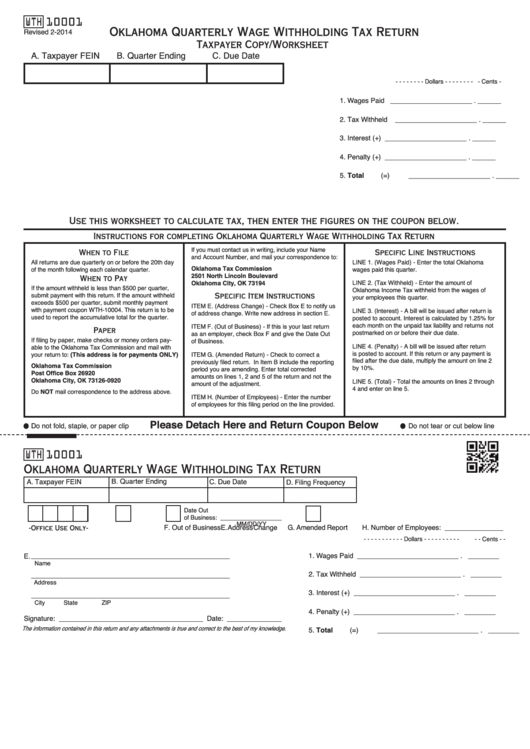

Oklahoma Withholding Form

Oklahoma Withholding Form - Married, but withhold at higher single rate. Employee's withholding certificate form 941; Web opers is required to withhold income tax from your monthly retirement benefit, unless you indicate on the withholding forms that you do not want taxes withheld. Web opers has two forms to provide tax withholding preferences for federal and state taxes. If you do not file a. Web this form is to change oklahoma withholding allowances. Web fill online, printable, fillable, blank form 10001: Web withholding tax : Use fill to complete blank online. Employers engaged in a trade or business who.

Oklahoma quarterly wage withholding tax return (oklahoma) form. Web up to 25% cash back file scheduled withholding tax returns. Residency relief act you must. Pass through withholding tax : Married, but withhold at higher single rate. This certificate is for income tax withholding purposes only. Employee's withholding certificate form 941; Non resident royalty withholding tax : Last nameyour social security number. If you do not file a.

Web additional oklahoma income tax when you file your return. Oklahoma quarterly wage withholding tax return (oklahoma) form. Business forms withholding alcohol &. Forms & publications specialty license plates tag, tax, title & fees unconventional vehicles. This worksheet need only be. Employers engaged in a trade or business who. This certificate is for income tax withholding purposes only. Pass through withholding tax : Employee's withholding certificate form 941; Web this form is to change oklahoma withholding allowances.

Oklahoma Employee Tax Withholding Form 2023

Use fill to complete blank online. Residency relief act you must. Oklahoma quarterly wage withholding tax return (oklahoma) form. Pass through withholding tax : Forms & publications specialty license plates tag, tax, title & fees unconventional vehicles.

OTC Form OW9D Download Printable PDF or Fill Online OutofState

Web opers has two forms to provide tax withholding preferences for federal and state taxes. Web fill online, printable, fillable, blank form 10001: Forms & publications specialty license plates tag, tax, title & fees unconventional vehicles. Residency relief act you must. Web withholding tax :

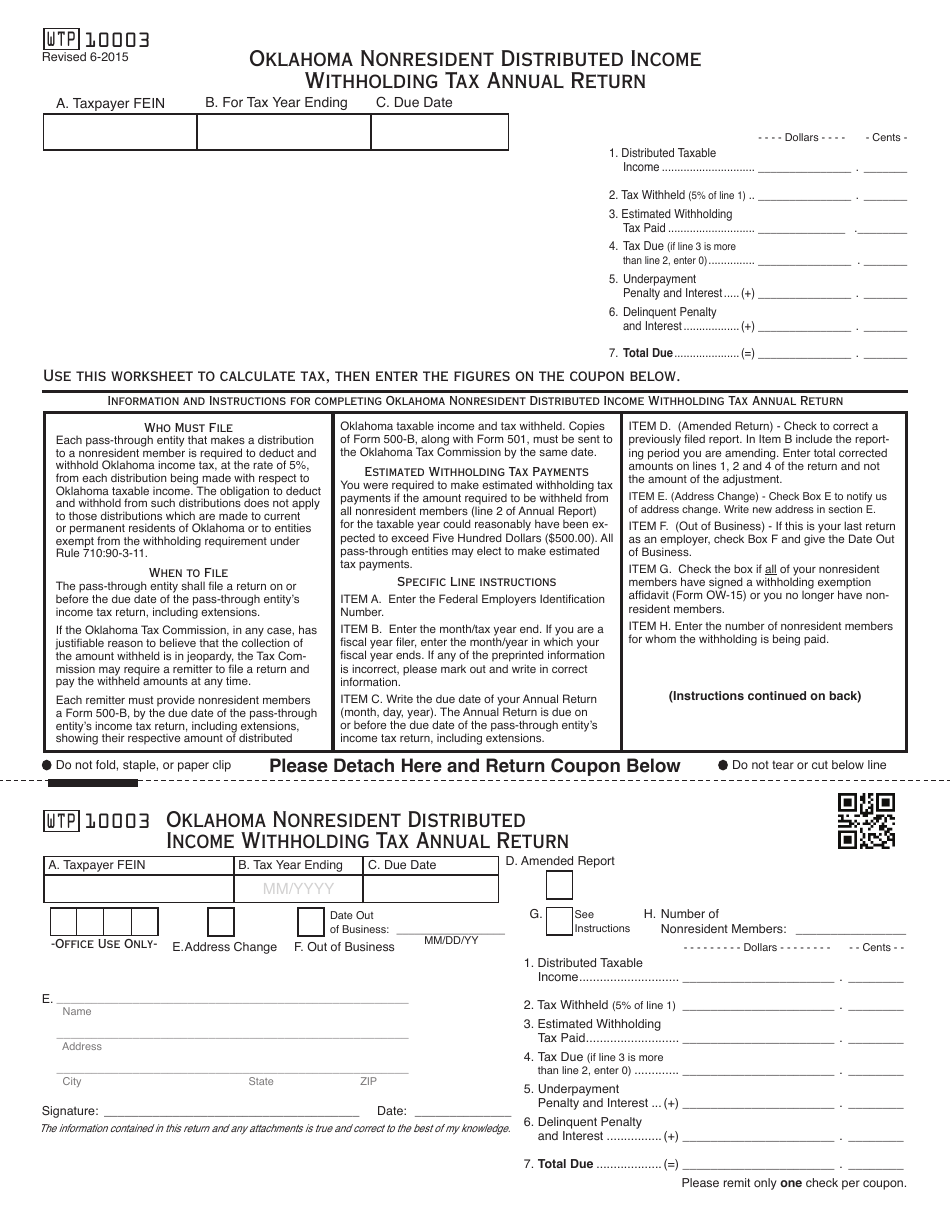

OTC Form WTP10003 Download Fillable PDF or Fill Online Oklahoma

Last nameyour social security number. Oklahoma quarterly wage withholding tax return (oklahoma) form. Business forms withholding alcohol &. Forms & publications specialty license plates tag, tax, title & fees unconventional vehicles. Employers engaged in a trade or business who.

Fill Free fillable Form OKW4 Employees Withholding Allowance

Business forms withholding alcohol &. Use fill to complete blank online. Oklahoma quarterly wage withholding tax return (oklahoma) form. Last nameyour social security number. Residency relief act you must.

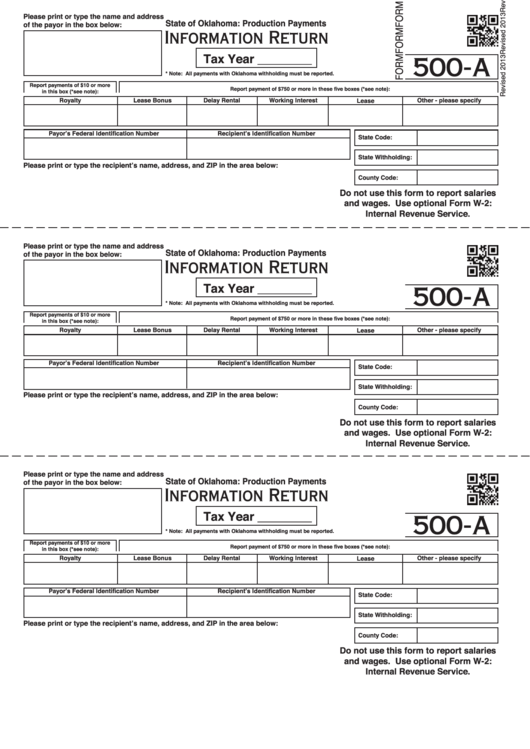

Fillable Form 500A Oklahoma Information Return printable pdf download

Web up to 25% cash back file scheduled withholding tax returns. If you do not file a. Employers engaged in a trade or business who. Web additional oklahoma income tax when you file your return. Web fill online, printable, fillable, blank form 10001:

OTC Form OW9MSE Download Fillable PDF or Fill Online Annual

Pass through withholding tax : Non resident royalty withholding tax : Web withholding tax : Forms & publications specialty license plates tag, tax, title & fees unconventional vehicles. This worksheet need only be.

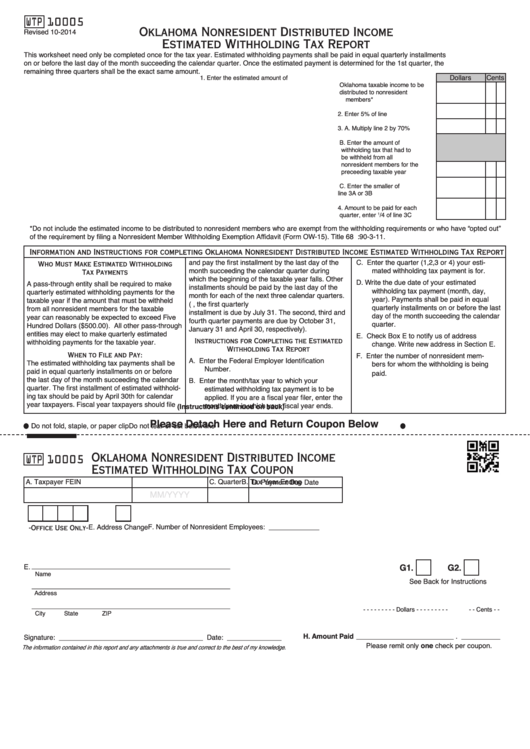

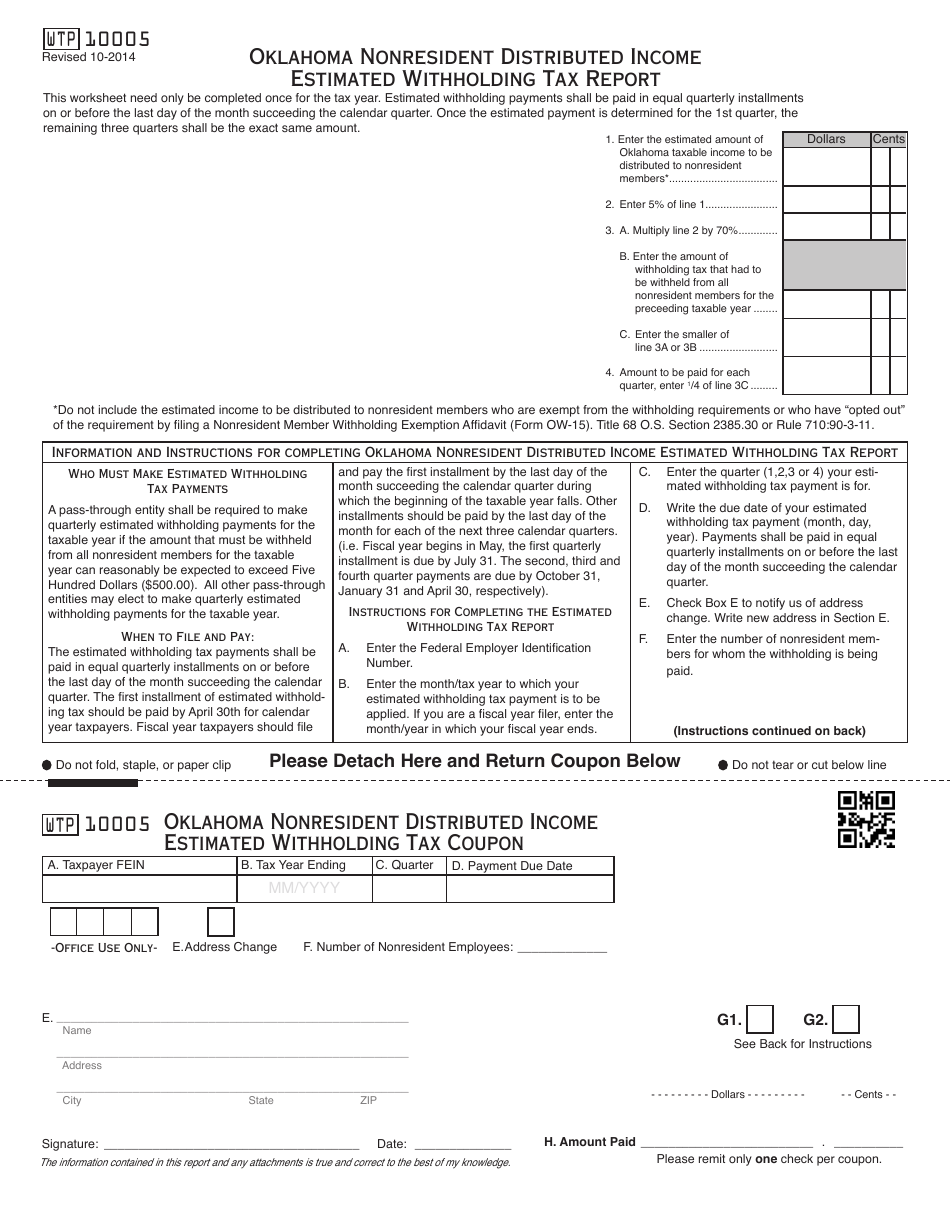

Fillable Oklahoma Nonresident Distributed Estimated Withholding

This certificate is for income tax withholding purposes only. Employee's withholding certificate form 941; Business forms withholding alcohol &. Oklahoma quarterly wage withholding tax return (oklahoma) form. Residency relief act you must.

Form WTP10005 Download Fillable PDF or Fill Online Oklahoma Nonresident

Married, but withhold at higher single rate. Business forms withholding alcohol &. This certificate is for income tax withholding purposes only. Web this form is to change oklahoma withholding allowances. Web withholding tax :

How To Fill Out Oklahoma Employers Withholding Tax Return Form

Married, but withhold at higher single rate. • if you have more than one employer, you should claim a smaller number or. Residency relief act you must. Web fill online, printable, fillable, blank form 10001: Apart from making scheduled tax payments, businesses on a monthly or quarterly payment schedule also must file.

Fillable Form Wth 10001 Oklahoma Quarterly Wage Withholding Tax

Web opers has two forms to provide tax withholding preferences for federal and state taxes. This certificate is for income tax withholding purposes only. Married, but withhold at higher single rate. Last nameyour social security number. Non resident royalty withholding tax :

Last Nameyour Social Security Number.

Non resident royalty withholding tax : This certificate is for income tax withholding purposes only. Residency relief act you must. Use fill to complete blank online.

Married, But Withhold At Higher Single Rate.

Business forms withholding alcohol &. Web opers has two forms to provide tax withholding preferences for federal and state taxes. Web withholding tax : Web up to 25% cash back file scheduled withholding tax returns.

Apart From Making Scheduled Tax Payments, Businesses On A Monthly Or Quarterly Payment Schedule Also Must File.

Web oklahoma taxpayer access point complete a withholding application request 1 complete a withholding application request did your business receive a. This worksheet need only be. If you do not file a. Web this form is to change oklahoma withholding allowances.

Forms & Publications Specialty License Plates Tag, Tax, Title & Fees Unconventional Vehicles.

Web fill online, printable, fillable, blank form 10001: Web opers is required to withhold income tax from your monthly retirement benefit, unless you indicate on the withholding forms that you do not want taxes withheld. • if you have more than one employer, you should claim a smaller number or. Oklahoma quarterly wage withholding tax return (oklahoma) form.