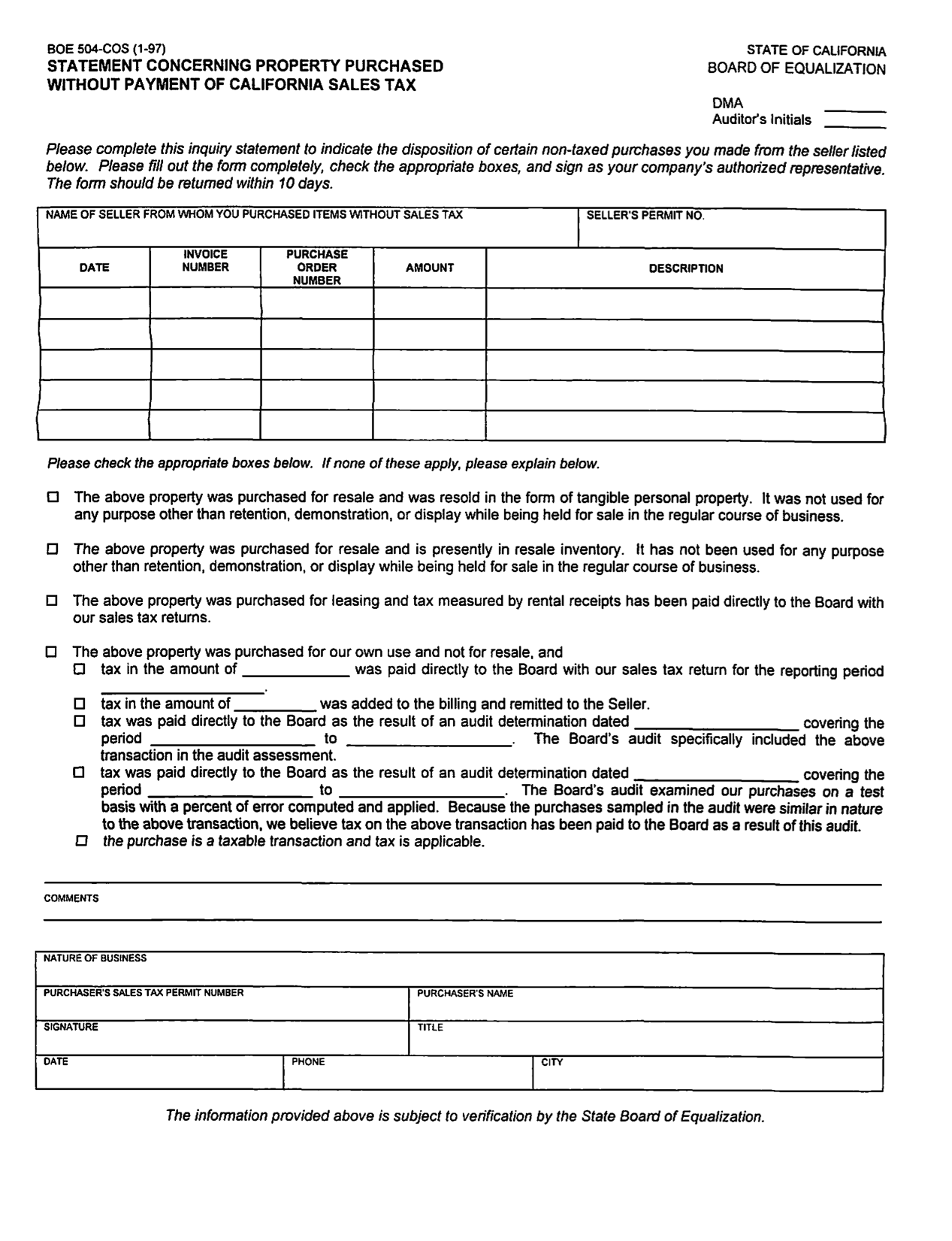

Rondam Ramblings California sales tax fail

Web instructions, and pubs is at irs.gov/forms. To access form 8815 exclusion of interest from series ee and i u.s. Web 1973 rulon white blvd. Web specific instructions line 1 column (a). Complete, edit or print tax forms instantly.

Form 8815 Exclusion of Interest From Series EE and I U.S. Savings

I'd like to exclude some us savings bond. Web posted june 4, 2019 5:28 pm last updated june 04, 2019 5:28 pm is there a place or way to complete form 8815 in turbo tax premier? Savings bonds issued after 1989 (for filers with. How do i get the tax exclusion? If using a private delivery service, send your returns.

BMW M3 Competition xDrive Tax Free Military Sales in Wuerzburg Price

Complete, edit or print tax forms instantly. Savings bonds the taxpayer can exclude interest income from series ee and series i us savings. If using a private delivery service, send your returns to the street address above for the submission processing center. Enter the name of the person who was enrolled at or attended an eligible educational institution or for.

Form 8815 Exclusion of Interest From Series EE and I U.S. Savings

Enter the name of the person who was enrolled at or attended an eligible educational institution or for whom you made contributions. Web posted june 4, 2019 5:28 pm last updated june 04, 2019 5:28 pm is there a place or way to complete form 8815 in turbo tax premier? To access form 8815 exclusion of interest from series ee.

2016 Form 8815 Edit, Fill, Sign Online Handypdf

Enter the name of the person who was enrolled at or attended an eligible educational institution or for whom you made contributions. Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and i u.s. File and pay your taxes online. For example, the form 1040 page is at. If you meet all.

IRS Form 8815 Download Fillable PDF or Fill Online Exclusion of

Complete, edit or print tax forms instantly. Savings bonds the taxpayer can exclude interest income from series ee and series i us savings. If you checked the box on line 2, send form 8822 to:. Web this number typically increases each year and irs form 8815 shows each year’s exclusion. Web schedule b (form 1040), line 3, or schedule 1.

Form 8815 Exclusion of Interest From Series EE and I U.S. Savings

For example, the form 1040 page is at. Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. Savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on. To access form 8815 exclusion of interest from series ee and.

Using I bonds for education savings / About Form 8815, Exclusion of

Web specific instructions line 1 column (a). You were already age 24 or older before your savings bonds were issued. Ad download or email irs 8815 & more fillable forms, register and subscribe now! Web this number typically increases each year and irs form 8815 shows each year’s exclusion. If you meet all the conditions, fill out irs form 8815.

Form 8815 Exclusion Of Interest printable pdf download

If you meet all the conditions, fill out irs form 8815 and submit it with your tax return. You were already age 24 or older before your savings bonds were issued. To access form 8815 exclusion of interest from series ee and i u.s. Savings bonds issued after 1989. Web this number typically increases each year and irs form 8815.

IRS 8815 2015 Fill out Tax Template Online US Legal Forms

Download or email irs 8815 & more fillable forms, register and subscribe now! Almost every form and publication has a page on irs.gov with a friendly shortcut. How do i get the tax exclusion? Web schedule b (form 1040), line 3, or schedule 1 (form 1040a), line 3, whichever applies' 14 cat. You were already age 24 or older before.

Web Individual Income Tax Forms.

File and pay your taxes online. Savings bonds issued after 1989. Enter the name of the person who was enrolled at or attended an eligible educational institution or for whom you made contributions. Savings bonds the taxpayer can exclude interest income from series ee and series i us savings.

Savings Bonds Issued After 1989 (For Filers With.

You were already age 24 or older before your savings bonds were issued. Web irs form 8815 gives details and instructions. Savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on. Savings bonds issued after 1989 (for filers with qualified higher.

Almost Every Form And Publication Has A Page On Irs.gov With A Friendly Shortcut.

10822s form 8815(2007) purpose of form 1. If you meet all the conditions, fill out irs form 8815 and submit it with your tax return. Web specific instructions line 1 column (a). Web schedule b (form 1040), line 3, or schedule 1 (form 1040a), line 3, whichever applies' 14 cat.

If Using A Private Delivery Service, Send Your Returns To The Street Address Above For The Submission Processing Center.

Ad download or email irs 8815 & more fillable forms, register and subscribe now! Web if you cashed series ee or i u.s. Download or email irs 8815 & more fillable forms, register and subscribe now! Web instructions, and pubs is at irs.gov/forms.