Promissory Note With Collateral Template

Promissory Note With Collateral Template - Web updated june 16, 2023. Create and download your promissory note in minutes. Web a secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the chance the borrower defaults. An unsecured promissory note is a promissory note that is written without any collateral. Contemporaneously prepare a loan agreement with a promissory note. For example, perhaps the borrower is putting up a piece of property as collateral. Web a promissory note also known as a loan agreement is an agreement to pay back a loan. A secured promissory note is used if personal property or real estate is collateral for the loan. Web before writing a promissory note, you must decide if the loan will be secured or unsecured. Web a secured promissory note is a legal agreement that requires a borrower to provide security for a loan.

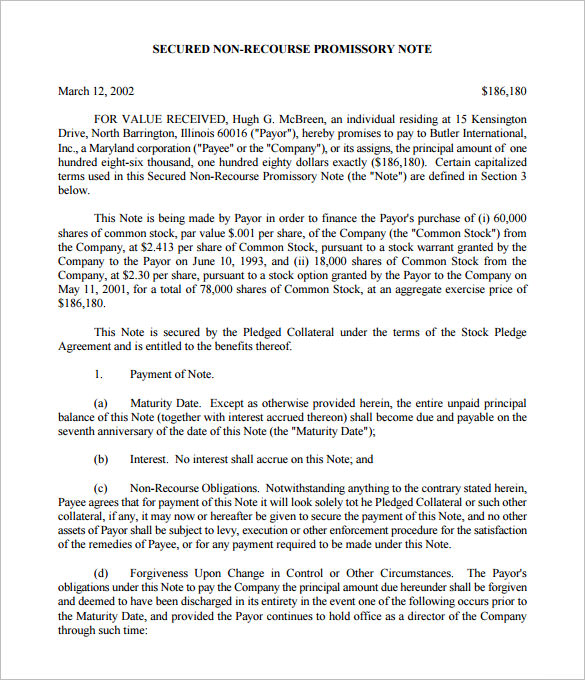

Web a secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the chance the borrower defaults. Unsecured notes may be used with small sums of money where there is. Web a secured promissory note is a legal agreement that requires a borrower to provide security for a loan. Create and download your promissory note in minutes. Web before writing a promissory note, you must decide if the loan will be secured or unsecured. For example, perhaps the borrower is putting up a piece of property as collateral. This type of note carries less risk to the lender and usually allows the borrower to pay a lesser interest rate. Web a promissory note formalizes the loan agreement and details the terms of payment. Web this collateral assignment of mortgages, loan documents and security agreements (this “assignment”) is made and entered into as of the [date] day of [month], [year], by [eligible cdfi], a nonprofit corporation duly organized and existing under the laws of the state of [state] (the “assignor”), as borrower, to and for. Web if the loan is secured by collateral, the promissory note should detail what the collateral is and its value.

With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid. For example, perhaps the borrower is putting up a piece of property as collateral. Unsecured notes may be used with small sums of money where there is. This document is used when a borrower agrees to give up collateral (property) if they fail to repay the loan. For example, auto loans are usually secured. Web a secured promissory note is a legal agreement that requires a borrower to provide security for a loan. Create and download your promissory note in minutes. Web a promissory note also known as a loan agreement is an agreement to pay back a loan. Web this collateral assignment of mortgages, loan documents and security agreements (this “assignment”) is made and entered into as of the [date] day of [month], [year], by [eligible cdfi], a nonprofit corporation duly organized and existing under the laws of the state of [state] (the “assignor”), as borrower, to and for. If the borrower doesn't pay, the lender can take the collateral.

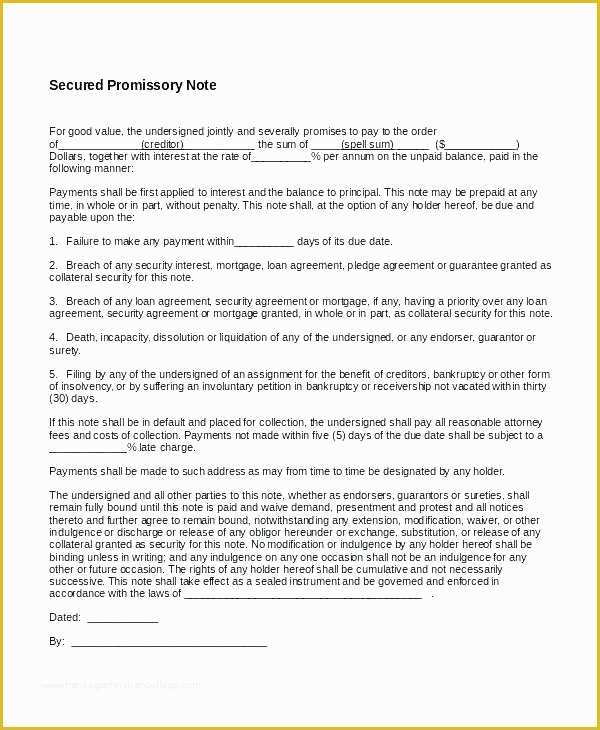

Free Promissory Note with Collateral Template Of Free Promissory Note

Web a promissory note formalizes the loan agreement and details the terms of payment. A promissory note is a written promise made by a borrower to a lender to repay a specified sum of money. Use promissory notes when lending out substantial amounts of money. For example, perhaps the borrower is putting up a piece of property as collateral. Ideal.

Promissory Note With Collateral

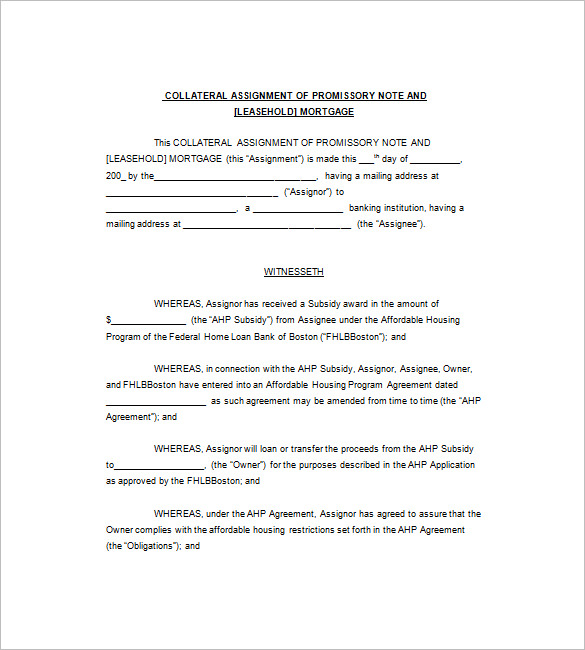

Web this collateral assignment of mortgages, loan documents and security agreements (this “assignment”) is made and entered into as of the [date] day of [month], [year], by [eligible cdfi], a nonprofit corporation duly organized and existing under the laws of the state of [state] (the “assignor”), as borrower, to and for. For example, perhaps the borrower is putting up a.

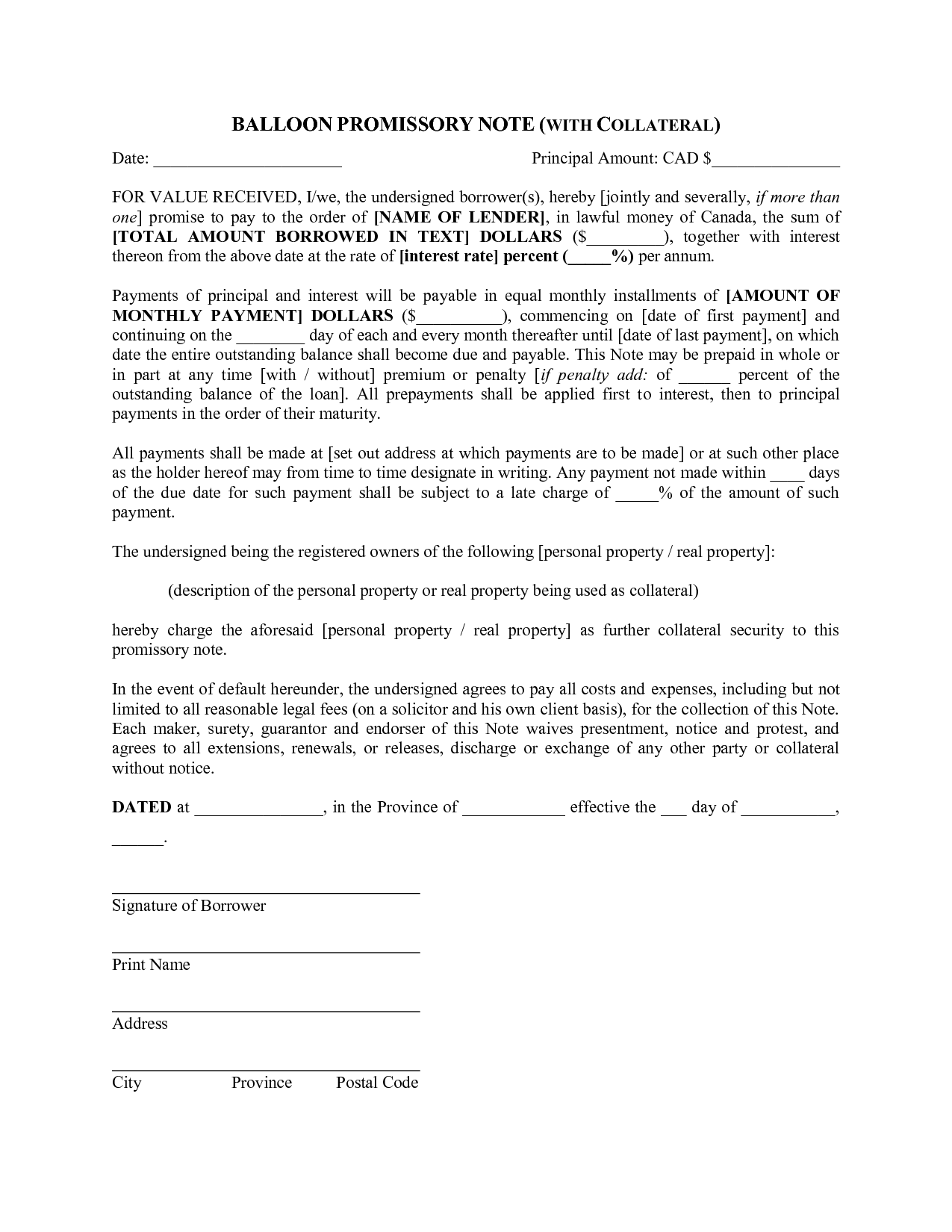

Promissory Note With Collateral Template

This document is used when a borrower agrees to give up collateral (property) if they fail to repay the loan. Contemporaneously prepare a loan agreement with a promissory note. Web this collateral assignment of mortgages, loan documents and security agreements (this “assignment”) is made and entered into as of the [date] day of [month], [year], by [eligible cdfi], a nonprofit.

Explore Our Sample of Promissory Note With Collateral Template Note

For example, perhaps the borrower is putting up a piece of property as collateral. This document is used when a borrower agrees to give up collateral (property) if they fail to repay the loan. Web a promissory note also known as a loan agreement is an agreement to pay back a loan. A secured promissory note is used if personal.

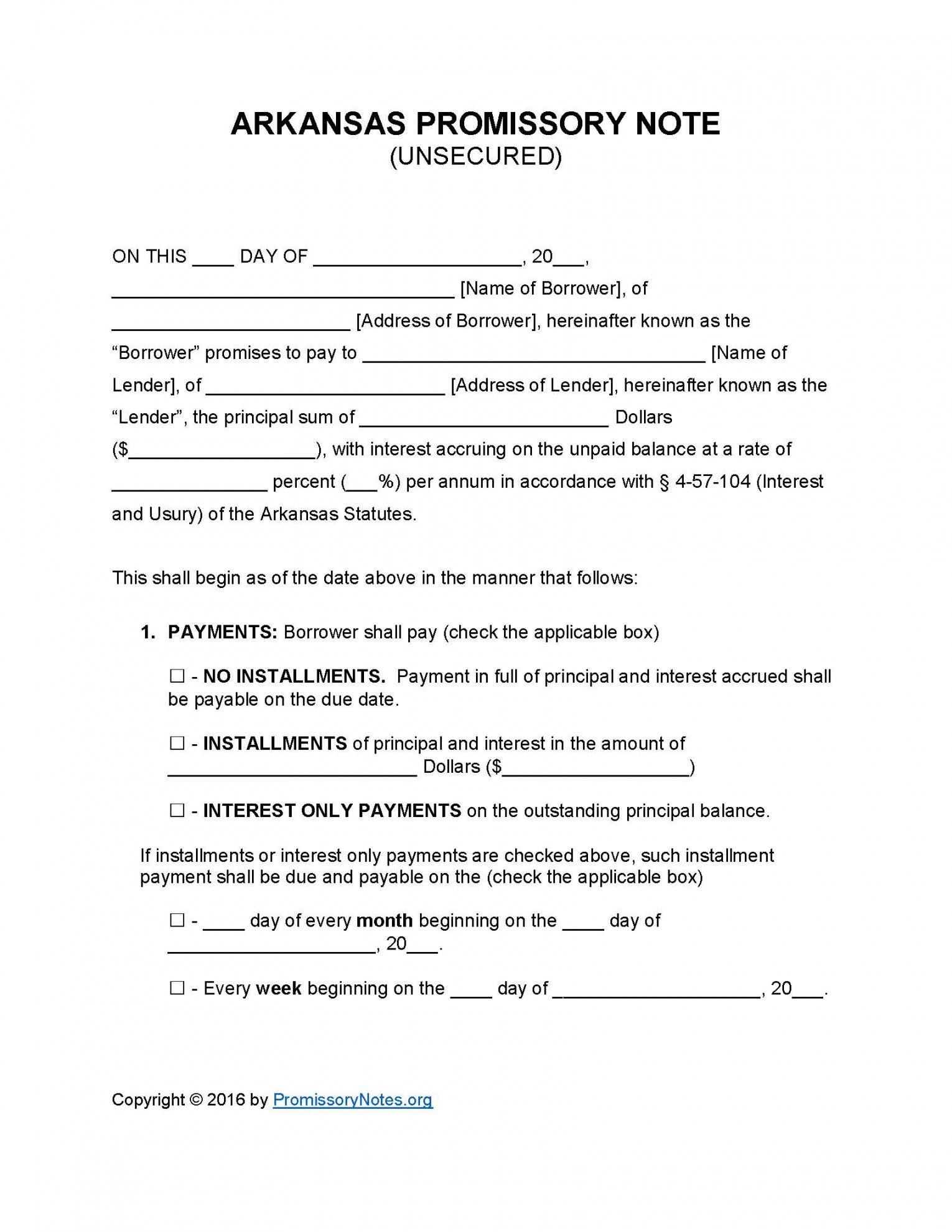

Free Promissory Note With Collateral Template Printable Templates

Unsecured notes may be used with small sums of money where there is. This type of note carries less risk to the lender and usually allows the borrower to pay a lesser interest rate. The lender may specify what collateral will be acceptable. Web a secured promissory note is a legal agreement that requires a borrower to provide security for.

Free Promissory Note with Collateral Template Of Secured Loan Note Word

Web if the loan is secured by collateral, the promissory note should detail what the collateral is and its value. Use promissory notes when lending out substantial amounts of money. Web a secured promissory note is a legal agreement that requires a borrower to provide security for a loan. An unsecured promissory note is a promissory note that is written.

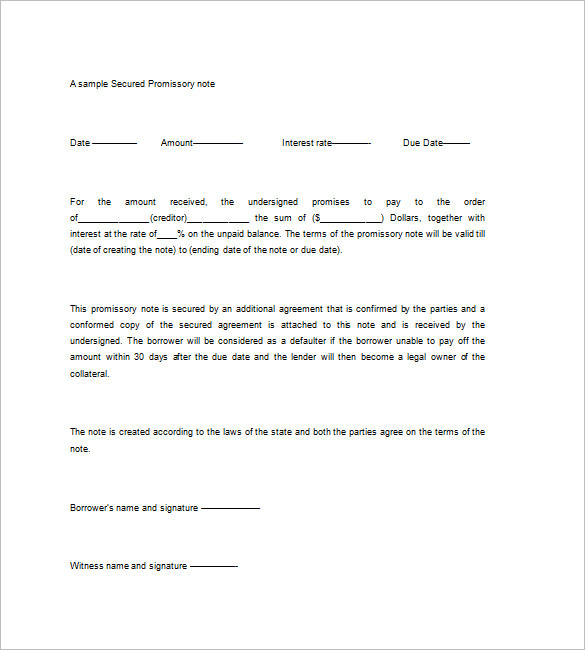

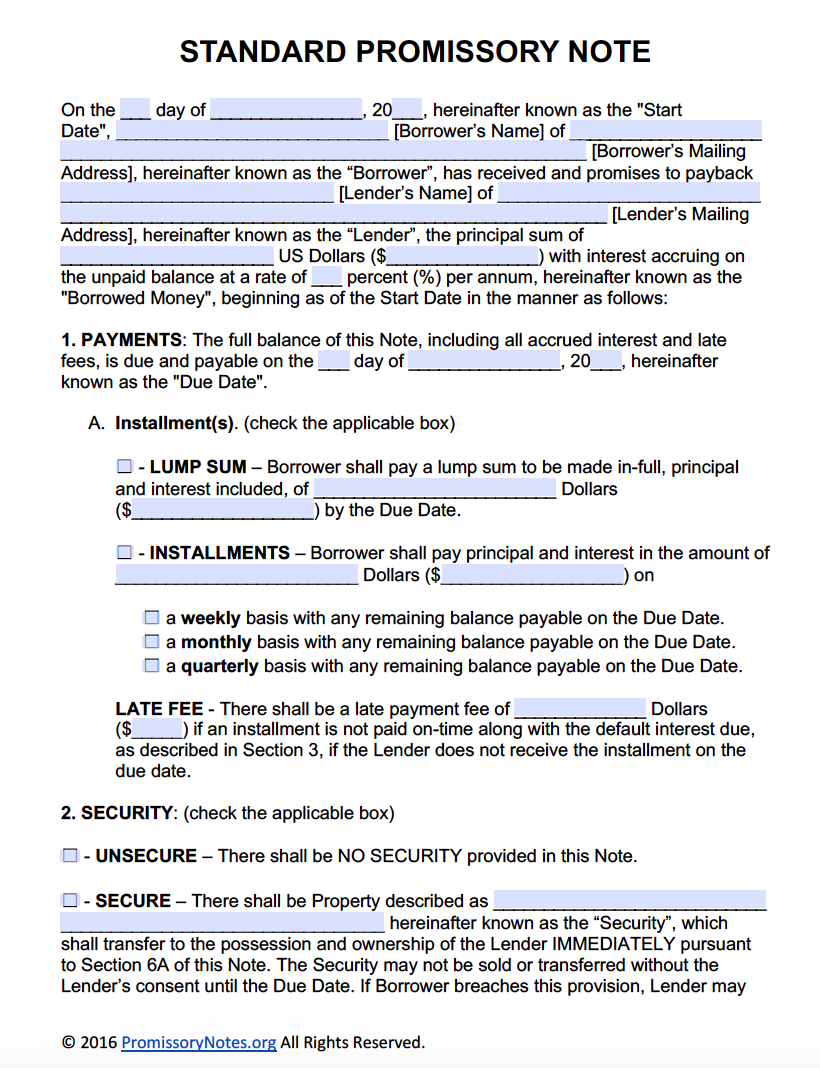

Promissory Notes Templates Free New Promissory Note Template 20 Free

Unsecured notes may be used with small sums of money where there is. Ideal utilities for the promissory notes include car, mortgages, business, student, and personal loans. Web a secured promissory note is one that comes with collateral for the lender to hold until their money is paid back. Web a promissory note formalizes the loan agreement and details the.

Free Promissory Note Template Adobe PDF & Microsoft Word Promissory

An unsecured promissory note is a promissory note that is written without any collateral. If the borrower doesn't pay, the lender can take the collateral. For example, auto loans are usually secured. This document is used when a borrower agrees to give up collateral (property) if they fail to repay the loan. Web a secured promissory note is a document.

Promissory Note With Collateral

Ideal utilities for the promissory notes include car, mortgages, business, student, and personal loans. Web a promissory note also known as a loan agreement is an agreement to pay back a loan. An unsecured promissory note is a promissory note that is written without any collateral. Create and download your promissory note in minutes. Web a secured promissory note is.

8+ Assignment of Promissory Note Free Sample, Example, Format Download!

Web before writing a promissory note, you must decide if the loan will be secured or unsecured. Web a secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the chance the borrower defaults. It is a legal document for a loan and.

Ideal Utilities For The Promissory Notes Include Car, Mortgages, Business, Student, And Personal Loans.

With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid. A promissory note is a written promise made by a borrower to a lender to repay a specified sum of money. Web before writing a promissory note, you must decide if the loan will be secured or unsecured. An unsecured promissory note is a promissory note that is written without any collateral.

This Document Is Used When A Borrower Agrees To Give Up Collateral (Property) If They Fail To Repay The Loan.

For example, perhaps the borrower is putting up a piece of property as collateral. Web a promissory note also known as a loan agreement is an agreement to pay back a loan. Web this collateral assignment of mortgages, loan documents and security agreements (this “assignment”) is made and entered into as of the [date] day of [month], [year], by [eligible cdfi], a nonprofit corporation duly organized and existing under the laws of the state of [state] (the “assignor”), as borrower, to and for. Unsecured notes may be used with small sums of money where there is.

Web A Secured Promissory Note Is One That Comes With Collateral For The Lender To Hold Until Their Money Is Paid Back.

Web a secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the chance the borrower defaults. Web updated june 16, 2023. A secured promissory note is used if personal property or real estate is collateral for the loan. The lender may specify what collateral will be acceptable.

For Example, Auto Loans Are Usually Secured.

Contemporaneously prepare a loan agreement with a promissory note. This type of note carries less risk to the lender and usually allows the borrower to pay a lesser interest rate. Web a promissory note formalizes the loan agreement and details the terms of payment. Web if the loan is secured by collateral, the promissory note should detail what the collateral is and its value.