Simple Ira Contribution Transmittal Form

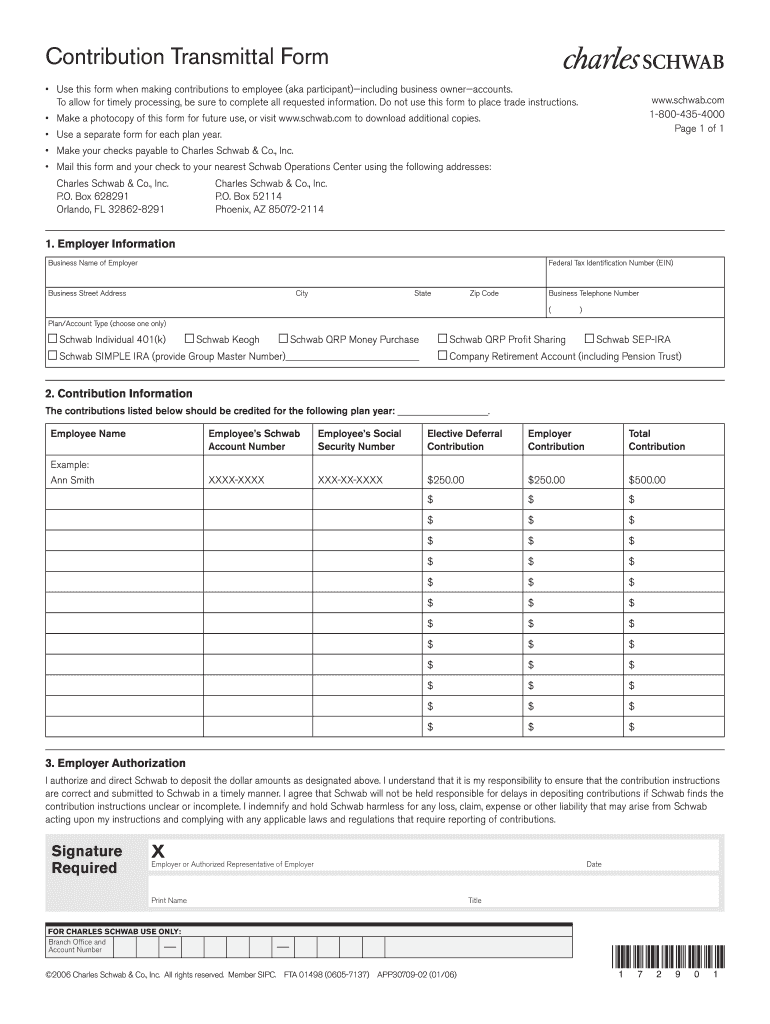

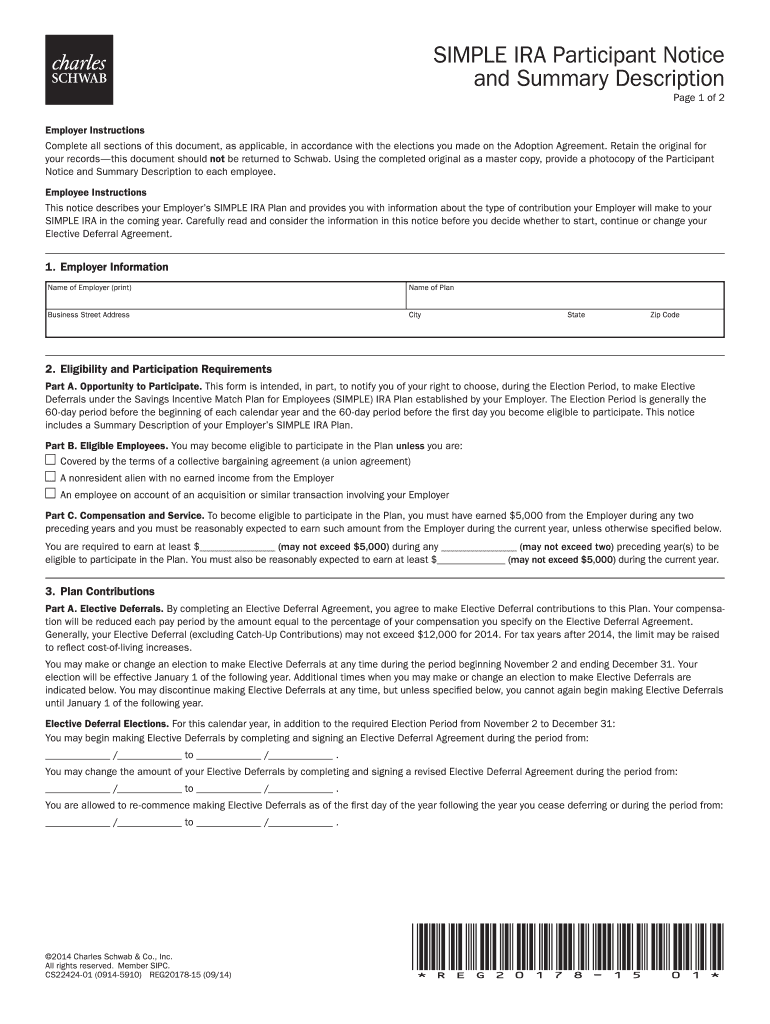

Simple Ira Contribution Transmittal Form - Contribution information(required) employee’s schwab simple ira account. Contribution transmittal (optional for contribution deposits) salary reduction agreement (retained by client’s payroll area) summary plan description and employer contribution notice. Web a simple ira plan ( s avings i ncentive m atch pl an for e mployees) allows employees and employers to contribute to traditional iras set up for employees. Trading and withdrawal authorization download: Simple ira contribution transmittal form download: All requested information is required. (“schwab”) when sending contributions made by the employer and contributions from employee deferrals. Boxes, please) city state zip code 2. • return a photocopy of this form to charles schwab & co., inc. Web once you have established your schwab simple ira plan, opened your own simple ira, and opened simple iras for eligible employees (as applicable), you may begin making contributions.

All requested information is required. Web a simple ira plan ( s avings i ncentive m atch pl an for e mployees) allows employees and employers to contribute to traditional iras set up for employees. Simple ira contribution transmittal form download: To fund your plan, print and complete the contribution transmittal form. All requested information is required. Web simple ira contribution transmittal form. • return a photocopy of this form to charles schwab & co., inc. Web once you have established your schwab simple ira plan, opened your own simple ira, and opened simple iras for eligible employees (as applicable), you may begin making contributions. Choose a simple ira plan. Employer information(required) name of employer (business name) schwab simple ira master account number plan administrator’s name plan administrator’s telephone number employer’s street address (no p.o.

Simple ira contribution transmittal form download: Web a simple ira plan ( s avings i ncentive m atch pl an for e mployees) allows employees and employers to contribute to traditional iras set up for employees. • return a photocopy of this form to charles schwab & co., inc. Choose a simple ira plan. Web once you have established your schwab simple ira plan, opened your own simple ira, and opened simple iras for eligible employees (as applicable), you may begin making contributions. Boxes, please) city state zip code 2. Use this form to remit simple ira contributions for your plan to schwab. Web individual 401(k) contribution transmittal form download: Trading and withdrawal authorization download: (“schwab”) when sending contributions made by the employer and contributions from employee deferrals.

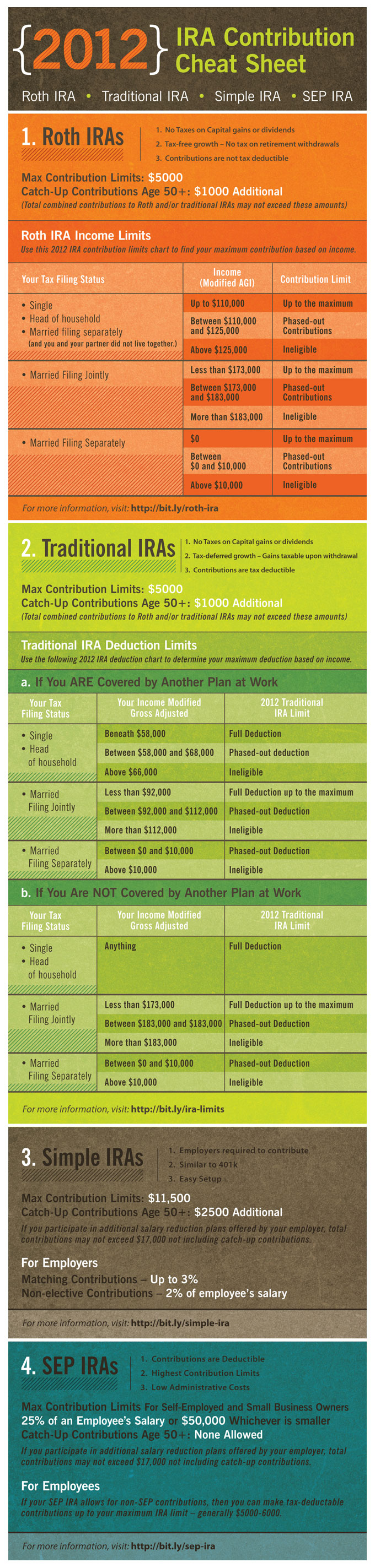

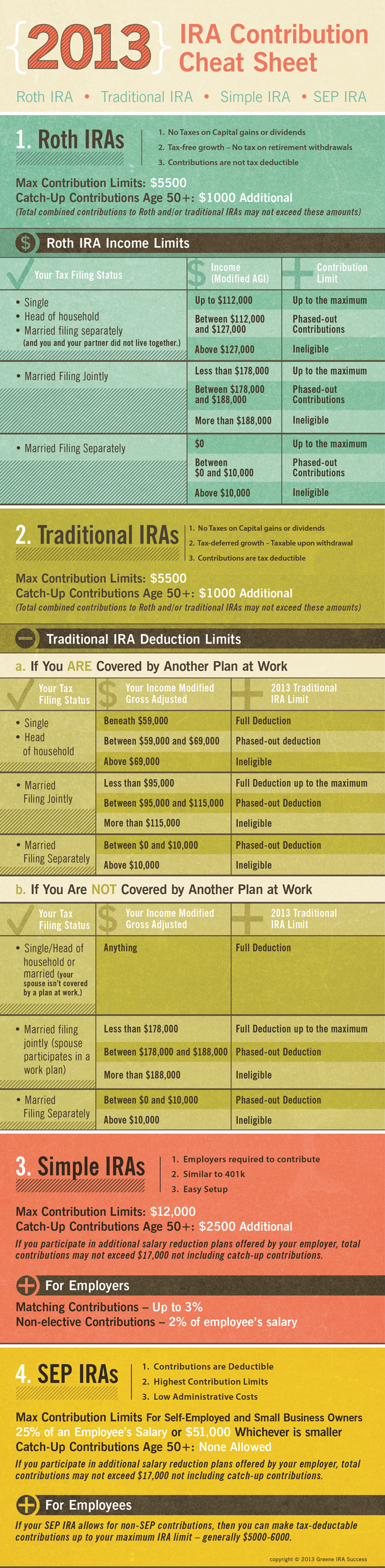

How to decide which IRA chart Traditional ira, Ira, Retirement accounts

All requested information is required. Contribution information(required) employee’s schwab simple ira account. Web individual 401(k) contribution transmittal form download: Web a simple ira plan ( s avings i ncentive m atch pl an for e mployees) allows employees and employers to contribute to traditional iras set up for employees. Web simple ira contribution transmittal form to the employer:

Edward Jones Simple Ira Contribution Transmittal Form Fill Out and

Web once you have established your schwab simple ira plan, opened your own simple ira, and opened simple iras for eligible employees (as applicable), you may begin making contributions. Boxes, please) city state zip code 2. Choose a simple ira plan. Employer information(required) name of employer (business name) schwab simple ira master account number plan administrator’s name plan administrator’s telephone.

Simple Ira Contribution Worksheet Fill Online, Printable, Fillable

Use this form to remit simple ira contributions for your plan to schwab. Choose a simple ira plan. Boxes, please) city state zip code 2. Web once you have established your schwab simple ira plan, opened your own simple ira, and opened simple iras for eligible employees (as applicable), you may begin making contributions. Web individual 401(k) contribution transmittal form.

Charles Schwab Simple Ira Contribution Transmittal Form Fill Out and

Employer information(required) name of employer (business name) schwab simple ira master account number plan administrator’s name plan administrator’s telephone number employer’s street address (no p.o. Web simple ira contribution transmittal form to the employer: Boxes, please) city state zip code 2. Contribution transmittal (optional for contribution deposits) salary reduction agreement (retained by client’s payroll area) summary plan description and employer.

Document Transmittal Form

Web a simple ira plan ( s avings i ncentive m atch pl an for e mployees) allows employees and employers to contribute to traditional iras set up for employees. Contribution information(required) employee’s schwab simple ira account. Trading and withdrawal authorization download: Web once you have established your schwab simple ira plan, opened your own simple ira, and opened simple.

Simple Ira Simple Ira Max Contribution 2013

(“schwab”) when sending contributions made by the employer and contributions from employee deferrals. Web a simple ira plan ( s avings i ncentive m atch pl an for e mployees) allows employees and employers to contribute to traditional iras set up for employees. Web simple ira contribution transmittal form. Use this form to remit simple ira contributions for your plan.

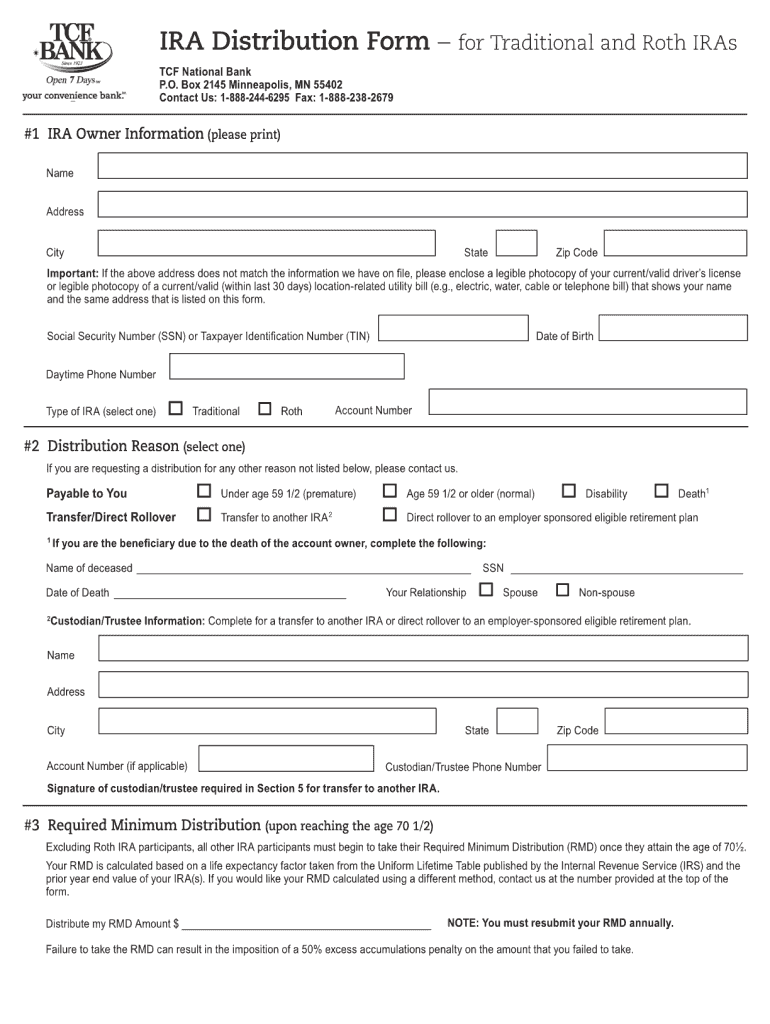

Principal bank ira distribution form Fill out & sign online DocHub

Employer information(required) name of employer (business name) schwab simple ira master account number plan administrator’s name plan administrator’s telephone number employer’s street address (no p.o. Contribution information(required) employee’s schwab simple ira account. Web simple ira contribution transmittal form to the employer: Use this form to remit simple ira contributions for your plan to schwab. Choose a simple ira plan.

2014 IRA Cheat Sheet Contribution Limits for Traditional, Roth, Simple

Simple ira contribution transmittal form download: Web individual 401(k) contribution transmittal form download: Employer information(required) name of employer (business name) schwab simple ira master account number plan administrator’s name plan administrator’s telephone number employer’s street address (no p.o. Contribution information(required) employee’s schwab simple ira account. Use this form to remit simple ira contributions for your plan to schwab.

FREE 9+ Sample Transmittal Forms in PDF

Web individual 401(k) contribution transmittal form download: (“schwab”) when sending contributions made by the employer and contributions from employee deferrals. • return a photocopy of this form to charles schwab & co., inc. Trading and withdrawal authorization download: Choose a simple ira plan.

SIMPLE IRA Contribution Limits for 2020 and 2021 NerdWallet

Contribution information(required) employee’s schwab simple ira account. To fund your plan, print and complete the contribution transmittal form. Boxes, please) city state zip code 2. Web once you have established your schwab simple ira plan, opened your own simple ira, and opened simple iras for eligible employees (as applicable), you may begin making contributions. All requested information is required.

Web Simple Ira Contribution Transmittal Form To The Employer:

To fund your plan, print and complete the contribution transmittal form. All requested information is required. Employer information(required) name of employer (business name) schwab simple ira master account number plan administrator’s name plan administrator’s telephone number employer’s street address (no p.o. Use this form to remit simple ira contributions for your plan to schwab.

Web Simple Ira Contribution Transmittal Form.

All requested information is required. Web individual 401(k) contribution transmittal form download: Choose a simple ira plan. (“schwab”) when sending contributions made by the employer and contributions from employee deferrals.

Contribution Transmittal (Optional For Contribution Deposits) Salary Reduction Agreement (Retained By Client’s Payroll Area) Summary Plan Description And Employer Contribution Notice.

Contribution information(required) employee’s schwab simple ira account. Web a simple ira plan ( s avings i ncentive m atch pl an for e mployees) allows employees and employers to contribute to traditional iras set up for employees. Trading and withdrawal authorization download: • return a photocopy of this form to charles schwab & co., inc.

Simple Ira Contribution Transmittal Form Download:

Boxes, please) city state zip code 2. Web once you have established your schwab simple ira plan, opened your own simple ira, and opened simple iras for eligible employees (as applicable), you may begin making contributions.