Ohio Withholding Form

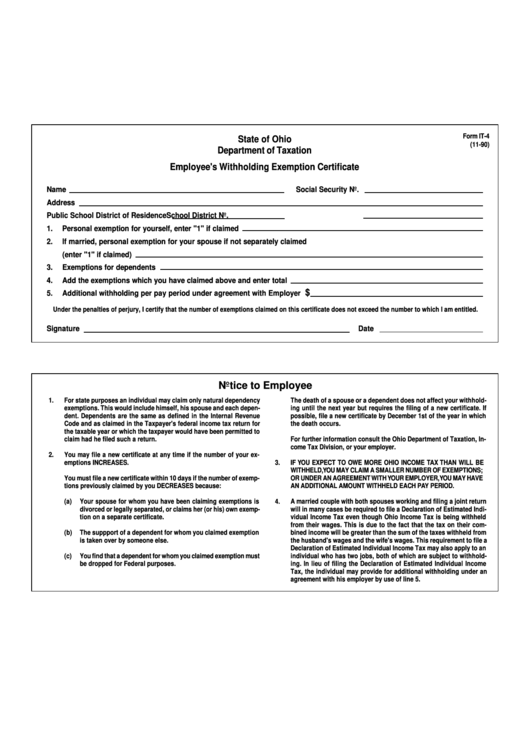

Ohio Withholding Form - The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Web the ohio department of taxation only requires 1099 forms that reflect ohio income tax withholding, such as forms 1099r, to be sent to us. The it 4 does not need to be filed with the department of taxation. If the ohio id number on a statement has 9 digits, enter only the first 8 digits. Such employees should complete sections i, iii, and iv of the it 4 only. The employer is required to have each employee that works in ohio to complete this form. Web ohio it 4 is an ohio employee withholding exemption certificate. View bulk orders tax professional bulk orders download tbor 1 declaration of tax representative. Certain employees may be exempt from ohio withholding because their income is not subject to ohio tax. A your withholding is subject to review by the irs.

Web jobs, both of which are subject to withholding. Most forms are available for download and some can be. Web the department of taxation recently revised form it 4, employee’s withholding exemption certificate. Web the ohio department of taxation only requires 1099 forms that reflect ohio income tax withholding, such as forms 1099r, to be sent to us. Request a state of ohio income tax form be mailed to you. Such employees should complete sections i, iii, and iv of the it 4 only. Filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your. This updated form, or an electronic equivalent, should be used by new hires or employees making ohio income tax withholding updates on or after december 7, 2020. If the ohio id number on a statement has 9 digits, enter only the first 8 digits. The employer is required to have each employee that works in ohio to complete this form.

The employee uses the ohio it 4 to determine the number of exemptions that the employee is entitled to claim, so that the employer can withhold the correct amount of ohio income tax. This updated form, or an electronic equivalent, should be used by new hires or employees making ohio income tax withholding updates on or after december 7, 2020. This revised it 4 replaces the following ohio withholding forms: Request a state of ohio income tax form be mailed to you. The employer is required to have each employee that works in ohio to complete this form. A your withholding is subject to review by the irs. Other tax forms — a complete database of state tax forms and instruction booklets is available here. If the ohio id number on a statement has 9 digits, enter only the first 8 digits. The it 4 does not need to be filed with the department of taxation. Web the ohio department of taxation only requires 1099 forms that reflect ohio income tax withholding, such as forms 1099r, to be sent to us.

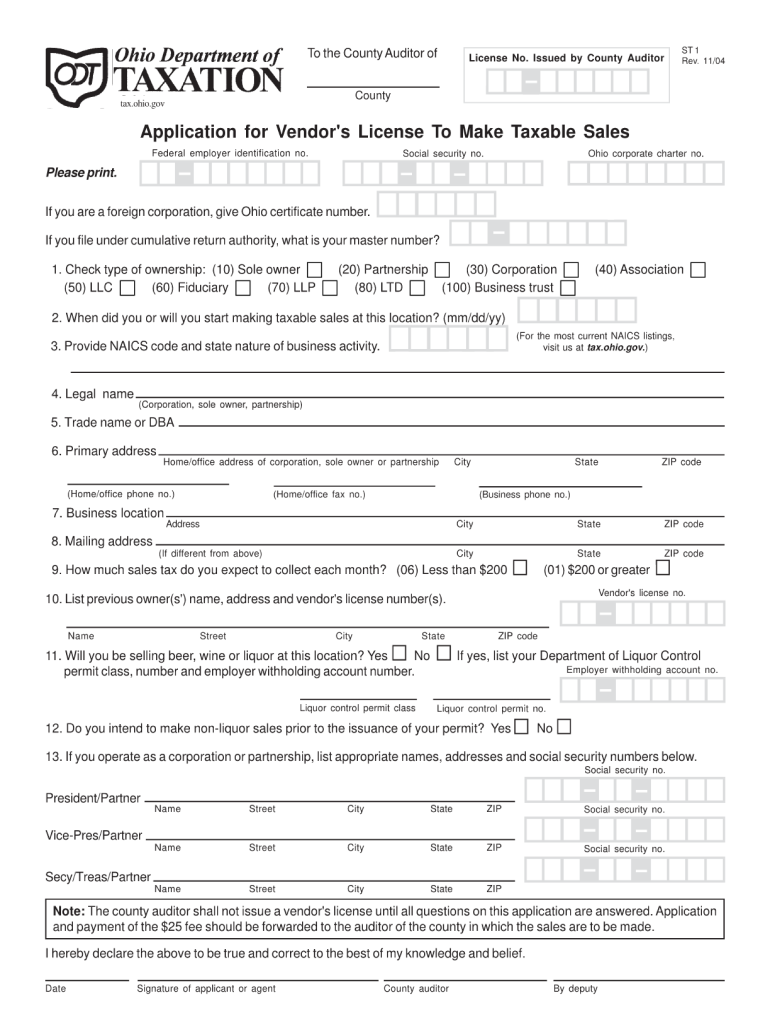

St 1 Form Fill Out and Sign Printable PDF Template signNow

His employer by using line 5. Web the department of taxation recently revised form it 4, employee’s withholding exemption certificate. Please review the 1099 specifications on the employer withholding divisions page. Web ohio it 4 is an ohio employee withholding exemption certificate. This updated form, or an electronic equivalent, should be used by new hires or employees making ohio income.

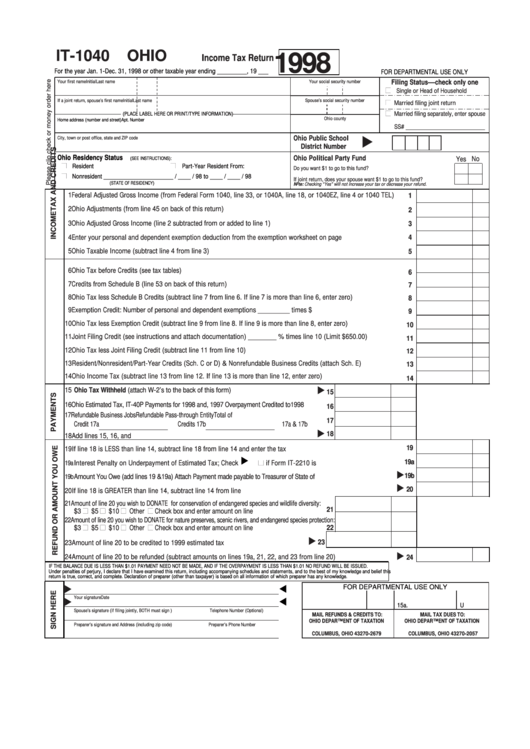

State Tax Withholding Form Ohio

Such employees should complete sections i, iii, and iv of the it 4 only. Filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your. If the ohio id number on a statement has 9 digits, enter only the first 8 digits..

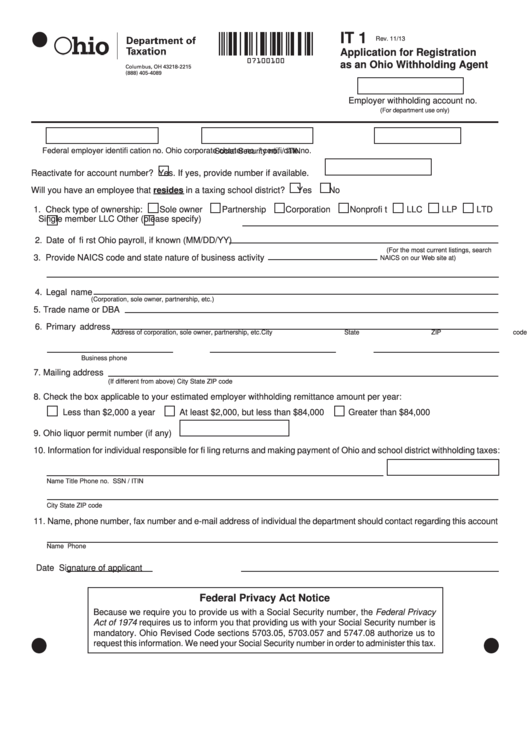

Fillable Form It 1 Application For Registration As An Ohio

This updated form, or an electronic equivalent, should be used by new hires or employees making ohio income tax withholding updates on or after december 7, 2020. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. In lieu of tion must be dropped for federal purposes. Access the forms you need to file.

Fillable Heap Form Printable Forms Free Online

View bulk orders tax professional bulk orders download tbor 1 declaration of tax representative. The employer is required to have each employee that works in ohio to complete this form. A your withholding is subject to review by the irs. Other tax forms — a complete database of state tax forms and instruction booklets is available here. His employer by.

Ohio Employee Tax Withholding Form 2022 2023

In lieu of tion must be dropped for federal purposes. Other tax forms — a complete database of state tax forms and instruction booklets is available here. Web jobs, both of which are subject to withholding. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Such employees should complete sections i, iii, and.

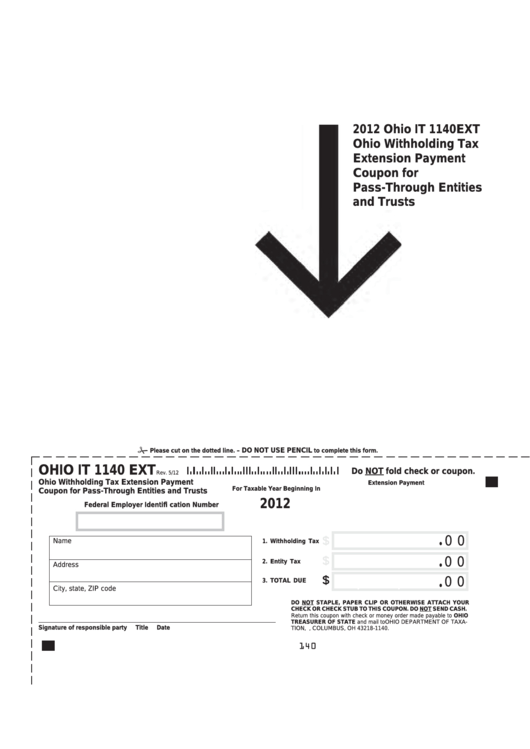

Fillable Ohio Form It 1140 Ext Ohio Withholding Tax Extension Payment

In lieu of tion must be dropped for federal purposes. Please review the 1099 specifications on the employer withholding divisions page. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. This updated form, or an electronic equivalent, should be used by new hires or employees making ohio income tax withholding updates on or.

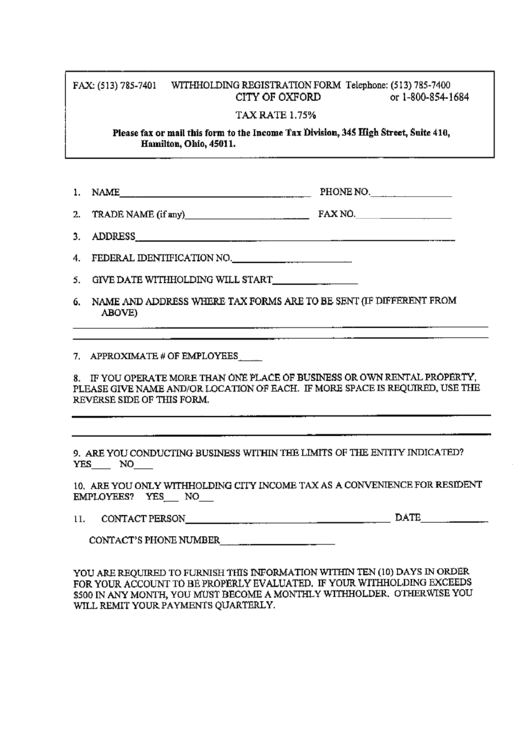

Withholding Registration Form City Of Oxford, Ohio printable pdf download

Certain employees may be exempt from ohio withholding because their income is not subject to ohio tax. Access the forms you need to file taxes or do business in ohio. This revised it 4 replaces the following ohio withholding forms: Such employees should complete sections i, iii, and iv of the it 4 only. Please review the 1099 specifications on.

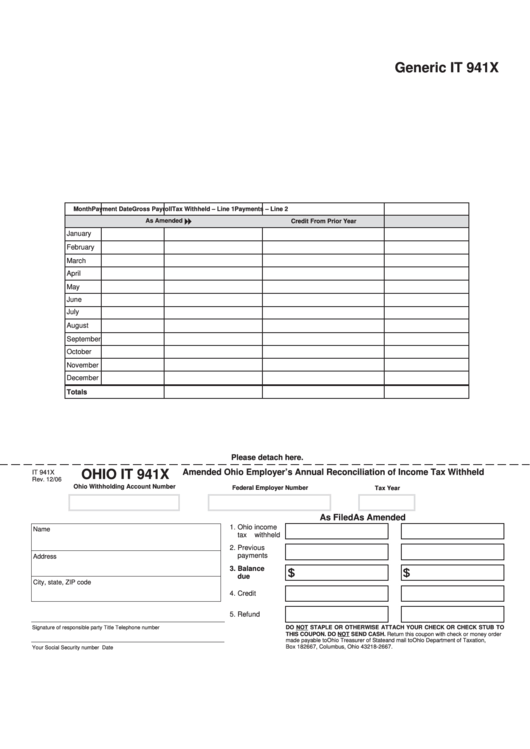

Fillable Form It 941x Amended Ohio Employer'S Annual Reconciliation

Most forms are available for download and some can be. Web jobs, both of which are subject to withholding. If the ohio id number on a statement has 9 digits, enter only the first 8 digits. Web the department of taxation recently revised form it 4, employee’s withholding exemption certificate. Please review the 1099 specifications on the employer withholding divisions.

Top Ohio Withholding Form Templates free to download in PDF format

This revised it 4 replaces the following ohio withholding forms: Most forms are available for download and some can be. Filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your. Web jobs, both of which are subject to withholding. Web the.

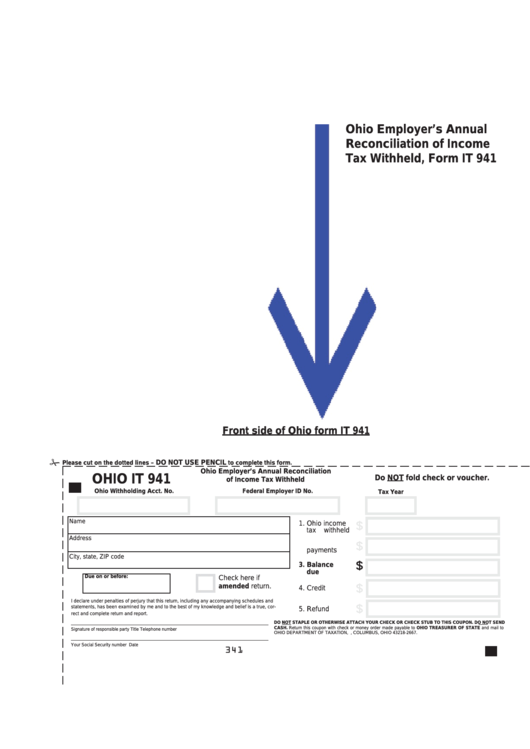

Fillable Ohio Form It 941 Ohio Employer'S Annual Reconciliation Of

Web the department of taxation recently revised form it 4, employee’s withholding exemption certificate. The employer is required to have each employee that works in ohio to complete this form. The it 4 does not need to be filed with the department of taxation. Request a state of ohio income tax form be mailed to you. Most forms are available.

Please Review The 1099 Specifications On The Employer Withholding Divisions Page.

Enter “p” in the “p/s” box if the form is the primary taxpayer’s and enter “s” if it is the spouse’s. Certain employees may be exempt from ohio withholding because their income is not subject to ohio tax. The it 4 does not need to be filed with the department of taxation. Access the forms you need to file taxes or do business in ohio.

This Revised It 4 Replaces The Following Ohio Withholding Forms:

The employer is required to have each employee that works in ohio to complete this form. Web ohio it 4 is an ohio employee withholding exemption certificate. A your withholding is subject to review by the irs. Such employees should complete sections i, iii, and iv of the it 4 only.

The Employee Uses The Ohio It 4 To Determine The Number Of Exemptions That The Employee Is Entitled To Claim, So That The Employer Can Withhold The Correct Amount Of Ohio Income Tax.

In lieu of tion must be dropped for federal purposes. Request a state of ohio income tax form be mailed to you. Web the ohio department of taxation only requires 1099 forms that reflect ohio income tax withholding, such as forms 1099r, to be sent to us. Filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your.

Web Jobs, Both Of Which Are Subject To Withholding.

Most forms are available for download and some can be. View bulk orders tax professional bulk orders download tbor 1 declaration of tax representative. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. This updated form, or an electronic equivalent, should be used by new hires or employees making ohio income tax withholding updates on or after december 7, 2020.