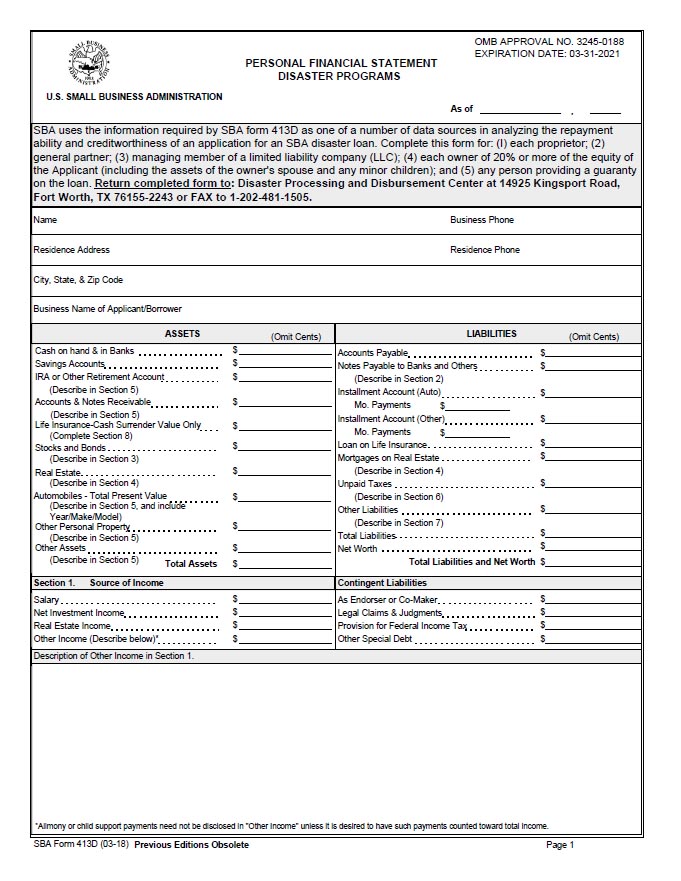

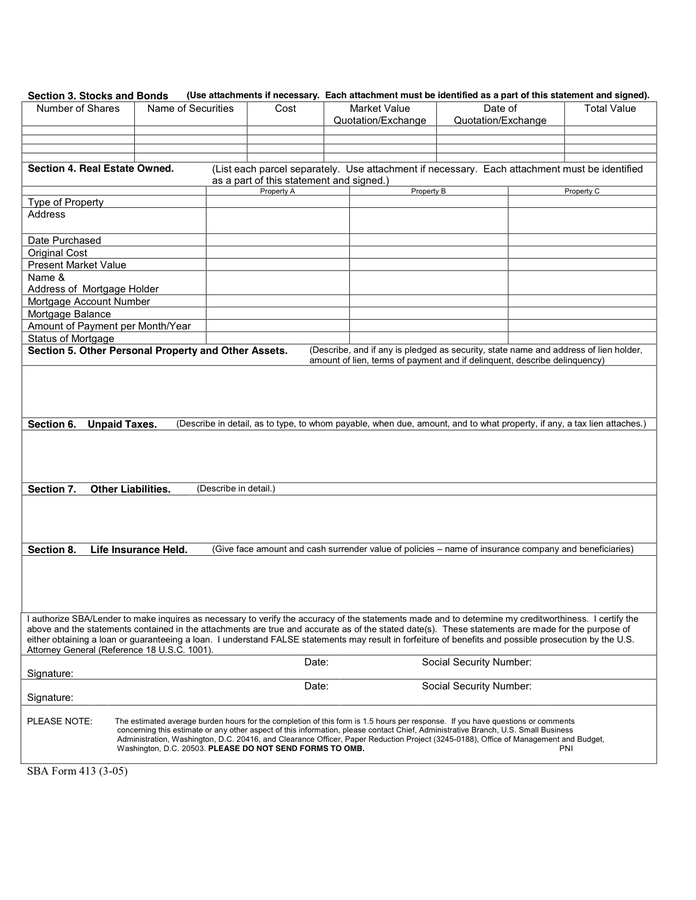

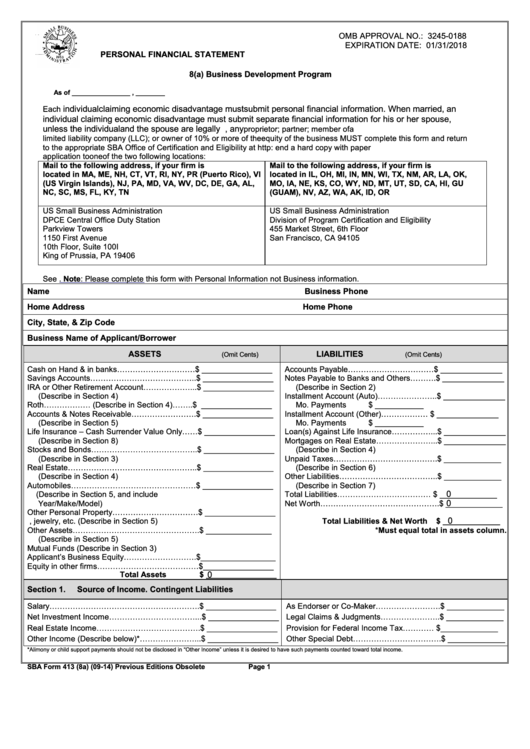

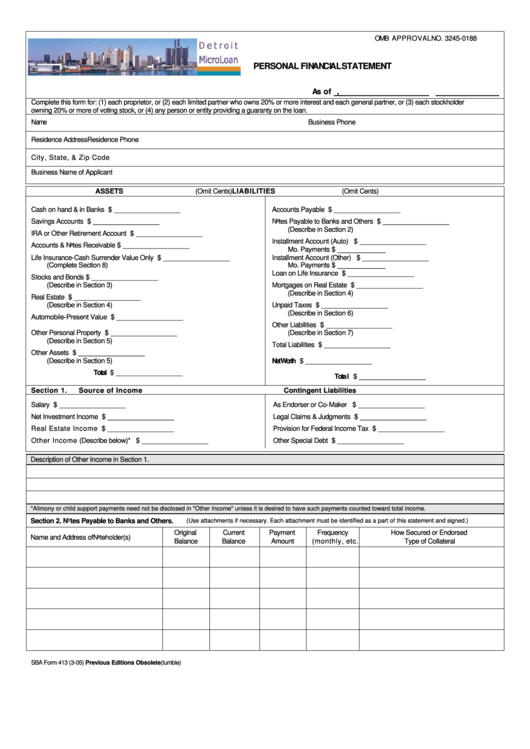

Sba Form 413 Personal Financial Statement

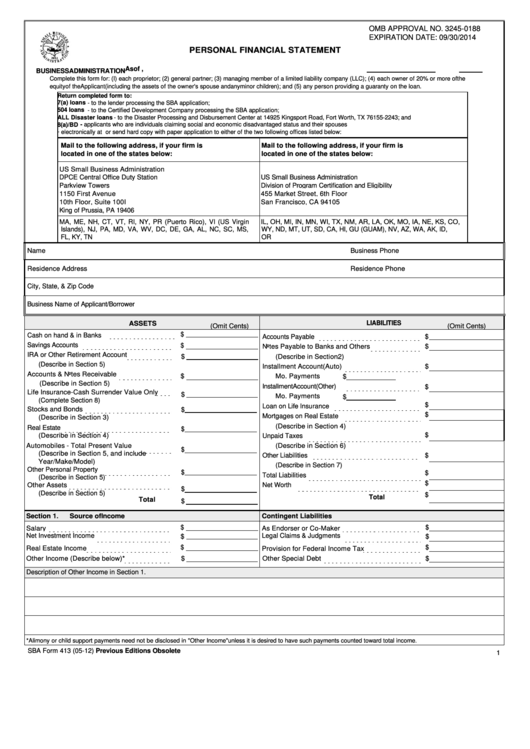

Sba Form 413 Personal Financial Statement - Web sba form 413 personal financial statement sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. This form is used to assess repayment ability and creditworthiness of applicants for: Why does the sba require form 413? Small business administration uses to assess the creditworthiness and repayment ability of its. It provides personal financial information for each partner or stockholder of a business who owns at least 20% of the business. Specifically, we’ll answer these questions and more: Web sba form 413 is a form used by the small business administration (sba). Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or, with respect to a surety bond, to assist in recovery in the event that the contractor defaults on the contract. It is completed when a small business owner wants to apply for a loan or surety bond with the sba. It is also known as a personal financial statement.

Specifically, we’ll answer these questions and more: It is also known as a personal financial statement. It is completed when a small business owner wants to apply for a loan or surety bond with the sba. Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or, with respect to a surety bond, to assist in recovery in the event that the contractor defaults on the contract. Web for personal finances, you must complete sba form 413 to apply for certain sba loans. Web sba form 413 personal financial statement sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. It provides personal financial information for each partner or stockholder of a business who owns at least 20% of the business. Sba lenders and surety companies/surety agents must begin to utilize the renewed version of sba form 413 (7a/504/sbg/oda/wosb/8a) immediately. Web sba form 413, formally titled “personal financial statement,” is a document that the u.s. Web sba form 413 is a form used by the small business administration (sba).

Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an applicant for an sba loan or, with respect to a surety bond, to assist in recovery in the event that the. It is also known as a personal financial statement. Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or, with respect to a surety bond, to assist in recovery in the event that the contractor defaults on the contract. This form is used to assess repayment ability and creditworthiness of applicants for: Sba lenders and surety companies/surety agents must begin to utilize the renewed version of sba form 413 (7a/504/sbg/oda/wosb/8a) immediately. Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or a guaranteed surety. What is sba form 413? Web for personal finances, you must complete sba form 413 to apply for certain sba loans. Small business administration uses to assess the creditworthiness and repayment ability of its. Specifically, we’ll answer these questions and more:

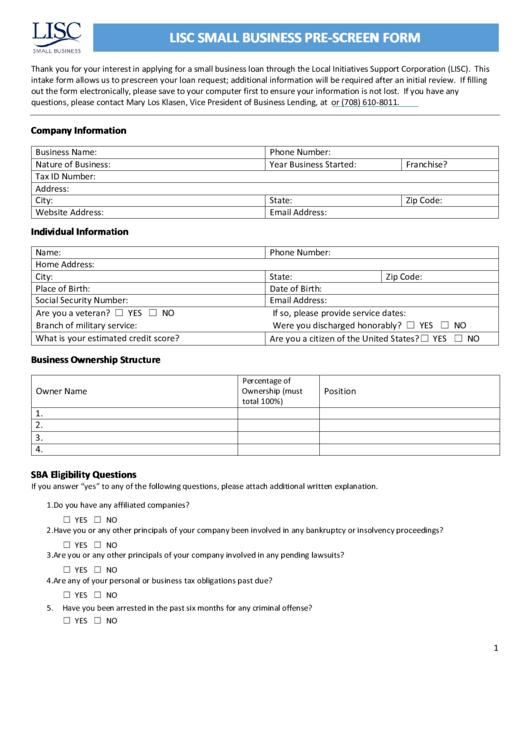

SBA Loan Help Navajo Thaw Implementation Plan

Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or, with respect to a surety bond, to assist in recovery in the event that the contractor defaults on the contract. Web sba form.

SBA Form 413 Instructions YouTube

Sba lenders and surety companies/surety agents must begin to utilize the renewed version of sba form 413 (7a/504/sbg/oda/wosb/8a) immediately. Web sba form 413 personal financial statement sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. Web sba uses the information required by this form 413 as one of a number of data.

Article

Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or a guaranteed surety. It is completed when a small business owner wants to apply for a loan or surety bond with the sba..

Fillable Sba Form 413 Personal Financial Statement U.s. Small

It is also known as a personal financial statement. This form is used to assess repayment ability and creditworthiness of applicants for: What is sba form 413? Web also called the personal financial statement (pfs), form 413 allows lenders to see what you already owe, and evaluate your creditworthiness. Web sba uses the information required by this form 413 as.

Sba 413 Balance Sheet Excel File Financial Statement Alayneabrahams

It is completed when a small business owner wants to apply for a loan or surety bond with the sba. It is also known as a personal financial statement. What is sba form 413? Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of.

Sba Form 413 Personal Financial Statement printable pdf download

What is sba form 413? Web for personal finances, you must complete sba form 413 to apply for certain sba loans. Web sba form 413 personal financial statement sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. Small business administration uses to assess the creditworthiness and repayment ability of its. Web sba.

Sba Form 413 Personal Financial Statement, Lisc Small Business Pre

Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an applicant for an sba loan or, with respect to a surety bond, to assist in recovery in the event that the. What is sba form 413? Why does the sba require form 413?.

SBA Form 413 Create & Download for Free PDF Word FormSwift

It provides personal financial information for each partner or stockholder of a business who owns at least 20% of the business. Web for personal finances, you must complete sba form 413 to apply for certain sba loans. Small business administration uses to assess the creditworthiness and repayment ability of its. Specifically, we’ll answer these questions and more: It is also.

Fill Free fillable SBA form 413 2014 PERSONAL FINANCIAL STATEMENT PDF

(1) each proprietor, or (2) each limited partner who ow ns 20% or more interest and each general partner, or (3) each stockholder ownin g 20% or more of voting stock, or (4) any person. Why does the sba require form 413? Web sba uses the information required by this form 413 as one of a number of data sources.

Sba Form 413 Personal Financial Statement printable pdf download

It is completed when a small business owner wants to apply for a loan or surety bond with the sba. Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or, with respect to.

Sba Lenders And Surety Companies/Surety Agents Must Begin To Utilize The Renewed Version Of Sba Form 413 (7A/504/Sbg/Oda/Wosb/8A) Immediately.

This form is used to assess repayment ability and creditworthiness of applicants for: Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or a guaranteed surety. Web also called the personal financial statement (pfs), form 413 allows lenders to see what you already owe, and evaluate your creditworthiness. Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an applicant for an sba loan or, with respect to a surety bond, to assist in recovery in the event that the.

It Is Completed When A Small Business Owner Wants To Apply For A Loan Or Surety Bond With The Sba.

(1) each proprietor, or (2) each limited partner who ow ns 20% or more interest and each general partner, or (3) each stockholder ownin g 20% or more of voting stock, or (4) any person. It provides personal financial information for each partner or stockholder of a business who owns at least 20% of the business. Web sba form 413 personal financial statement sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. It is also known as a personal financial statement.

Web For Personal Finances, You Must Complete Sba Form 413 To Apply For Certain Sba Loans.

Web sba form 413 is a form used by the small business administration (sba). Small business administration uses to assess the creditworthiness and repayment ability of its. Web sba form 413, formally titled “personal financial statement,” is a document that the u.s. Specifically, we’ll answer these questions and more:

What Is Sba Form 413?

Why does the sba require form 413? Web sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba guaranteed 7(a) or 504 loan or, with respect to a surety bond, to assist in recovery in the event that the contractor defaults on the contract.