Rita Form 37 Instructions

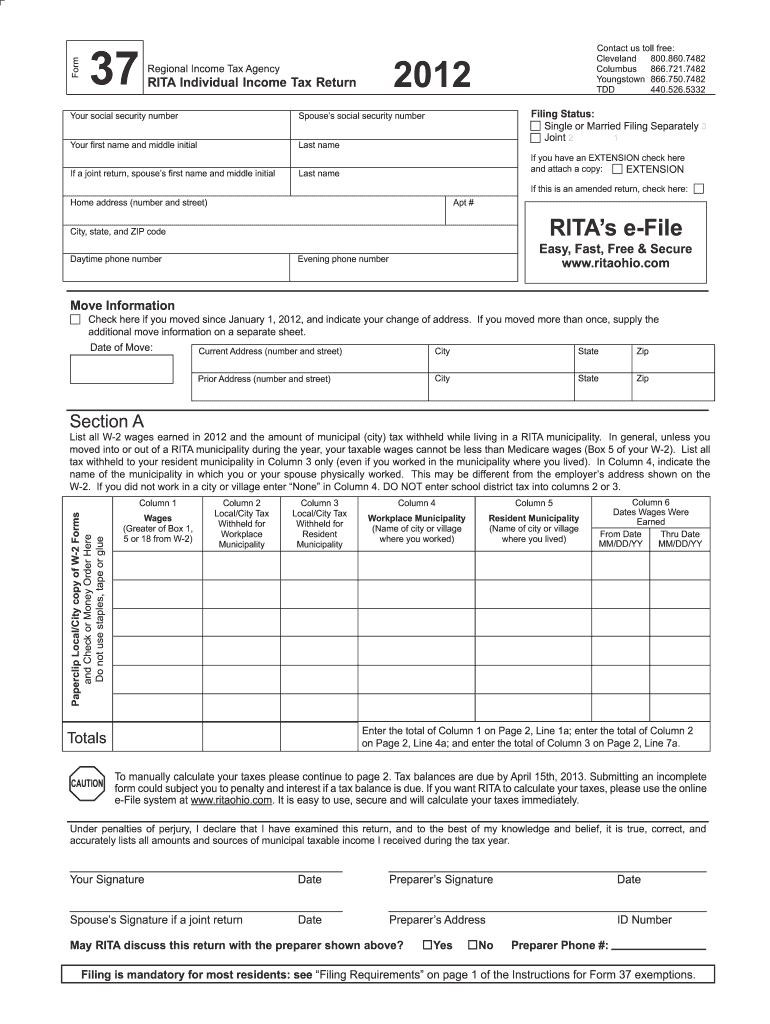

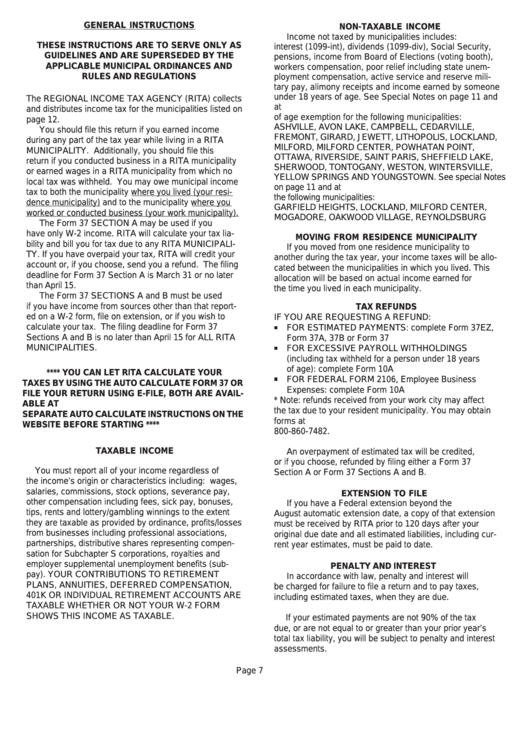

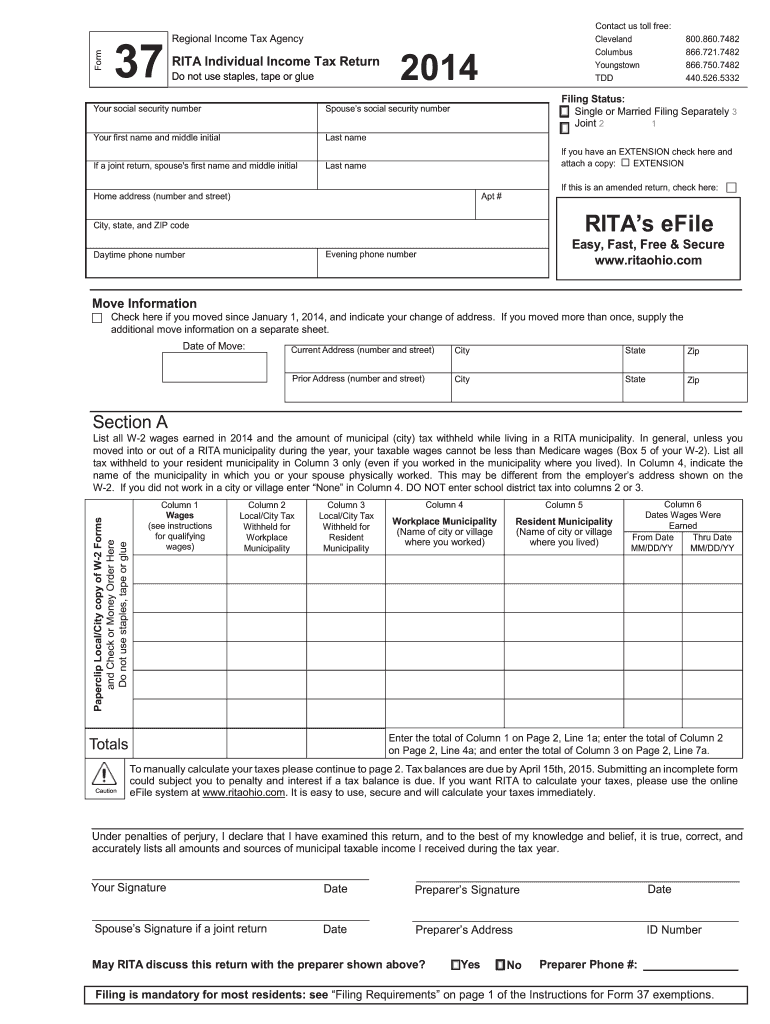

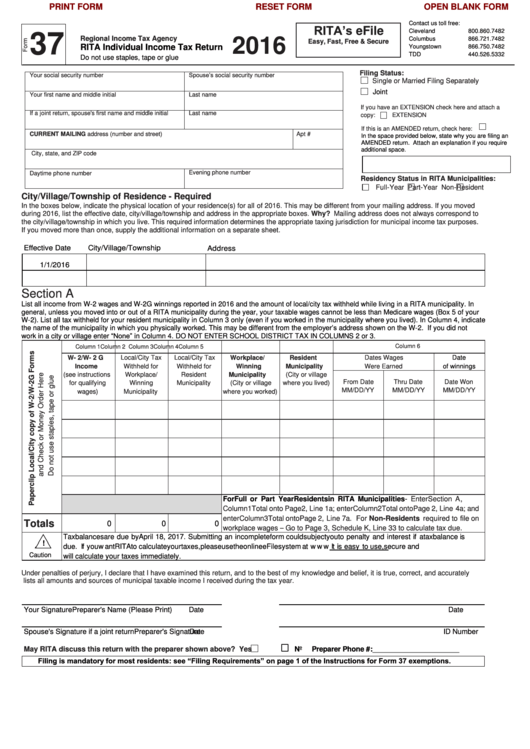

Rita Form 37 Instructions - Filing is mandatory for most. Web regional income tax agency 37. Web of the year, you must file a return with rita unless you are eligible to file a declaration of exemption. Pick the form you would like to sign and then click the upload button. The applicable municipal ordinances and rules and regulations take precedence. When you file a form 10a, the tax withheld from section a, columns 2 or 3 ofform 37 must be reduced by the amount claimed on the refund request. A rita cannot be filed if you were only reimbursed rita in the previous. Web do i have to file a form 37 ohio rita tax form when i don't live in a rita city? Web a state must be claimed on the certification form with state taxes included for state tax consideration. Web the following forms can be found on the rita website:individual formsform 37 individual municipal income tax return form 37 instructions form 75 individual registration.

To verify or find out if you live in a school district or city with an income tax enter your address at:. A declaration of exemption form may be filed electronically or. A rita cannot be filed if you were only reimbursed rita in the previous. Web fillable pdf version of form 37. Web filing is mandatory for most residents: Pick the form you would like to sign and then click the upload button. Rita individual income tax return. See “filing requirements” on page 1 of the instructions for form 37 exemptions. When you file a form 10a, the tax withheld from section a, columns 2 or 3 ofform 37 must be reduced by the amount claimed on the refund request. Form 37 instructions “worksheet 2” may be used to calculate your estimated income.

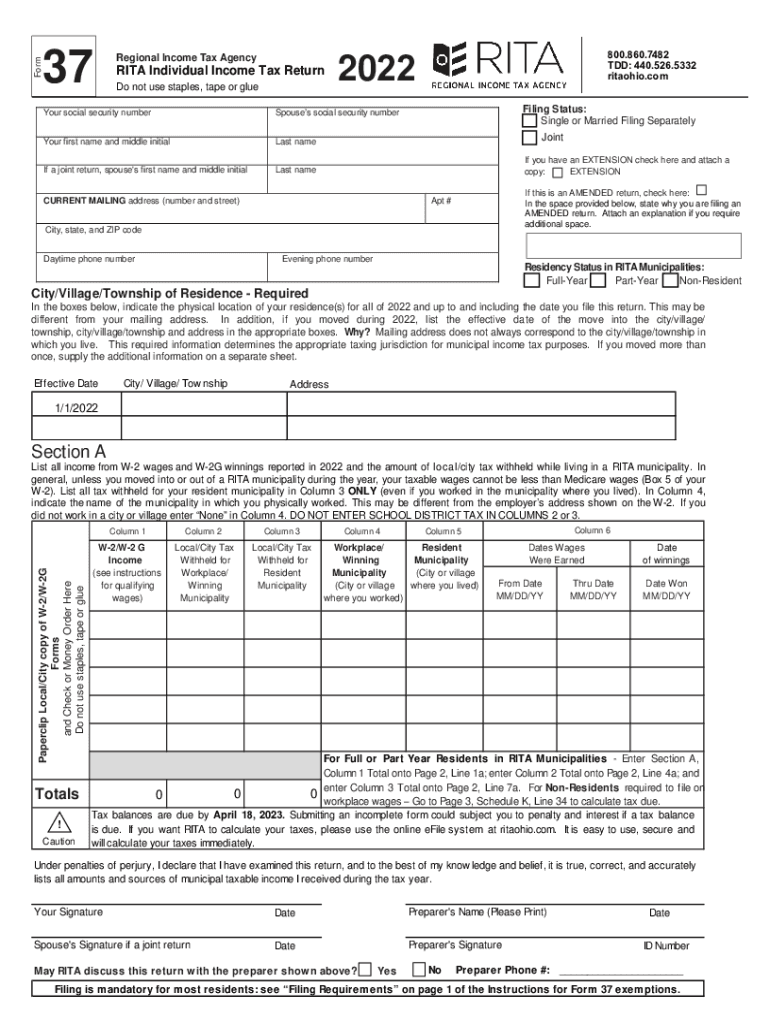

See required documentation on page 2 of these instructions for the. Returns filed by mail must be postmarked no later than april 15, 2020. Web the year, you must file a return with rita unless you are eligible to file a declaration of exemption. Form 37 instructions “worksheet 2” may be used to calculate your estimated income. Do not use staples, tape or glue. Rita individual income tax return. Web instructions for form 37. A declaration of exemption form may be filed electronically or. Rita will prepare your return for you. When you file a form 10a, the tax withheld from section a, columns 2 or 3 ofform 37 must be reduced by the amount claimed on the refund request.

How to fill out rita form 37 2012 Fill out & sign online DocHub

Web regional income tax agency rita individual income tax return do not use staples, tape or glue filing status: Rita will prepare your return for you. Web filing is mandatory for most residents: Fill out this sheet, attach your documents and drop it. I am ready to file my ohio taxes by mail.

RITA 32 FormQuarterly Tax Tax Rate Taxes

Taxbalancesare due by april 17,. I am ready to file my ohio taxes by mail. Web regional income tax agency 37. Web instructions for form 37. Web the following forms can be found on the rita website:individual formsform 37 individual municipal income tax return form 37 instructions form 75 individual registration.

Instructions For Form 37 Rita Individual Tax Return State Of

Returns filed by mail must be postmarked no later than april 15, 2020. Web a state must be claimed on the certification form with state taxes included for state tax consideration. Web greater than your prior year's total tax liability, you will be subject to penalty and interest. Web the year, you must file a return with rita unless you.

rita form 27 Fill out & sign online DocHub

Web regional income tax agency rita individual income tax return do not use staples, tape or glue filing status: Web a state must be claimed on the certification form with state taxes included for state tax consideration. Filing is mandatory for most. Web instructions for form 37. Web instructions for form 37.

Rita Form 37 Instructions Fill Out and Sign Printable PDF Template

Single or married filing separately. Web instructions for form 37. Web greater than your prior year's total tax liability, you will be subject to penalty and interest. See required documentation on page 2 of these instructions for the. Do not use staples, tape or glue.

Rita Form 118 ascari, 89,90

Form 37 instructions “worksheet 2” may be used to calculate your estimated income. Web filing is mandatory for most residents: When you file a form 10a, the tax withheld from section a, columns 2 or 3 ofform 37 must be reduced by the amount claimed on the refund request. Web regional income tax agency 37. Web fillable pdf version of.

2014 Form OH RITA 37 Fill Online, Printable, Fillable, Blank pdfFiller

Web a state must be claimed on the certification form with state taxes included for state tax consideration. See required documentation on page 2 of these instructions for the. A declaration of exemption form may be filed electronically or. Taxbalancesare due by april 17,. Web instructions for form 37.

Rita Form 48 Fill Online, Printable, Fillable, Blank pdfFiller

Pick the form you would like to sign and then click the upload button. Web the year, you must file a return with rita unless you are eligible to file a declaration of exemption. The tt instruction sheet says that, but it. When you file a form 10a, the tax withheld from section a, columns 2 or 3 ofform 37.

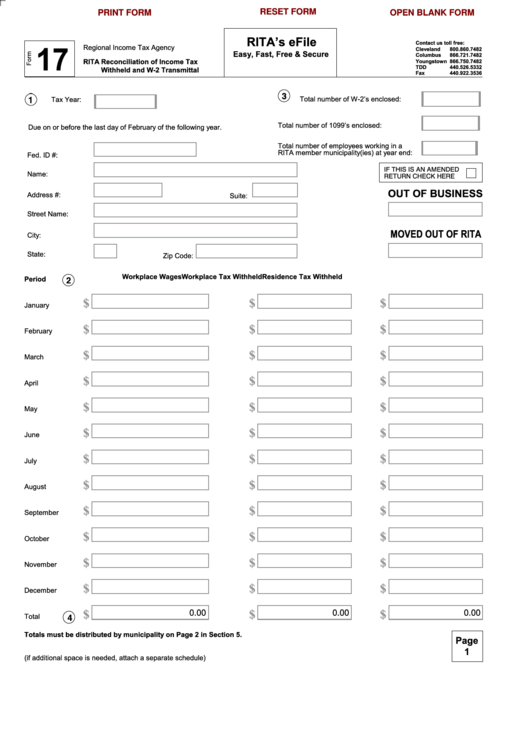

Fillable Form 17 Rita printable pdf download

Web a state must be claimed on the certification form with state taxes included for state tax consideration. The applicable municipal ordinances and rules and regulations take precedence. A declaration of exemption form may be filed electronically or. When you file a form 10a, the tax withheld from section a, columns 2 or 3 ofform 37 must be reduced by.

Web Do I Have To File A Form 37 Ohio Rita Tax Form When I Don't Live In A Rita City?

Web fillable pdf version of form 37. Returns filed by mail must be postmarked no later than april 15, 2020. Web regional income tax agency rita individual income tax return do not use staples, tape or glue filing status: A declaration of exemption form may be filed electronically or.

Rita Will Prepare Your Return For You.

See “filing requirements” on page 1 of the instructions for form 37 exemptions. Web instructions for form 37. Web instructions for form 37. I am ready to file my ohio taxes by mail.

Pick The Form You Would Like To Sign And Then Click The Upload Button.

Web if you were a resident of a rita municipality during any part of the year, you must either file a form 37 return with rita or, if eligible, a declaration of exemption. These instructions are 20only guidelines. Web of the year, you must file a return with rita unless you are eligible to file a declaration of exemption. Web filing is mandatory for most residents:

A Rita Cannot Be Filed If You Were Only Reimbursed Rita In The Previous.

See required documentation on page 2 of these instructions for the. Do not use staples, tape or glue. Web a state must be claimed on the certification form with state taxes included for state tax consideration. When you file a form 10a, the tax withheld from section a, columns 2 or 3 ofform 37 must be reduced by the amount claimed on the refund request.