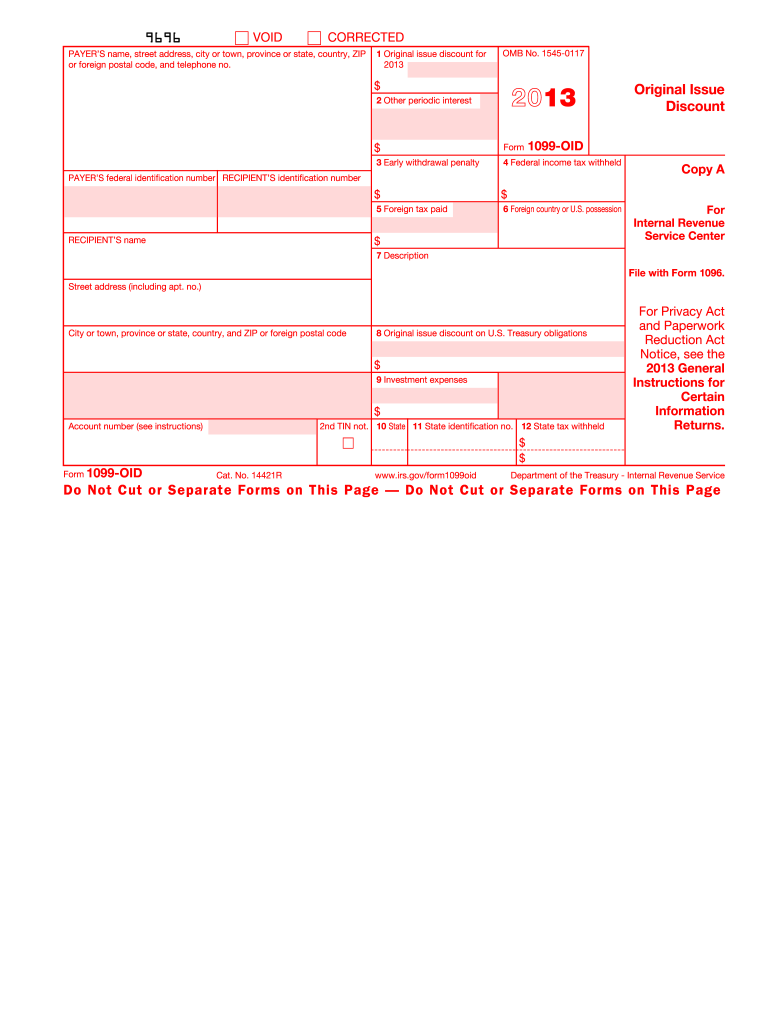

Oid Form 1099

Oid Form 1099 - This form can also be filed for any person for whom you withheld and. Enter the necessary information on. Sign into your turbotax account; Oid stands for original issue discount. Web original issue discount (oid) regards interest income; Sometimes you might need to. Debt instruments issued after july 1,. Oid arises when a bond is issued for a price less than its face value or principal amount. Web information for owners of oid debt instruments. Get ready for tax season deadlines by completing any required tax forms today.

Get ready for tax season deadlines by completing any required tax forms today. Enter the necessary information on. However, you may choose to report the qualified stated interest on. This form shows the amount of oid (box 1) to include in your income. Get ready for tax season deadlines by completing any required tax forms today. Web its primary purpose is to help brokers and other middlemen identify publicly offered original issue discount (oid) debt instruments they may hold as nominees for the true owners, so. It is the discount from par value at the time a bond or other debt instrument is issued. Create a free taxbandits account step 2: Web information for owners of oid debt instruments. Sometimes you might need to.

Sometimes you might need to. Start with your company’s name and address, then list the payee’s name, address, and. Complete, edit or print tax forms instantly. If boxes 8 and 11 are blank. Furnish copy b to each owner. Web information for owners of oid debt instruments. Create a free taxbandits account step 2: Open or continue your return and then search for this exact. However, you may choose to report the qualified stated interest on. This form can also be filed for any person for whom you withheld and.

1099OID for HR 1424 returnthe1099oidtotheprincipal

Debt instruments issued after july 1,. This form can also be filed for any person for whom you withheld and. Web its primary purpose is to help brokers and other middlemen identify publicly offered original issue discount (oid) debt instruments they may hold as nominees for the true owners, so. Furnish copy b to each owner. If boxes 8 and.

1099 Oid Form Fill Out and Sign Printable PDF Template signNow

Web its primary purpose is to help brokers and other middlemen identify publicly offered original issue discount (oid) debt instruments they may hold as nominees for the true owners, so. Sign into your turbotax account; Enter the necessary information on. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

1099 OID Tax Form, Issuer or State Copy C Free Shipping

It is the discount from par value at the time a bond or other debt instrument is issued. Open or continue your return and then search for this exact. Oid stands for original issue discount. Sign into your turbotax account; File copy a of the form with the irs.

Irs Printable 1099 Form Printable Form 2022

It is the discount from par value at the time a bond or other debt instrument is issued. However, the rule of including oid in. Start with your company’s name and address, then list the payee’s name, address, and. Get ready for tax season deadlines by completing any required tax forms today. Debt instruments issued after july 1,.

Form 1099OID Original Issue Discount Definition

Start with your company’s name and address, then list the payee’s name, address, and. However, you may choose to report the qualified stated interest on. Oid stands for original issue discount. This form can also be filed for any person for whom you withheld and. This form shows the amount of oid (box 1) to include in your income.

Entering & Editing Data > Form 1099OID

It is the discount from par value at the time a bond or other debt instrument is issued. Sign into your turbotax account; Web original issue discount (oid) regards interest income; Complete, edit or print tax forms instantly. Web its primary purpose is to help brokers and other middlemen identify publicly offered original issue discount (oid) debt instruments they may.

W9 vs 1099 IRS Forms, Differences, and When to Use Them

If boxes 8 and 11 are blank. Web information for owners of oid debt instruments. Sometimes you might need to. File copy a of the form with the irs. Enter the necessary information on.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Web original issue discount (oid) regards interest income; However, the rule of including oid in. Furnish copy b to each owner. Oid arises when a bond is issued for a price less than its face value or principal amount. Open or continue your return and then search for this exact.

Fillable Form 1099Oid Original Issue Discount 2018 printable pdf

Oid stands for original issue discount. Get ready for tax season deadlines by completing any required tax forms today. This form can also be filed for any person for whom you withheld and. Complete, edit or print tax forms instantly. File copy a of the form with the irs.

Complete, Edit Or Print Tax Forms Instantly.

Enter the necessary information on. Web information for owners of oid debt instruments. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

Oid Stands For Original Issue Discount.

Start with your company’s name and address, then list the payee’s name, address, and. Oid arises when a bond is issued for a price less than its face value or principal amount. It is the discount from par value at the time a bond or other debt instrument is issued. Debt instruments issued after july 1,.

However, You May Choose To Report The Qualified Stated Interest On.

Create a free taxbandits account step 2: Sign into your turbotax account; Web original issue discount (oid) regards interest income; Get ready for tax season deadlines by completing any required tax forms today.

This Form Shows The Amount Of Oid (Box 1) To Include In Your Income.

File copy a of the form with the irs. This form can also be filed for any person for whom you withheld and. If boxes 8 and 11 are blank. Sometimes you might need to.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)