Ny Form Ct 3

Ny Form Ct 3 - E yesno all filers must enter tax period: Fill out the requested boxes. Web file now with turbotax related new york corporate income tax forms: Use a ct 3 s 2022 template to make your document workflow more streamlined. Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the new york state combined group except for the taxpayer. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web new york state return within 90 days thereafter. Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the new york state combined group except for the taxpayer.

Average value of property(see instructions). Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Web file now with turbotax related new york corporate income tax forms: E yesno all filers must enter tax period: Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Web new york state return within 90 days thereafter. Use a ct 3 s 2022 template to make your document workflow more streamlined. Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the new york state combined group except for the taxpayer. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

Fill out the requested boxes. Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the new york state combined group except for the taxpayer. Web new york state return within 90 days thereafter. Web file now with turbotax related new york corporate income tax forms: Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the new york state combined group except for the taxpayer. Use a ct 3 s 2022 template to make your document workflow more streamlined. Changes for the current tax year (general and by tax law article). Easily fill out pdf blank, edit, and sign them. Average value of property(see instructions). Save or instantly send your ready documents.

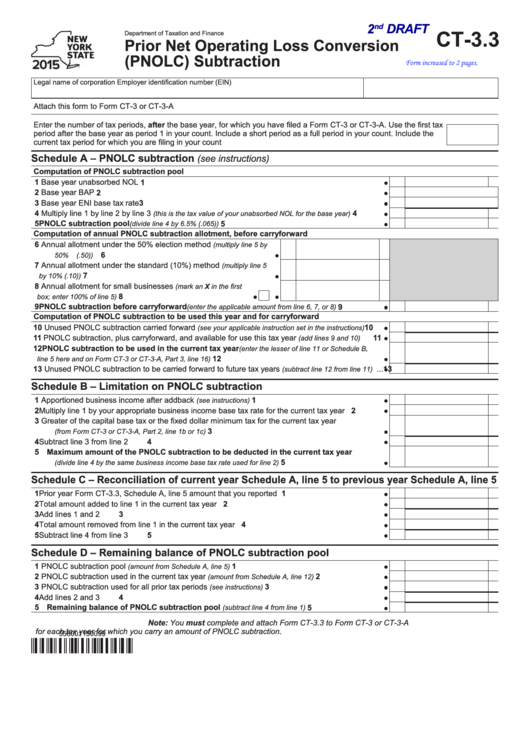

Form Ct3.3 Draft Prior Net Operating Loss Conversion (Pnolc

Web new york state return within 90 days thereafter. E yesno all filers must enter tax period: Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the new york state combined group except for the taxpayer. Fill out the requested boxes. Web file now with turbotax related new york corporate income.

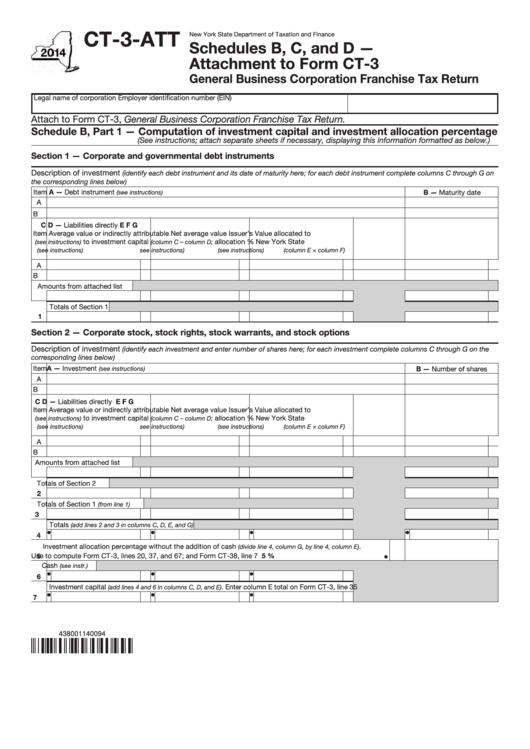

Form Ct3Att Schedules B, C, And D Attachment To Form Ct3

Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the new york state combined group except for the taxpayer. Fill out the requested boxes. Web new york state return within 90 days thereafter. Changes for the current tax year (general and by tax law article). Web watch newsmax live for the.

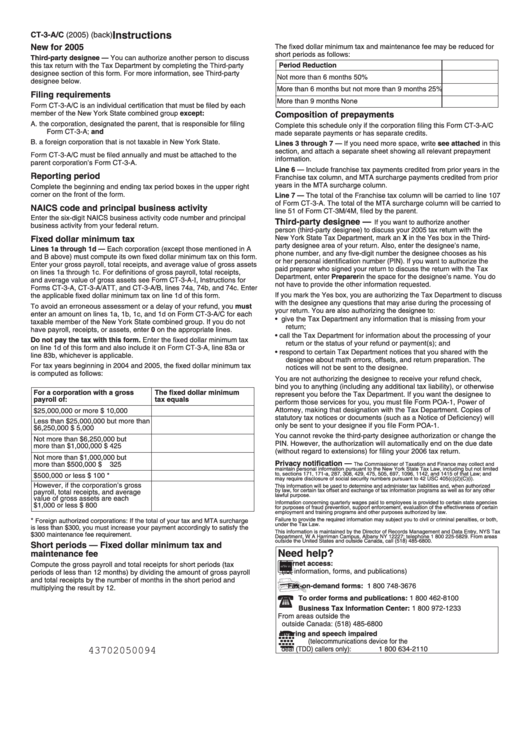

Form Ct3A/c Instructions Tax Department New York printable pdf

Average value of property(see instructions). Web new york state return within 90 days thereafter. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Web form ct‑3‑a/bc is an individual certification that must be filed.

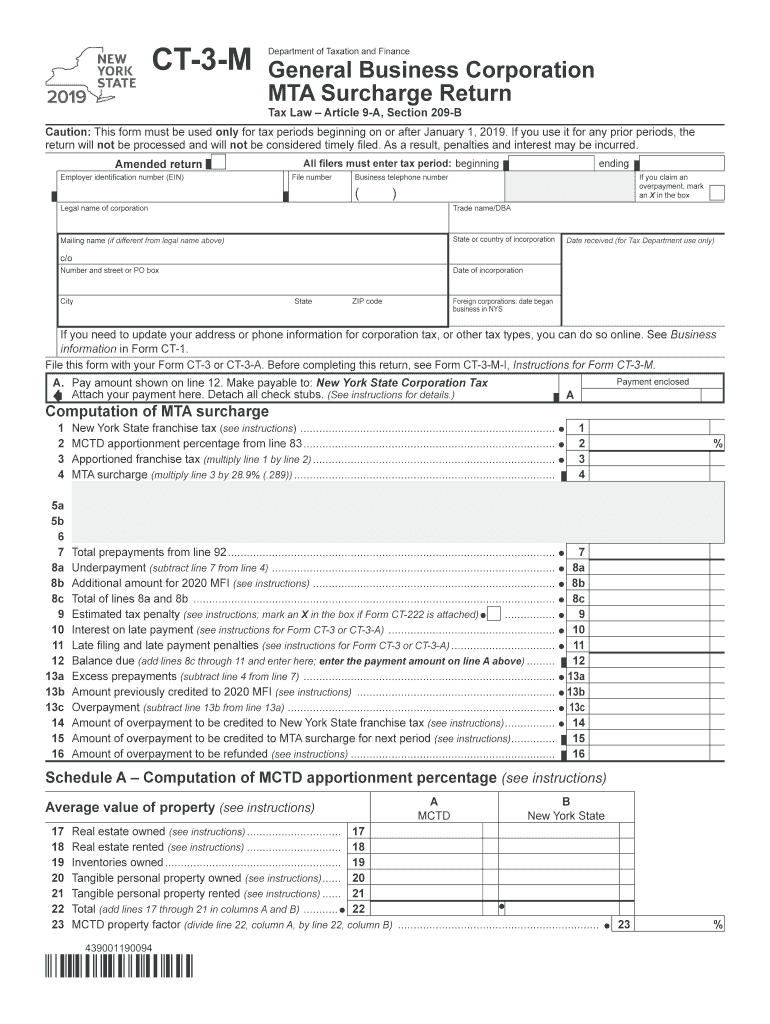

Ct 3 M Instructions Form Fill Out and Sign Printable PDF Template

Web file now with turbotax related new york corporate income tax forms: Fill out the requested boxes. Use a ct 3 s 2022 template to make your document workflow more streamlined. Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the new york state combined group except for the taxpayer. Easily.

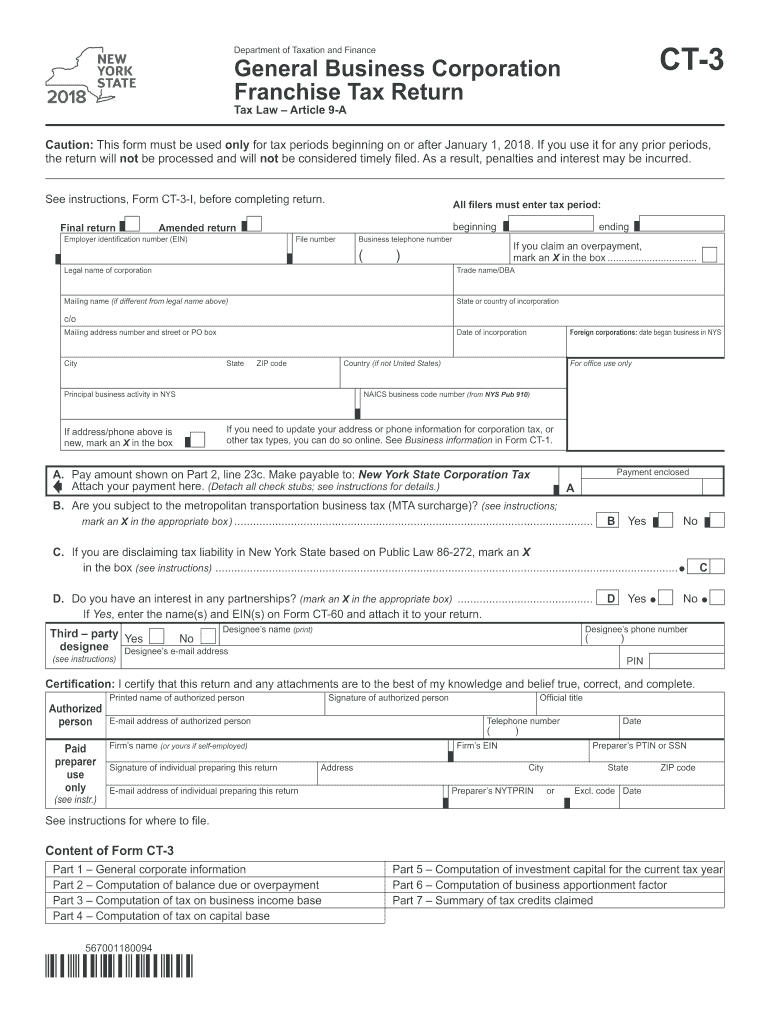

Form CT 3 General Business Corporation Franchise Tax Return YouTube

Average value of property(see instructions). Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Use a ct 3 s 2022 template to make your document workflow more streamlined. E yesno all filers must enter tax period: Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer.

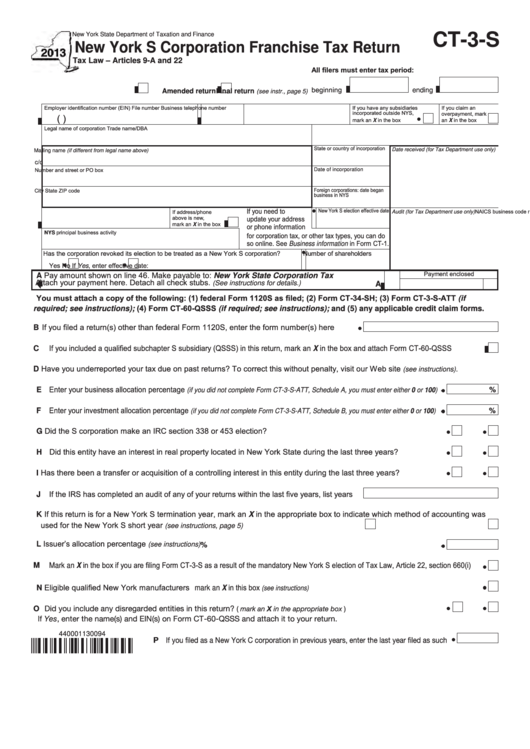

Form Ct3S New York S Corporation Franchise Tax Return 2013

Fill out the requested boxes. Web file now with turbotax related new york corporate income tax forms: Easily fill out pdf blank, edit, and sign them. Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the new york state combined group except for the taxpayer. Use a ct 3 s 2022.

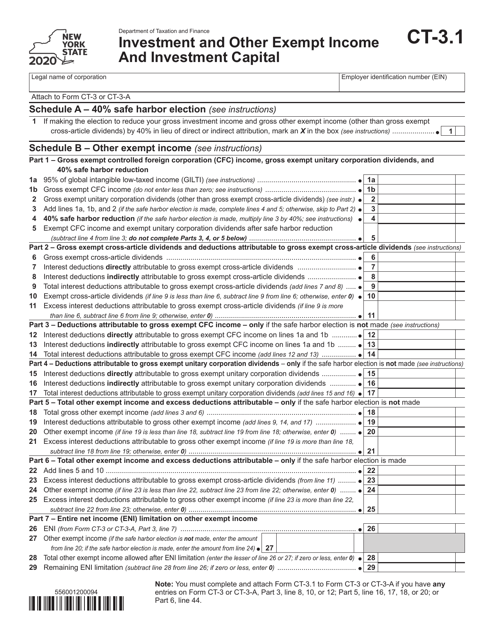

Form CT3.1 Download Printable PDF or Fill Online Investment and Other

Easily fill out pdf blank, edit, and sign them. Fill out the requested boxes. Web file now with turbotax related new york corporate income tax forms: Save or instantly send your ready documents. E yesno all filers must enter tax period:

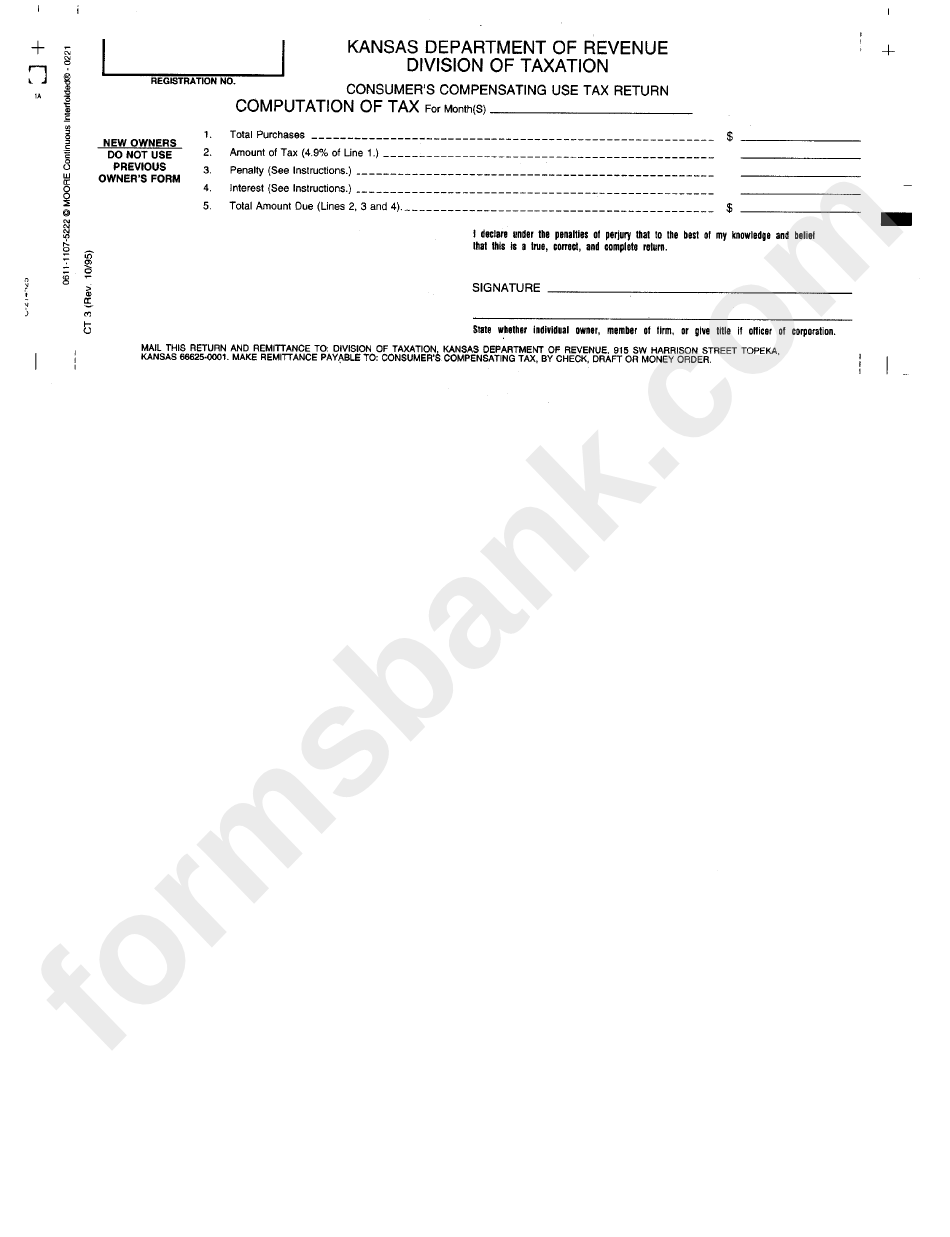

Form Ct 3 Consumer'S Compensating Use Tax Return Kansas Department

E yesno all filers must enter tax period: Fill out the requested boxes. Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the new york state combined group except for the taxpayer. Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the.

NYS DT Ct Fill Out and Sign Printable PDF Template signNow

Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the new york state combined group except for the taxpayer. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Fill out the requested boxes. Web form ct‑3‑a/bc is an individual certification that must.

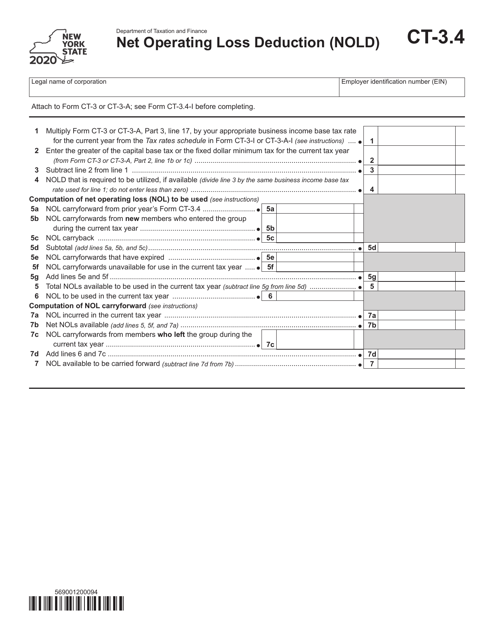

Form CT3.4 Download Printable PDF or Fill Online Net Operating Loss

Web file now with turbotax related new york corporate income tax forms: Changes for the current tax year (general and by tax law article). Average value of property(see instructions). Fill out the requested boxes. Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the new york state combined group except for.

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the new york state combined group except for the taxpayer. Fill out the requested boxes. Changes for the current tax year (general and by tax law article). Web form ct‑3‑a/bc is an individual certification that must be filed by each member, including non‑taxpayer members, of the new york state combined group except for the taxpayer.

E Yesno All Filers Must Enter Tax Period:

Average value of property(see instructions). Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Web new york state return within 90 days thereafter. Easily fill out pdf blank, edit, and sign them.

Save Or Instantly Send Your Ready Documents.

Web file now with turbotax related new york corporate income tax forms: Use a ct 3 s 2022 template to make your document workflow more streamlined.