Small Estate Affidavit Florida Form

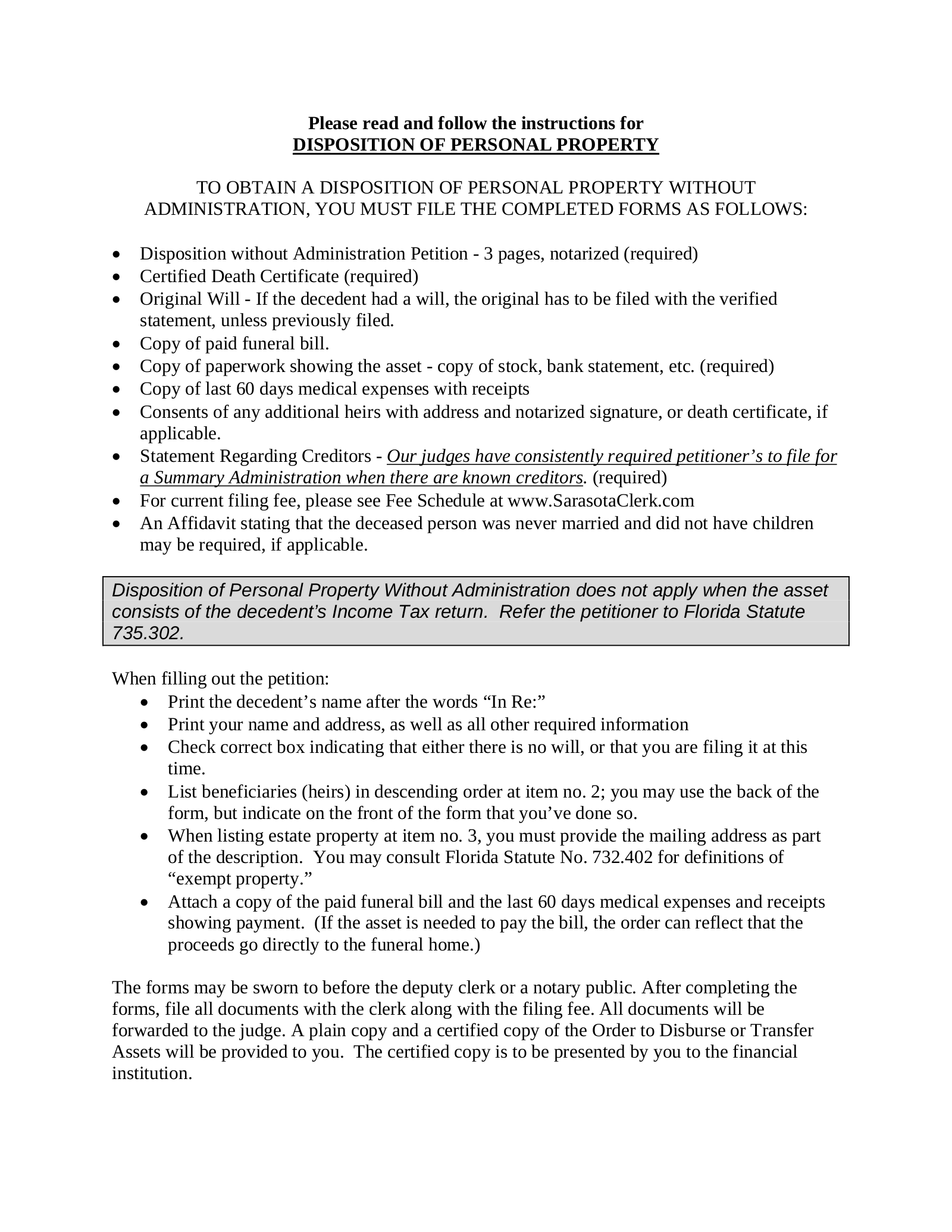

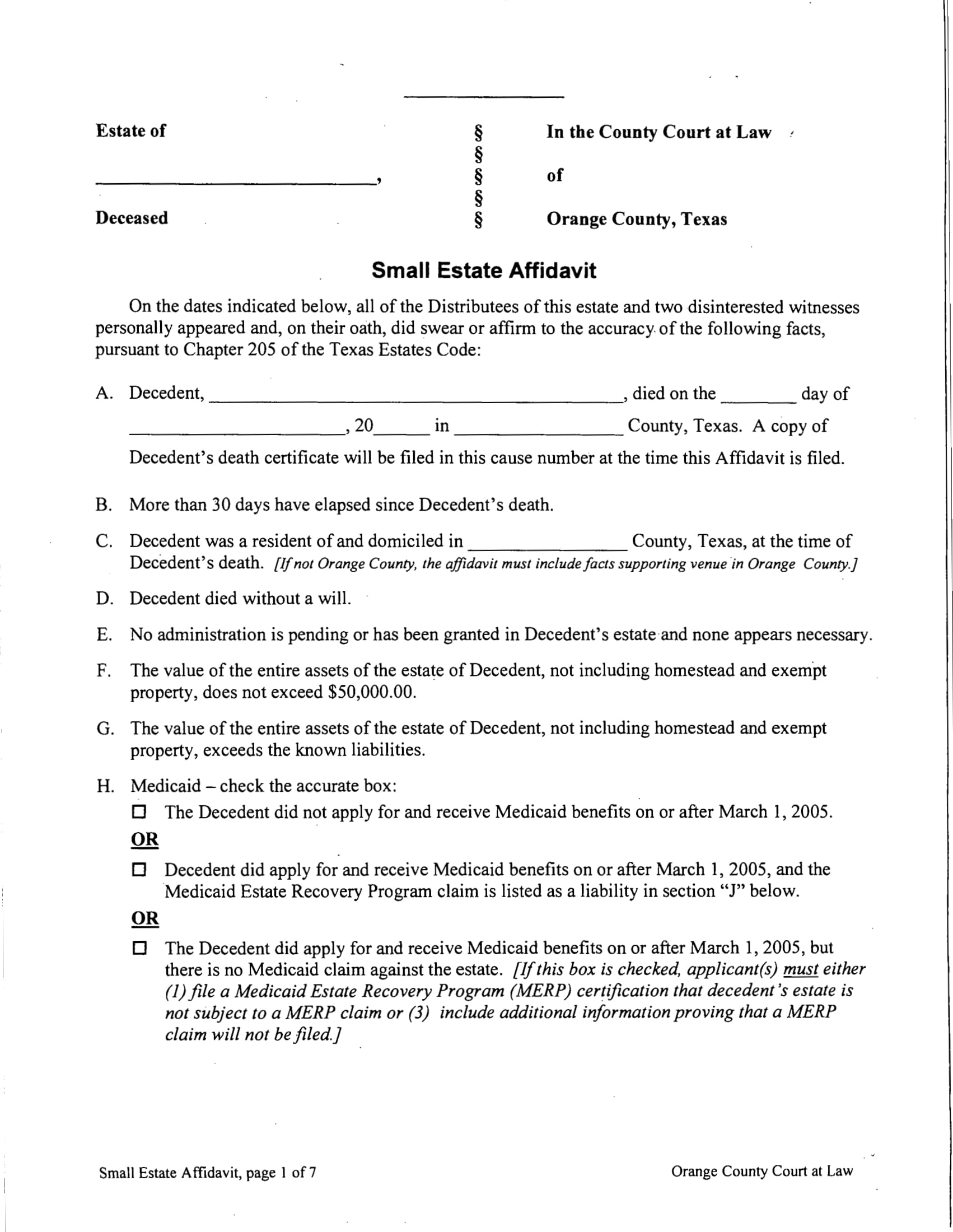

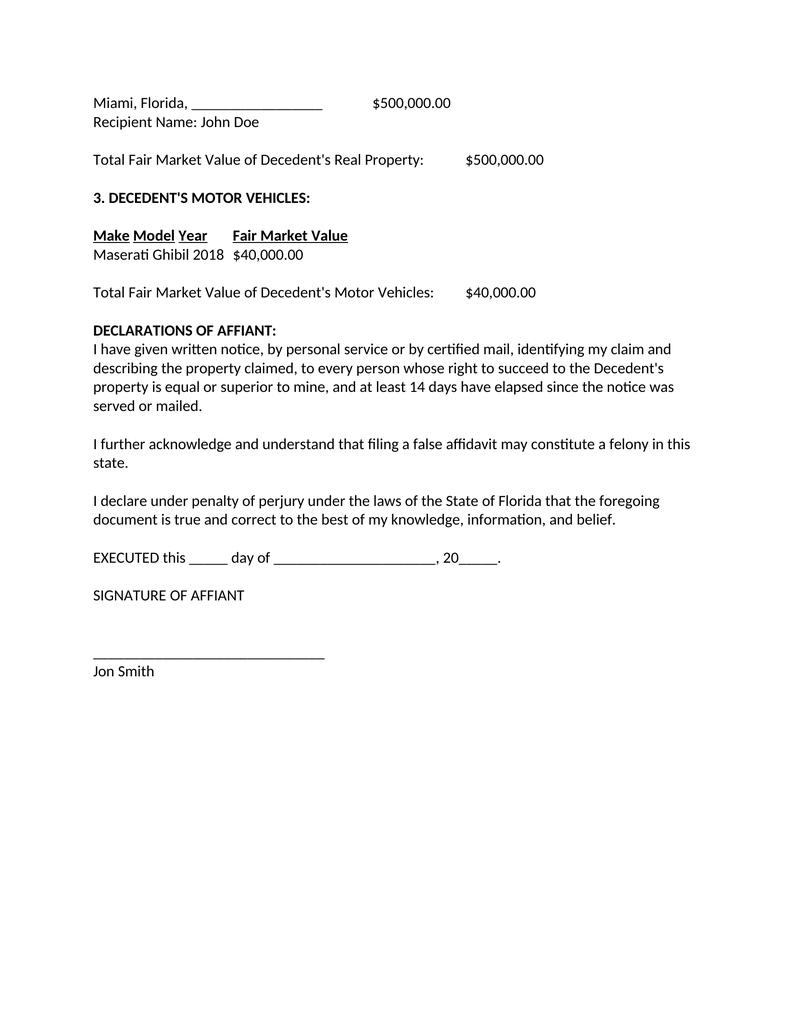

Small Estate Affidavit Florida Form - Instead, when someone dies in leaving a small estate, there are two other procedures available to the heirs and beneficiaries who want to avoid probate. Web updated july 17, 2023 a small estate affidavit is a court document that allows beneficiaries to bypass the often lengthy probate process and expedite the distribution of an estate after someone’s death. Just because florida does not have a small estate affidavit, that does not mean that florida does not have procedures for handling small estates. Web the florida small estate affidavit, also called the “disposition of personal property without administration” form, is a contract used for permitting the rightful heir to a deceased individual (the “decedent”) with the legal right to collect their assets, so long the total value of their belongings does not exceed $75,000. The decedent [decedent name], has died on [date of death], in the county of [county] and state of [state]. Before the undersigned authority personally appeared. One of these documents is the florida small estate affidavit (sea) form. (name of decedent) state of. Web (4) the family member may use an affidavit in substantially the following form to fulfill the requirements of subsection (3): One process is known as a “ disposition of personal property without administration.”.

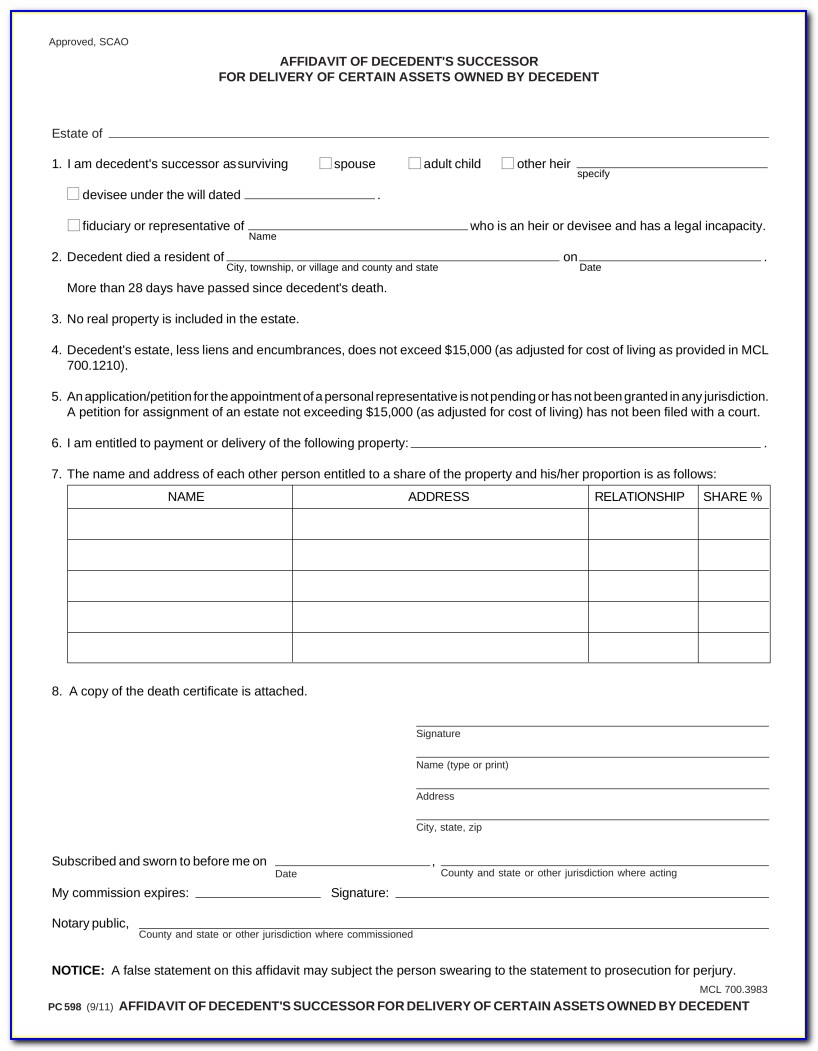

Web does florida have a small estate affidavit process? In florida, the form is called the “disposition of personal property without administration” and it has a different recording process than other states. Other states require that the affidavit be filed with the court. There are options when seeking a florida small estate affidavit and looking to claim, with few court proceedings, the assets of a person who has died. Web how to file a small estate affidavit in florida. This affidavit of the small estate is executed for the purpose of establishing [affiant name] as a legal heir for the herein mentioned estate of the decedent. Both affidavits of heirship and small estate affidavits are administered under chapter 733.203 and following, as the same document. We usually get this question when someone dies without a beneficiary of a life insurance policy, ira or 401k. The general answer is no, or at least not in the way that is helpful to most families. To qualify for this process, the total value of the decedent’s estate must not exceed a state’s monetary limit.

Before the undersigned authority personally appeared. Find out the restrictions and how to use the one that applies to your situation. (for estates with a total value of unclaimed property in the amount of $10,000 or less) 1. (name of decedent) state of. Web (4) the family member may use an affidavit in substantially the following form to fulfill the requirements of subsection (3): In florida, the form is called the “disposition of personal property without administration” and it has a different recording process than other states. Read on to find out how small estates in florida are handled without a small estate affidavit. The decedent [decedent name], has died on [date of death], in the county of [county] and state of [state]. Web the pinellas county clerk is pleased to offer a new service, turbocourt, which makes the task of filling out forms easier to understand and offers a convenient method to prepare forms, petitions and other court documents for the following case types: Web home small estate affidavit form florida small estate affidavit form florida small estate affidavit form in the united states, including florida, an individual’s death is followed by signing and submitting various documents.

Free Florida Small Estate Affidavit PDF eForms

There are options when seeking a florida small estate affidavit and looking to claim, with few court proceedings, the assets of a person who has died. The general answer is no, or at least not in the way that is helpful to most families. Instead, when someone dies in leaving a small estate, there are two other procedures available to.

Free Texas Small Estate Affidavit Form Form Resume Examples EpDLEy85xR

The first is called disposition of without administration. In florida, the form is called the “disposition of personal property without administration” and it has a different recording process than other states. Web (2) upon informal application by affidavit, letter, or otherwise by any interested party, and if the court is satisfied that subsection (1) is applicable, the court, by letter.

FREE 9+ Small Estate Affidavit Forms in PDF

Web home small estate affidavit form florida small estate affidavit form florida small estate affidavit form in the united states, including florida, an individual’s death is followed by signing and submitting various documents. Disposition without administration §735.301, florida statutes claims against small estates that fall within the following categories may be paid/satisfied simply by completing and then filing this verified.

FREE Florida Small Estate Affidavit Download Estates, Florida, Beach

Check the download pdf files instead of automatically opening them in chrome option. Web the florida small estate affidavit, also called the “disposition of personal property without administration” form, is a contract used for permitting the rightful heir to a deceased individual (the “decedent”) with the legal right to collect their assets, so long the total value of their belongings.

Small Estate AffidavitFlorida Attorney Docs

Find out the restrictions and how to use the one that applies to your situation. Web the pinellas county clerk is pleased to offer a new service, turbocourt, which makes the task of filling out forms easier to understand and offers a convenient method to prepare forms, petitions and other court documents for the following case types: The decedent [decedent.

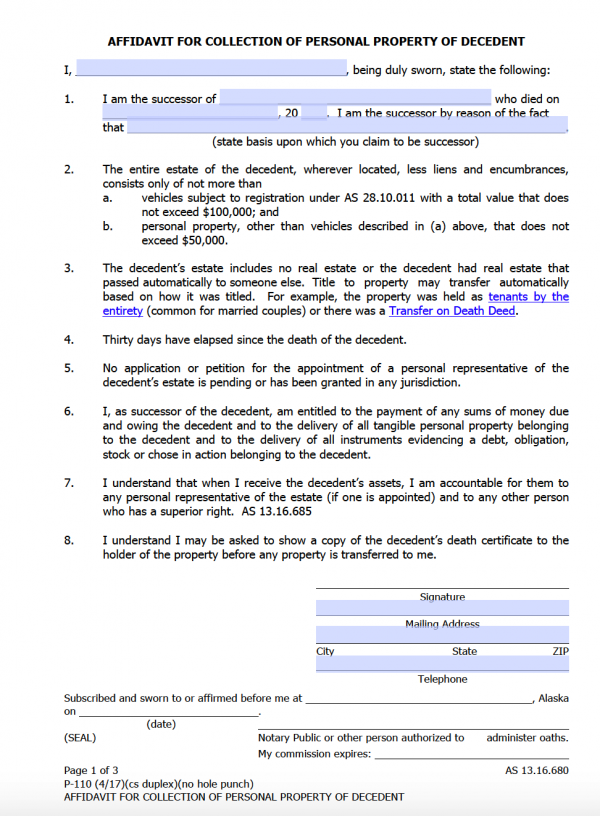

Free Alaska Small Estate Affidavit Form Small Estate Affidavit Form

The general answer is no, or at least not in the way that is helpful to most families. We usually get this question when someone dies without a beneficiary of a life insurance policy, ira or 401k. Web the florida small estate affidavit, also called the “disposition of personal property without administration” form, is a contract used for permitting the.

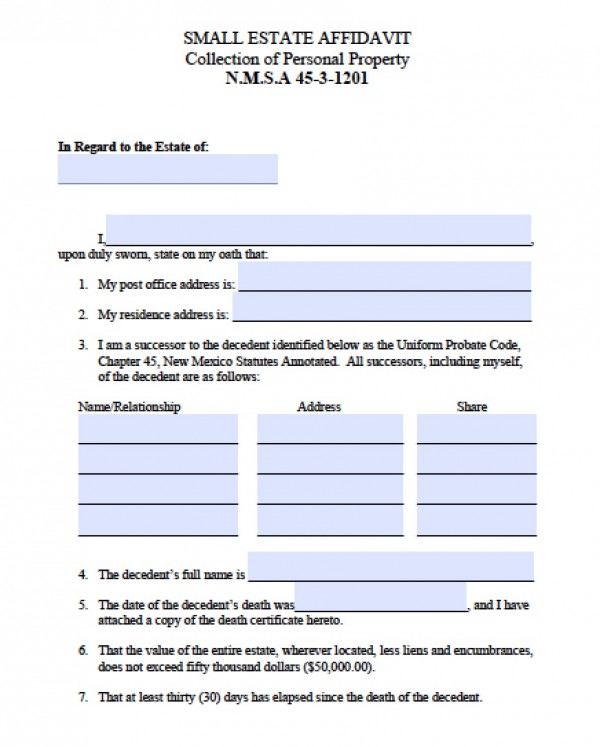

Free New Mexico Small Estate Affidavit Form Small Estate Affidavit Form

(for estates with a total value of unclaimed property in the amount of $10,000 or less) 1. Both affidavits of heirship and small estate affidavits are administered under chapter 733.203 and following, as the same document. Web the florida small estate affidavit, also called the disposition of personal property without administration form, is a contract used for permitting the rightful.

Free Small Estate Affidavit Make & Download Rocket Lawyer

Before the undersigned authority personally appeared. Disposition without administration §735.301, florida statutes claims against small estates that fall within the following categories may be paid/satisfied simply by completing and then filing this verified statement with the required documents and obtaining an order of the court. Web how to file a small estate affidavit in florida. If an estate is uncomplicated.

Affidavit Of Heirship Form Florida Form Resume Examples OPV8XxL8JQ

Web updated july 17, 2023 a small estate affidavit is a court document that allows beneficiaries to bypass the often lengthy probate process and expedite the distribution of an estate after someone’s death. Both affidavits of heirship and small estate affidavits are administered under chapter 733.203 and following, as the same document. Web a florida small estate affidavit is a.

Free Florida Small Estate Affidavit Form PDF Word

Instead, when someone dies in leaving a small estate, there are two other procedures available to the heirs and beneficiaries who want to avoid probate. We usually get this question when someone dies without a beneficiary of a life insurance policy, ira or 401k. Web (4) the family member may use an affidavit in substantially the following form to fulfill.

Deceased Owner’s Name (The “Decedent”):

Instead, when someone dies in leaving a small estate, there are two other procedures available to the heirs and beneficiaries who want to avoid probate. This means that you can complete forms on your computer or mobile device by typing information into the form fields. To qualify for this process, the total value of the decedent’s estate must not exceed a state’s monetary limit. We usually get this question when someone dies without a beneficiary of a life insurance policy, ira or 401k.

One Process Is Known As A “ Disposition Of Personal Property Without Administration.”.

Read on to find out how small estates in florida are handled without a small estate affidavit. Web florida small estate affidavit. Web the florida small estate affidavit, also called the disposition of personal property without administration form, is a contract used for permitting the rightful heir to a deceased individual (the decedent) with the legal right to collect their assets, so long the total value of their belongings does not exceed Use this form only if a will was not created when an individual (the decedent) died.

Domestic Violence Injunctions, Dissolutions Of Marriage With Children, Dissolutions Of Marriage.

A hearing will not be required in most (name of decedent) state of. Web home small estate affidavit form florida small estate affidavit form florida small estate affidavit form in the united states, including florida, an individual’s death is followed by signing and submitting various documents. Web a florida small estate affidavit is a document that allows an estate to be distributed without court probate.

Find Out The Restrictions And How To Use The One That Applies To Your Situation.

(for estates with a total value of unclaimed property in the amount of $10,000 or less) 1. Before the undersigned authority personally appeared. Before filling out the form, make sure you qualify with florida state requirements. The decedent [decedent name], has died on [date of death], in the county of [county] and state of [state].