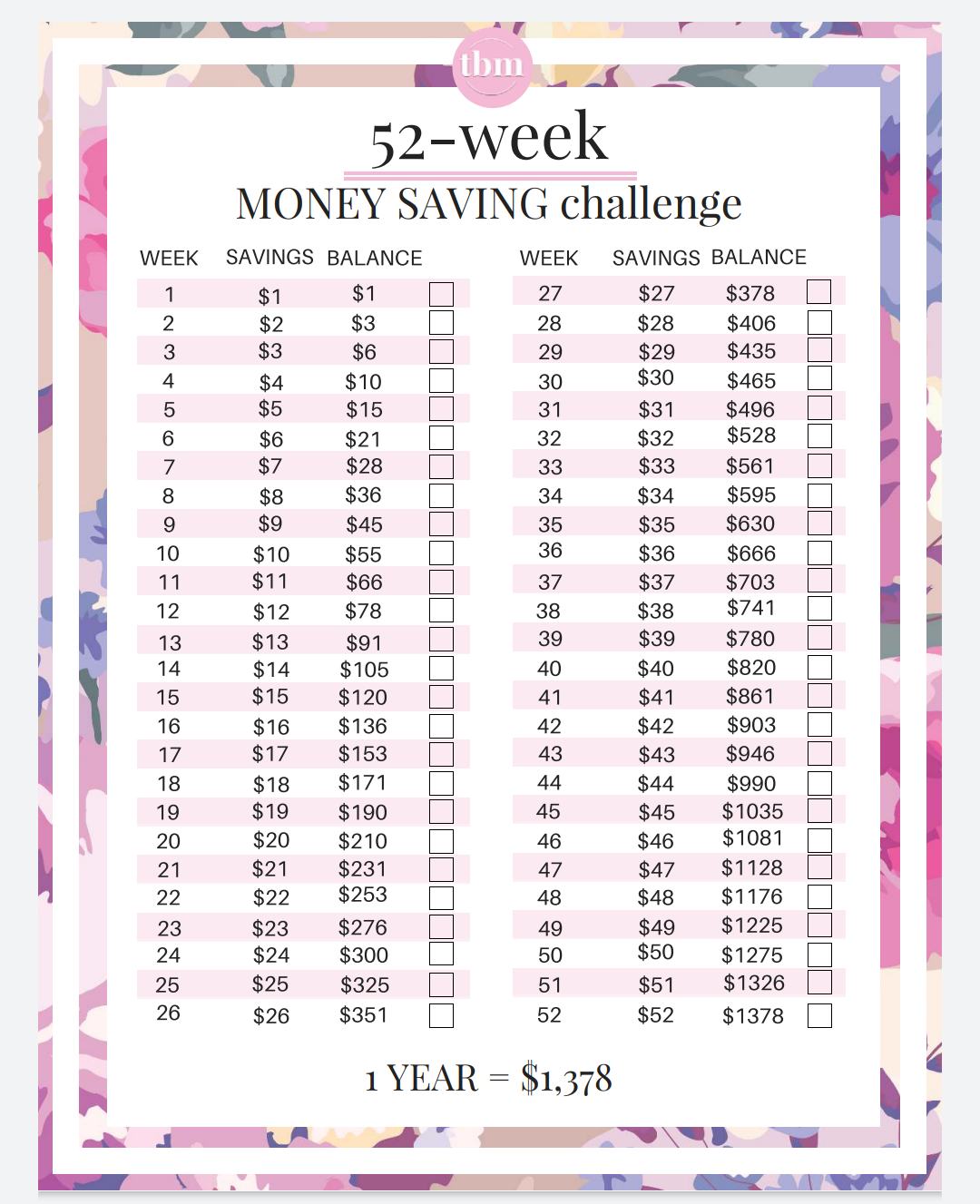

Printable Money Challenge Chart

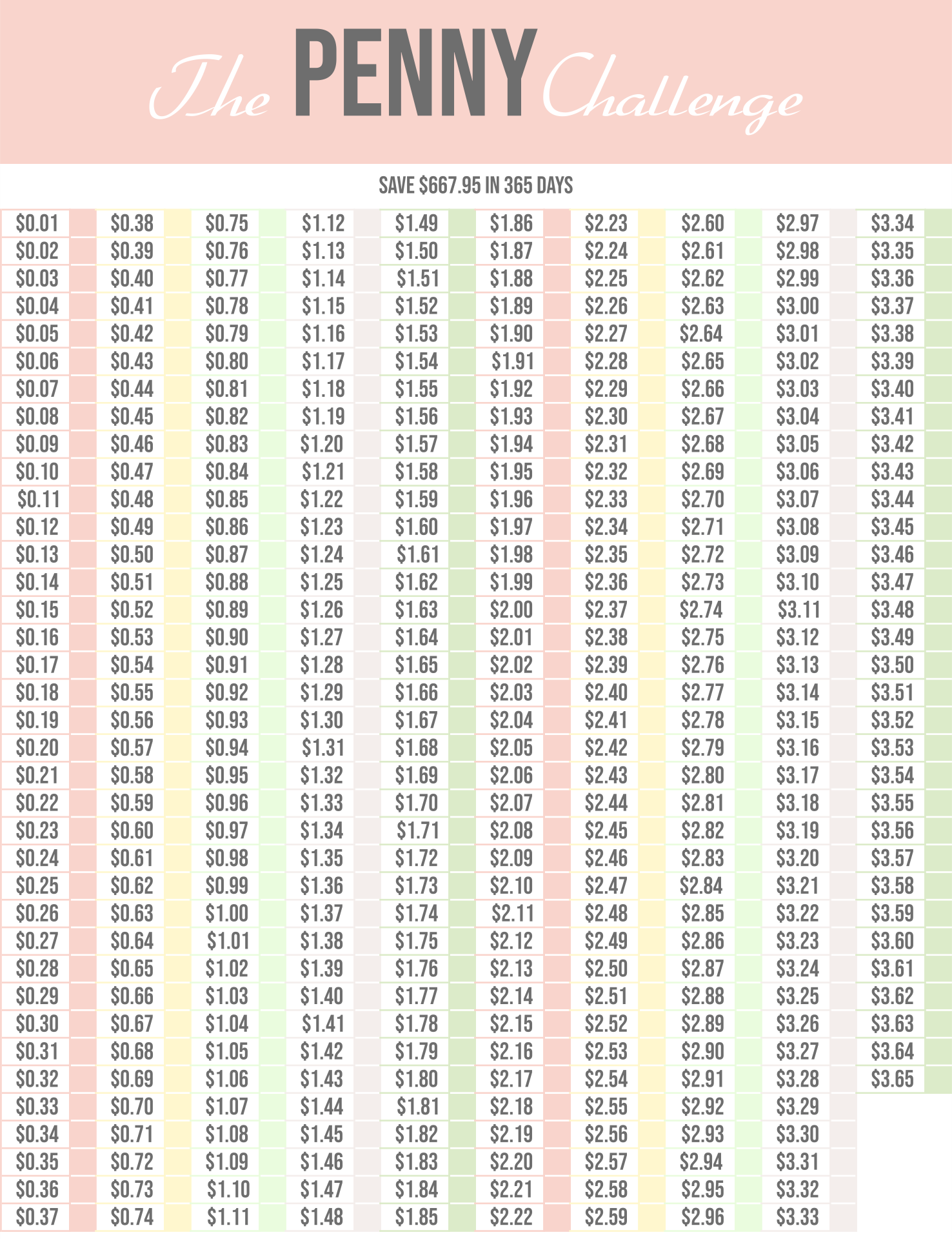

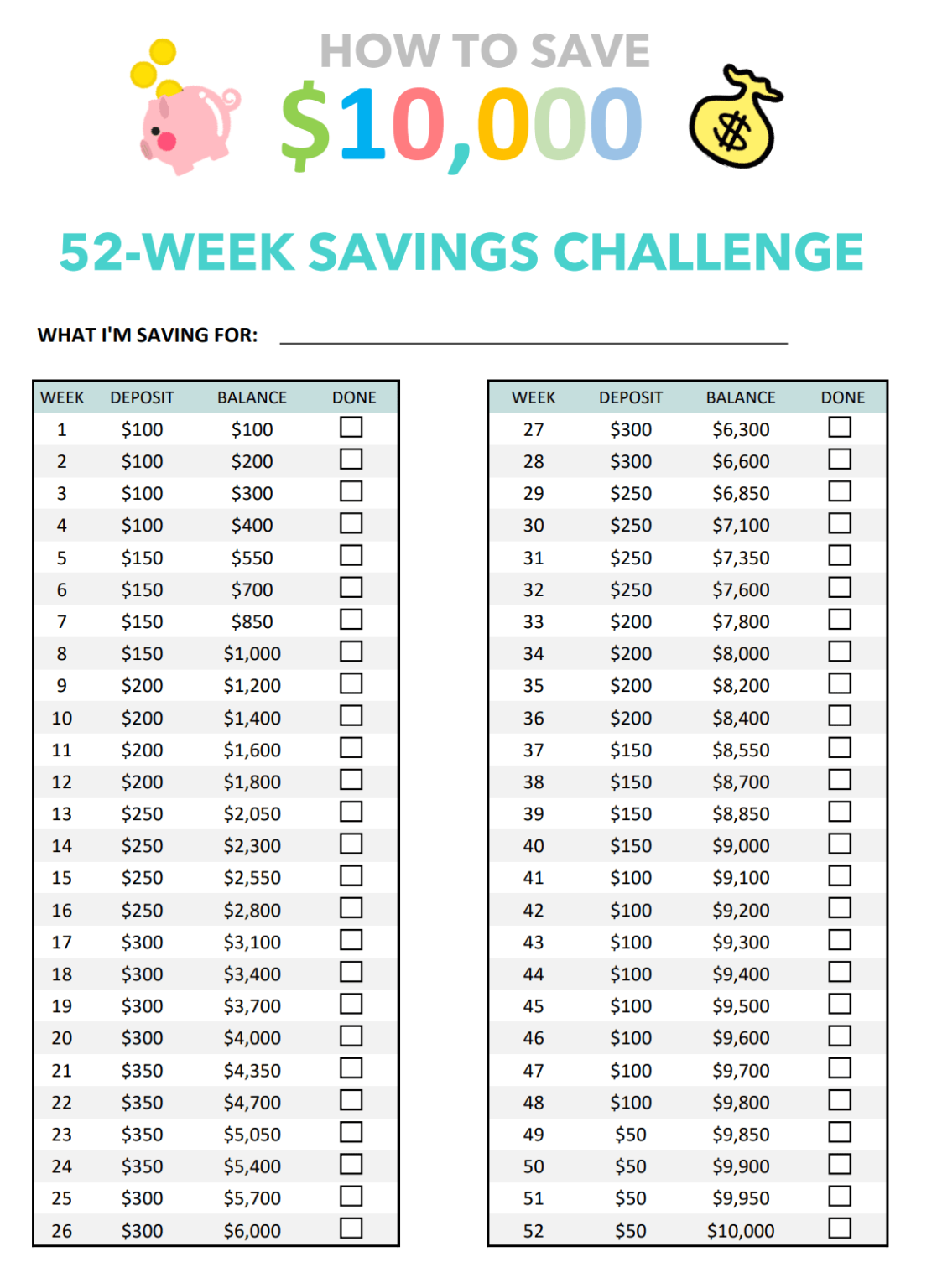

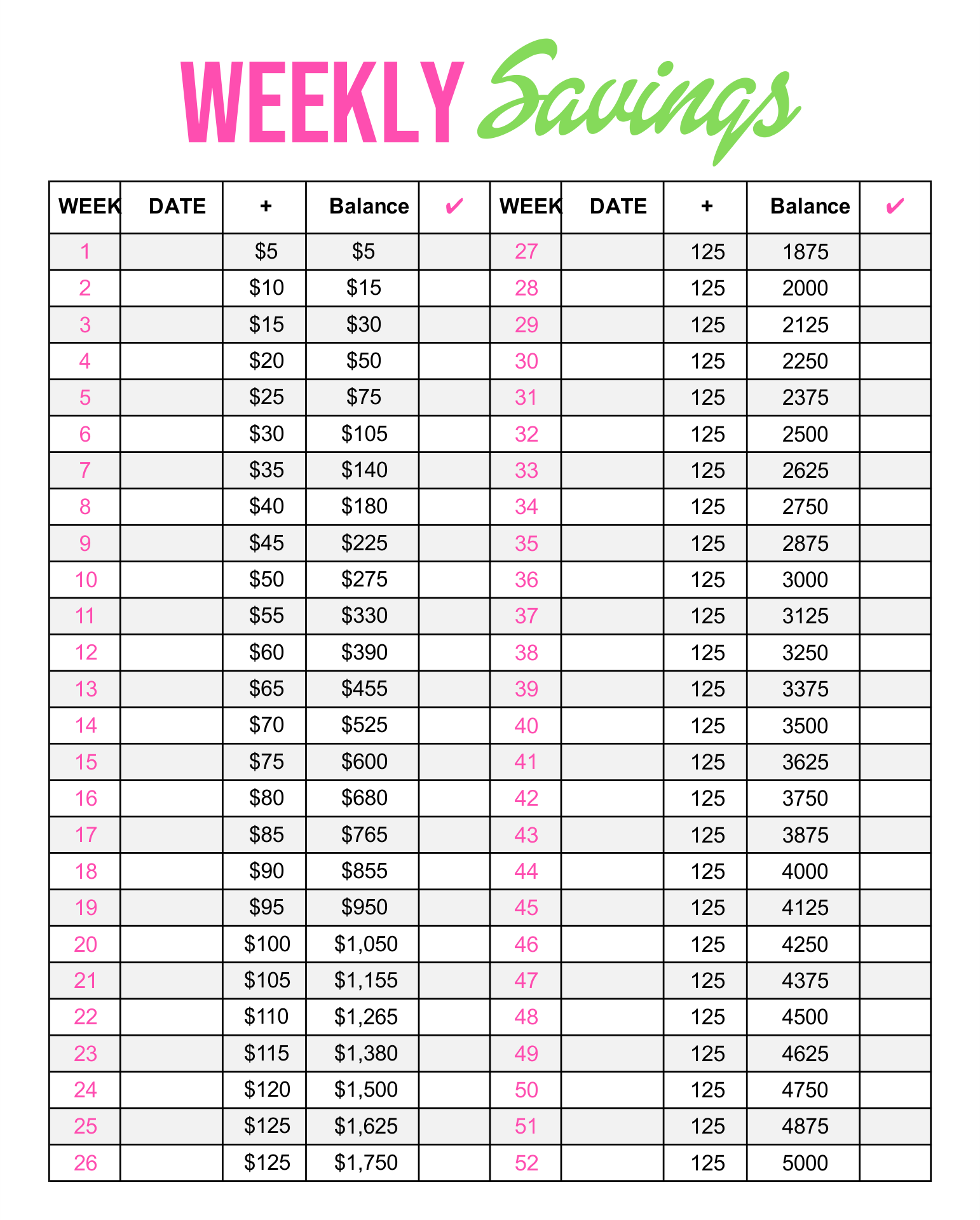

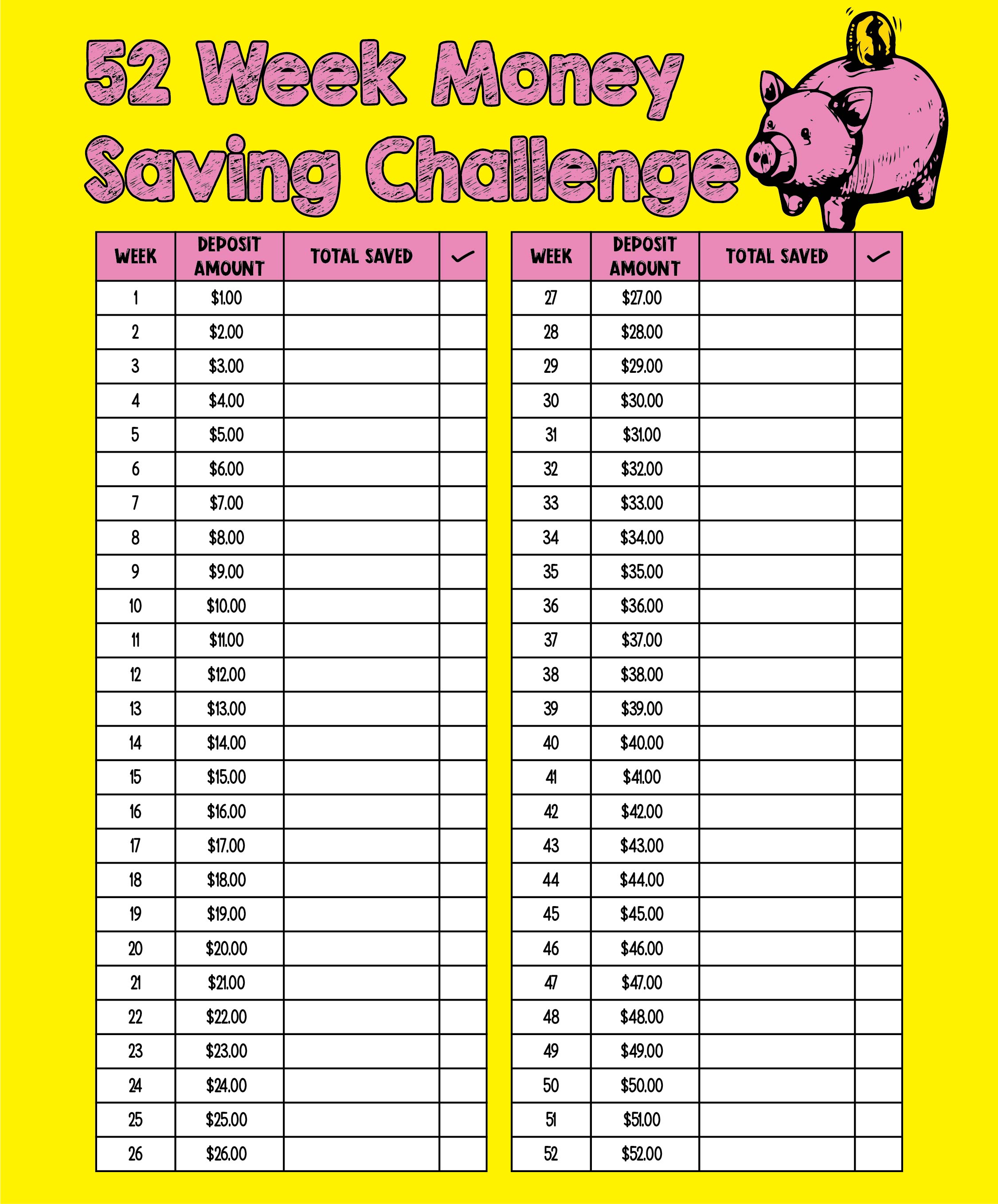

Printable Money Challenge Chart - Web enter how much weight you want to lose, the timeframe to lose it, and how much you want to bet each month for that period. Reverse order / backwards 3. This version of the savings challenge takes the amounts $1 to $52 and mixes them up. The calculator determines your prize amount, up to. Web the traditional 52 week money saving challenge suggests you save the same amount as the week number. Web 3 100 envelope challenge chart 4 variations of the challenge 5 the benefits 6 the problems what is the 100 envelope challenge? Web random 52 week money challenge printable. Web fun printable penny savings challenge where you can save over 600 dollars in one year just by savings pennies a day. You start saving one penny on the first day. Put 100 envelopes in a box and shuffle.

If you’re ready to spend less money and improve your financial situation, saving money on a daily basis is a fun way to do it. On the second day, you save. Web it is called the penny challenge. Web the traditional 52 week money saving challenge suggests you save the same amount as the week number. Put 100 envelopes in a box and shuffle. We’ve got a free printable tracker for everyone, no matter your budget or schedule. Web random 52 week money challenge printable. Reverse order / backwards 3. Web enter how much weight you want to lose, the timeframe to lose it, and how much you want to bet each month for that period. For example, on week 36 this means you’d put away £36 into your.

Web using a 100 envelope challenge chart printable is a simple way to keep track of your progress with saving. For example, on week 36 this means you’d put away £36 into your. Web it is called the penny challenge. Web random 52 week money challenge printable. The calculator determines your prize amount, up to. This version of the savings challenge takes the amounts $1 to $52 and mixes them up. Web enter how much weight you want to lose, the timeframe to lose it, and how much you want to bet each month for that period. On the second day, you save. You’ll also find a blank editable template,. You start saving one penny on the first day.

10 Best 52 Week Penny Challenge Chart Printable

Web fun printable penny savings challenge where you can save over 600 dollars in one year just by savings pennies a day. We’ve got a free printable tracker for everyone, no matter your budget or schedule. On the second day, you save. Web 3 100 envelope challenge chart 4 variations of the challenge 5 the benefits 6 the problems what.

52Week Money Challenge Printable 2019 Simplified Motherhood

Web it is called the penny challenge. Put 100 envelopes in a box and shuffle. Web fun printable penny savings challenge where you can save over 600 dollars in one year just by savings pennies a day. Great way to teach kids how to save. You’ll also find a blank editable template,.

52 Weeks Money Challenge Printable (Free Templates To Boost Your

We’ve got a free printable tracker for everyone, no matter your budget or schedule. Put 100 envelopes in a box and shuffle. Web 3 100 envelope challenge chart 4 variations of the challenge 5 the benefits 6 the problems what is the 100 envelope challenge? Web enter how much weight you want to lose, the timeframe to lose it, and.

Printable 52 Week Money Challenge Template Printable Templates

Web using a 100 envelope challenge chart printable is a simple way to keep track of your progress with saving. Web check out our weekly savings plan challenges! Web it is called the penny challenge. For example, on week 36 this means you’d put away £36 into your. On the second day, you save.

52 Week Money Challenge Printable

Web using a 100 envelope challenge chart printable is a simple way to keep track of your progress with saving. Web 3 100 envelope challenge chart 4 variations of the challenge 5 the benefits 6 the problems what is the 100 envelope challenge? The calculator determines your prize amount, up to. Great way to teach kids how to save. Put.

10 Best 52 Week Penny Challenge Chart Printable

The calculator determines your prize amount, up to. Web the traditional 52 week money saving challenge suggests you save the same amount as the week number. Start by printing out the 52 week. If you’re ready to spend less money and improve your financial situation, saving money on a daily basis is a fun way to do it. You start.

10 Best Reverse 52 Week Money Challenge Chart Printable

On the second day, you save. Web the traditional 52 week money saving challenge suggests you save the same amount as the week number. Web random 52 week money challenge printable. You’ll also find a blank editable template,. We’ve got a free printable tracker for everyone, no matter your budget or schedule.

52 WEEK MONEY CHALLENGE.

For example, on week 36 this means you’d put away £36 into your. The calculator determines your prize amount, up to. We’ve got a free printable tracker for everyone, no matter your budget or schedule. Reverse order / backwards 3. You’ll also find a blank editable template,.

Money Challenge Chart Printable Monthly Money Challenge Chart

Put 100 envelopes in a box and shuffle. Web using a 100 envelope challenge chart printable is a simple way to keep track of your progress with saving. This version of the savings challenge takes the amounts $1 to $52 and mixes them up. Web the traditional 52 week money saving challenge suggests you save the same amount as the.

Printable Money Challenge Chart

Web fun printable penny savings challenge where you can save over 600 dollars in one year just by savings pennies a day. Web random 52 week money challenge printable. This version of the savings challenge takes the amounts $1 to $52 and mixes them up. Put 100 envelopes in a box and shuffle. Reverse order / backwards 3.

You’ll Also Find A Blank Editable Template,.

Web enter how much weight you want to lose, the timeframe to lose it, and how much you want to bet each month for that period. Start by printing out the 52 week. Web the traditional 52 week money saving challenge suggests you save the same amount as the week number. We’ve got a free printable tracker for everyone, no matter your budget or schedule.

For Example, On Week 36 This Means You’d Put Away £36 Into Your.

Web using a 100 envelope challenge chart printable is a simple way to keep track of your progress with saving. Put 100 envelopes in a box and shuffle. Web fun printable penny savings challenge where you can save over 600 dollars in one year just by savings pennies a day. Web 3 100 envelope challenge chart 4 variations of the challenge 5 the benefits 6 the problems what is the 100 envelope challenge?

On The Second Day, You Save.

Web it is called the penny challenge. Web random 52 week money challenge printable. Great way to teach kids how to save. Reverse order / backwards 3.

If You’re Ready To Spend Less Money And Improve Your Financial Situation, Saving Money On A Daily Basis Is A Fun Way To Do It.

This version of the savings challenge takes the amounts $1 to $52 and mixes them up. Web check out our weekly savings plan challenges! You start saving one penny on the first day. The calculator determines your prize amount, up to.