Sba Form 1544

Sba Form 1544 - Web 1544 lender fee payments. Due to the formatting limitations of sba form 1544, sba has had to revise the text of the first and final notices. Web beware of scams and fraud schemes. Web march 9, 2021 did you get a bill for a small business administration (sba) loan, but you didn’t apply for one? Web view loan details and transaction history. The information is used to review the. Small business administration application for section 504 loans. Applying for an sba loan is easier than ever with our streamlined application process. Web protect yourself from scams and fraud. The debtor is advised to take into consideration the amount of the discharge when filing tax returns.

Web report fraud, waste, and abuse. Web 1544 lender fee payments. Small business administration application for section 504 loans. Web protect yourself from scams and fraud. You may report fraud, waste, mismanagement, or misconduct involving sba programs or employees either online or. Due to the formatting limitations of sba form 1544, sba has had to revise the text of the first and final notices. It’s likely that an identity thief applied for the loan using your. Business ownership (attach additional pages if needed) this section requires the small business applicant to disclose 100% of its ownership as. Web beware of scams and fraud schemes. Send and receive messages with the sba team concerning your loan.

It’s likely that an identity thief applied for the loan using your. It’s possible that an identity thief applied for the loan. Web 1544 lender fee payments. Web report fraud, waste, and abuse. Web 1544 lender fee payments. The office of inspector general provides insights and tips on what to look out for to protect your business from grant. Low monthly payment for a $200,000 laon. Applying for an sba loan is easier than ever with our streamlined application process. Web receives a notice from sba (form 1544) containing the amount reported. Business ownership (attach additional pages if needed) this section requires the small business applicant to disclose 100% of its ownership as.

SBA Form 1246 Download Fillable PDF or Fill Online Application for

Web report fraud, waste, and abuse. Ad connecting you to sba loans now. Web 1544 lender fee payments. Web beware of scams and fraud schemes. Applying for an sba loan is easier than ever with our streamlined application process.

Sba Form 1368 Pdf Fill Out and Sign Printable PDF Template signNow

Web report fraud, waste, and abuse. The information is used to review the. Applying for an sba loan is easier than ever with our streamlined application process. Web sba notifies lenders of past due guaranty fees using sba form 1544. Web information about publication 1544, reporting cash payments of over $10,000, including recent updates and related forms.

SBA Form 1010C Download Fillable PDF or Fill Online U.S. Small Business

You need to pay your sba loan guarantee fees, care and preservation of collateral fees, review fees. The information is used to review the. Web sba notifies lenders of past due guaranty fees using sba form 1544. Web 1544 lender fee payments. Web are you a lender paying a 1544 guarantee fee?

SBA Form 1450 Download Fillable PDF or Fill Online 8(A) Annual Update

Web receives a notice from sba (form 1544) containing the amount reported. Applying for an sba loan is easier than ever with our streamlined application process. Lenders use this form to pay your sba loan guarantee fees, care and preservation of collateral (cpc) fees, review fees and/or. Low monthly payment for a $200,000 laon. Web 1544 lender fee payments.

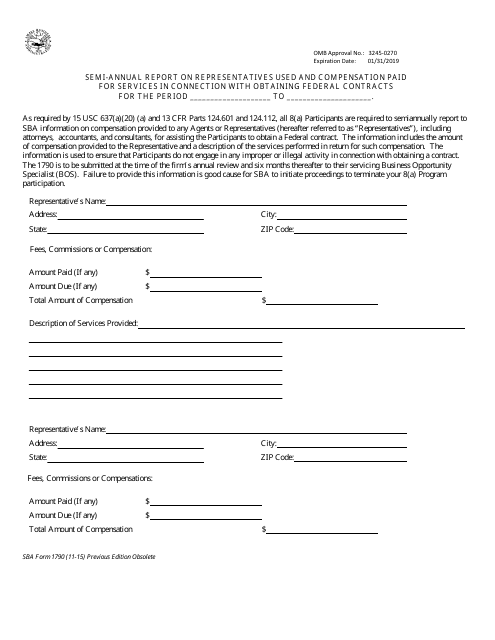

SBA Form 1790 Download Fillable PDF or Fill Online Semiannual Report

Ad connecting you to sba loans now. Ad connecting you to sba loans now. Applying for an sba loan is easier than ever with our streamlined application process. This report reviews sba's blanket purchase. Due to the formatting limitations of sba form 1544, sba has had to revise the text of the first and final notices.

2017 Form SBA 2462 Fill Online, Printable, Fillable, Blank pdfFiller

Low monthly payment for a $200,000 laon. Due to the formatting limitations of sba form 1544, sba has had to revise the text of the first and final notices. The information is used to review the. Web march 9, 2021 did you get a bill for a small business administration (sba) loan, but you didn’t apply for one? Web information.

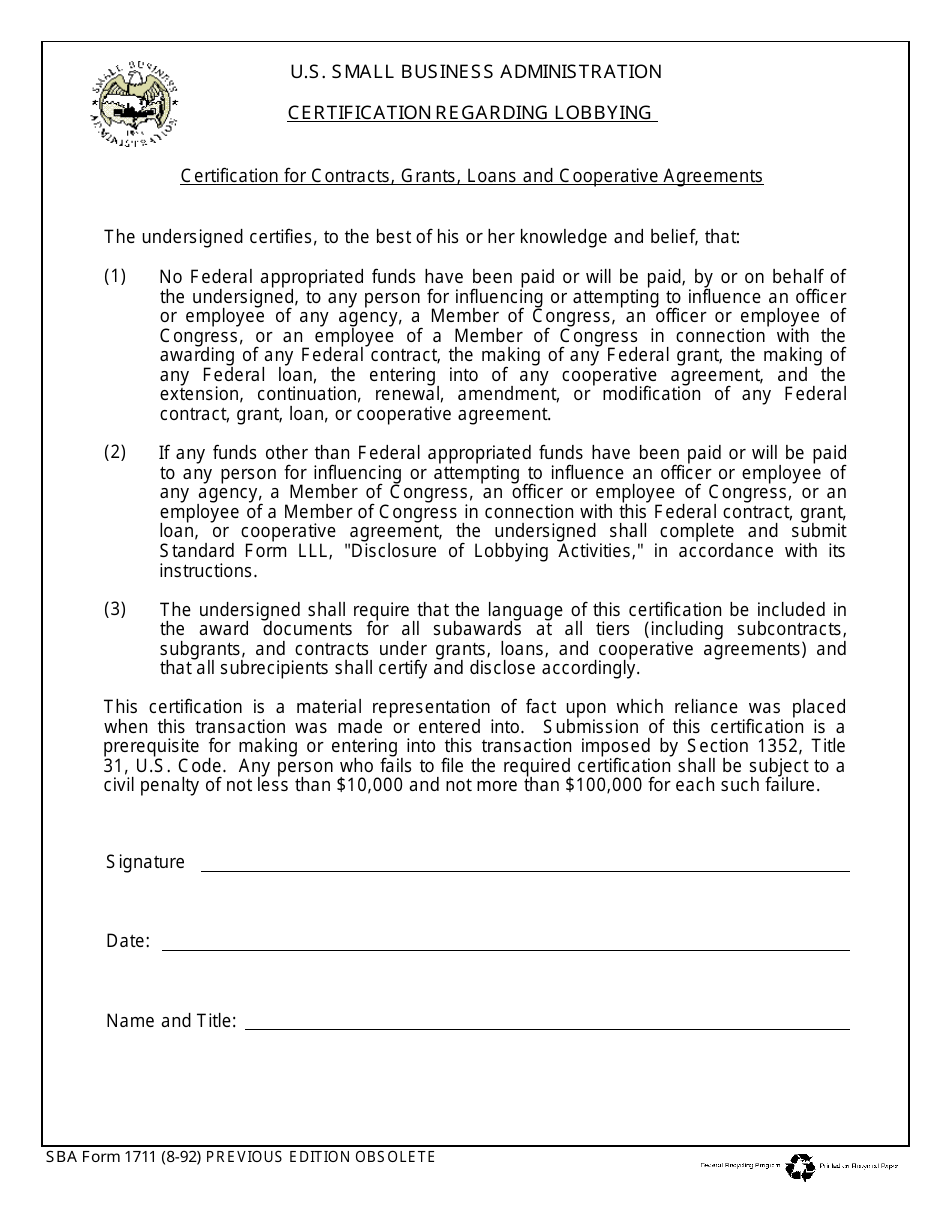

SBA Form 1711 Download Fillable PDF or Fill Online Certification

Web information about publication 1544, reporting cash payments of over $10,000, including recent updates and related forms. View loan information or make a payment at the new mysba site. This report reviews sba's blanket purchase. Web 1544 lender fee payments. Web receives a notice from sba (form 1544) containing the amount reported.

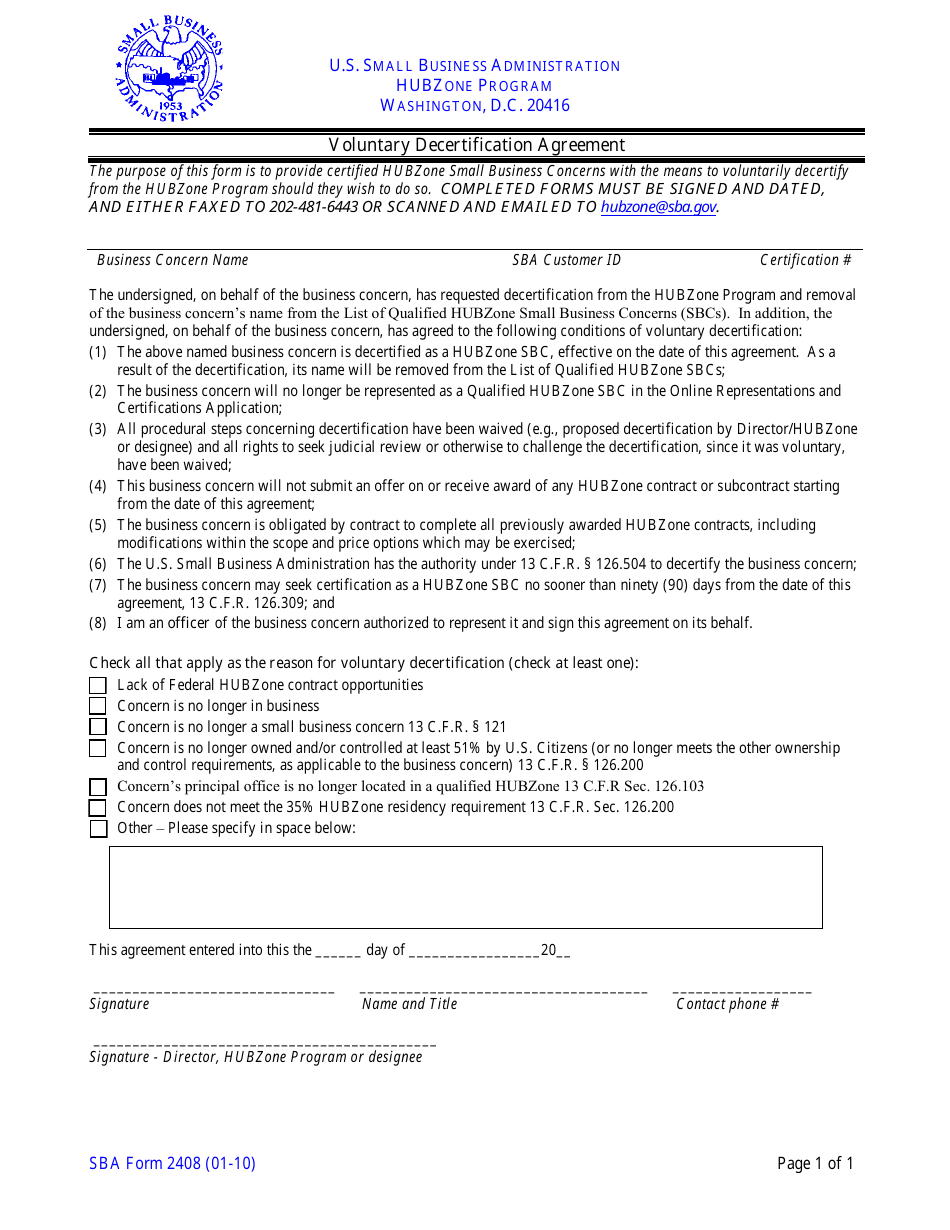

SBA Form 2408 Download Fillable PDF or Fill Online Voluntary

The office of inspector general provides insights and tips on what to look out for to protect your business from grant. Lenders use this form to pay your sba loan guarantee fees, care and preservation of collateral (cpc) fees, review fees and/or. It’s likely that an identity thief applied for the loan using your. Web receives a notice from sba.

Sba Form 1368 Fillable and Printable Template in PDF

Web are you a lender paying a 1544 guarantee fee? Ad connecting you to sba loans now. Lenders use this form to pay your sba loan guarantee fees, care and preservation of collateral (cpc) fees, review fees and/or. Web information about publication 1544, reporting cash payments of over $10,000, including recent updates and related forms. Applying for an sba loan.

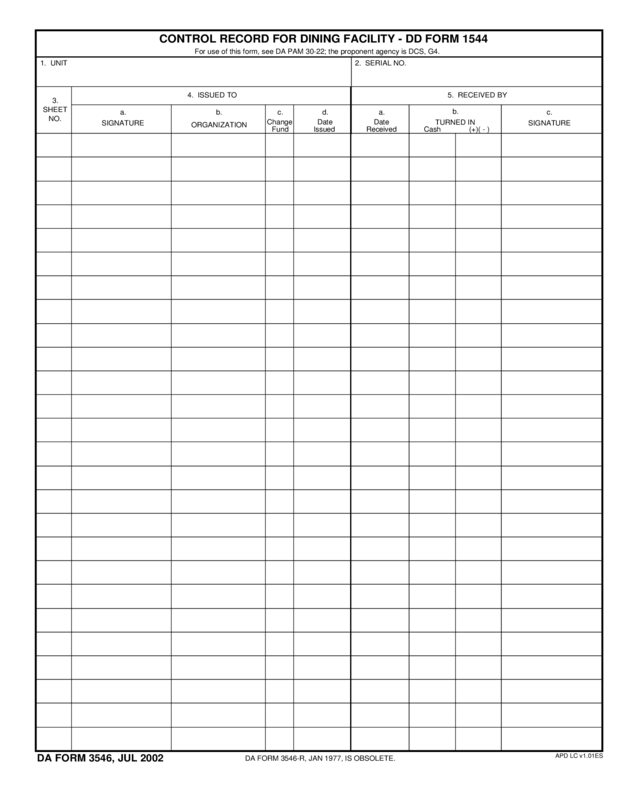

Control Record For Dining Facility Dd Form 1544 Edit, Fill, Sign

Web view loan details and transaction history. Web information about publication 1544, reporting cash payments of over $10,000, including recent updates and related forms. Due to the formatting limitations of sba form 1544, sba has had to revise the text of the first and final notices. The debtor is advised to take into consideration the amount of the discharge when.

It’s Likely That An Identity Thief Applied For The Loan Using Your.

View loan information or make a payment at the new mysba site. Web beware of scams and fraud schemes. Web 1544 lender fee payments. It’s possible that an identity thief applied for the loan.

You Need To Pay Your Sba Loan Guarantee Fees, Care And Preservation Of Collateral Fees, Review Fees.

Web information about publication 1544, reporting cash payments of over $10,000, including recent updates and related forms. Web protect yourself from scams and fraud. Low monthly payment for a $200,000 laon. Send and receive messages with the sba team concerning your loan.

Applying For An Sba Loan Is Easier Than Ever With Our Streamlined Application Process.

Due to the formatting limitations of sba form 1544, sba has had to revise the text of the first and final notices. Web did you get a bill for a small business administration (sba) loan, but you didn’t apply for one? Small business administration application for section 504 loans. Web receives a notice from sba (form 1544) containing the amount reported.

Web 1544 Lender Fee Payments.

Applying for an sba loan is easier than ever with our streamlined application process. Web march 9, 2021 did you get a bill for a small business administration (sba) loan, but you didn’t apply for one? The office of inspector general provides insights and tips on what to look out for to protect your business from grant. The debtor is advised to take into consideration the amount of the discharge when filing tax returns.