Schedule G Tax Form

Schedule G Tax Form - Ad access irs tax forms. Complete, edit or print tax forms instantly. Instead file schedule c (form 1040) or. Web other income, including federal and state gasoline or fuel tax credit or refund (see instructions). Use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or. Web order tax forms and instructions; Any donation will reduce your refund or. Get ready for tax season deadlines by completing any required tax forms today. Web schedule g (form 990) 2023 page 2 part ii fundraising events. Web we last updated federal 1120 (schedule g) in february 2023 from the federal internal revenue service.

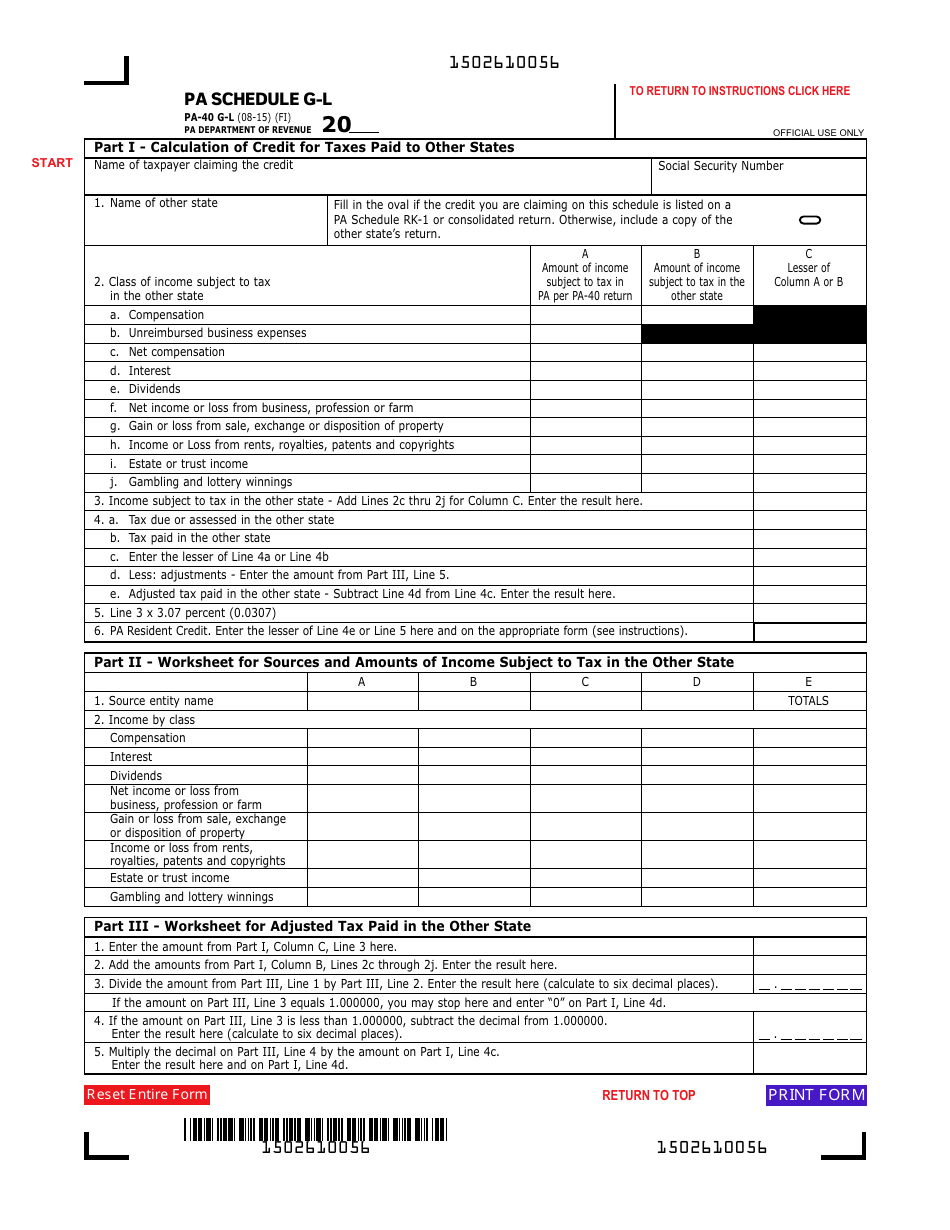

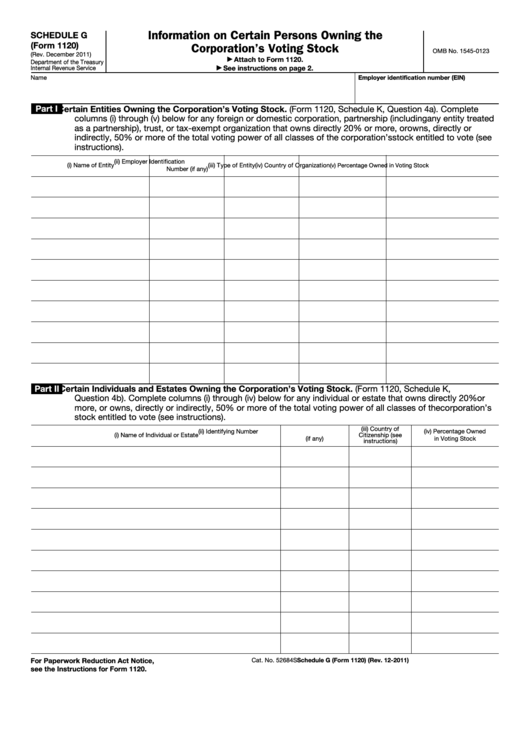

Use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or. Instead file schedule c (form 1040) or. Schedule g—tax computation and payments. For optimal functionality, save the form to your computer before completing or printing. Web schedule g (form 990) 2023 page 2 part ii fundraising events. Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than. Who can use the form. Web we last updated federal 1120 (schedule g) in february 2023 from the federal internal revenue service. Web purpose of schedule. Web schedule b—income distribution deduction.29 schedule g—tax computation and payments.30 net investment income tax.35 other information.

Get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with tax returns due. About schedule 8812 (form 1040), credits for. Web we last updated federal 1120 (schedule g) in february 2023 from the federal internal revenue service. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web order tax forms and instructions; Any donation will reduce your refund or. Complete, edit or print tax forms instantly. Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than.

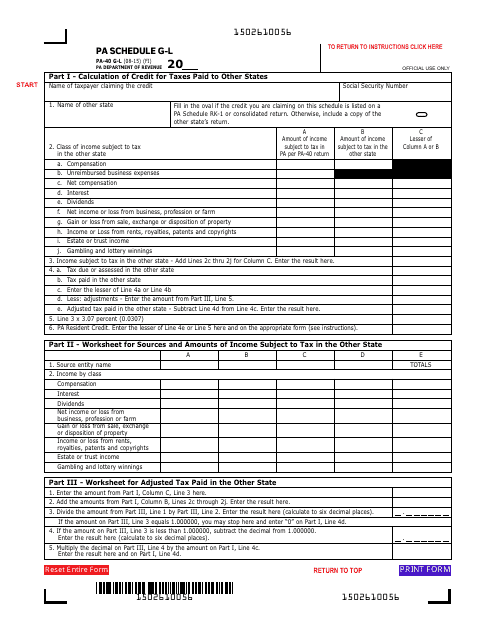

Form PA40 Schedule GL Download Fillable PDF or Fill Online Resident

Web order tax forms and instructions; Complete, edit or print tax forms instantly. ( for a copy of a form, instruction, or publication) address to mail form to irs: Web we last updated federal 1120 (schedule g) in february 2023 from the federal internal revenue service. Web 1 best answer tagteam level 15 for a trust return what is a.

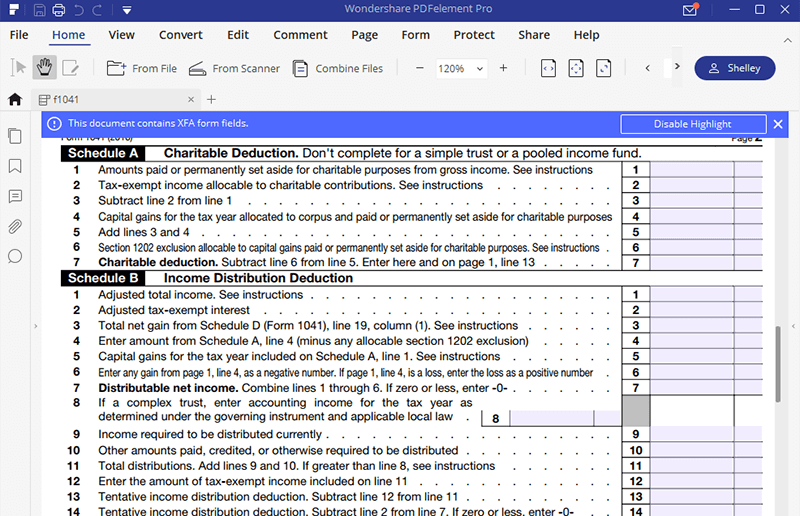

Guide for How to Fill in IRS Form 1041

Ad access irs tax forms. Web depending on when your business closed or your activity ceased in the city, it may still be necessary to file a final return. Web schedule b—income distribution deduction.29 schedule g—tax computation and payments.30 net investment income tax.35 other information. Use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates.

schedule g form 990 2021 Fill Online, Printable, Fillable Blank

Name(s) as shown on tax. Web schedule b—income distribution deduction.29 schedule g—tax computation and payments.30 net investment income tax.35 other information. Web addresses for forms beginning with the number 7. For optimal functionality, save the form to your computer before completing or printing. Web depending on when your business closed or your activity ceased in the city, it may still.

Form PA40 Schedule GL Download Fillable PDF or Fill Online Resident

Complete, edit or print tax forms instantly. Instead file schedule c (form 1040) or. Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than. Complete, edit or print tax forms instantly. Use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or.

Form 1120 (Schedule G) Information on Certain Persons Owning the

Ad access irs tax forms. For optimal functionality, save the form to your computer before completing or printing. Download or email irs 1120 & more fillable forms, register and subscribe now! Web we last updated federal 1120 (schedule g) in february 2023 from the federal internal revenue service. Complete, edit or print tax forms instantly.

Fillable Schedule G (Form 1120) Information On Certain Persons Owning

Web other income, including federal and state gasoline or fuel tax credit or refund (see instructions). Instead file schedule c (form 1040) or. Complete, edit or print tax forms instantly. Web purpose of schedule. Get ready for tax season deadlines by completing any required tax forms today.

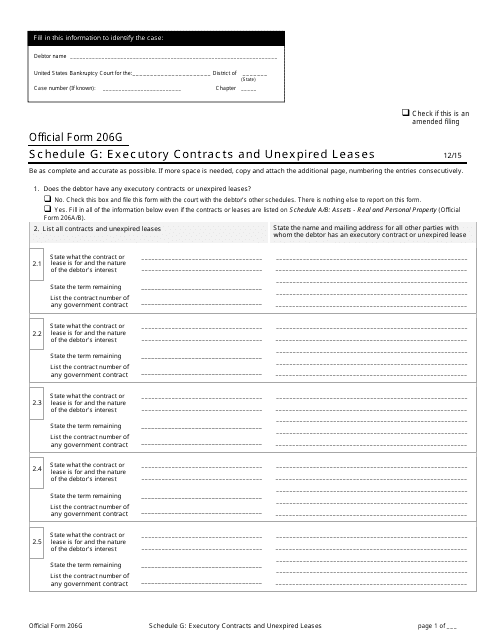

Official Form 206G Schedule G Download Printable PDF or Fill Online

Use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Name(s) as shown on tax. ( for a copy of a form, instruction, or publication) address to mail form to irs:

form 1120 schedule g 2017 Fill Online, Printable, Fillable Blank

Web 1 best answer tagteam level 15 for a trust return what is a schedule g and where do i find it? that is the tax computations section located on page 2 of your 1041. Web order tax forms and instructions; Web we last updated federal 1120 (schedule g) in february 2023 from the federal internal revenue service. Download or.

1099 G Tax Form Explained Unemployment is Taxable! YouTube

About schedule 8812 (form 1040), credits for. Web schedule g (form 990) 2023 page 2 part ii fundraising events. Who can use the form. Web addresses for forms beginning with the number 7. Schedule g—tax computation and payments.

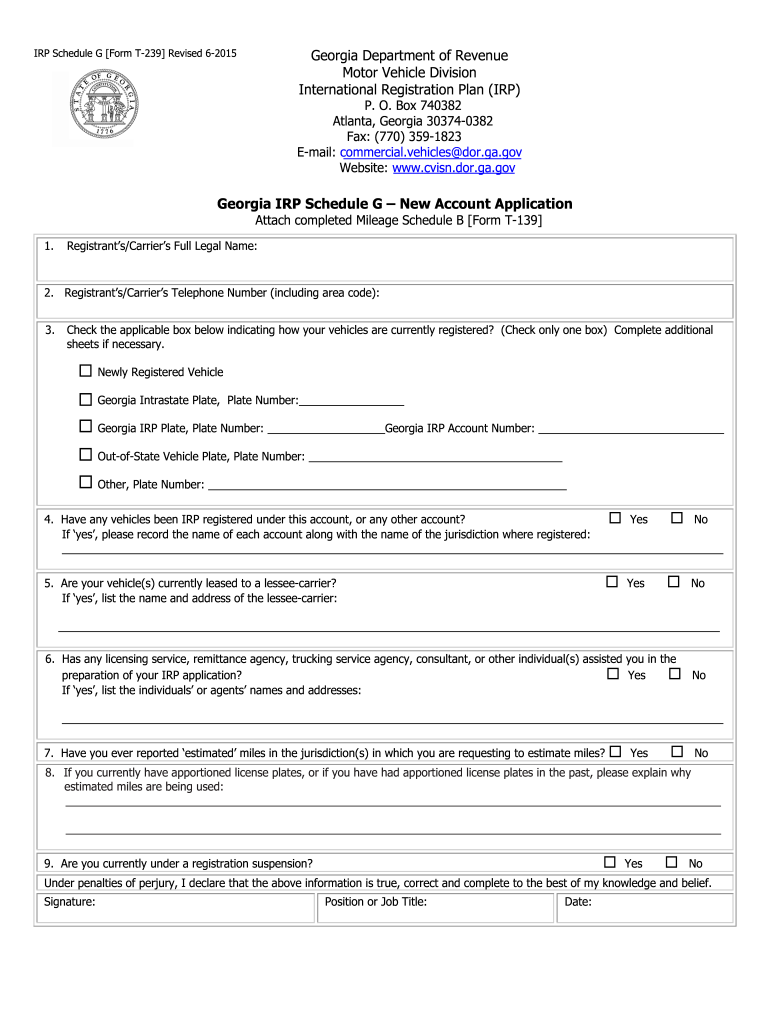

20152019 Form GA T239 IRP Schedule G Fill Online, Printable

Use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or. Web 1 best answer tagteam level 15 for a trust return what is a schedule g and where do i find it? that is the tax computations section located on page 2 of your 1041. Web depending on.

Complete, Edit Or Print Tax Forms Instantly.

Get ready for tax season deadlines by completing any required tax forms today. Any donation will reduce your refund or. Web other income, including federal and state gasoline or fuel tax credit or refund (see instructions). Web schedule g (form 990) 2023 page 2 part ii fundraising events.

Complete If The Organization Answered “Yes” On Form 990, Part Iv, Line 18, Or Reported More Than.

Web depending on when your business closed or your activity ceased in the city, it may still be necessary to file a final return. About schedule 8812 (form 1040), credits for. Download or email irs 1120 & more fillable forms, register and subscribe now! Ad access irs tax forms.

Instead File Schedule C (Form 1040) Or.

Web we last updated federal 1120 (schedule g) in february 2023 from the federal internal revenue service. For optimal functionality, save the form to your computer before completing or printing. ( for a copy of a form, instruction, or publication) address to mail form to irs: Complete, edit or print tax forms instantly.

Web Order Tax Forms And Instructions;

Who can use the form. Use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or. Web schedule b—income distribution deduction.29 schedule g—tax computation and payments.30 net investment income tax.35 other information. Web addresses for forms beginning with the number 7.