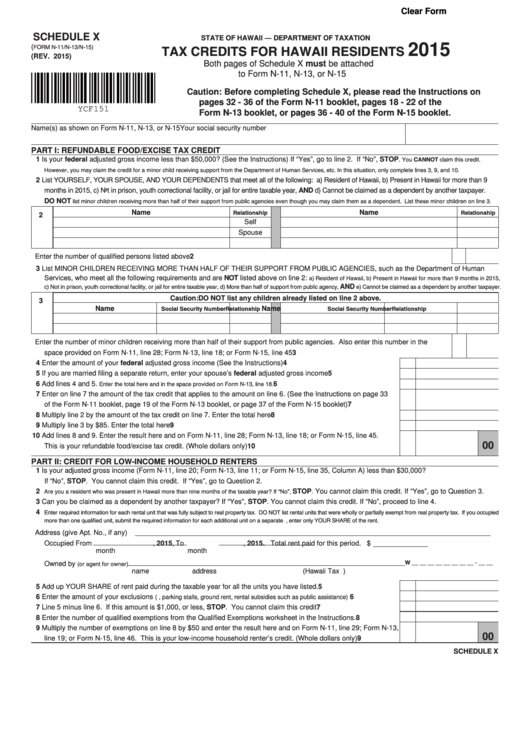

Schedule X Tax Form

Schedule X Tax Form - Web tax credit were made, or you think you may be eligible to claim a premium tax credit, fill out form 8962 before filling out schedule a, line 1. Complete irs tax forms online or print government tax documents. Ad access irs tax forms. These tax rate schedules are provided to help you estimate your 2022 federal income tax. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web if you are an individual filing an amended personal income tax return, use schedule x to determine any additional amount you owe or refund due to you, and to provide reason(s). Web x is for schedule x. We've been in the trucking industry 67+ years. There is no schedule x for individuals for federal income tax purposes. Ira/keogh plan, qualified charitable ira.

Web to claim the dependent exemption credit, taxpayers complete form ftb 3568, alternative identifying information for the dependent exemption credit, attach the form and required. Attach this schedule to amended form. Use this address if you are not enclosing a payment use this. Person filing form 8865, any required statements to qualify for the. You can now file form. Complete, edit or print tax forms instantly. Web a foreign country, u.s. Web schedule x other income. Complete irs tax forms online or print government tax documents. There is no schedule x for individuals for federal income tax purposes.

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Complete irs tax forms online or print government tax documents. Web schedule x, line 2 worksheet. Distributions and roth ira conversion distributions 1. You can now file form. Web schedule x california explanation of amended return changes. Person filing form 8865, any required statements to qualify for the. Web tax credit were made, or you think you may be eligible to claim a premium tax credit, fill out form 8962 before filling out schedule a, line 1. Web x is for schedule x. Web schedule x other income.

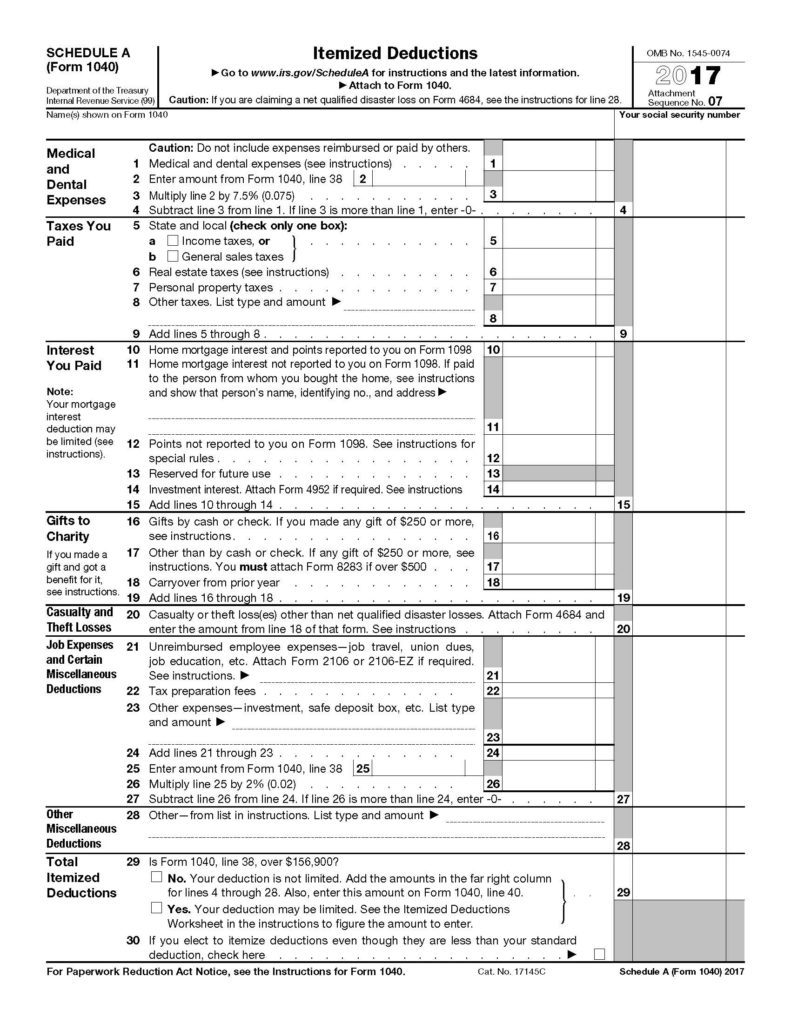

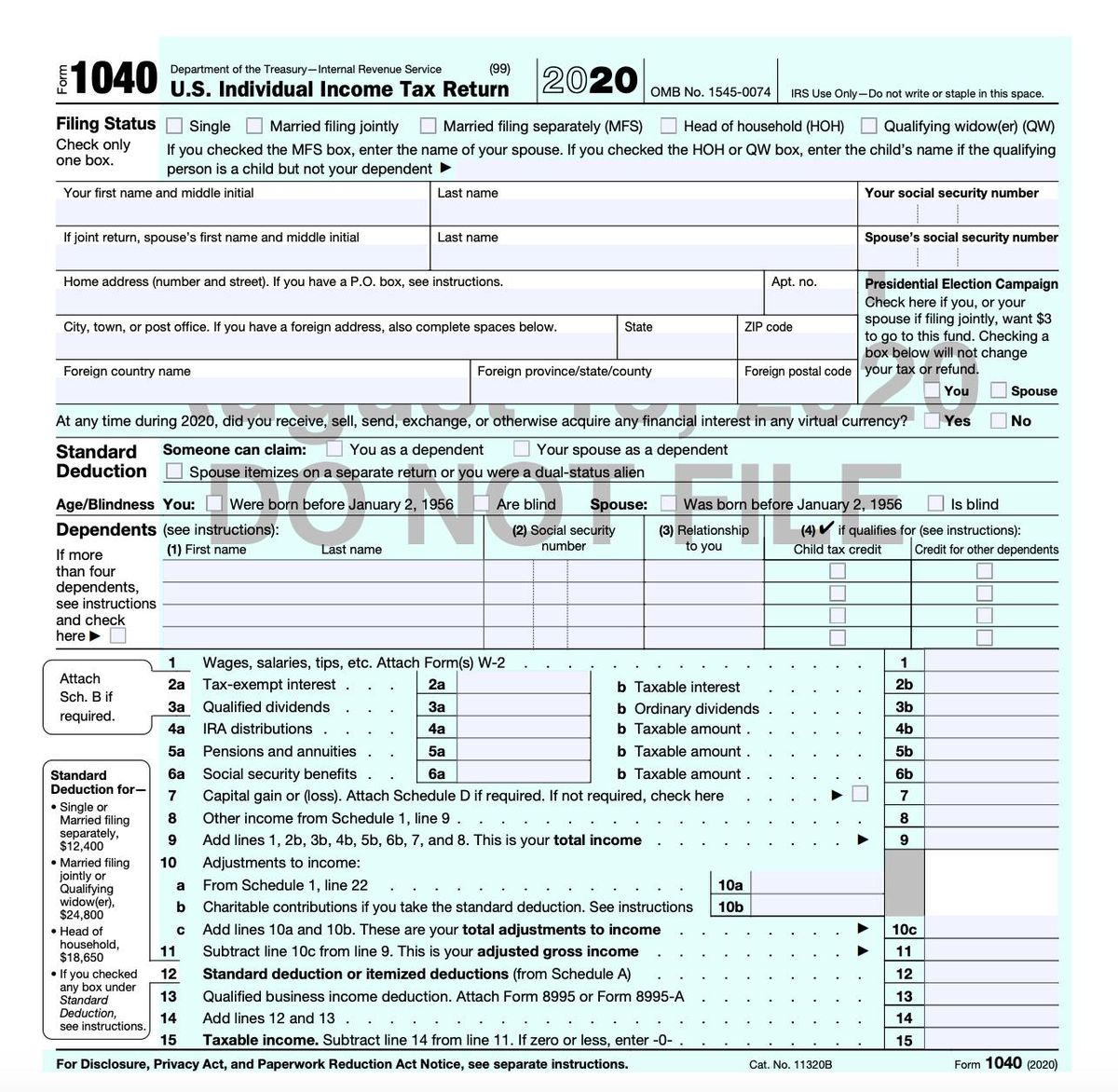

2018 Federal Tax Form 1040 Schedule 1 2021 Tax Forms 1040

You can now file form. Web attach schedule x to your updated form 540/540nr, sign the amended return and mail it to one of the addresses listed below. Complete, edit or print tax forms instantly. Distributions and roth ira conversion distributions 1. Ad access irs tax forms.

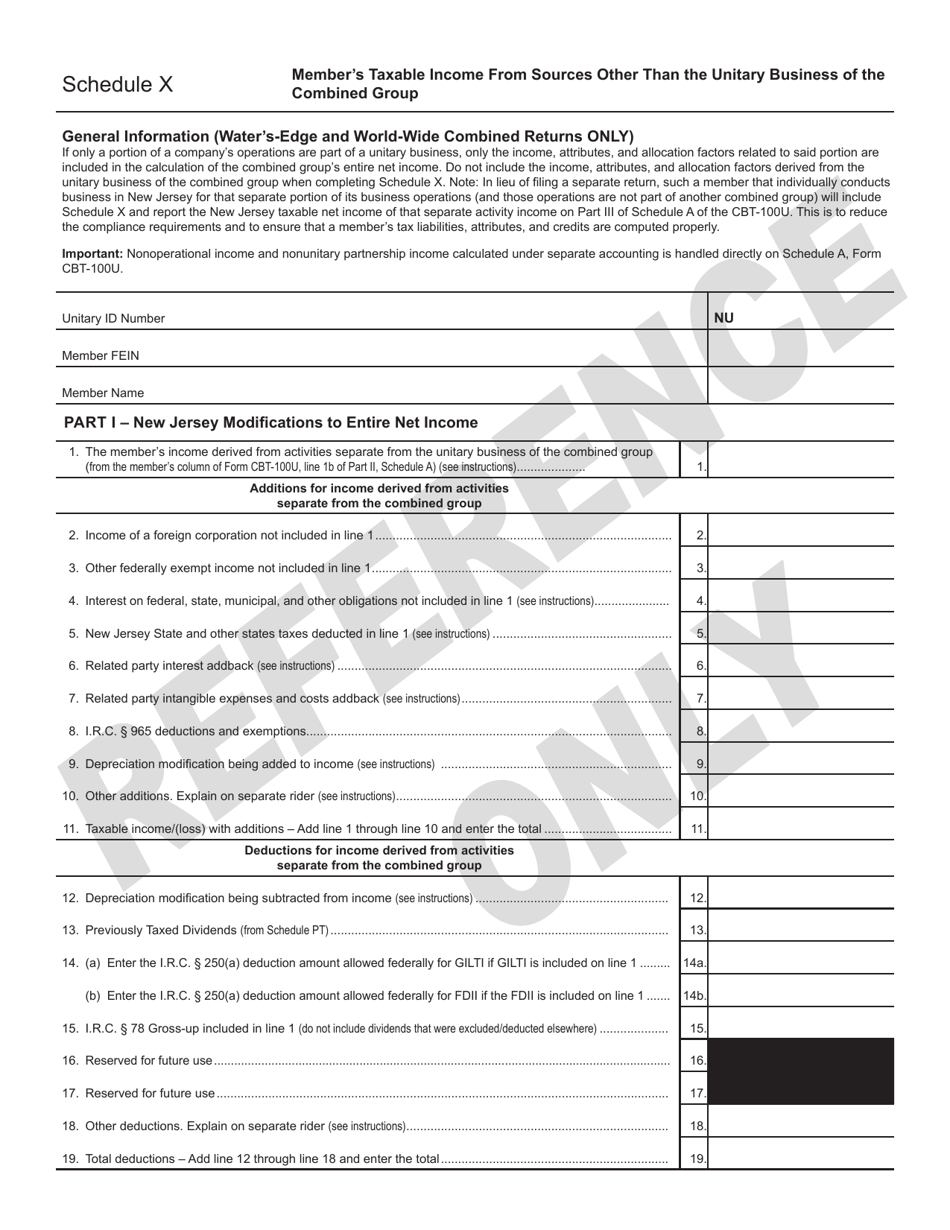

Schedule X Download Printable PDF or Fill Online Member's Taxable

Web there are several ways to submit form 4868. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Person filing form 8865, any required statements to qualify for the. We've been in the trucking industry 67+ years. Last name social security number of proprietor schedule x other income.

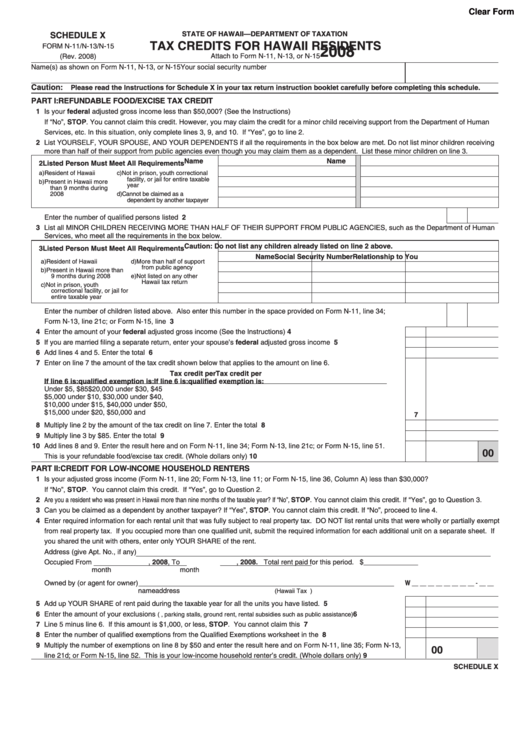

Fillable Form N11/n13/n15 Schedule X Tax Credits For Hawaii

Ad access irs tax forms. 8531223 schedule x 2022 taxable year attach this schedule. Distributions and roth ira conversion distributions 1. Web schedule x california explanation of amended return changes. Can i efile schedule x?

Schedule K1 Tax Form What Is It and Who Needs to Know? mojafarma

Web tax credit were made, or you think you may be eligible to claim a premium tax credit, fill out form 8962 before filling out schedule a, line 1. Web attach schedule x to your updated form 540/540nr, sign the amended return and mail it to one of the addresses listed below. Distributions and roth ira conversion distributions 1. Ad.

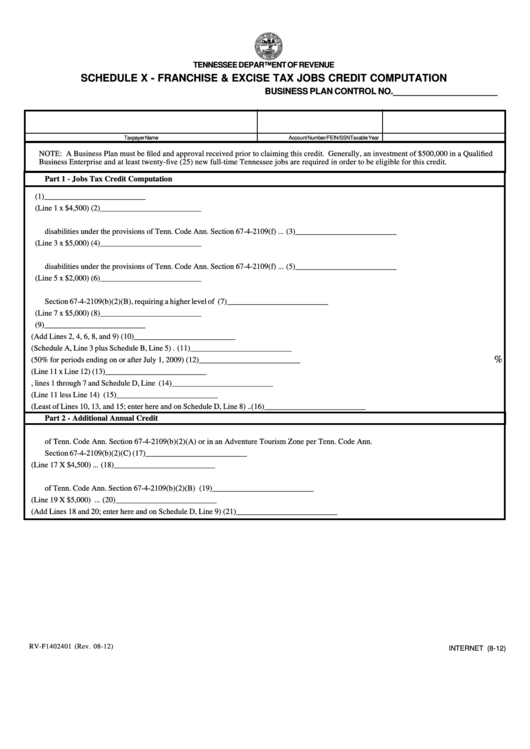

Fillable Schedule X Franchise & Excise Tax Jobs Credit Computation

Web if you are an individual filing an amended personal income tax return, use schedule x, california explanation of amended return changes, to determine any additional amount. Person filing form 8865, any required statements to qualify for the. Ira/keogh plan, qualified charitable ira. Attach this schedule to amended form. Use this address if you are not enclosing a payment use.

Irs 1040 Form Where To Mail Tax Form 1040 1800TAXFIRM® / You can

Web updated for tax year 2022 • june 15, 2023 06:46 pm. The form 1040 has six new numbered schedules (you can. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Complete, edit or print tax forms instantly. Attach this schedule to amended form 540, form 540 2ez, or form.

The Ultimate Tax Guide Know your tax forms Schedule E

These tax rate schedules are provided to help you estimate your 2022 federal income tax. For privacy notice, get ftb 1131 eng/sp. Distributions and roth ira conversion distributions 1. Can i efile schedule x? Web a foreign country, u.s.

Solved 2016 Federal Tax Rate Schedule Schedule XSingle S...

Web there are several ways to submit form 4868. We've been in the trucking industry 67+ years. Attach this schedule to amended form. These tax rate schedules are provided to help you estimate your 2022 federal income tax. Web schedule x, line 2 worksheet.

Irs Tax Forms 2021 Printable Example Calendar Printable

Web all individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f, should mail their form 9465 to. These tax rate schedules are provided to help you estimate your 2022 federal income tax. The form 1040 has six new numbered schedules (you can. Ira/keogh plan, qualified.

Fillable Schedule X (Form N11/n13/n15) Tax Credits For Hawaii

Web schedule x, line 2 worksheet. Web all individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f, should mail their form 9465 to. Complete, edit or print tax forms instantly. We've been in the trucking industry 67+ years. Web find massachusetts schedule x instructions at.

These Tax Rate Schedules Are Provided To Help You Estimate Your 2022 Federal Income Tax.

Attach this schedule to amended form. Web schedule x, line 2 worksheet. Complete irs tax forms online or print government tax documents. Web tax credit were made, or you think you may be eligible to claim a premium tax credit, fill out form 8962 before filling out schedule a, line 1.

502 For How To Figure Your.

Person filing form 8865, any required statements to qualify for the. 8531223 schedule x 2022 taxable year attach this schedule. Web updated for tax year 2022 • june 15, 2023 06:46 pm. Web a foreign country, u.s.

There Is No Schedule X For Individuals For Federal Income Tax Purposes.

Last name social security number of proprietor schedule x other income. Ira/keogh plan, qualified charitable ira. Web to claim the dependent exemption credit, taxpayers complete form ftb 3568, alternative identifying information for the dependent exemption credit, attach the form and required. We've been in the trucking industry 67+ years.

Web Attach Schedule X To Your Updated Form 540/540Nr, Sign The Amended Return And Mail It To One Of The Addresses Listed Below.

Web if you are an individual filing an amended personal income tax return, use schedule x, california explanation of amended return changes, to determine any additional amount. Web there are several ways to submit form 4868. Web schedule x other income. Web all individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f, should mail their form 9465 to.