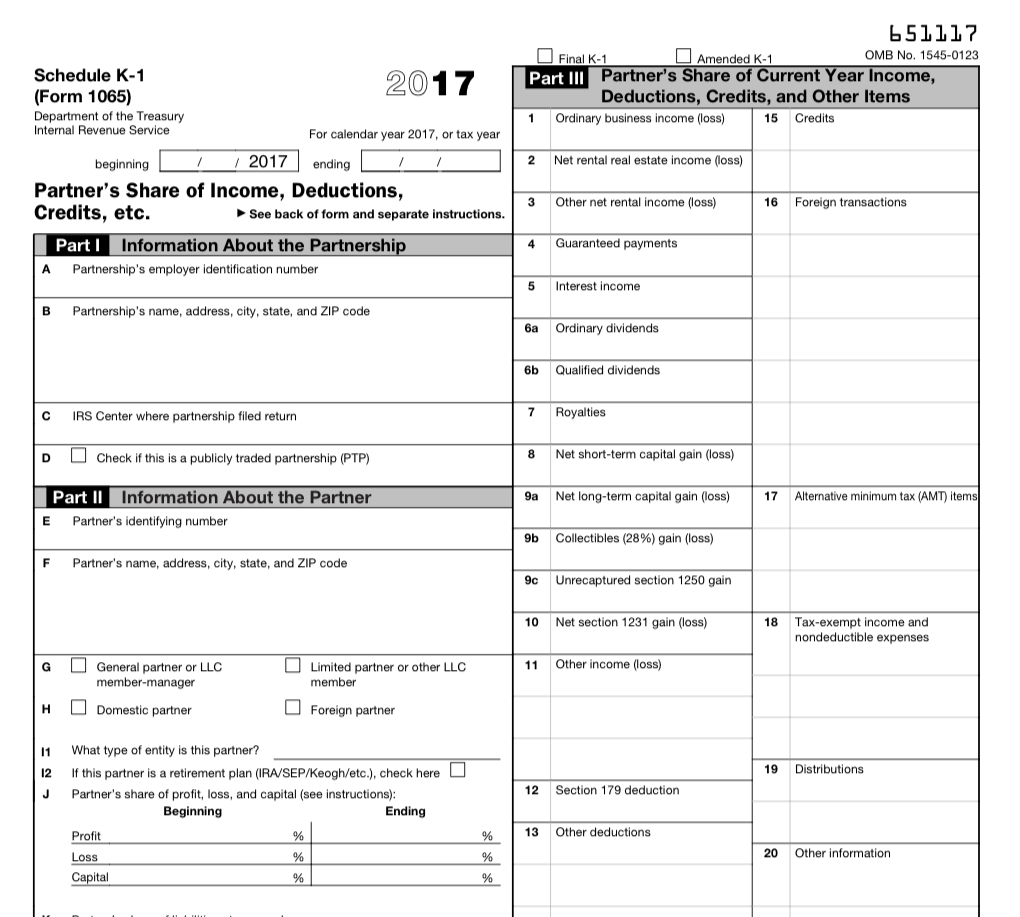

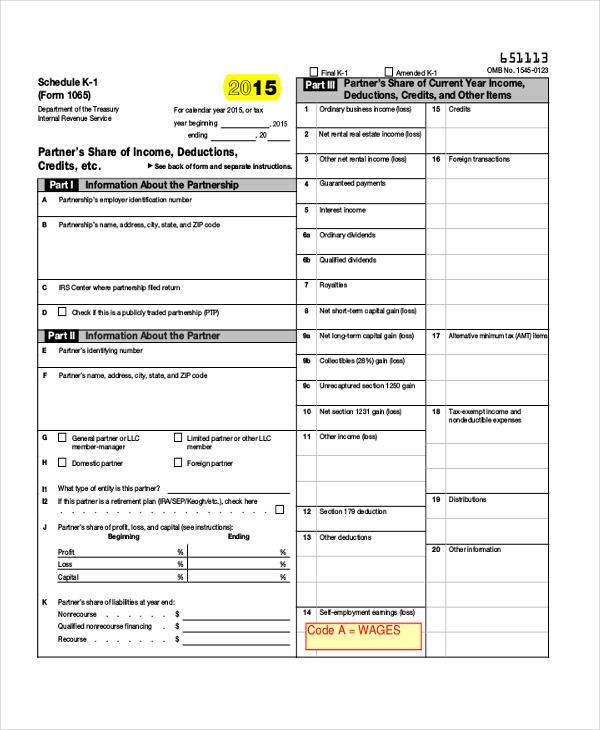

Printable K 1 Tax Form

Printable K 1 Tax Form - For calendar year 2021, or tax year beginning / / 2021. — is used to provide the partner, shareholder, or. Start completing the fillable fields and carefully. Department of the treasury internal revenue service. Web inheriting property or other assets typically involves filing the appropriate tax forms with the irs. Use get form or simply click on the template preview to open it in the editor. Department of the treasury internal revenue service for calendar year 2022, or tax year. Get ready for this year's tax season quickly and safely with pdffiller! Ending / / partner’s share of income,. The business must be a partnership business structure.

Use get form or simply click on the template preview to open it in the editor. Department of the treasury internal revenue service. Web inheriting property or other assets typically involves filing the appropriate tax forms with the irs. Department of the treasury internal revenue service for calendar year 2022, or tax year. Start completing the fillable fields and carefully. Get ready for this year's tax season quickly and safely with pdffiller! For calendar year 2021, or tax year beginning / / 2021. The business must be a partnership business structure. It’s possible to get multiple. Ending / / partner’s share of income,.

Department of the treasury internal revenue service for calendar year 2022, or tax year. Ending / / partner’s share of income,. It’s possible to get multiple. Get ready for this year's tax season quickly and safely with pdffiller! Department of the treasury internal revenue service. Web inheriting property or other assets typically involves filing the appropriate tax forms with the irs. For calendar year 2021, or tax year beginning / / 2021. Start completing the fillable fields and carefully. — is used to provide the partner, shareholder, or. The business must be a partnership business structure.

IRS 1120S Schedule K1 2012 Fill and Sign Printable Template Online

Web inheriting property or other assets typically involves filing the appropriate tax forms with the irs. The business must be a partnership business structure. Department of the treasury internal revenue service. For calendar year 2021, or tax year beginning / / 2021. Use get form or simply click on the template preview to open it in the editor.

K 1 Form Fill Out and Sign Printable PDF Template signNow

Get ready for this year's tax season quickly and safely with pdffiller! For calendar year 2021, or tax year beginning / / 2021. Use get form or simply click on the template preview to open it in the editor. Department of the treasury internal revenue service. Start completing the fillable fields and carefully.

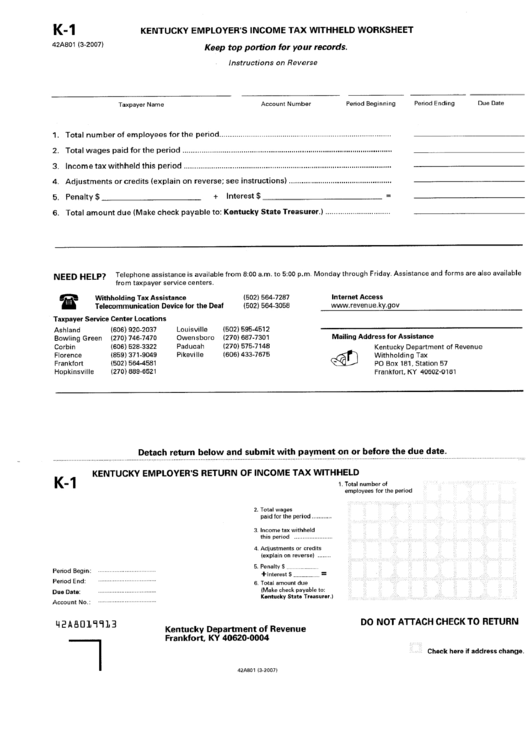

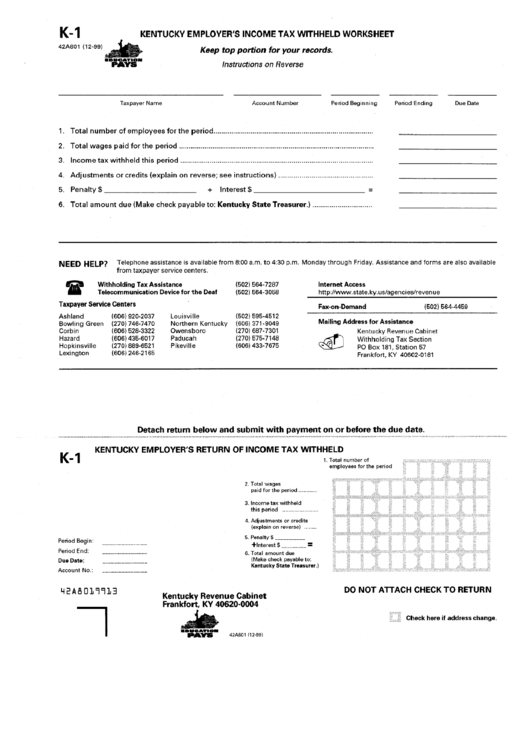

Form K1 Kentucky Employer'S Tax Withheld Worksheet printable

It’s possible to get multiple. — is used to provide the partner, shareholder, or. Use get form or simply click on the template preview to open it in the editor. Department of the treasury internal revenue service for calendar year 2022, or tax year. Web inheriting property or other assets typically involves filing the appropriate tax forms with the irs.

Form K1 Kentucky Employer'S Return Of Tax Withheld printable

It’s possible to get multiple. The business must be a partnership business structure. Start completing the fillable fields and carefully. Department of the treasury internal revenue service. Department of the treasury internal revenue service for calendar year 2022, or tax year.

FREE 17+ Sample Schedule Forms in PDF MS Word Excel

For calendar year 2021, or tax year beginning / / 2021. Ending / / partner’s share of income,. Start completing the fillable fields and carefully. — is used to provide the partner, shareholder, or. It’s possible to get multiple.

How to Read and Love a K1 Tax Form Actively Passive

For calendar year 2021, or tax year beginning / / 2021. Use get form or simply click on the template preview to open it in the editor. The business must be a partnership business structure. Department of the treasury internal revenue service. Department of the treasury internal revenue service for calendar year 2022, or tax year.

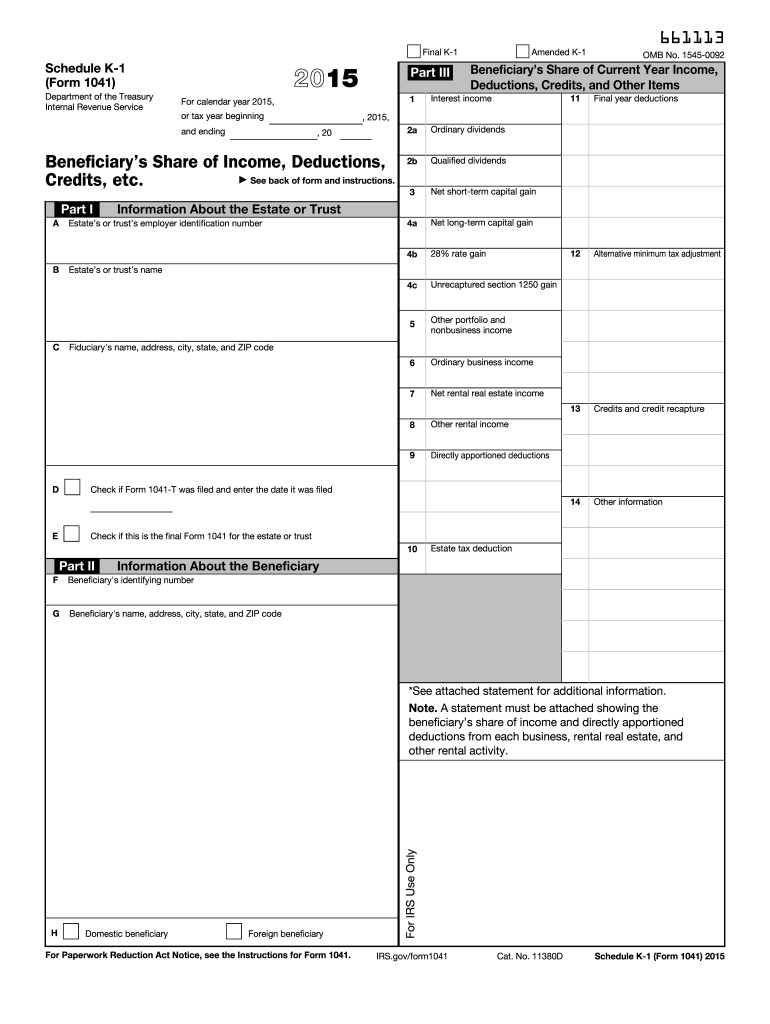

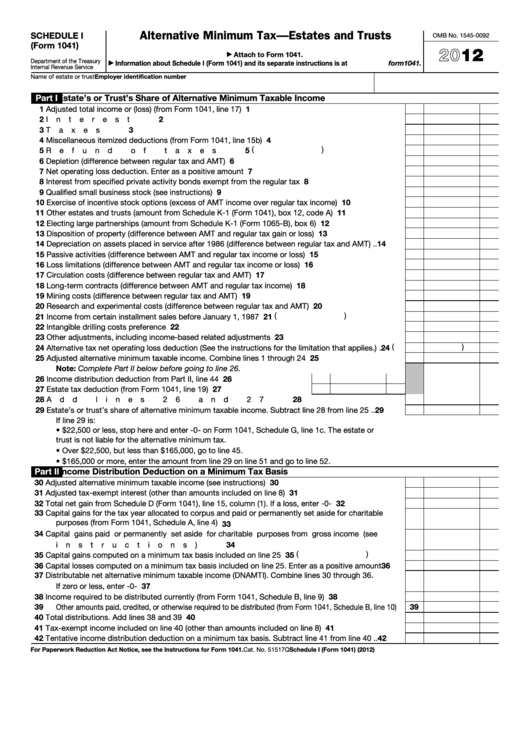

Fillable Schedule K1 (Form 1041) Alternative Minimum Tax Estates

Ending / / partner’s share of income,. The business must be a partnership business structure. Get ready for this year's tax season quickly and safely with pdffiller! For calendar year 2021, or tax year beginning / / 2021. Use get form or simply click on the template preview to open it in the editor.

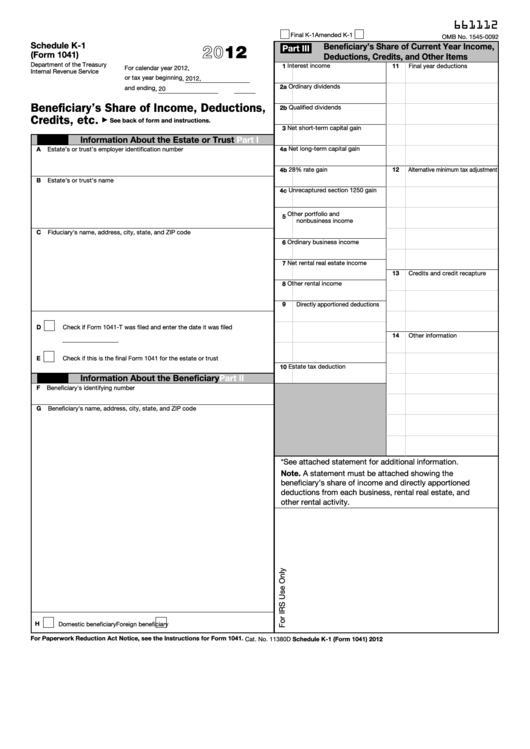

Fillable Schedule K1 (Form 1041) Beneficiary'S Share Of

Start completing the fillable fields and carefully. Department of the treasury internal revenue service for calendar year 2022, or tax year. The business must be a partnership business structure. — is used to provide the partner, shareholder, or. It’s possible to get multiple.

What Are Schedule K1 Documents Used For?

Department of the treasury internal revenue service for calendar year 2022, or tax year. Start completing the fillable fields and carefully. For calendar year 2021, or tax year beginning / / 2021. The business must be a partnership business structure. It’s possible to get multiple.

Schedule K 1 Tax Form What Is It And Who Needs To Know 1040 Form

For calendar year 2021, or tax year beginning / / 2021. Web inheriting property or other assets typically involves filing the appropriate tax forms with the irs. — is used to provide the partner, shareholder, or. Start completing the fillable fields and carefully. It’s possible to get multiple.

Get Ready For This Year's Tax Season Quickly And Safely With Pdffiller!

Ending / / partner’s share of income,. Department of the treasury internal revenue service for calendar year 2022, or tax year. Start completing the fillable fields and carefully. Use get form or simply click on the template preview to open it in the editor.

The Business Must Be A Partnership Business Structure.

Web inheriting property or other assets typically involves filing the appropriate tax forms with the irs. Department of the treasury internal revenue service. For calendar year 2021, or tax year beginning / / 2021. — is used to provide the partner, shareholder, or.

:max_bytes(150000):strip_icc()/ScheduleK-1-PartnersShareofIncomeetc.-1-134752a3fa884035822acd99c23703e0.png)