Schedule J Form 5471

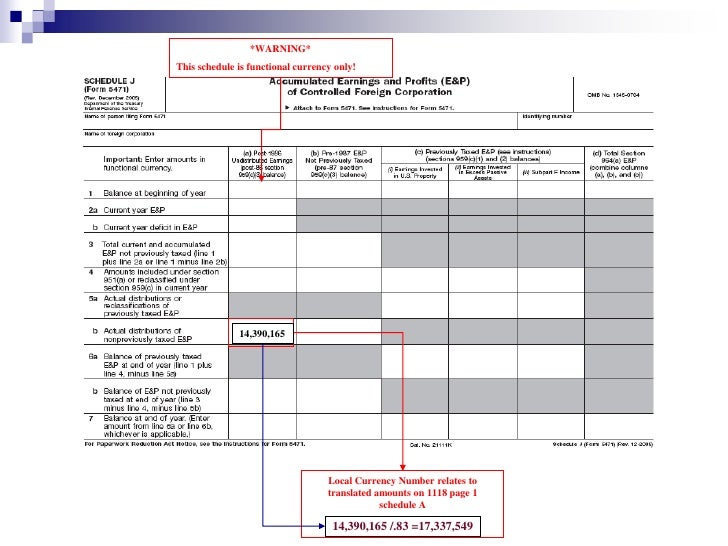

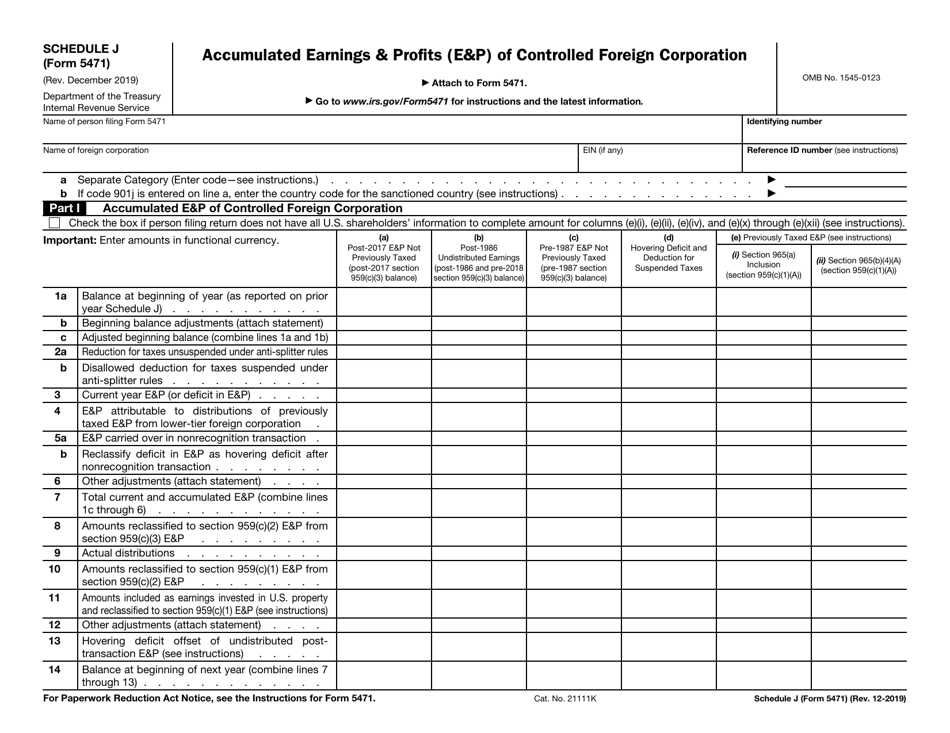

Schedule J Form 5471 - Schedule j contains information about the cfc's earnings and profits (e&p). Web schedule j of form 5471 has also added the following new columns: Use schedule j to report a cfc’s accumulated e&p in its functional currency, computed under sections 964(a) and 986(b). Also use this schedule to report the e&p of specified foreign corporations that are only treated as cfcs for limited purposes under section 965(e) (2). 2) hovering deficit and deduction for suspended taxes. Web (new) 2021 schedule j of form 5471. Name of person filing form 5471. In most cases, special ordering rules under section 959 of the internal revenue code apply in determining how e&p is reported on schedule j. Web schedule j (form 5471) (rev. In most cases, special ordering rules under section 959 of the internal revenue code apply in.

Also use this schedule to report the e&p of specified foreign corporations that are only treated as cfcs for limited purposes under section 965(e) (2). In most cases, special ordering rules under section 959 of the internal revenue code apply in determining how e&p is reported on schedule j. More importantly, schedule j tracks the corporations various. Schedule j contains information about the cfc's earnings and profits (e&p). Accumulated earnings & profits (e&p) of controlled foreign corporation. Web schedule j (form 5471) (rev. Form 5471 filers generally use the same category of filer codes used on form 1118. 4) pti from section 965 (b) (4) (a) (section 959 (c) (1) (a)). Web schedule j of form 5471 has also added the following new columns: For instructions and the latest information.

Web schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”) in its functional currency. Form 5471 filers generally use the same category of filer codes used on form 1118. Use schedule j to report a cfc’s accumulated e&p in its functional currency, computed under sections 964(a) and 986(b). Reference id number of foreign corporation. 4) pti from section 965 (b) (4) (a) (section 959 (c) (1) (a)). Part i—accumulated e&p of controlled foreign corporation; Schedule j contains information about the cfc's earnings and profits (e&p). Name of person filing form 5471. 3) pti from section 965 (a) inclusion (section 959 (c) (1) (a)). For instructions and the latest information.

I.R.S. Form 5471, Schedule J YouTube

December 2020) department of the treasury internal revenue service. In most cases, special ordering rules under section 959 of the internal revenue code apply in. Web schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”). Web schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation.

Demystifying the All New 2020 Tax Year IRS Form 5471 Schedule J SF

Use schedule j to report a cfc’s accumulated e&p in its functional currency, computed under sections 964(a) and 986(b). 2) hovering deficit and deduction for suspended taxes. Schedule j contains information about the cfc's earnings and profits (e&p). December 2020) department of the treasury internal revenue service. Reference id number of foreign corporation.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

Columns (a), (b), and (c) column (d) column (e) column (f) specific instructions related to lines 1 through 13. December 2020) department of the treasury internal revenue service. Web schedule j of form 5471 has also added the following new columns: Accumulated earnings & profits (e&p) of controlled foreign corporation. 2) hovering deficit and deduction for suspended taxes.

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

Name of person filing form 5471. For instructions and the latest information. In most cases, special ordering rules under section 959 of the internal revenue code apply in. Web changes to separate schedule e (form 5471). Use schedule j to report a cfc’s accumulated e&p in its functional currency, computed under sections 964(a) and 986(b).

A Deep Dive into the IRS Form 5471 Schedule J SF Tax Counsel

Web schedule j (form 5471) (rev. Accumulated earnings & profits (e&p) of controlled foreign corporation. Web schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”) in its functional currency. Web changes to separate schedule e (form 5471). Web schedule j of form 5471 has also added the following new columns:

Schedule J Example Fill Online, Printable, Fillable, Blank pdfFiller

Web (new) 2021 schedule j of form 5471. Web schedule j of form 5471 has also added the following new columns: 2) hovering deficit and deduction for suspended taxes. Form 5471 filers generally use the same category of filer codes used on form 1118. Web schedule j (form 5471) (rev.

IRS Form 5471 Schedule J Download Fillable PDF or Fill Online

Web schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”) in its functional currency. Web (new) 2021 schedule j of form 5471. More importantly, schedule j tracks the corporations various. Web schedule j of form 5471 has also added the following new columns: Use schedule j to report a cfc’s accumulated e&p.

form 5471 schedule j 2019 Fill Online, Printable, Fillable Blank

Accumulated earnings & profits (e&p) of controlled foreign corporation. Form 5471 filers generally use the same category of filer codes used on form 1118. Exploring the (new) 2021 schedule j of form 5471: Also use this schedule to report the e&p of specified foreign corporations that are only treated as cfcs for limited purposes under section 965(e) (2). Columns (a),.

The Tax Times IRS Issues Updated New Form 5471 What's New?

December 2020) department of the treasury internal revenue service. Columns (a), (b), and (c) column (d) column (e) column (f) specific instructions related to lines 1 through 13. Web changes to separate schedule e (form 5471). In most cases, special ordering rules under section 959 of the internal revenue code apply in determining how e&p is reported on schedule j..

IRS Form 5471 (Schedule J) 2018 2019 Fillable and Editable PDF Template

Web schedule j (form 5471) (rev. Web (new) 2021 schedule j of form 5471. Web schedule j of form 5471 has also added the following new columns: Web schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”) in its functional currency. Name of person filing form 5471.

Web Schedule J Of Form 5471 Tracks The Earnings And Profits (“E&P”) Of A Controlled Foreign Corporation (“Cfc”) In Its Functional Currency.

Schedule j contains information about the cfc's earnings and profits (e&p). In most cases, special ordering rules under section 959 of the internal revenue code apply in determining how e&p is reported on schedule j. When it comes to the various international information reporting forms required by us persons with foreign assets, internal revenue service — form 5471 is one of the most complicated tax forms. 3) pti from section 965 (a) inclusion (section 959 (c) (1) (a)).

Web Schedule J (Form 5471) (Rev.

4) pti from section 965 (b) (4) (a) (section 959 (c) (1) (a)). Accumulated earnings & profits (e&p) of controlled foreign corporation. Form 5471 filers generally use the same category of filer codes used on form 1118. Also use this schedule to report the e&p of specified foreign corporations that are only treated as cfcs for limited purposes under section 965(e) (2).

In Most Cases, Special Ordering Rules Under Section 959 Of The Internal Revenue Code Apply In.

December 2020) department of the treasury internal revenue service. Part i—accumulated e&p of controlled foreign corporation; Web changes to separate schedule e (form 5471). Use schedule j to report a cfc’s accumulated e&p in its functional currency, computed under sections 964(a) and 986(b).

2) Hovering Deficit And Deduction For Suspended Taxes.

For instructions and the latest information. Web schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”). Reference id number of foreign corporation. Web (new) 2021 schedule j of form 5471.