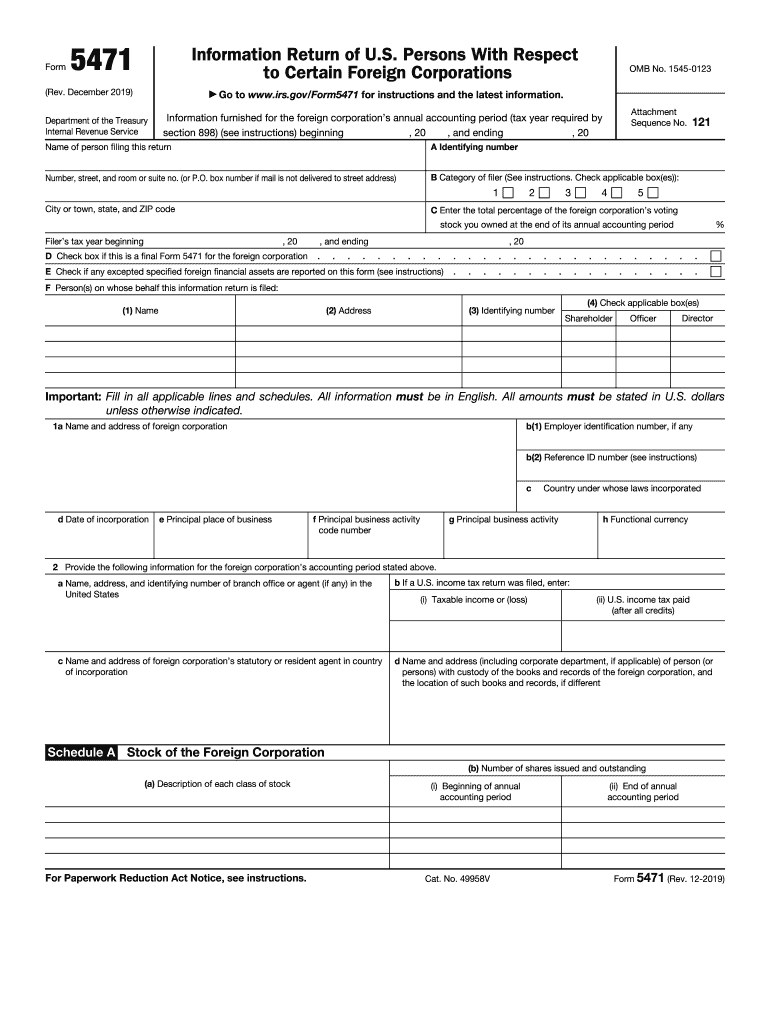

Tax Form 5471

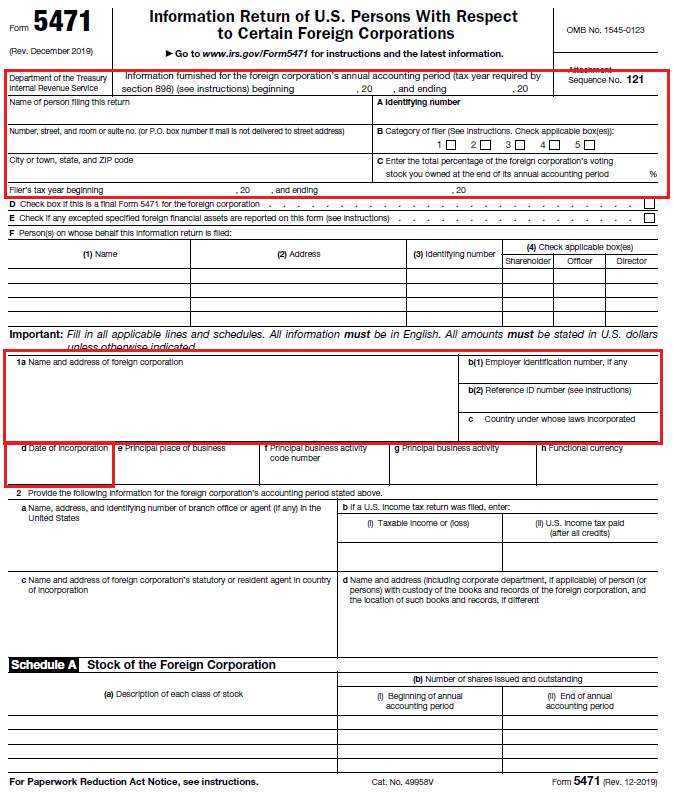

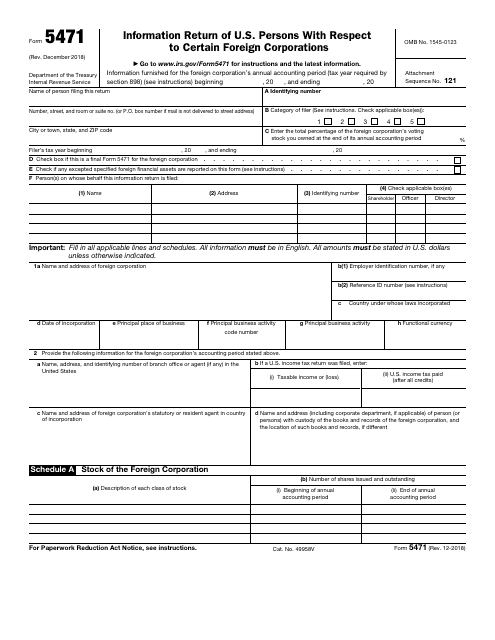

Tax Form 5471 - Web taxact supports form 5471 information return of u.s. Citizens/u.s residents who are shareholders, officers or directors. Web instructions for form 5471(rev. Web file your taxes for free. Web what is irs form 5471? Unlike a regular c corporation, the income of a foreign corporation. Citizens and residents who are officers, directors or shareholders in certain foreign corporations must file form 5471 as part of their expat tax return. Web failure to timely file a form 5471 or form 8865 is generally subject to a $10,000 penalty per information return, plus an additional $10,000 for each month the. Web form 5471 was significantly revised after the tax cuts and jobs act was enacted in 2017. The irs tax form 5471 is an information return (not tax return) required for u.s.

Persons with respect to certain foreign corporations. Web what is irs form 5471? Unlike a regular c corporation, the income of a foreign corporation. Web form 5471 is similar in some respects to the information return for a partnership, an s corporation or a trust. Web form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company transactions, foreign taxes, foreign bank and. December 2021) department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Web instructions for form 5471(rev. Web taxact supports form 5471 information return of u.s. Person filing form 8865, any required statements to qualify for the.

Web what is irs form 5471? The december 2021 revision of separate. Web employer's quarterly federal tax return. The irs tax form 5471 is an information return (not tax return) required for u.s. Web form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company transactions, foreign taxes, foreign bank and. Web instructions for form 5471(rev. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; At this time, we only support the creation and electronic filing of.

Demystifying the All New 2020 Tax Year IRS Form 5471 Schedule J SF

Web what is irs form 5471? Web taxact supports form 5471 information return of u.s. The irs tax form 5471 is an information return (not tax return) required for u.s. At this time, we only support the creation and electronic filing of. Web form 5471 was significantly revised after the tax cuts and jobs act was enacted in 2017.

IRS Form 5471 Carries Heavy Penalties and Consequences

Web failure to timely file a form 5471 or form 8865 is generally subject to a $10,000 penalty per information return, plus an additional $10,000 for each month the. Web for the latest information about developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to. Persons with respect to certain.

The Tax Times IRS Issues Updated New Form 5471 What's New?

Web taxact supports form 5471 information return of u.s. Web failure to timely file a form 5471 or form 8865 is generally subject to a $10,000 penalty per information return, plus an additional $10,000 for each month the. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web employer's quarterly federal tax return. Web.

What is a Dormant Foreign Corporation?

Web what is irs form 5471? Web form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company transactions, foreign taxes, foreign bank and. Web form 5471 is similar in some respects to the information return for a partnership, an s corporation or a trust. Web taxact supports form 5471 information return of u.s. The irs.

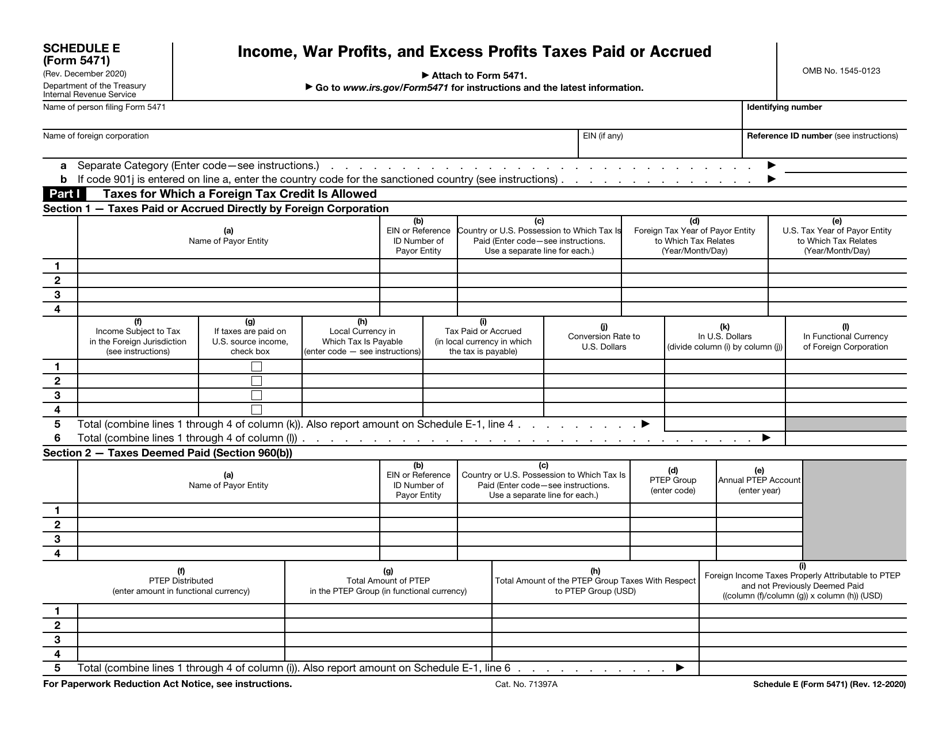

Demystifying the All New 2020 Tax Year IRS Form 5471 Schedule E

The irs tax form 5471 is an information return (not tax return) required for u.s. And we've made yearly updates based on regulatory guidance that's been issued since. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web for the latest information about developments related to form 5471, its schedules, and its instructions, such.

IRS Form 5471 Download Fillable PDF or Fill Online Information Return

Get ready for tax season deadlines by completing any required tax forms today. Persons with respect to certain foreign corporations. Web file your taxes for free. The december 2021 revision of separate. Person filing form 8865, any required statements to qualify for the.

Form 5471 Your US Expat Taxes and Reporting Requirements

The irs tax form 5471 is an information return (not tax return) required for u.s. Web form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company transactions, foreign taxes, foreign bank and. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web what is.

Demystifying the All New 2020 Tax Year IRS Form 5471 Schedule P

Citizens and residents who are officers, directors or shareholders in certain foreign corporations must file form 5471 as part of their expat tax return. Web attach form 5472 to the reporting corporation's income tax return and file where the corporation files its return. Sign in to your account. Complete, edit or print tax forms instantly. The irs tax form 5471.

Form 5471 2018 Fill out & sign online DocHub

January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web what is irs form 5471? At this time, we only support the creation and electronic filing of. Persons with respect to certain foreign corporations. Web file your taxes for free.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Get ready for tax season deadlines by completing any required tax forms today. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. The december 2021 revision of separate. Web form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company transactions, foreign taxes, foreign bank and. Web.

Person Filing Form 8865, Any Required Statements To Qualify For The.

And we've made yearly updates based on regulatory guidance that's been issued since. Web attach form 5472 to the reporting corporation's income tax return and file where the corporation files its return. Unlike a regular c corporation, the income of a foreign corporation. Get ready for tax season deadlines by completing any required tax forms today.

Web Irs Form 5471 Is A Tax Filing Document Used By Individuals In The United States About Money Or Stocks They Hold In Foreign Countries As A Result Of Foreign Business.

January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Persons with respect to certain foreign corporations. Web file your taxes for free. Sign in to your account.

Web For The Latest Information About Developments Related To Form 5471, Its Schedules, And Its Instructions, Such As Legislation Enacted After They Were Published, Go To.

Web failure to timely file a form 5471 or form 8865 is generally subject to a $10,000 penalty per information return, plus an additional $10,000 for each month the. Web instructions for form 5471(rev. The irs tax form 5471 is an information return (not tax return) required for u.s. Web form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company transactions, foreign taxes, foreign bank and.

At This Time, We Only Support The Creation And Electronic Filing Of.

Web employer's quarterly federal tax return. Web what is irs form 5471? Web form 5471 is similar in some respects to the information return for a partnership, an s corporation or a trust. Citizens and residents who are officers, directors or shareholders in certain foreign corporations must file form 5471 as part of their expat tax return.