Small Estate Affidavit Form California

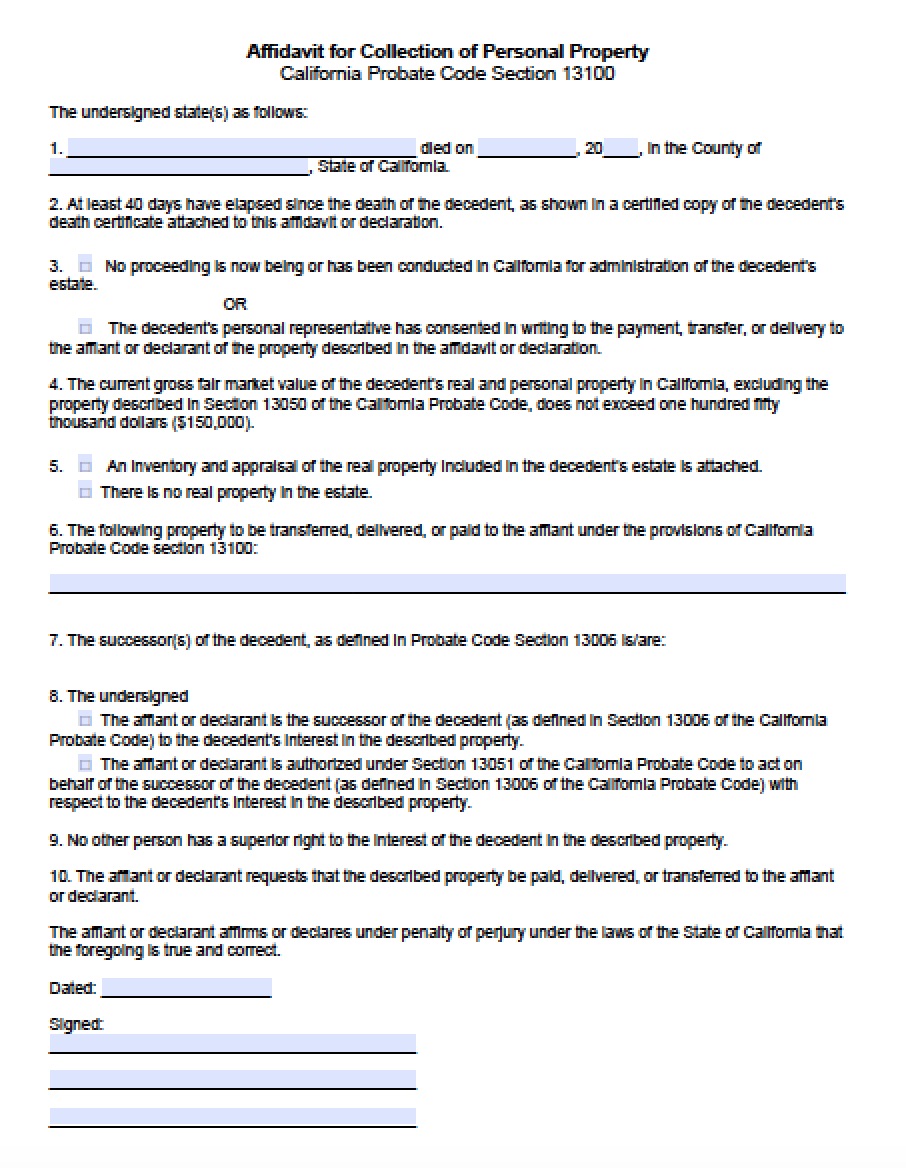

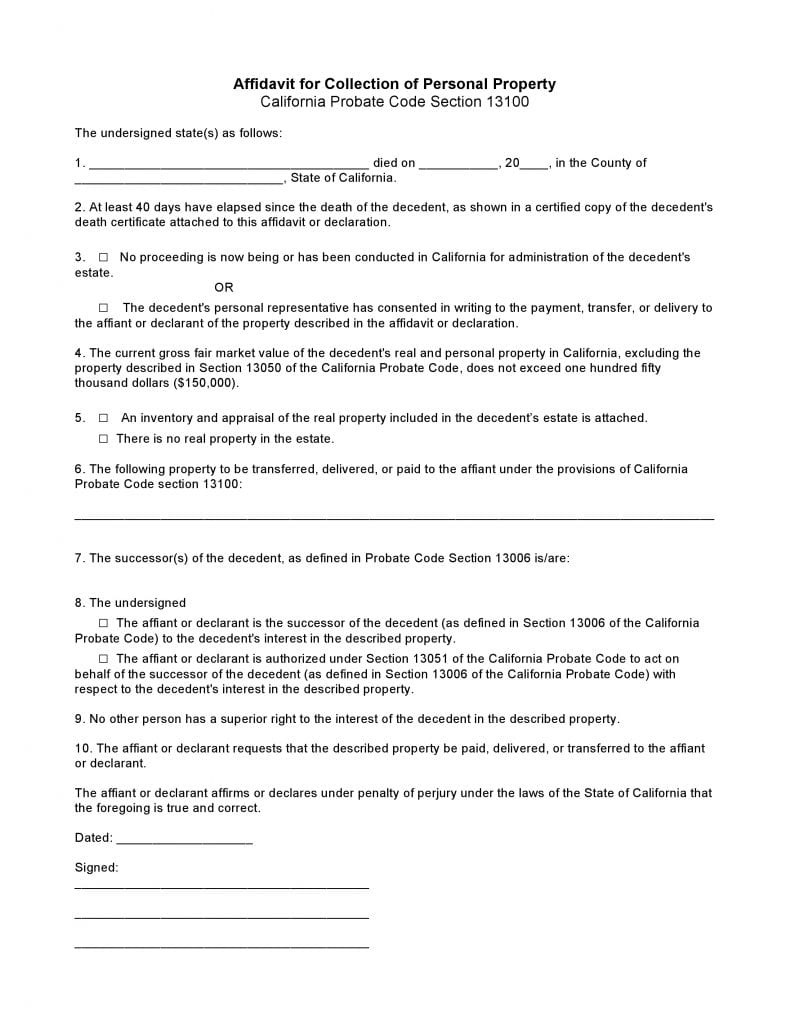

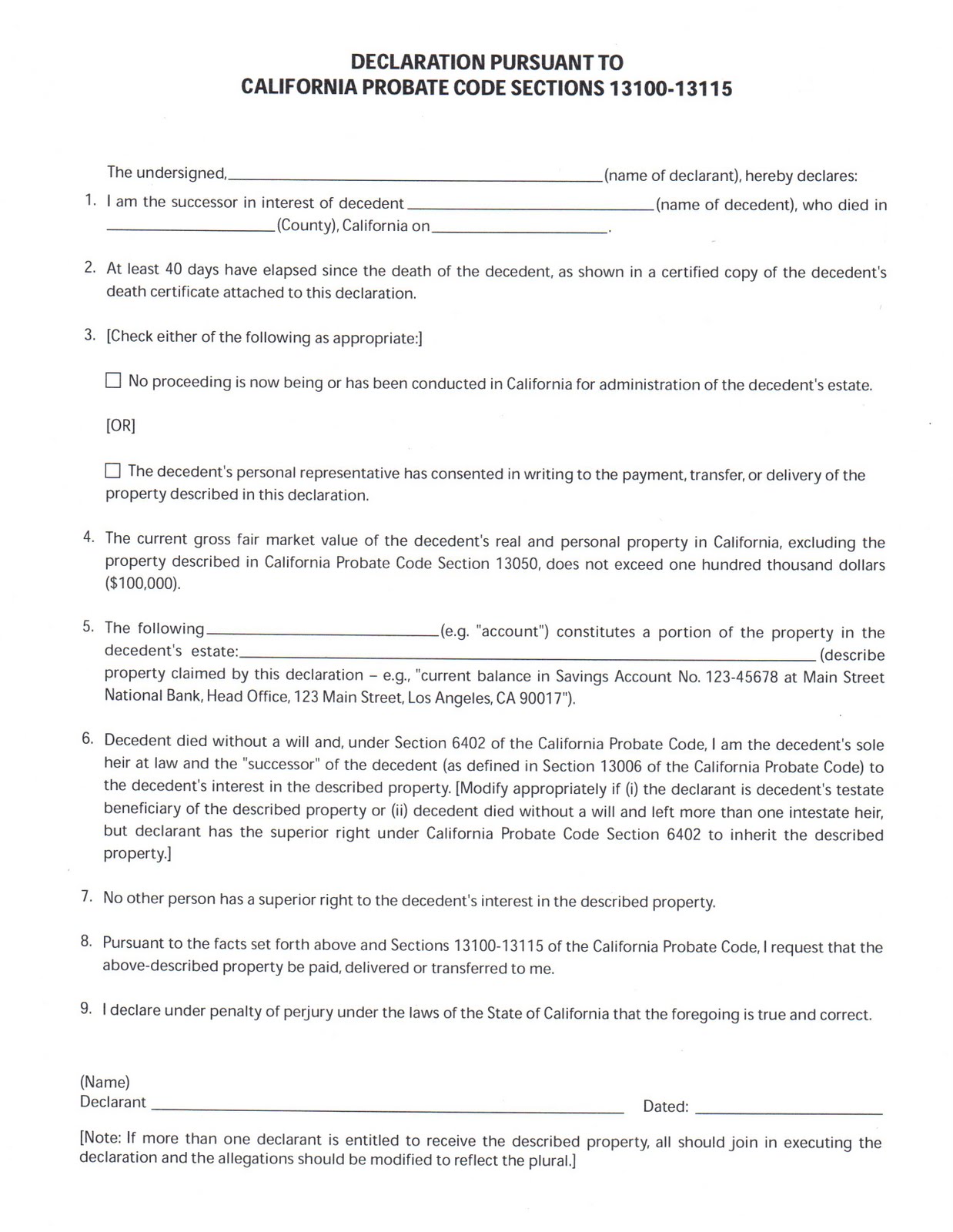

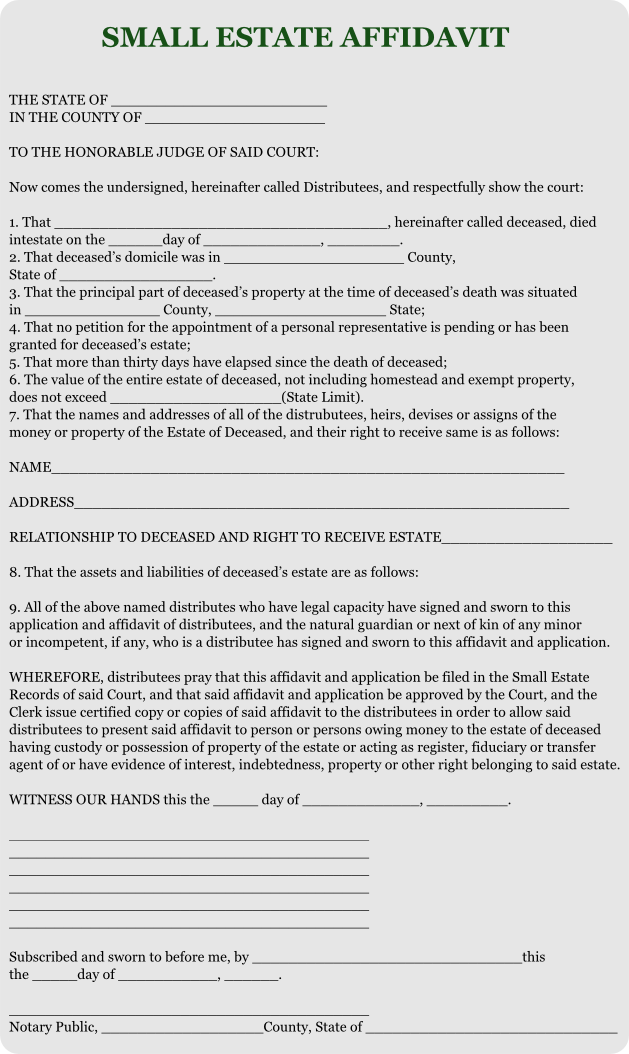

Small Estate Affidavit Form California - The gross total value of the estate may not exceed $184,500, including unpaid wages. You must obtain the form used by the probate court in the county where the deceased was a resident. You give this affidavit to the person, company, or financial institution (such as a bank) that has the property so that they can legally transfer it to your name. Use your indications to submit established track record areas. Obtain and complete the california small estate affidavit. A california small estate affidavit, or “ petition to determine succession to real property ,” is used by the rightful heirs to an estate of a person who died (the “decedent”). If you and the estate qualify, then you can complete the affidavit. Web property described in section 13050 of the california probate code, does not exceed one hundred sixty six thousand two hundred fifty dollars ($166,250) if decedent died before april 1, 2022 or one hundred eighty four thousand five hundred dollars ($184,500) if decedent died on or after april 1, 2022. Web superior court of california, county of street address: Web you may be able to use a small estate affidavit to have the property transferred to you.

Web property described in section 13050 of the california probate code, does not exceed one hundred sixty six thousand two hundred fifty dollars ($166,250) if decedent died before april 1, 2022 or one hundred eighty four thousand five hundred dollars ($184,500) if decedent died on or after april 1, 2022. If you and the estate qualify, then you can complete the affidavit. There is a special form for this that you can get from most banks and lawyers. Web california small estate affidavit. Add your own info and speak to data. Affidavit re real property of small value for court use only 1. The gross total value of the estate may not exceed $184,500, including unpaid wages. The total net value of the estate cannot be more than $184,500 for it to qualify under this process and bypass probate. For recorder's use only estate of (name): The gross total value of the estate may not exceed $184,500, including unpaid wages.

The total net value of the estate cannot be more than $184,500 for it to qualify under this process and bypass probate. Make sure that you enter correct details and numbers throughout suitable areas. Obtain and complete the california small estate affidavit. Family members that file a small estate affidavit to claim heirship of their deceased loved one’s real estate use these forms to avoid probate court. You must obtain the form used by the probate court in the county where the deceased was a resident. Web you may be able to use a small estate affidavit to have the property transferred to you. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer personal property by writing an affidavit. There is a special form for this that you can get from most banks and lawyers. Web property described in section 13050 of the california probate code, does not exceed one hundred sixty six thousand two hundred fifty dollars ($166,250) if decedent died before april 1, 2022 or one hundred eighty four thousand five hundred dollars ($184,500) if decedent died on or after april 1, 2022. A california small estate affidavit, or “ petition to determine succession to real property ,” is used by the rightful heirs to an estate of a person who died (the “decedent”).

Free Small Estate Affidavit Form Illinois Universal Network

Web california small estate affidavit. Affidavit re real property of small value for court use only 1. Web you may be able to use a small estate affidavit to have the property transferred to you. (decedent’s name) _____________________________________ died on (date) _______________________, in county of _________________________, state of. The gross total value of the estate may not exceed $184,500, including.

Free California Small Estate Affidavit Form PDF Word

If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer personal property by writing an affidavit. Make sure that you enter correct details and numbers throughout suitable areas. Web california small estate affidavit instructions. Obtain and complete the california small estate affidavit. Web california small estate affidavit.

Small Estate Affidavit California Form 13100 Form Resume Examples

If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer personal property by writing an affidavit. Web for a complete list, see california probate code section 13050. Web you may be able to use a small estate affidavit to have the property transferred to you. You must obtain.

Affidavit Of Death Of Trustee Form California Form Resume Examples

(decedent’s name) _____________________________________ died on (date) _______________________, in county of _________________________, state of. The total net value of the estate cannot be more than $184,500 for it to qualify under this process and bypass probate. Web how to complete any small estate affidavit california online: Web superior court of california, county of street address: Web for a complete list, see.

Free Small Estate Affidavit Form Free Small Estate Affidavit Form

The gross total value of the estate may not exceed $184,500, including unpaid wages. Web california small estate affidavit instructions. Obtain and complete the california small estate affidavit. On the site with all the document, click on begin immediately along with complete for the editor. Web property described in section 13050 of the california probate code, does not exceed one.

Probate Form 13100 Affidavit For Small Estates Universal Network

On the site with all the document, click on begin immediately along with complete for the editor. Make sure that you enter correct details and numbers throughout suitable areas. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer personal property by writing an affidavit. The gross total.

Download Free California Small Estate Affidavit Form Form Download

There is a special form for this that you can get from most banks and lawyers. Web property described in section 13050 of the california probate code, does not exceed one hundred sixty six thousand two hundred fifty dollars ($166,250) if decedent died before april 1, 2022 or one hundred eighty four thousand five hundred dollars ($184,500) if decedent died.

Estate Planning in California Small Estate Affidavit

Affidavit re real property of small value for court use only 1. For recorder's use only estate of (name): Family members that file a small estate affidavit to claim heirship of their deceased loved one’s real estate use these forms to avoid probate court. Obtain and complete the california small estate affidavit. Family members that file a small estate affidavit.

small estate affidavit california form Small Estate

The gross total value of the estate may not exceed $184,500, including unpaid wages. Family members that file a small estate affidavit to claim heirship of their deceased loved one’s real estate use these forms to avoid probate court. There is a special form for this that you can get from most banks and lawyers. If the total value of.

Web You May Be Able To Use A Small Estate Affidavit To Have The Property Transferred To You.

Web how to complete any small estate affidavit california online: Affidavit re real property of small value for court use only 1. Add your own info and speak to data. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer personal property by writing an affidavit.

For Recorder's Use Only Estate Of (Name):

The gross total value of the estate may not exceed $184,500, including unpaid wages. There is a special form for this that you can get from most banks and lawyers. Web california small estate affidavit. A california small estate affidavit, or “ petition to determine succession to real property ,” is used by the rightful heirs to an estate of a person who died (the “decedent”).

Web For A Complete List, See California Probate Code Section 13050.

Web california small estate affidavit. If you and the estate qualify, then you can complete the affidavit. Web california small estate affidavit instructions. You give this affidavit to the person, company, or financial institution (such as a bank) that has the property so that they can legally transfer it to your name.

(Decedent’s Name) _____________________________________ Died On (Date) _______________________, In County Of _________________________, State Of.

The gross total value of the estate may not exceed $184,500, including unpaid wages. Web superior court of california, county of street address: Web updated april 14, 2023. Make sure that you enter correct details and numbers throughout suitable areas.