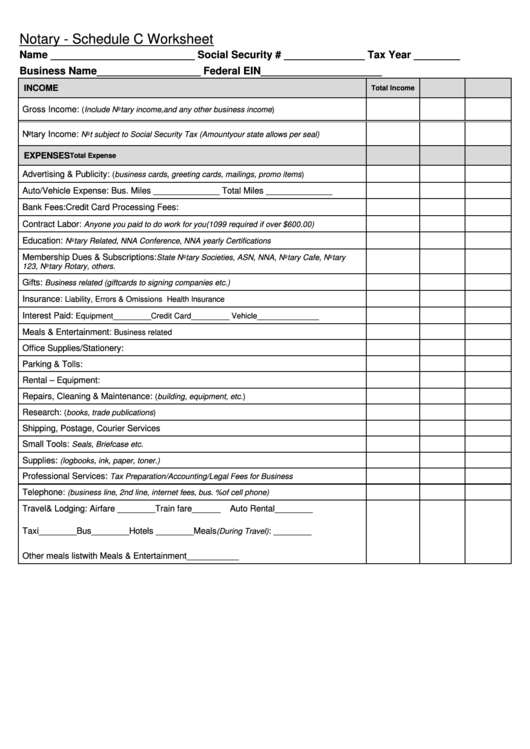

Printable Schedule C Worksheet

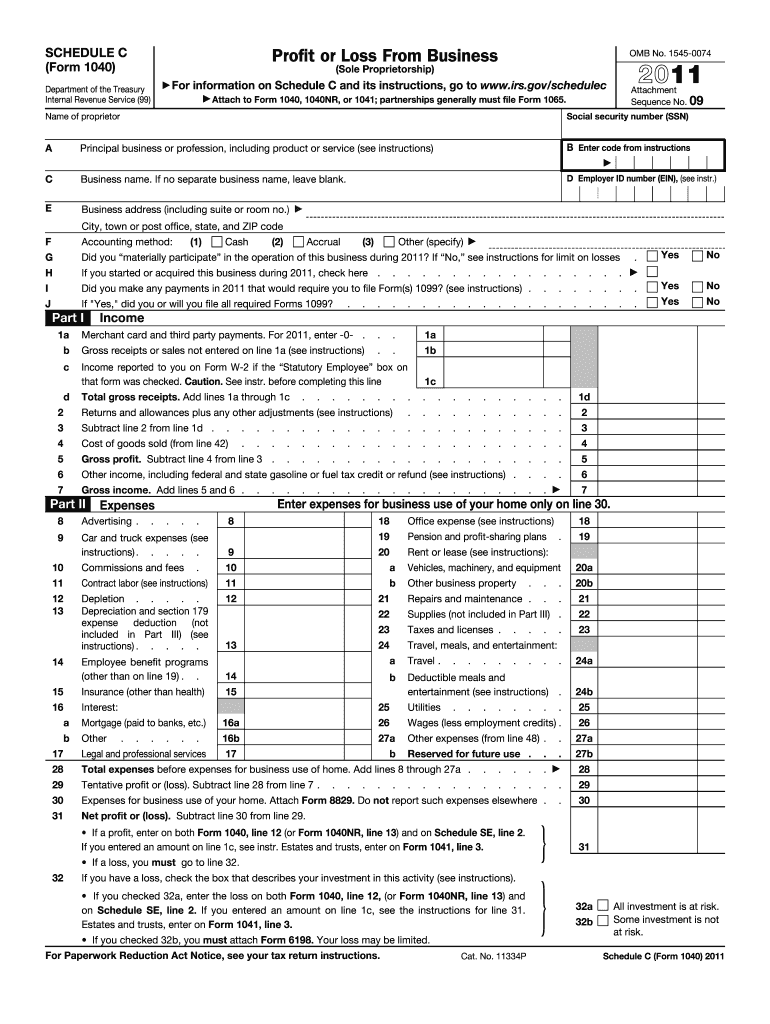

Printable Schedule C Worksheet - Partnerships must generally file form 1065. Web go to www.irs.gov/schedulec for instructions and the latest information. Use a separate worksheet for each business owned/operated. Square, paypal, etc.) expense category amount comments Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses. Partnerships must generally file form 1065. The law requires you to keep adequate records to complete your schedule c. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)_____ address (if any) _____ is this your first year in business? Use separate sheet for each business. Web schedule c worksheet hickman & hickman, pllc.

Download the excel worksheet here. Web go to www.irs.gov/schedulec for instructions and the latest information. Web the best way to track income & expenses for tax form 1040. Partnerships must generally file form 1065. Use a separate worksheet for each business owned/operated. Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses. Web schedule c worksheet hickman & hickman, pllc. Square, paypal, etc.) expense category amount comments The law requires you to keep adequate records to complete your schedule c. Partnerships must generally file form 1065.

Use separate sheet for each business. Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses. The law requires you to keep adequate records to complete your schedule c. Web the best way to track income & expenses for tax form 1040. Download the excel worksheet here. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)_____ address (if any) _____ is this your first year in business? Please review each line of this questionnaire and answer every question. Partnerships must generally file form 1065. Partnerships must generally file form 1065. Square, paypal, etc.) expense category amount comments

Schedule C Expenses Spreadsheet Download Laobing Kaisuo —

Please review each line of this questionnaire and answer every question. Web schedule c worksheet hickman & hickman, pllc. Use a separate worksheet for each business owned/operated. • inventory • net loss • employees/contractors • depreciation • pension and profit sharing • mortgage interest • business use of home Web the best way to track income & expenses for tax.

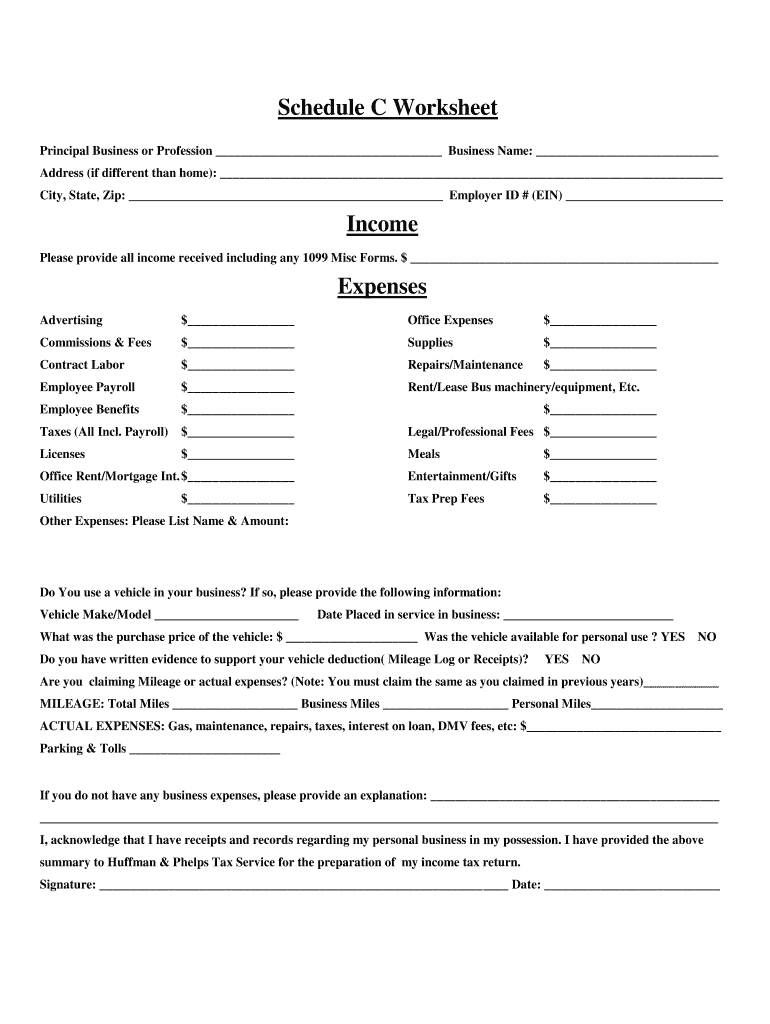

Simplified Worksheet For Schedule C Schedule C Worksheet Printable Pdf

Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Get out your shoebox of 2022 receipts and let’s get organized. Web the best way to track income & expenses for tax form 1040. Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us.

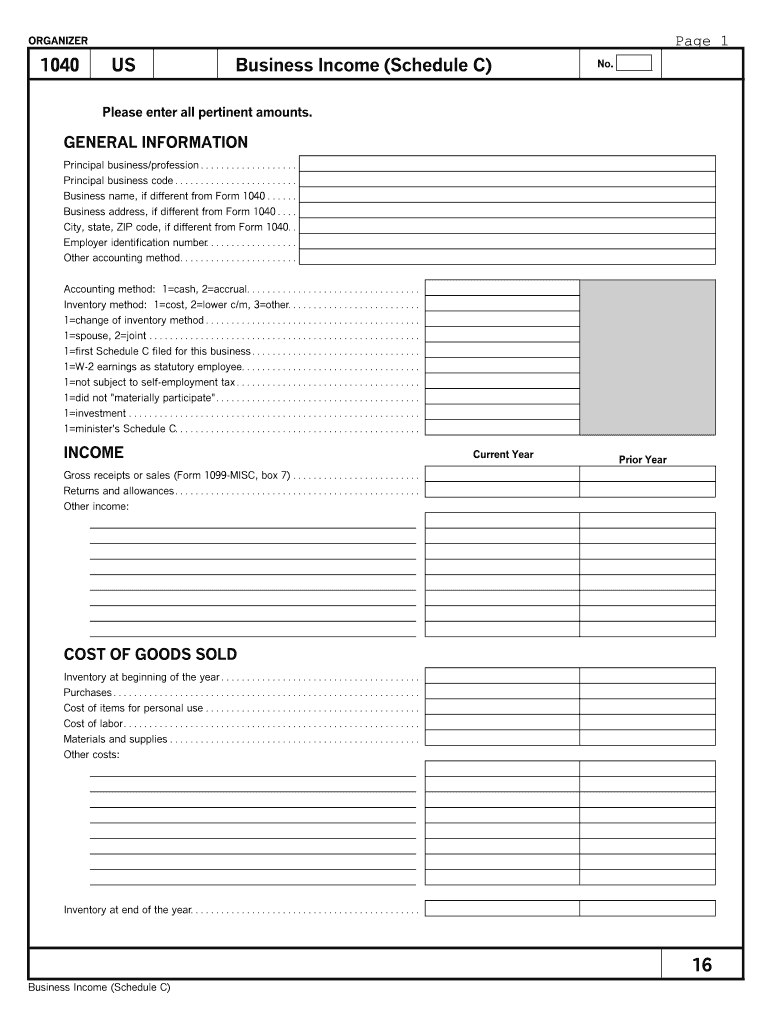

Schedule C Form Fill Out and Sign Printable PDF Template signNow

The law requires you to keep adequate records to complete your schedule c. Web go to www.irs.gov/schedulec for instructions and the latest information. Use separate sheet for each business. Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses. Download.

Schedule C Expenses Spreadsheet Of Schedule C Expenses —

Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)_____ address (if any) _____ is this your first year in business? Use separate sheet for each business. Partnerships must generally file form 1065. Web go to www.irs.gov/schedulec for instructions and the.

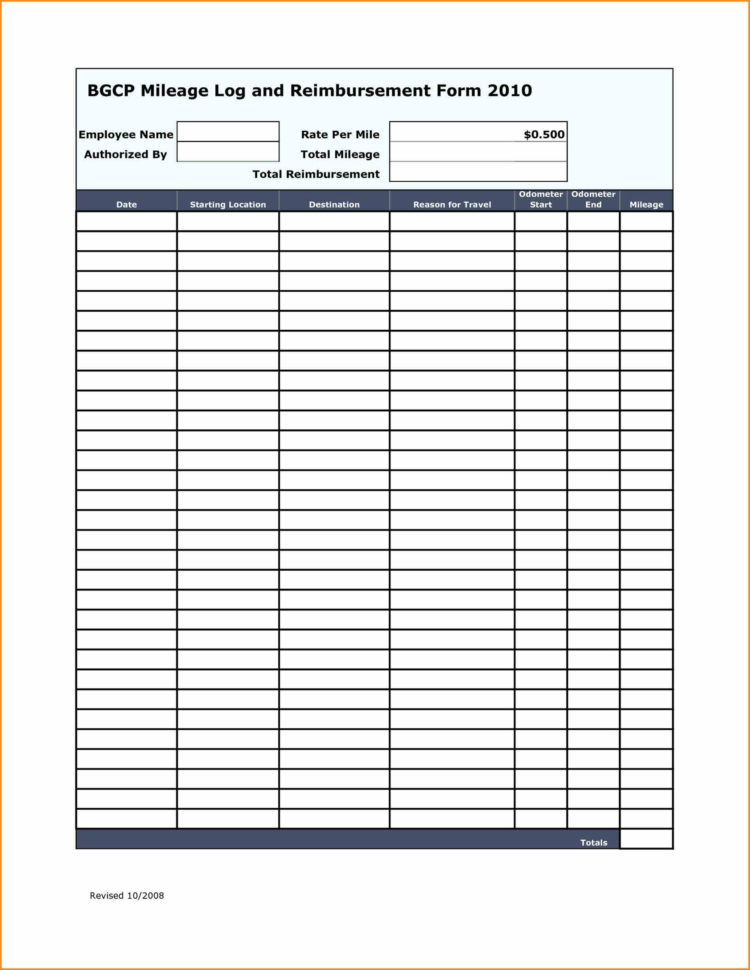

Schedule C Car And Truck Expenses Worksheet Awesome Driver —

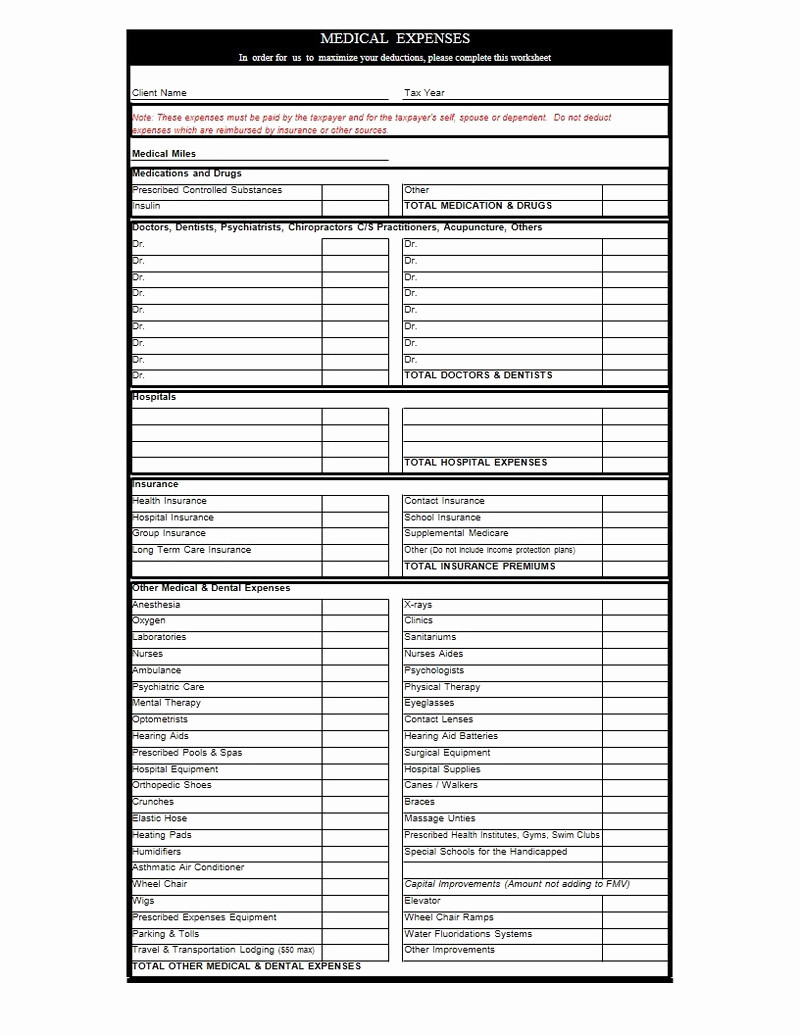

Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses. Get out your shoebox of 2022 receipts and let’s get organized. Web the best way to track income & expenses for tax form 1040. • inventory • net loss •.

Who's required to fill out a Schedule C IRS form?

Use a separate worksheet for each business owned/operated. Get out your shoebox of 2022 receipts and let’s get organized. • inventory • net loss • employees/contractors • depreciation • pension and profit sharing • mortgage interest • business use of home Please review each line of this questionnaire and answer every question. Partnerships must generally file form 1065.

Printable Schedule C Form Fill Out and Sign Printable PDF Template

Partnerships must generally file form 1065. Get out your shoebox of 2022 receipts and let’s get organized. Please review each line of this questionnaire and answer every question. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)_____ address (if any).

Schedule C Worksheet Form Fill Out and Sign Printable PDF Template

Partnerships must generally file form 1065. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)_____ address (if any) _____ is this your first year in business? • inventory • net loss • employees/contractors • depreciation • pension and profit sharing.

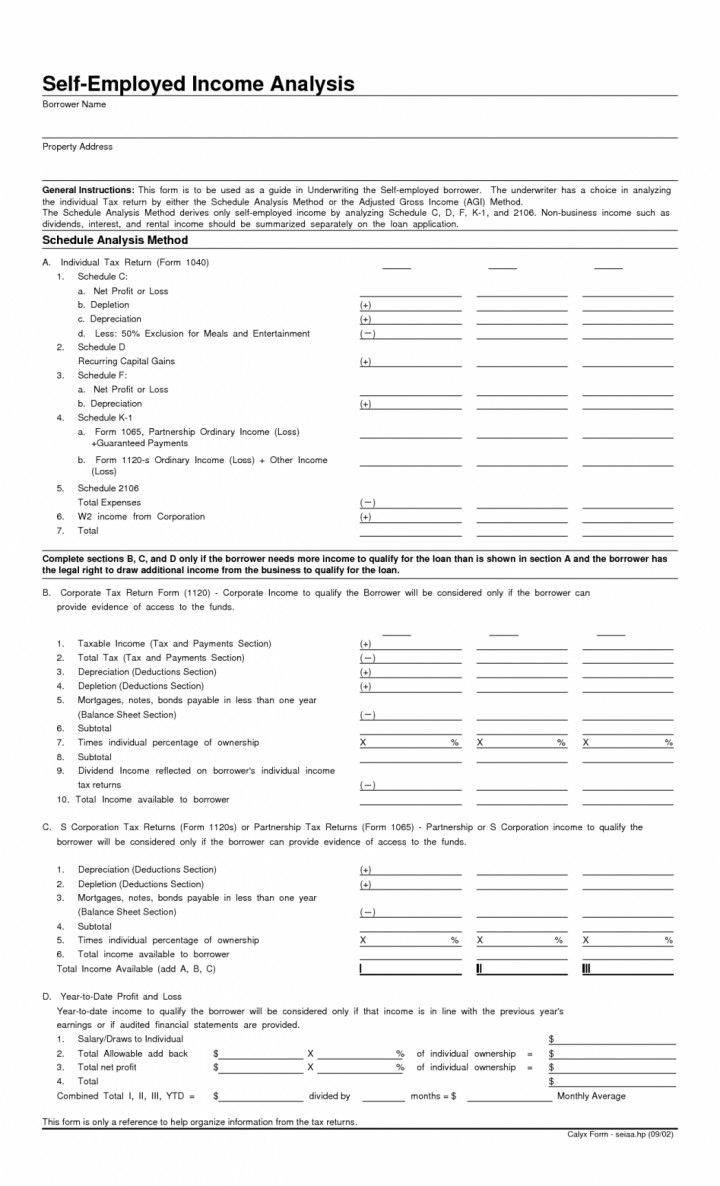

Schedule C Calculation Worksheet —

The law requires you to keep adequate records to complete your schedule c. Use separate sheet for each business. Download the excel worksheet here. Web schedule c worksheet hickman & hickman, pllc. Partnerships must generally file form 1065.

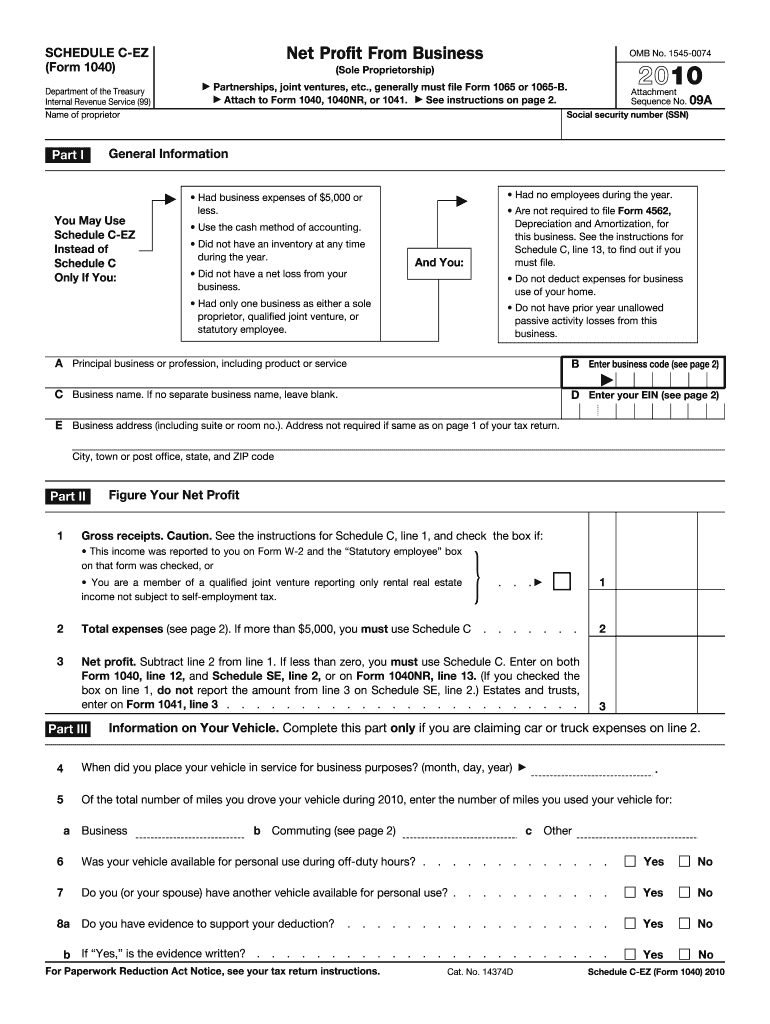

Schedule C Ez Form Fill Out and Sign Printable PDF Template signNow

Square, paypal, etc.) expense category amount comments Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)_____ address (if any) _____ is this your first year in business? Download the excel worksheet here. Web go to www.irs.gov/schedulec for instructions and the.

Web Form 1040 Schedule C (Profit Or Loss From Business) This Questionnaire Lists The Types Of Records You Need To Send Us To Prove Your Schedule C Income And Expenses.

Web go to www.irs.gov/schedulec for instructions and the latest information. Use separate sheet for each business. Download the excel worksheet here. Square, paypal, etc.) expense category amount comments

• Inventory • Net Loss • Employees/Contractors • Depreciation • Pension And Profit Sharing • Mortgage Interest • Business Use Of Home

Get out your shoebox of 2022 receipts and let’s get organized. The law requires you to keep adequate records to complete your schedule c. Web go to www.irs.gov/schedulec for instructions and the latest information. Please review each line of this questionnaire and answer every question.

Partnerships Must Generally File Form 1065.

Web schedule c worksheet hickman & hickman, pllc. Partnerships must generally file form 1065. Web the best way to track income & expenses for tax form 1040. Use a separate worksheet for each business owned/operated.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)