Tax Form 5695 Instructions

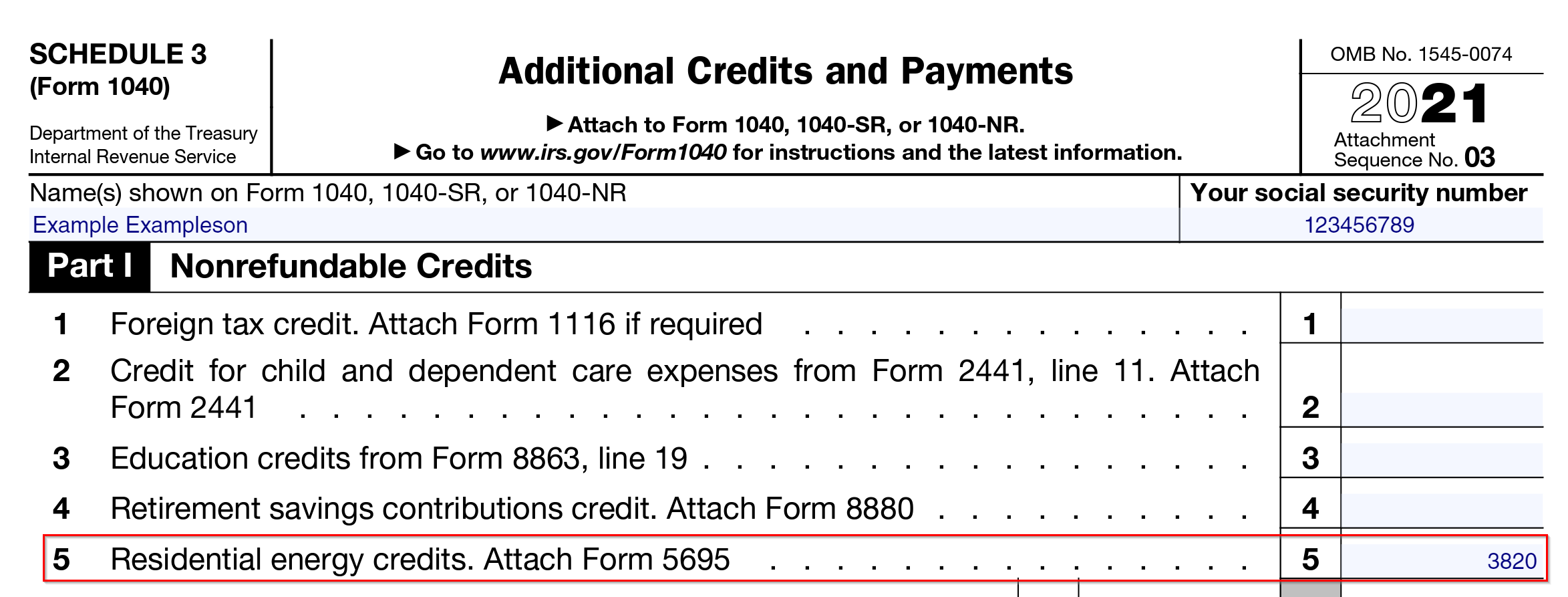

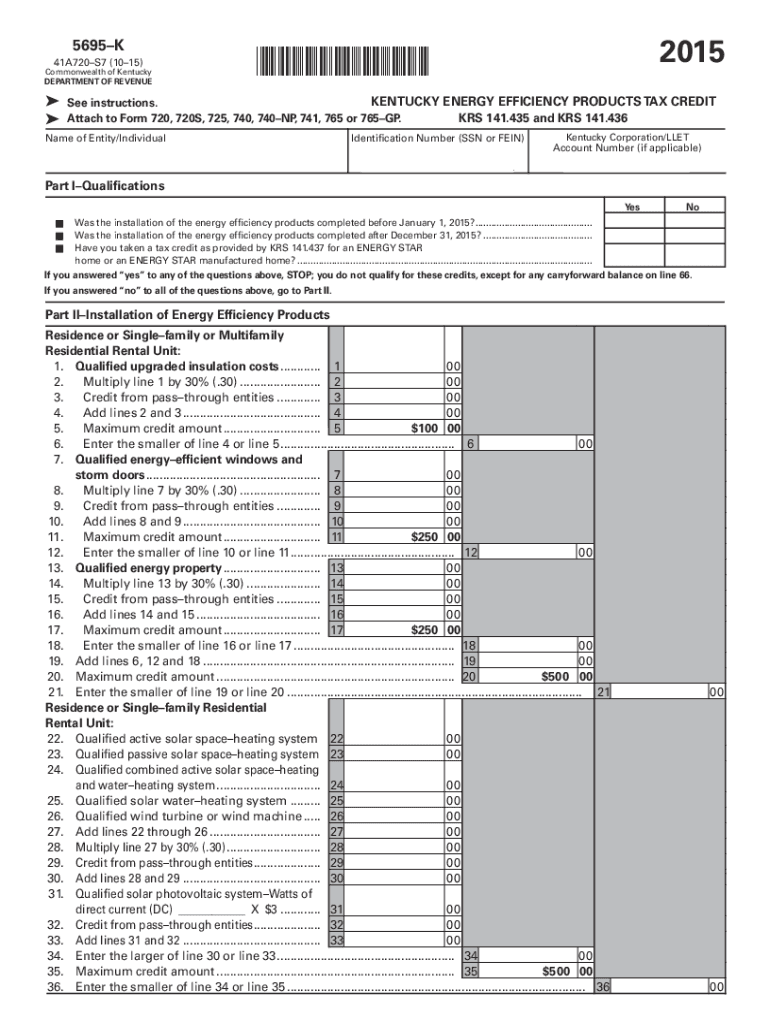

Tax Form 5695 Instructions - Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. Web on line 14, you will need to enter the credit limitation based on your tax liability. Also use form 5695 to take any residential energy efficient property credit. • the residential energy efficient property credit, and. Web per irs instructions for form 5695, page 1: Residential energy property credit (section 25d) through 2019, taxpayers. Use form 5695 to figure and take your residential energy credits. The residential energy credits are: Web purpose of form use form 5695 to figure and take your residential energy credits. The residential energy credits are:

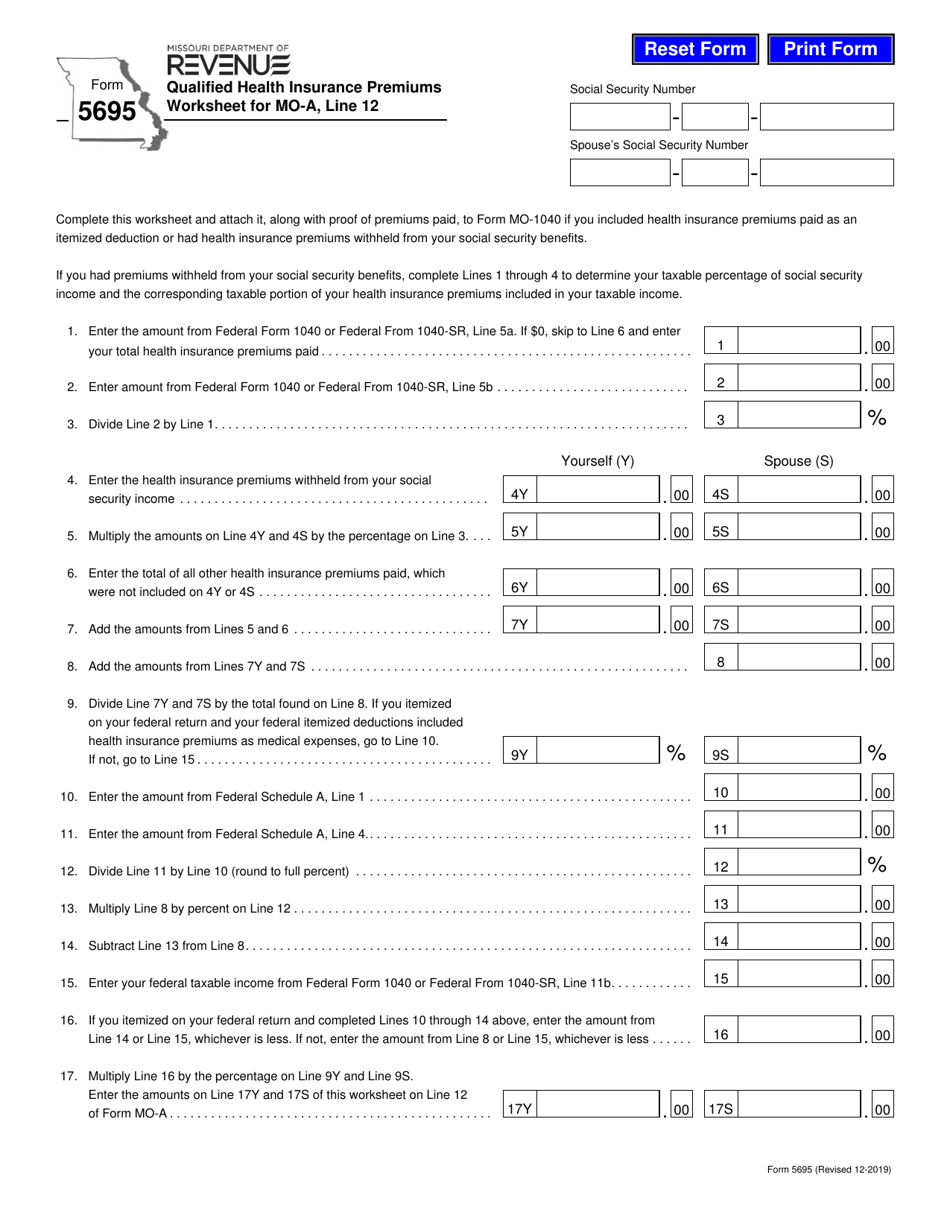

• the residential clean energy credit, and • the. Web we last updated the residential energy credits in december 2022, so this is the latest version of form 5695, fully updated for tax year 2022. You can download or print current. Web purpose of form use form 5695 to figure and take the residential energy efficient property credit. Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. Web on line 14, you will need to enter the credit limitation based on your tax liability. Also use form 5695 to take any residential energy efficient property credit. The form 5695 instructions include a worksheet on page 4 to help you make the necessary. This form is for income. Keywords relevant to mo form 5695 missouri.

Web the instructions give taxpayers additional information regarding eligibility for the credit. Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. Web more about the federal form 5695 tax credit. Keywords relevant to mo form 5695 missouri. • the residential energy efficient property credit, and • the. The residential energy credits are: • the residential energy efficient property credit, and. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Web purpose of form use form 5695 to figure and take your residential energy credits. Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

We last updated federal form 5695 in december 2022 from the federal internal revenue service. Use form 5695 to figure and take your residential energy credits. Web the instructions give taxpayers additional information regarding eligibility for the credit. The residential energy credits are: Use form 5695 to figure and take.

Energy Efficient Home Improvement Tax Credit 2018 Home Improvement

• the residential energy efficient property credit, and • the. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Web the instructions give taxpayers additional information regarding eligibility for the credit. Web purpose of form use form 5695 to figure and take the residential energy efficient property credit. Residential energy.

How to Claim the Federal Solar Tax Credit Form 5695 Instructions

Web more about the federal form 5695 tax credit. Web purpose of form use form 5695 to figure and take your residential energy credits. • the residential energy efficient property credit, and. Web up to $40 cash back сomplete the missouri tax form 5695 for free get started! Web on line 14, you will need to enter the credit limitation.

Form 5695 Instructions & Information on IRS Form 5695

Purpose of form use form 5695 to figure and take your residential energy credits. Web general instructions future developments for the latest information about developments related to form 5695 and its instructions, such as legislation enacted after they were. Web use form 5695 to figure and take your residential energy credits. The residential energy efficient property credit, and the. You.

Form 5695 Download Fillable PDF or Fill Online Qualified Health

The residential energy credits are: Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. The form 5695 instructions include a worksheet on page 4 to help you make the necessary. Residential energy property credit (section 25d) through 2019, taxpayers. You can download or print current.

2020 Form 5695 Instructions Fill Out and Sign Printable PDF Template

Web purpose of form use form 5695 to figure and take your residential energy credits. Purpose of form use form 5695 to figure and take your residential energy credits. We last updated federal form 5695 in december 2022 from the federal internal revenue service. Web use form 5695 to figure and take your residential energy credits. The residential energy credits.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Web use form 5695 to figure and take your residential energy credits. Also use form 5695 to take any residential energy efficient property credit. The residential energy efficient property credit, and the. We last updated federal form 5695 in december.

How to Claim the Federal Solar Investment Tax Credit Solar Sam

Web purpose of form use form 5695 to figure and take your residential energy credits. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Rate free missouri form 5695. We last updated federal form 5695 in december 2022 from the federal internal revenue service. The form 5695 instructions include a.

Tax 2022 Irs Latest News Update

The residential energy credits are: • the residential energy efficient property credit, and • the. Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. The residential energy credits are: The residential energy credits are:

Tax Form 5695 by AscendWorks Issuu

The residential energy credits are: This form is for income. Web general instructions future developments for the latest information about developments related to form 5695 and its instructions, such as legislation enacted after they were. We last updated federal form 5695 in december 2022 from the federal internal revenue service. Also use form 5695 to take any residential energy efficient.

The Residential Energy Efficient Property Credit, And The.

The residential energy credits are: • the residential energy efficient property credit, and • the. To add or remove this. Web purpose of form use form 5695 to figure and take your residential energy credits.

Web We Last Updated The Residential Energy Credits In December 2022, So This Is The Latest Version Of Form 5695, Fully Updated For Tax Year 2022.

Web general instructions future developments for the latest information about developments related to form 5695 and its instructions, such as legislation enacted after they were. Web purpose of form use form 5695 to figure and take your residential energy credits. Keywords relevant to mo form 5695 missouri. The residential energy credits are:

The Residential Energy Credits Are:

Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. • the residential clean energy credit, and • the. Web use form 5695 to figure and take your residential energy credits. • the residential energy efficient property credit, and.

Residential Energy Property Credit (Section 25D) Through 2019, Taxpayers.

The residential energy credits are: Rate free missouri form 5695. Also use form 5695 to take any residential energy efficient property credit. The residential energy credits are: