Pcori Fee 2022 Form 720

Pcori Fee 2022 Form 720 - Fee amount plan year form 720 filing date $ 2.66 per covered life Payment amounts due in 2022 will differ based on the. Web the aca requires applicable employers to report and pay the fee once a year, using form 720 for the quarterly federal excise tax return that you can get from. For plans that ended december 2022, the pcori fee is $3.00 per. Web it is required to be reported only once a year in july. Web form 720 and full payment of the pcori fees are due by july 31 of each year and generally cover plan years that end during the preceding calendar year. Web the fee is paid using quarterly excise tax form 720, line 133, and must generally be paid no later than july 31st of the year following the last day of the plan. Web the pcori fee is due by july 31, 2022 and must be reported on form 720. It is reported on irs form 720.*. Web jun 19, 2023 | all, compliance each year, employers must wait for the irs to update form 720 in order to pay their pcor fees with the correct form.

For plans that ended december 2022, the pcori fee is $3.00 per. Web in 2023, the irs will issue an updated form 720 for the second quarter with the pcori fees adjusted for the upcoming july 31 payment date. Payment amounts due in 2022 will differ based on the. For plans that ended december 2022, the pcori fee is $3.00 per employee, and it is due. Web it is required to be reported only once a year in july. It is reported on irs form 720.*. It is reported on irs form 720.*. The form 720 itself is found here. Fee amount plan year form 720 filing date $ 2.66 per covered life Web jun 19, 2023 | all, compliance each year, employers must wait for the irs to update form 720 in order to pay their pcor fees with the correct form.

Payment amounts due in 2022 will differ based on the. Web an updated 720 form has just been released by the irs for submitting the latest pcori payments by the due date of july 31, 2023. Web form 720 and full payment of the pcori fees are due by july 31 of each year and generally cover plan years that end during the preceding calendar year. It is reported on irs form 720.*. Web the pcori fee is due by july 31, 2022 and must be reported on form 720. Web the fee is paid using quarterly excise tax form 720, line 133, and must generally be paid no later than july 31st of the year following the last day of the plan. Web the aca requires applicable employers to report and pay the fee once a year, using form 720 for the quarterly federal excise tax return that you can get from. It is reported on irs form 720.*. Web in 2023, the irs will issue an updated form 720 for the second quarter with the pcori fees adjusted for the upcoming july 31 payment date. Web jun 19, 2023 | all, compliance each year, employers must wait for the irs to update form 720 in order to pay their pcor fees with the correct form.

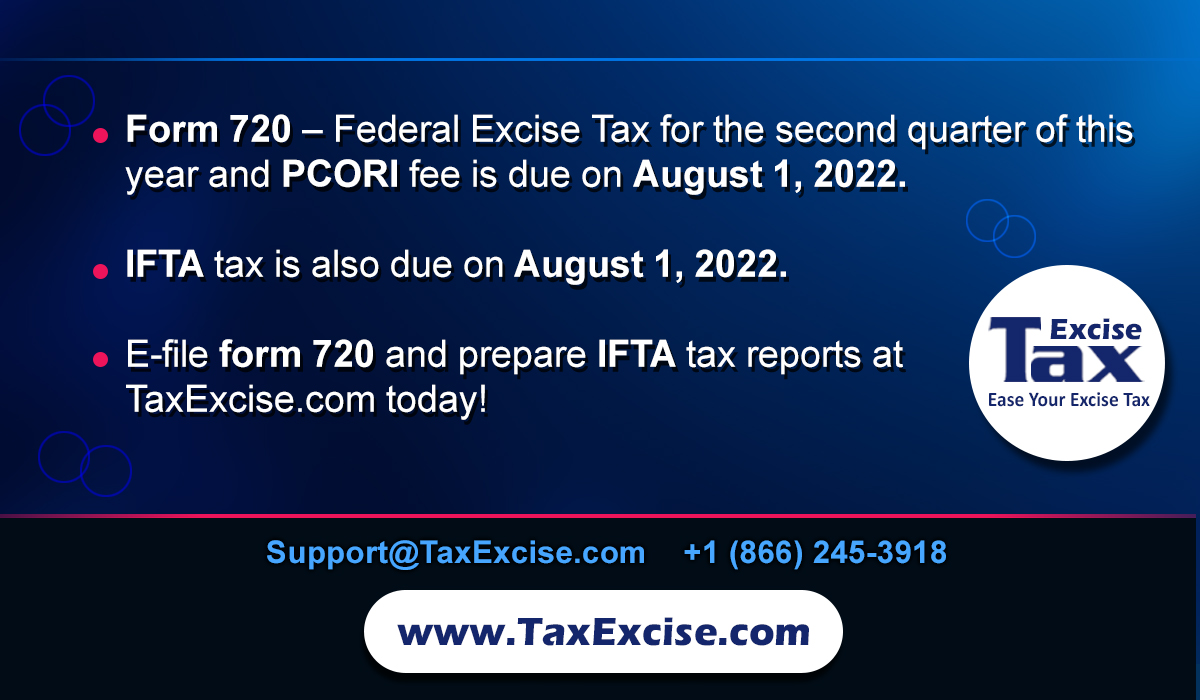

PCORI fee deadline July 31, 2022

For plans that ended december 2022, the pcori fee is $3.00 per employee, and it is due. Web jun 19, 2023 | all, compliance each year, employers must wait for the irs to update form 720 in order to pay their pcor fees with the correct form. It is reported on irs form 720.*. Web the aca requires applicable employers.

PCORI Fee Due August 1, 2022 P&A Group

For plans that ended december 2022, the pcori fee is $3.00 per employee, and it is due. Web the fee is paid using quarterly excise tax form 720, line 133, and must generally be paid no later than july 31st of the year following the last day of the plan. Web form 720 and full payment of the pcori fees.

PCORI Reminder 2016 Rates for SelfInsured Plans

The form 720 itself is found here. Web the pcori fee is due by july 31, 2022 and must be reported on form 720. Web form 720 and full payment of the pcori fees are due by july 31 of each year and generally cover plan years that end during the preceding calendar year. Web in 2023, the irs will.

August 1 is the deadline for reporting federal excise tax form 720

Web the pcori fee is due by july 31, 2022 and must be reported on form 720. Web form 720 and full payment of the pcori fees are due by july 31 of each year and generally cover plan years that end during the preceding calendar year. Web jun 19, 2023 | all, compliance each year, employers must wait for.

PCORI fee Form 720 available now

It is reported on irs form 720.*. Web in 2023, the irs will issue an updated form 720 for the second quarter with the pcori fees adjusted for the upcoming july 31 payment date. Web form 720 and full payment of the pcori fees are due by july 31 of each year and generally cover plan years that end during.

Compliance Alert Reminder PCORI Fees Due By July 31, 2022 Woodruff

Web it is required to be reported only once a year in july. Web in 2023, the irs will issue an updated form 720 for the second quarter with the pcori fees adjusted for the upcoming july 31 payment date. Web jun 19, 2023 | all, compliance each year, employers must wait for the irs to update form 720 in.

How to complete IRS Form 720 for the PatientCentered Research

Web jun 19, 2023 | all, compliance each year, employers must wait for the irs to update form 720 in order to pay their pcor fees with the correct form. Web the pcori fee is due by july 31, 2022 and must be reported on form 720. Web in 2023, the irs will issue an updated form 720 for the.

Form 720 and PCORI Fees Due July 31st Gilroy Kernan & Gilroy

Fee amount plan year form 720 filing date $ 2.66 per covered life Web the fee is paid using quarterly excise tax form 720, line 133, and must generally be paid no later than july 31st of the year following the last day of the plan. It is reported on irs form 720.*. Web it is required to be reported.

IRS 20222023 PCORI Fee Released ELI Advisors

For plans that ended december 2022, the pcori fee is $3.00 per employee, and it is due. Web the aca requires applicable employers to report and pay the fee once a year, using form 720 for the quarterly federal excise tax return that you can get from. It is reported on irs form 720.*. Web in 2023, the irs will.

August 1, 2022, is the deadline for payment of the PatientCentered

Web it is required to be reported only once a year in july. Web the pcori fee is due by july 31, 2022 and must be reported on form 720. Web in general, health fsas are not subject to the pcori fee. Web it is required to be reported only once a year in july. For plans that ended december.

For Plans That Ended December 2022, The Pcori Fee Is $3.00 Per.

Web it is required to be reported only once a year in july. The form 720 itself is found here. Web form 720 and full payment of the pcori fees are due by july 31 of each year and generally cover plan years that end during the preceding calendar year. Web an updated 720 form has just been released by the irs for submitting the latest pcori payments by the due date of july 31, 2023.

Web The Aca Requires Applicable Employers To Report And Pay The Fee Once A Year, Using Form 720 For The Quarterly Federal Excise Tax Return That You Can Get From.

Web the fee is paid using quarterly excise tax form 720, line 133, and must generally be paid no later than july 31st of the year following the last day of the plan. Fee amount plan year form 720 filing date $ 2.66 per covered life Web jun 19, 2023 | all, compliance each year, employers must wait for the irs to update form 720 in order to pay their pcor fees with the correct form. Web the pcori fee is due by july 31, 2022 and must be reported on form 720.

Web In 2023, The Irs Will Issue An Updated Form 720 For The Second Quarter With The Pcori Fees Adjusted For The Upcoming July 31 Payment Date.

Web in general, health fsas are not subject to the pcori fee. It is reported on irs form 720.*. For plans that ended december 2022, the pcori fee is $3.00 per employee, and it is due. It is reported on irs form 720.*.

Web It Is Required To Be Reported Only Once A Year In July.

Payment amounts due in 2022 will differ based on the.